Blacqbook

Introduction

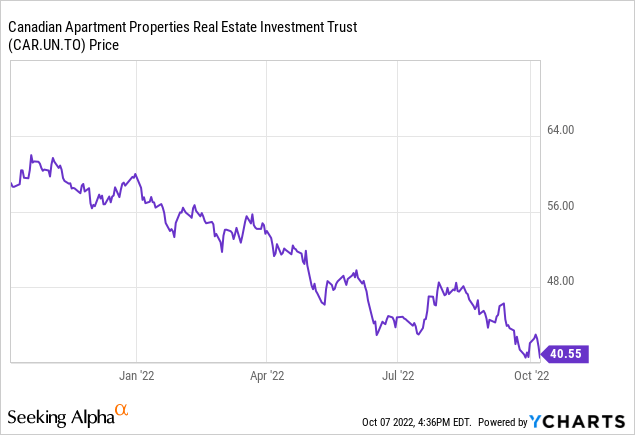

About 13 months ago, I argued it was time to sell Canadian Apartment Properties REIT (OTC:CDPYF) (CAR.UN:CA) as it was an easy decision to make. Today, just over 13 months later, the share price of Canadian Apartment REIT has dropped from more than C$61/share to just over C$40/share, a drop of in excess of 33%. This has rekindled my interest, not in the least because the dividend yield has increased again to a more acceptable 3.5%.

The US listing of Canadian Apartment REIT has an average daily volume of just over 1,000 shares. The Canadian listing, where Canadian Apartment REIT is trading with CAR.UN as its ticker symbol on the Toronto Stock Exchange, is much more liquid with an average daily volume exceeding 450,000 shares per day. The Canadian listing is clearly the better option here as the liquidity is superior.

The FFO and AFFO results remain strong

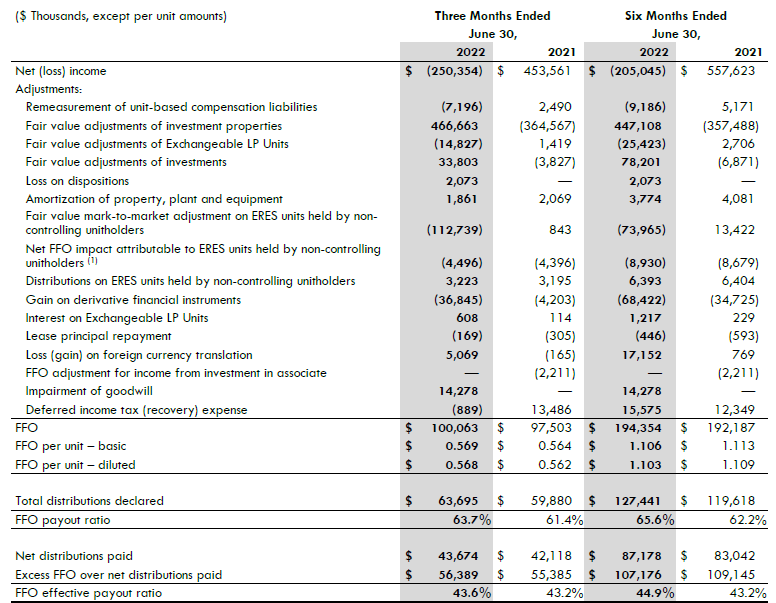

One of the most important metrics of a REIT is obviously the FFO and AFFO. Canadian Apartment REIT publishes the FFO and the NFFO, the Normalized Funds From Operations, which is similar to the AFFO as we know it.

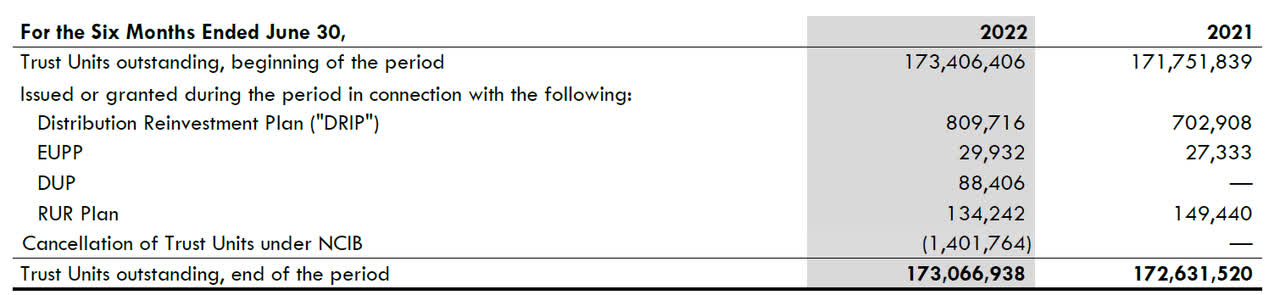

And when looking at the financial results of CAR.UN, we see the REIT has pretty much come to a standstill as although the total FFO increased, the increased share count also means the performance on a per-share basis hasn’t really improved much in the past year. As you can see below, CAR.UN reported a total FFO of approximately C$100M in the second quarter of this year and while that is a pretty nice 2.5% increase compared to the second quarter of 2021, the FFO per unit has increased by just 1% to C$0.569. Looking at the H1 performance:

CAR Investor Relations

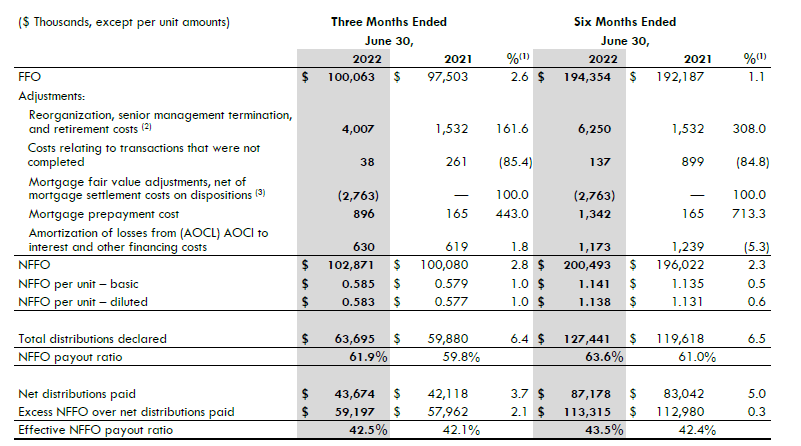

Fortunately the NFFO performance looks better. As you can see below, the REIT generated almost C$103M in NFFO during the second quarter which worked out to be approximately C$0.585 per unit, an increase of approximately 1% (which is slightly higher than the FFO per share increase).

CAR Investor Relations

The total payout ratio based on the NFFO was just under 62% as CAR.UN is paying a dividend of C$1.45/share on an annual basis (divided in twelve equal monthly installments). The image above shows the “effective NFFO payout ratio” as well. That ratio is lower than the 61.9% during the second quarter, as this takes the stock dividend into account. A portion of the shareholders elects to receive its monthly dividends in new shares and this obviously reduces the net cash outflow.

CAR Investor Relations

A look at the balance sheet: expect manageable headwinds

Issuing stock as part of the dividend program also helps the balance sheet as it allows Canadian Apartment REIT to retain a substantial portion of its NFFO on the balance sheet. As shown in the image above, CAR was able to retain in excess of C$113.3M in cash on its balance sheet. While it declared in excess of C$127M in distributions, only C$87.2M was paid out in cash and the remaining C$40M was covered by issuing new shares.

That’s positive for the balance sheet as it allows CAR to retain cash, but as the share price started to decrease, CAR also started to buy back stock and the net share count actually decreased in the first half of the year.

CAR Investor Relations

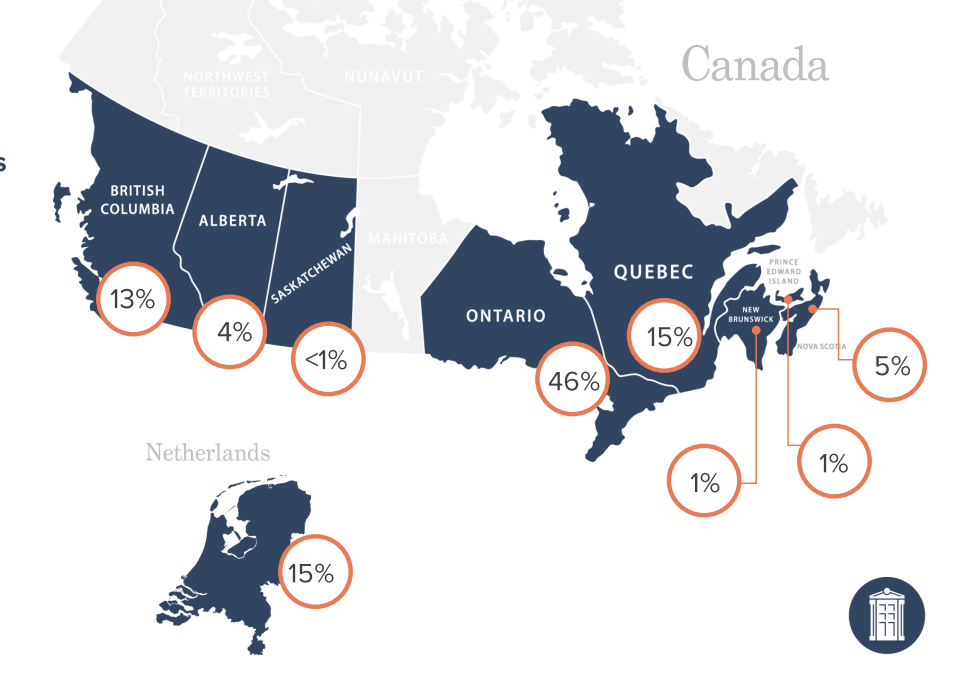

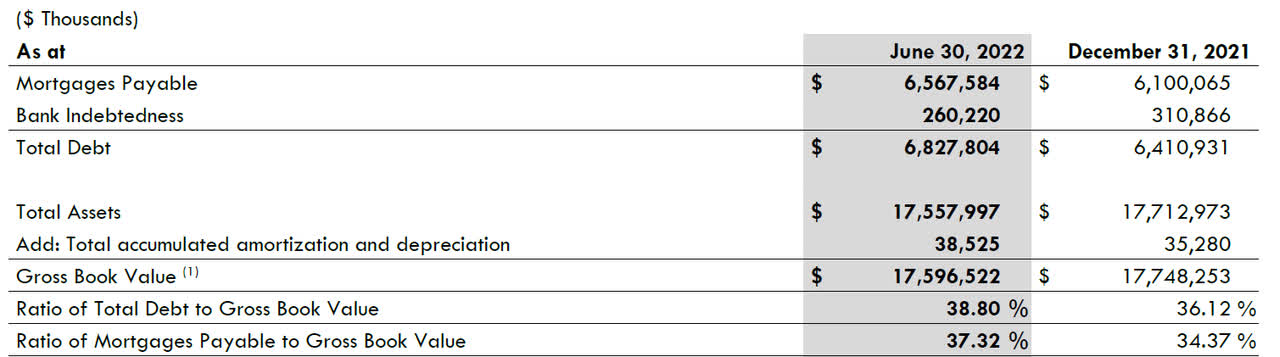

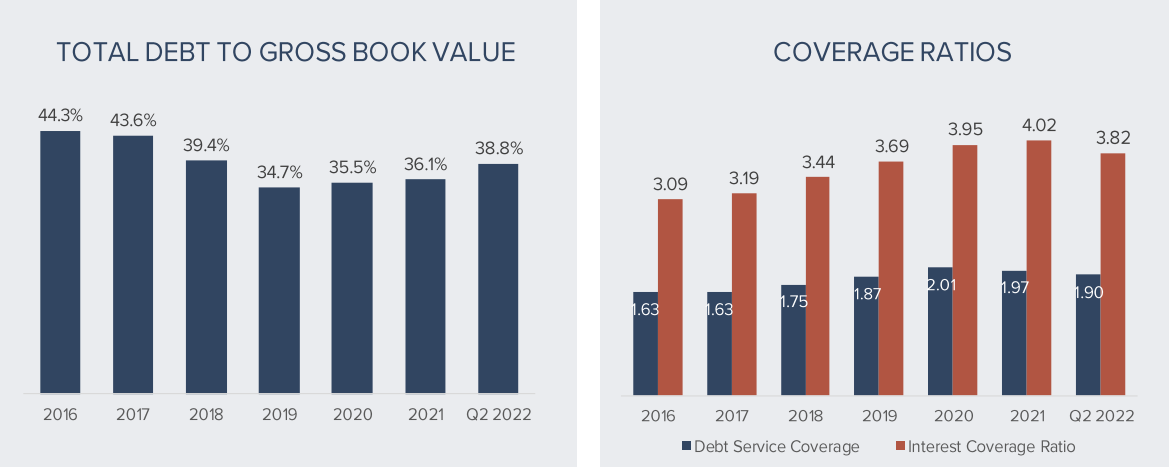

A buyback program makes sense if it creates value, and if a company can afford it. Canadian Apartment can definitely afford it as its balance sheet shows a net debt position of approximately C$6.6B based on a total of in excess of C$17B in properties and other long-term investments. This means the debt ratio is less than 40%.

CAR Investor Relations

The main question now obviously also is how reliable the book value of the properties is, as that value is important for two reasons: Is buying back its own shares indeed a good idea, and how reliable is the sub-40% LTV ratio?

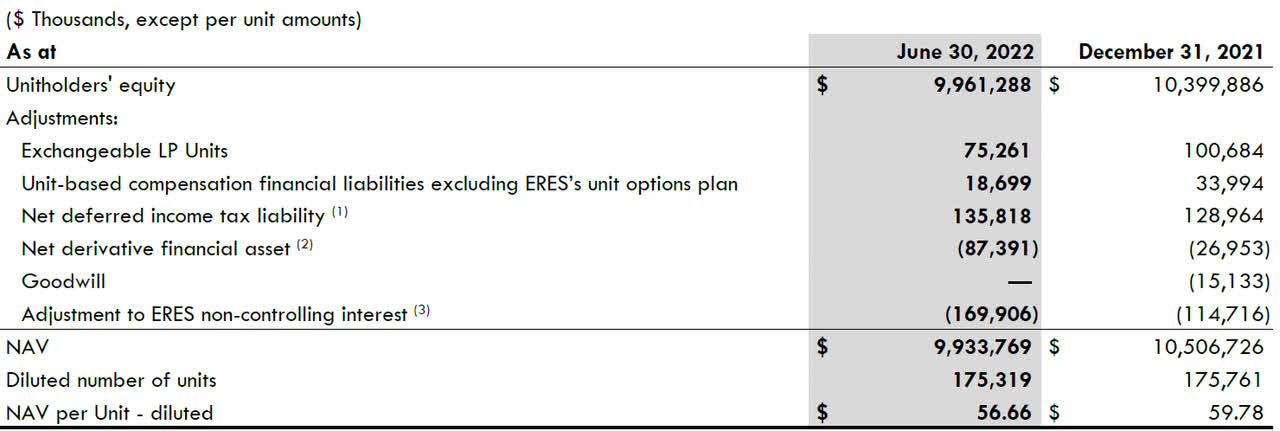

First of all, let’s have a look at the official NAV/share, which fell from almost C$60/share at the end of last year to just over C$56.6 as of the end of June.

CAR Investor Relations

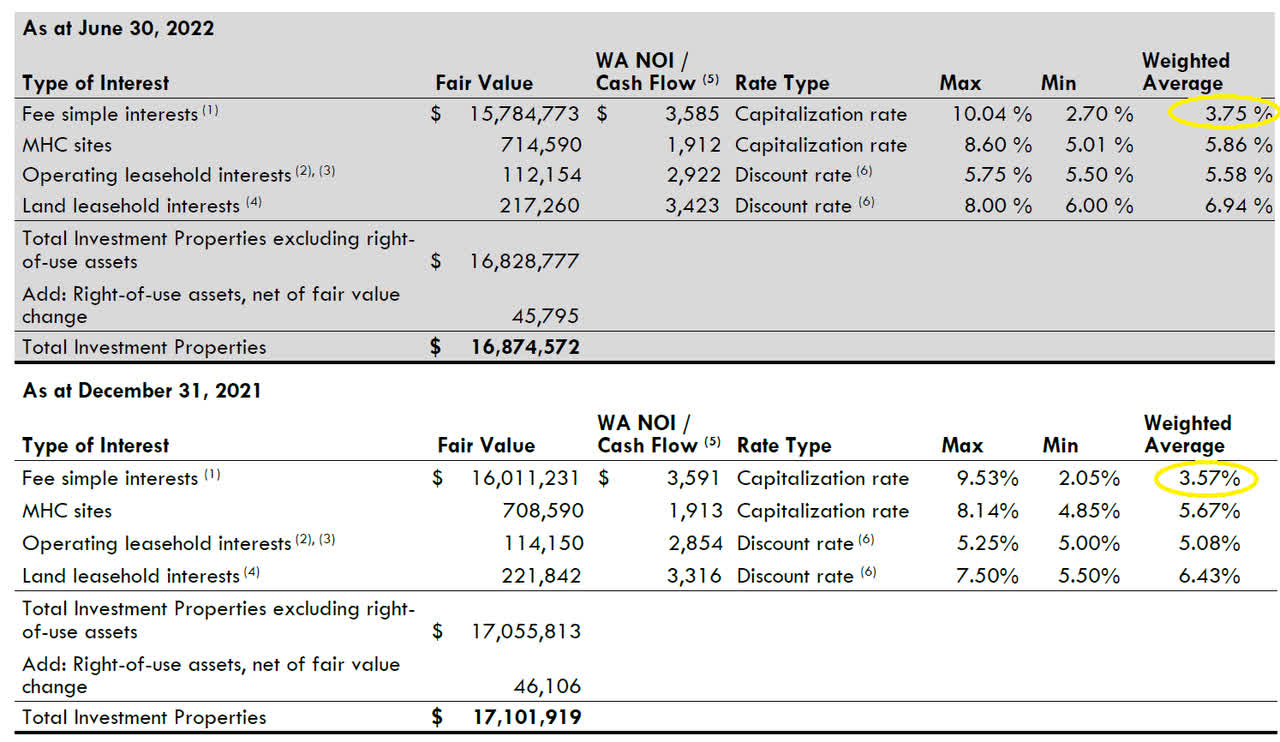

Why is that? Because CAR had to record a C$466M valuation decrease on its investment properties during the second quarter. As the interest rates are increasing again, the capitalization rate for real estate assets is increasing as well and as the rent hikes happen at a slower pace and with a certain time delay, an increase in the capitalization rates leads to an immediate value decrease.

As you can see below, the “fee simple interests,” which make up the vast majority of the assets, saw the capitalization rate increase from 3.57% to 3.75%. And this 18 base point increase resulted in a loss of several hundreds of millions on the fair value of these assets.

CAR Investor Relations

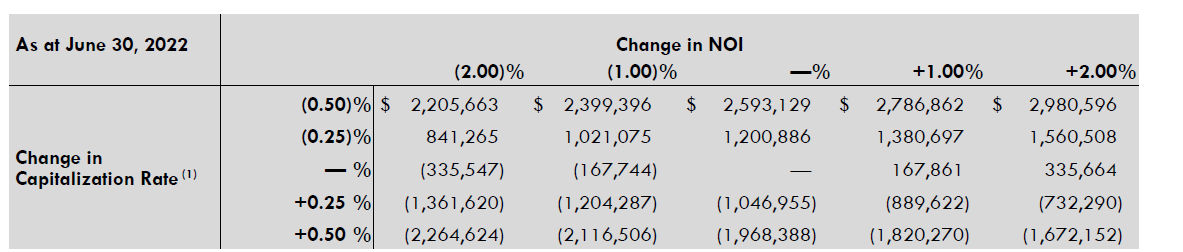

And the situation could actually get worse. CAP REIT provided a sensitivity analysis. As you can see below, a 0.50% increase in the capitalization rate (which is still pretty low as this would for instance still value the assets at a capitalization rate of just 4.25%) will reduce the value of the assets by approximately C$2B. Hiking the rent will be helpful as a simultaneous hike of 2% will reduce the fair value loss to “just” C$1.67B.

CAR Investor Relations

Personally, I think the capitalization rates will increase by much more than just 0.5% and I think we’re heading back toward a 5% capitalization rate for residential real estate, but I also think CAR’s net operating income also will increase by more than 2% as it will be able to gradually hike the rent.

If I would assume a 125 base point capitalization rate increase and a corresponding 10% NOI increase, I anticipate about C$3.3B in book value to “evaporate.” This won’t happen overnight, and the process could be halted by a stabilization of the interest rates on the financial markets, but I think it’s fair to expect additional book value reductions.

This also wouldn’t necessarily put Canadian Apartment REIT in a tough spot. While the book value would fall by about C$20/share, the “new” book value of around C$35-37/share is just 10% below the current share price, so the market already appears to be taking further hits to the NAV into account.

I also don’t think the LTV ratio will become a major problem. In the scenario outlined above, the LTV ratio would increase to approximately 48%. And keep in mind the REIT is retaining in excess of C$200M in cash per year to its balance sheet by maintaining a conservative payout ratio and offering a stock dividend.

CAR Investor Relations

Investment thesis

I am not interested in CAR because of its discount to its NAV as I think the NAV will continue to come down over the next six quarters. I think the current share price of around C$40 is pretty fair for a REIT that will have to adjust to the new normal when it comes to interest rates. I think the dividend is safe, and the balance sheet is safe as well, but the NAV/share of almost C$57/share will almost certainly come down.

Seeking Alpha

In hindsight, my entry point and exit point were well timed, and although I think CAR.UN isn’t out of the woods yet, I’m slowly turning slightly optimistic again. This doesn’t mean I’ll run out and buy the stock right away, but I’m considering writing out of the money put options. The P35 for March 2023 for instance can be sold for C$1.20 while a P40 for December 2022 can be sold for C$1.80.

Be the first to comment