Justin Sullivan/Getty Images News

Meta Platforms, Inc. (NASDAQ:FB) has frustrated investors since the corporate name change from “Facebook” in October of last year. Indeed, the stock is down by more than 40% from its 2021 peak amid some market skepticism on whether CEO Mark Zuckerberg will be able to recreate the magic from the last decade with its new focus on the “metaverse”. That said, we believe it’s time to turn bullish on FB ahead of its upcoming Q1 report. Expectations are low and we see a good chance the company can surprise to the upside.

The silver lining of the selloff is a reset of valuation for the company which we see as attractive with several long-term growth opportunities. The reality is that Meta Platforms remains a cash flow machine with a clear leadership position in social media. We like the stock at the current level as a good entry point for a long-term holding as FB is well-positioned to recover its blue-chip status.

Why Did Meta Platforms Stock Drop?

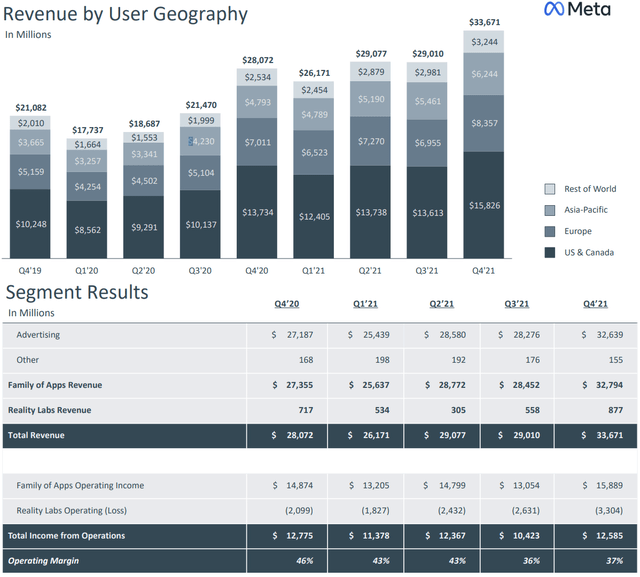

The story for Meta Platforms in 2021 was otherwise impressive growth and earnings emerging out of the pandemic. The company reached $118 billion in revenue last year, up 37% year-over-year, while EPS of $13.77 was also a record compared to $10.09 in 2020. The challenge has been to maintain that momentum despite signs of slowing user metrics, with respect to the Facebook platform. Notably, the operating margin in the last reported Q4 at 37% has declined from 46% in Q4 2020 highlighting a trend of rising cost pressures.

source: company IR

Shares of FB hit an all-time high of $383 in September, before trending lower with the broader weakness in the technology sector. The company has also been dealing with regulatory concerns related to user privacy and content moderation. In this regard, the name change to Meta Platforms came at a pivotal time for the company with a sense of needing a refresh to support the next stage of growth.

The vision for the metaverse is an evolution of the mobile internet based on a more immersive user experience through virtual reality as a new ecosystem for work, gaming, relationships, and more. Meta believes it can be the leader in the metaverse, leveraging new technologies while partnering with creators and developers.

As it relates to the outlook for 2022, the impact for Meta is twofold. First, top-line growth is up against a difficult comparison in 2021 with limited signs that a “Reality Labs” segment metaverse product in development is going to move the needle anytime soon. Second, the expectation is for a ramp-up in spending and investments set to pressure earnings. Meta last guided for 2022 full-year Capex in a range between $29 billion to $34 billion, up from $19.2 billion last year.

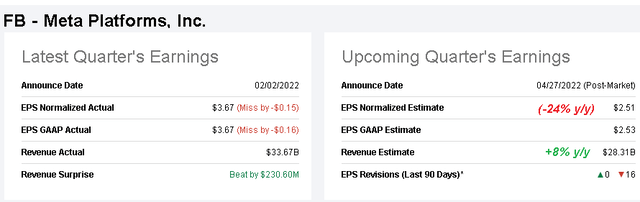

During the Q4 earnings report back in February, the company guided for Q1 revenue growth between just 3% and 11% which ended up spooking the market. The result is an expectation that 2022 EPS declines by 11% versus 2021 with a series of revisions lower to the consensus over the last several months.

So putting it all together, shares have sold off on a reassessment of the earnings outlook while questions regarding the direction of the metaverse have added a new layer of risk. Still, for FB bulls it’s encouraging that the selloff in shares that accelerated off the Q4 report found some support at around $200 per share. This is a level that goes back to a trading range in 2019 before the pandemic. The bottoming pattern in recent months, including a current rally of nearly 20% from the lows, is a positive sign going forward.

Seeking Alpha

FB Q1 Earnings Preview

With Meta Platforms set to release Q1 earnings on Wednesday, April 27th after the market closes, we see some reasons to get bullish into this report. The consensus is for EPS of $2.51, representing a decline of 24% y/y is in the context of the recent trends in margins while also up against a strong Q1 2021. The revenue forecast at $28.3 billion, up 8% y/y is within the guidance range of 3% to 11%.

The upside here is that management may have taken a conservative approach to its near-term outlook, setting up a scenario of “underpromising and overdelivering”. Anecdotally, there is a case to be made that the major current events environment during Q1 including the Omicron surge at the start of the quarter, the Russia-Ukraine invasion, record inflation, and even the strong labor market may have boosted engagement across the social media platforms.

Seeking Alpha

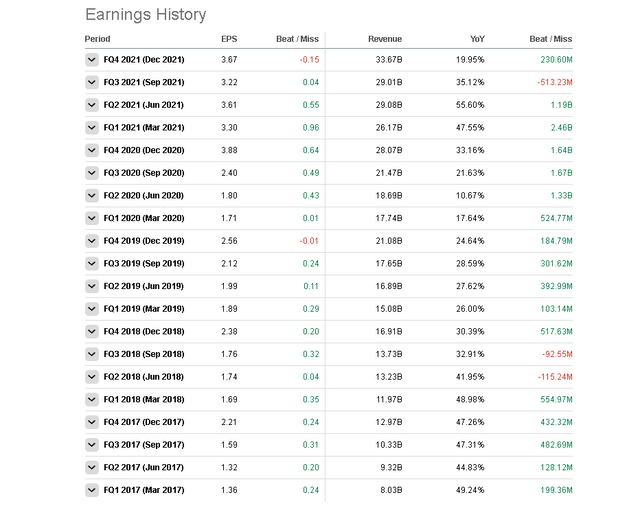

It’s hard to bet against FB into any quarter. We highlight that the company has a strong record of beating expectations, only missing the quarterly EPS estimates two times in the last 5-years. The interpretation here is that management is capable of making the necessary adjustment to exceed financial targets.

Seeking Alpha

Is Meta Platforms A Good Long-Term Investment?

Even with the recent share price volatility, it’s important to remember that Meta fundamentals are still solid. The company is highly profitable with positive free cash flow and effectively zero financial debt. With an understanding that the core business is in advertising, Meta’s platform is an important communications tool for large and small businesses which we view as an opportunity still in the early stages. Even if user growth is getting saturated in developed markets, the bullish case is that Meta continues to drive monetization higher through its initiatives including video.

Within social media, one of the major industry developments has been the headlines of Elon Musk attempting to takeover Twitter Inc. (TWTR). The insight we offer is that when Elon attempted to question Twitter’s current strategy and direction, he may have inadvertently given an endorsement of Meta’s social media prowess.

In a tweet earlier this month, Musk highlighted how the top followed accounts on Twitter were mostly inactive with the celebrities and public figures simply not utilizing the platform. On the other hand, a quick search on Meta’s ecosystem confirms that these very same superstars post regularly, particularly on “Instagram“. While Meta does not break out its Instagram metrics, it’s clear the format is alive and well as the preferred communications model.

source: Twitter

In our view, the quality and intangibles within FB’s brand portfolio are underappreciated which provides confidence in a positive long-term outlook. There are unique aspects of both Facebook and Instagram that represent a differentiation compared to smaller platforms like “TikTok”, “Snapchat” from Snap Inc (SNAP), and even Twitter that end up being more niche. In our opinion, Meta is a good investment because its social media positioning is top-tier while competitors are fighting it out on the B-list.

From Meta’s startup through Facebook as a simple website to the global expansion and transition into mobile, including the acquisition of WhatsApp and Instagram; the long-term outlook from here will depend on getting it right one more time with the metaverse vision. By this measure, 2022 is still a transitional year.

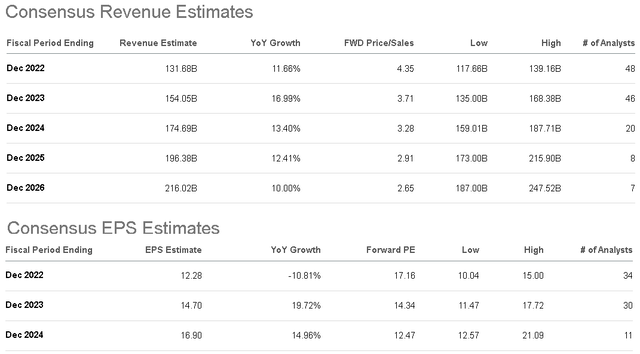

According to consensus estimates, the market is forecasting annual revenue growth averaging around 13% over the next 5-years. On the EPS side, getting past the forecasted 11% pullback in earnings this year, the market sees EPS growth rebounding to 20% in 2023 and 15% in 2024. The bullish case is that these estimates are simply too low with revenue and earnings potentially ending up several times higher over the next decade as Meta launches new products and services expanding its reach.

Seeking Alpha

Is Meta Overvalued Now?

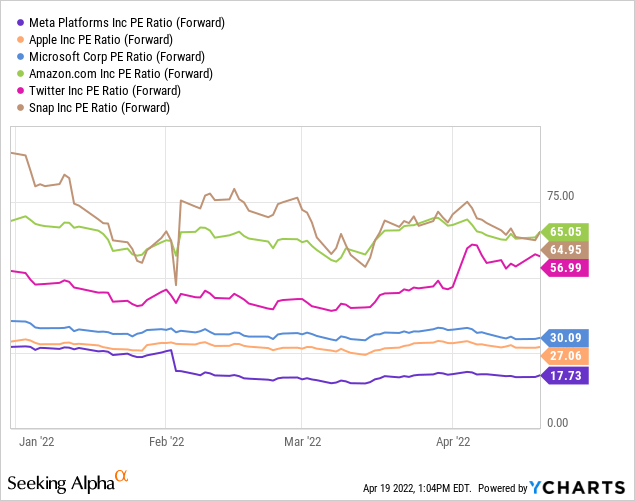

Following the selloff in shares, Meta is now the value pick among mega-cap tech leaders and also social media peers. The stock trading at an 18x forward P/E is at a large discount compared to names like Apple (AAPL) at 27x, Microsoft (MSFT) at 30x, and Twitter at 57x.

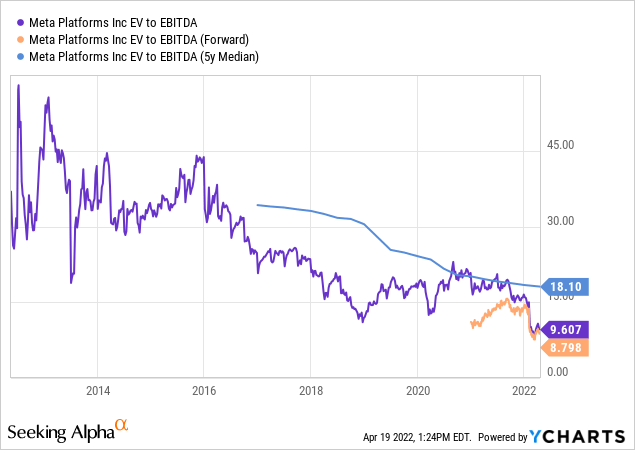

While all these companies have different business models and focus on various segments, they are all competitors in some ways, vying for a leadership role in the next iteration of internet content. In our view, FB deserves a larger premium considering its growth potential if and when the metaverse becomes mainstream. We also note that as a multiple of EBITDA, shares of FB have never been cheaper at 9x. If the current investments payoff as the building blocks for the next growth cycle, shares will need to reprice significantly higher.

Is FB Stock A Buy, Sell, or Hold?

In our view, the market is simply too bearish on Facebook and the stock is undervalued. A Q1 earnings report next week with no big downside surprises could be enough to help the stock regain positive momentum if there is a sense that earnings are resilient despite the macro headwinds. We rate FB as a buy with a price target for the year ahead at $300 representing a forward P/E of 25x on the current consensus 2022 EPS. Longer-term, the stock can climb significantly higher as it executes its metaverse growth strategy.

In terms of risks, Meta remains exposed to macro trends including the strength in consumer spending. A deteriorating global growth outlook would be bearish for the stock if it drives a slowdown in advertising activity. The stock is cheap, but could still get cheaper.

We’re a bit more optimistic about the economy focusing on the underlying post-pandemic momentum trends along with a strong labor market as strong points in Meta’s near-term operating environment. The average revenue per Facebook user along with the firm-wide operating margin will be key monitoring points over the next few quarters.

Be the first to comment