Feverpitched

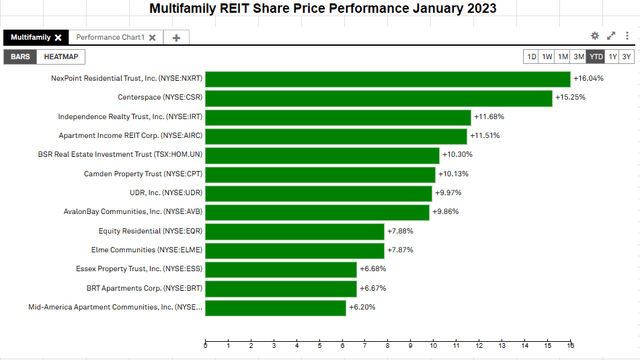

In January, I reviewed the trouncing Multifamily REIT shares took in 2022 and opined that, operationally, it is a tough road ahead. Markets ignored this sentiment and the sector turned in a stellar performance for the month.

For most issues, this surprises me because the just published February 2023 Apartment List National Rent Report describes that their rent index fell by 0.3% over the course of January; the fifth straight month-over-month decline. It surprises me even more for the top-tier, Class A property companies like Camden Property Trust (NYSE:CPT) because data indicate that they face many market headwinds.

That Was Then, This Is Now

When the COVID lockdown economy reopened with the widely pursued, work-from-anywhere migration, demographically savvy CPT was in all the right places at the right time. People and jobs flocked to sunbelt markets where Camden had a dominant presence and double digit rent growth became the rule. From June 30, 2020 to December 31, 2021, CPT more than doubled shareholders’ investment and nearly doubled the REIT index returns.

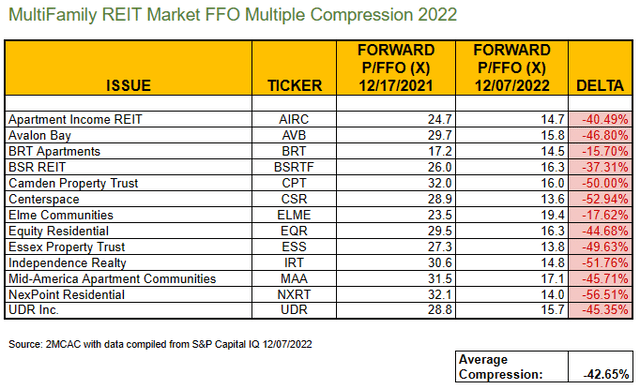

Over the same time period the multifamily REIT sector assumed a tech stock like P/FFO growth multiple.

Alas, renting out apartments is not an economic disruptor like, say, ChatGPT, it’s just old-fashioned real estate. As the table describes, by late 2022 the sector’s shares had compressed to a more sustainable mid-teens multiple.

Then in January, investors became amnesic to the prevailing rent growth trend’s demise.

The Headwinds

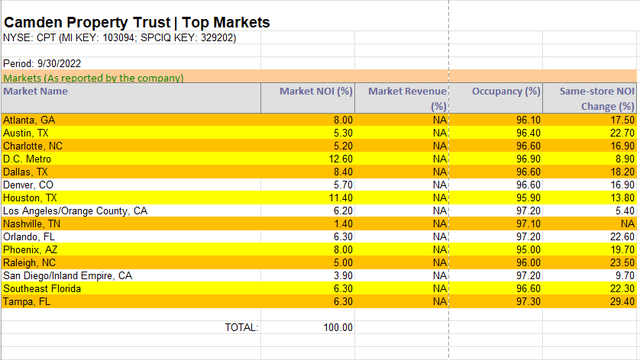

Camden Property Trust is an excellent REIT and has delivered strong results in every market it has entered.

If you examine performance in each of their top markets, you quickly see that they experienced high occupancies and high teen to low 20% same store NOI growth. You should also take note that the table reports for the period ending 09/30/2022. They now face much tougher comps and double digit rent growth has not only vanished, it may be reversing.

Looking at Apartment List’s rent trends you see that January average rents nationally were up 3.3% year-over-year and in many of CPT’s markets rents have started to decline.

Apartment List’s Market By Market Rent Trends

Atlanta: Average Rent in Atlanta, GA & Rent Price Trends (apartmentlist.com)

Austin: Average Rent in Austin, TX & Rent Price Trends (apartmentlist.com)

Charlotte: Average Rent in Charlotte, NC & Rent Price Trends (apartmentlist.com)

D. C. Metro: Average Rent in Washington, DC & Rent Price Trends (apartmentlist.com)

Dallas: Average Rent in Dallas, TX & Rent Price Trends (apartmentlist.com)

Denver: Average Rent in Denver, CO & Rent Price Trends (apartmentlist.com)

Houston: Average Rent in Houston, TX & Rent Price Trends (apartmentlist.com)

Los Angeles: Average Rent in Los Angeles, CA & Rent Price Trends (apartmentlist.com)

Orlando: Average Rent in Orlando, FL & Rent Price Trends (apartmentlist.com)

Phoenix: Average Rent in Phoenix, AZ & Rent Price Trends (apartmentlist.com)

Raleigh: Average Rent in Raleigh, NC & Rent Price Trends (apartmentlist.com)

San Diego: Average Rent in San Diego, CA & Rent Price Trends (apartmentlist.com)

Southeast Florida: Average Rent in Fort Lauderdale, FL & Rent Price Trends (apartmentlist.com) Average Rent in Miami, FL & Rent Price Trends (apartmentlist.com)

Tampa: Average Rent in Tampa, FL & Rent Price Trends (apartmentlist.com)

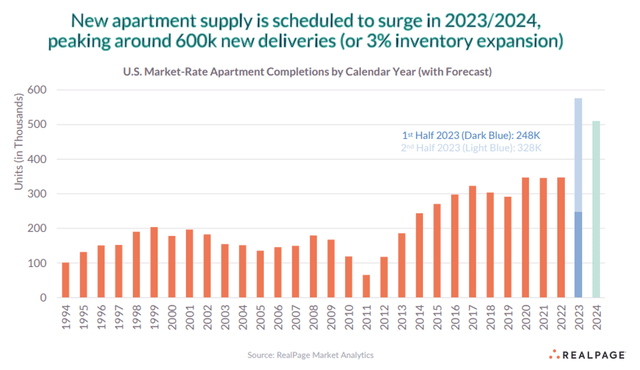

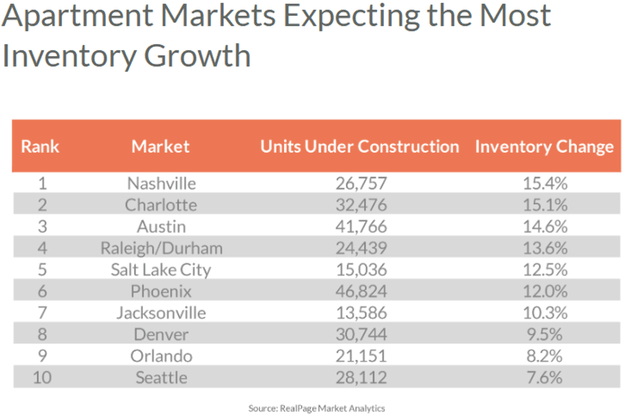

Slowing household formation may be a contributing factor to declining rents, but a bigger cause is new inventory. Camden identified the markets with the most potential and developers had spotted the same opportunity. In many markets, new apartment delivery will outstrip demand over the next couple of years.

Development

It is currently estimated that new apartment deliveries will approach 600,000 units in 2023 and 2024.

Not every market will see huge new supply, but many of Camden’s markets will see apartment inventory expand meaningfully .

Camden acknowledges the headwinds the surging inventory presents, but their long industry experience allows them to respond with a calm patience.

Camden’s Frank Perspective

In CPT’s 4Q22 earnings call, CEO Rick Campo describes the market conditions now evolving as a return to normal. That return to normal translates to a good business environment, it just pales to 2022’s sugar high of 15% rent growth.

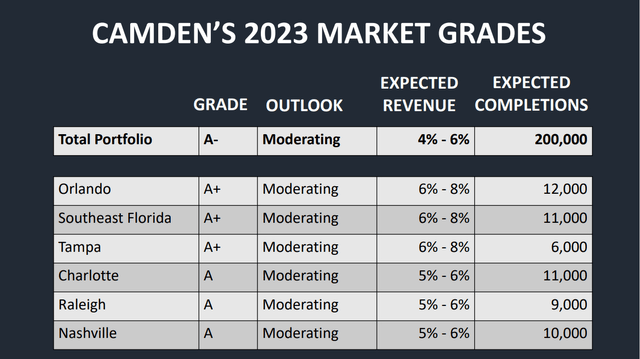

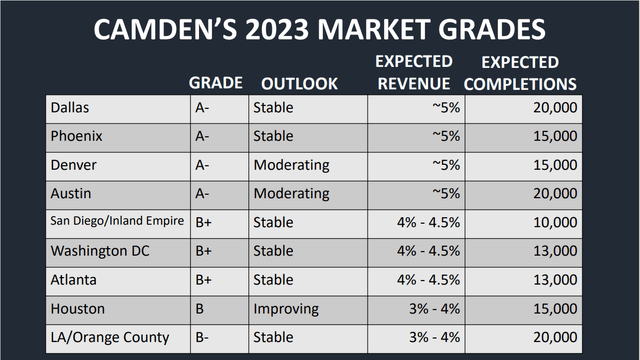

With their earnings release, Camden issued a markets report card that gave the total portfolio a grade of A-.

Their estimates of 2023 rent growth and expected deliveries are very much in line with data coming from third party sources, but Camden sees the markets as more nuanced and that they will still achieve 5.1% revenue growth this year.

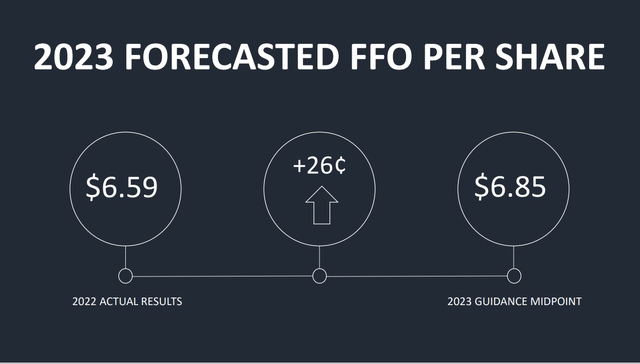

In providing initial 2023 guidance, they forecast $0.26/share FFO growth at midpoint (a 3.945% improvement over 2022 results). They also displayed their confidence by hiking the dividend by 6.4%.

Our Take

Camden Property Trust has one of the most experienced, capable, investment worthy teams in the whole REIT universe. We maintain a small, long position in CPT and plan to expand it.

In consideration of current share pricing however, we will take management’s advice and exercise patience. CPT is always on our radar. If prices fall to 15X FFO/share, we will buy big.

Be the first to comment