marlaynaglynnbrown/iStock via Getty Images

The Q1 Earnings Season for the Gold Juniors Index (GDXJ) is just around the corner, and one of the first companies to release its preliminary results was Calibre Mining (OTCQX:CXBMF). Overall, the company had a decent start to the year, with the contribution from its new Pan Mine offsetting the slight decline in production at its Nicaraguan operations. This has left the company tracking well against its FY2022 guidance. Based on Calibre’s track record of operational excellence and solid organic growth profile, I would view sharp pullbacks as buying opportunities.

El Limon Drill Core (Company Website)

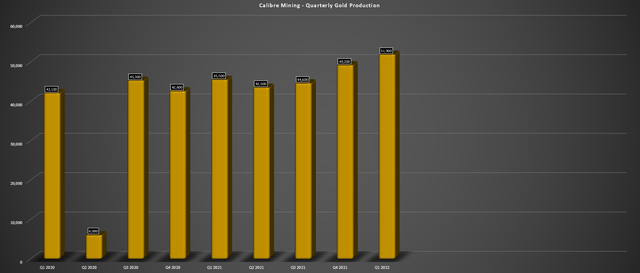

Calibre Mining released its preliminary Q1 results last week, reporting quarterly production of ~51,900 ounces, a new record for the company, and a ~15% increase year-over-year. The sharp increase in production was helped by the company’s new Pan Mine, acquired in its acquisition of Fiore Gold, which contributed 9,000 ounces in the quarter. It’s worth noting that this figure would have been higher, but this was not a full quarter for Pan due to the closing date of the acquisition (January 12th) and fewer ounces placed on the pads in Q4 2021. Let’s take a closer look below:

Calibre – Quarterly Gold Production (Company Filings, Author’s Chart)

The chart above shows that Calibre saw a meaningful increase in sequential and year-over-year production, with quarterly production trouncing the previous quarterly record. This figure would have been higher if not for the back-end weighted production at its Nicaraguan operations this year and the fact that Fiore’s contribution of 9,000 ounces was based on just a partial quarter (~10 weeks of production). However, with Nicaraguan production increasing and a full quarter of contribution from Pan going forward, I would expect more quarterly records to come for Calibre.

Pan Mine (Company Presentation)

Digging into the Nicaraguan operations, it was a soft start to 2022 for Calibre, with gold production of just ~42,900 ounces, down from ~45,500 ounces in Q1 2021. This was related to lower throughput and a lower overall recovery rate, with ~401,200 tonnes processed at slightly higher grades with a recovery rate of 90.1%. These figures were slightly below the ~419,300 tonnes processed at 3.54 grams per tonne in Q1 2021, at a higher recovery rate of 91.3%.

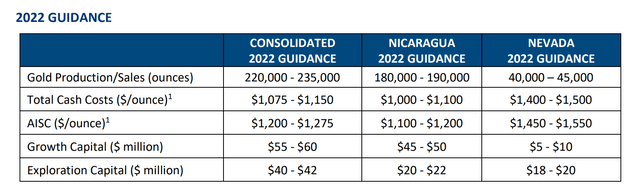

Calibre Mining 2022 Guidance (Company News Release)

While we did see a slight dip in production at the Limon and Libertad, it’s important to note that the company is expecting a significant increase in H2 production related to mine sequencing. So, while H1 production could come in below 86,000 ounces, we should see production improve to ~100,000 ounces in the second half. This will help to pull down costs in the second half of the year, while costs would appear quite high in H1 2022 due to adding a higher-cost operation (Pan Mine guidance: $1,500/oz midpoint) and lower sales at its larger assets.

Exploration

One of the key differentiators for Calibre is its aggressive exploration budget, which investors should be very encouraged by, with not enough companies spending like Calibre on exploration. As discussed by the company, its FY2022 exploration budget is $41 million, which is 40% higher than Fortuna Silver’s (FSM) exploration budget despite Calibre having a much smaller production profile (~225,000 GEOs vs. ~350,000 GEOs).

This suggests a high probability of making new near-mine discoveries and building on resources/reserves, which is what I like to see, especially from smaller companies that call themselves growth stories. Karora (OTCQX:KRRGF) has a similar strategy of spending at least $12 million per ~100,000 ounces produced, and so far, this has paid off well for the company. However, Calibre’s budget is one of the most aggressive sector-wide at ~$17.4 million per 100,000 ounces produced. Within this program is ~85,000 meters planned in Nevada so that Calibre can work to extend the relatively short mine life at Pan.

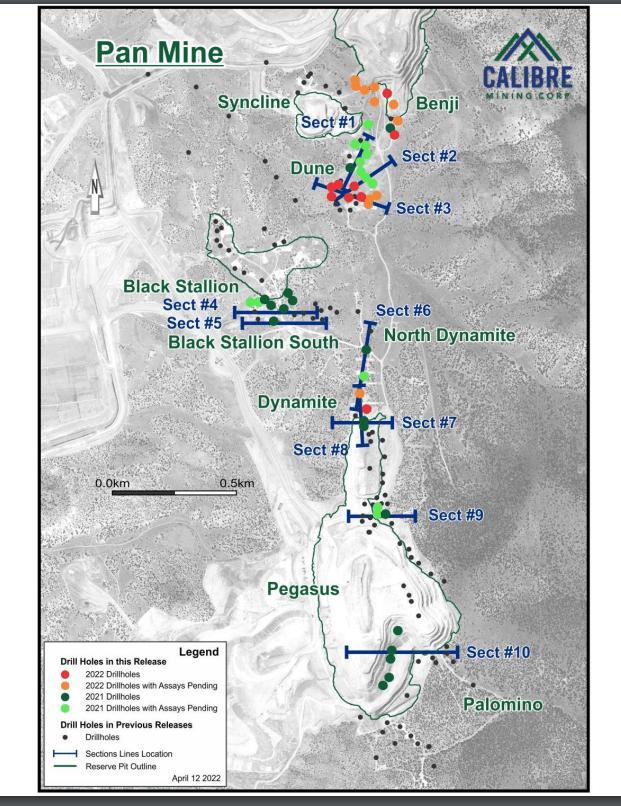

Pan Mine Exploration (Company Website)

So far, this large drill program is paying off. This is evidenced by the company releasing solid results in April from the Dynamite target, Pegasus target, Dune target, and Black Stallion target, which all lie near current operations. Some highlight holes are as follows:

- 18.3 meters at 1.29 grams per tonne gold (Dynamite, drilled below north edge of mineralization)

- 9.1 meters at 1.46 grams per tonne gold (Dynamite, below current pit design)

- 9.1 meters at 1.01 grams per tonne gold (Pegasus, drilled down-dip of inferred resources, and adjacent to PR21-045, which hit 1.02 grams per tonne gold over 50.3 meters)

- 15.2 meters at 0.95 grams per tonne gold (Dune, in between known resource areas)

- 25.9 meters at 0.75 grams per tonne gold (Black Stallion, confirming the presence of new mineralized breccia bodies outside the primary control for ore grade mineralization)

While these highlight holes are not representative of the average grade of all holes released, they are solid intercepts and are well above the average reserve grade of 0.42 grams per tonne of gold at Pan. So, while I expect meaningful reserve growth, we could also see a slight lift in the average grade at Pan, which could boost the production profile in future years.

Financial Results

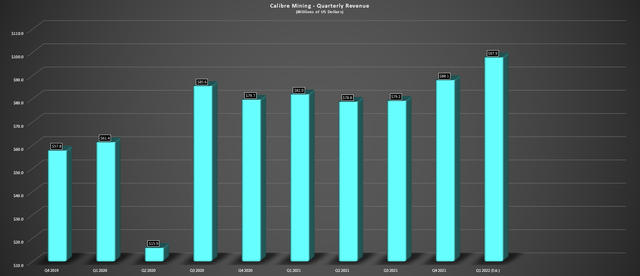

Moving over to Calibre’s financial results, the company should report record revenue of ~$98 million in Q1 2022 depending on its average realized gold price, with ~52,300 ounces sold in Q1 2022. This would represent a more than 10% increase sequentially and a 19% increase from the year-ago period. This is based on my expectations for an average realized gold price of $1,870/oz or higher. Looking ahead to Q2 2022, we should see revenue hit the $100 million mark, with similar gold sales in the period at an average realized price of ~$1,915/oz, helped by the strength in the gold price quarter-to-date.

Calibre Mining – Quarterly Revenue (Company Filings, Author’s Chart & Estimates)

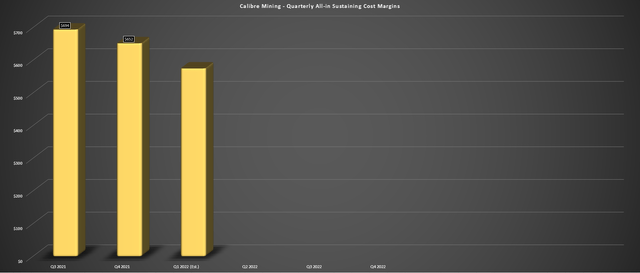

Looking at margins, we are likely to see some margin compression on a sequential and year-over-year basis in Q1, with all-in sustaining cost [AISC] margins likely to come in below $580/oz. This will represent a more than 15% decline year-over-year and a double-digit decline sequentially. The increase in costs is related to lower production in the first half at Calibre’s Nicaraguan operations, the addition of a relatively high-cost operation (Pan), and inflationary pressures.

However, for the full year, and assuming Calibre meets its guidance midpoint of ~$1,238/oz, we could see slight margin expansion. This assumes an average realized gold price of $1,915/oz or higher for the year, which would offset the higher operating costs. Assuming an average realized gold price of $1,915/oz, which doesn’t appear unreasonable, Calibre’s AISC margins would come in at $677/oz, up 3% from the $655/oz reported in FY2021.

Calibre Mining – Quarterly AISC Margins (Company Filings, Author’s Chart & Estimates)

While this low-single-digit margin expansion might pale compared to some peers, it’s important to note that Calibre has a path towards meaningful organic growth, utilizing excess mill capacity at Libertad with high-grade Eastern Borosi material. Meanwhile, even after factoring in some inflationary pressure, Gold Rock could be a $1,090/oz per annum operation, below Calibre’s current consolidated AISC.

Although we’re still a few years away from potential optimization at Pan, higher Nicaraguan production, and first production from Gold Rock, there is a path to much lower costs medium-term. Therefore, Calibre is what I would consider a high-quality growth, evidenced by meaningful low-capex organic growth with a simultaneous path to higher margins on a consolidated basis and increased diversification (4 assets vs. 3 assets).

So, is the stock a Buy?

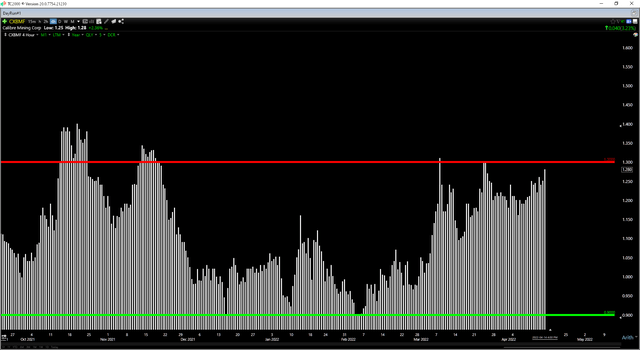

While Calibre is very reasonably valued at barely 1.4x FY2022 sales estimates at a fully diluted market cap of ~$625 million, the stock is sitting just shy of a potential resistance level at US$1.28, with no strong support until US$0.90 – US$1.00. This doesn’t mean that the stock can’t head higher, but when it comes to small-cap producers, I prefer to buy at support or on technical breakdowns, not near multi-month resistance. So, while I see Calibre Mining as a Hold given its strong organic growth profile, I no longer see the stock at a low-risk buy point.

CXBMF Technical Picture (TC2000.com)

Calibre Mining had a solid start to FY2022, and true to form, the company looks like it will have no problem meeting and potentially beating its FY2022 guidance midpoint. Meanwhile, the company’s future looks quite bright with a more diversified production profile, meaningful growth in the tank at existing/development assets, and a steady stream of exploration results from its aggressive drill program. Given the company’s operational excellence and industry-leading organic growth potential, I would view sharp pullbacks as buying opportunities.

Be the first to comment