Mrinal Pal/iStock Editorial via Getty Images

We are bullish on Cadence Design Systems (NASDAQ:CDNS), Inc. Our buy thesis is based on our belief that CDNS plays a fundamental role in Electronic Design Automation (EDA). CDNS provides tools to help customers design electronic products such as chips and other devices. CDNS’ business is fueled by the demand for new products and better designs for existing ones.

The company provides a wide range of services for data science, machine learning, computing, automobile, 5G communication, and IoT markets. We believe CDNS stands to benefit from the microchip industry’s demand for new chip designs and believe its EDA business could potentially offset semiconductor slowdowns. Chip demand fluctuates, but demand for new chip designs is constantly growing. Companies are always looking for newer technology and optimized designs. CDNS enables its customers to design new products, thus providing a technological edge over the competition. We like CDNS because it provides the chip design services necessary for technological advancements. With increased global digitalization, we expect demand for CDNS chip design services to increase and recommend buying the stock.

Demand for EDA business is constant and increasing

We believe the EDA business is remarkably stable in all kinds of markets. We recommend investors buy CDNS shares because the company is well positioned within the EDA industry and its peer group. The services and products CDNS provides pivotal to chip design. CDNS provides services that enable the billions of transistors within chips to work flawlessly to make devices such as our phones, computers, and other electronic devices work. CDNS products help customers design more complex and faster chips to beat the competition.

According to Allied Market Research, the EDA market size was $11.5B in 2020 and is projected to reach $20.89B by 2027, growing at a CAGR of 9.6%. The EDA market is dominated by CDNS and its main competitor, Synopsys Inc (SNPS). We believe investing in CDNS is equivalent to investing in the EDA industry because when the industry grows, so will CDNS’ business. The following image outlines the global EDA market forecasts.

Allied Market Research

CDNS is at the center of the microchip industry shift

The company is at the center of a microchip industry shift to smaller chips and proprietary designs. Many software and other companies that once bought their chips from third parties are now designing their chips in-house. Apple (AAPL), Tesla (TSLA), Amazon (AMZN), and other tech giants are increasingly looking to design their purpose-built chips. As more companies venture into chip design, CDNS’ client base will likely expand. CDNS services are a vital step in the chip design process that cannot be skipped. The company provides its customers with software, hardware services, and reusable IC designs. These services help customers understand how to make better chips quickly. In previous decades, CDNS’ customer base was limited to traditional semiconductor manufacturers; now, its customer base is expanding to other chip-design newcomers such as Meta (META), Google (GOOGL) (GOOG), and Amazon. We believe CDNS will grow with the increasing and reliable demand for new chip designs.

We also believe demand for CDNS products correlates with the increased demand for semiconductor devices. According to IDC, the semiconductor industry is forecasted to grow at a CAGR of 13.7%. Increased demand for new designs and redesigns of existing products drives the growth of semiconductors. We believe the company’s chip design prowess could potentially ease the semiconductor slowdown by spurring demand for newer, more efficient chips. We believe the company provides an attractive risk-reward and recommend investors buy the stock at current prices.

Stock performance

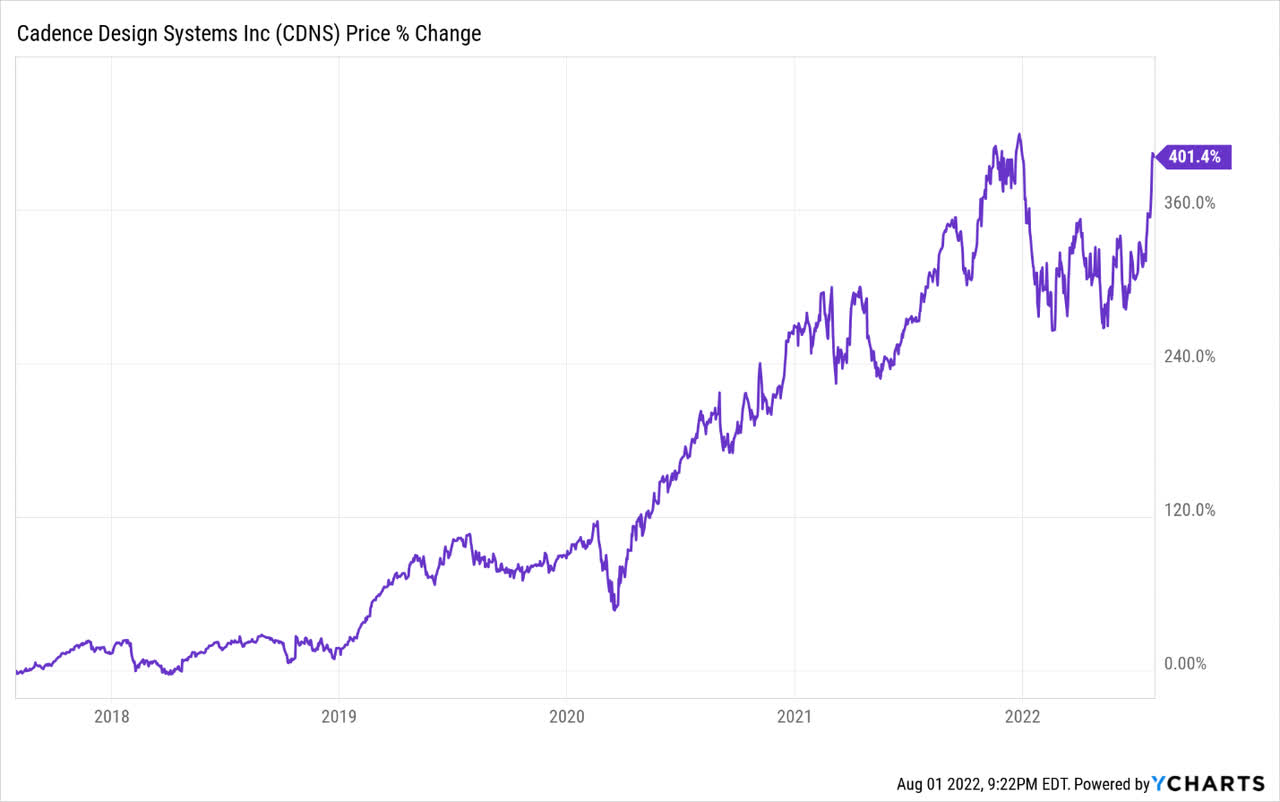

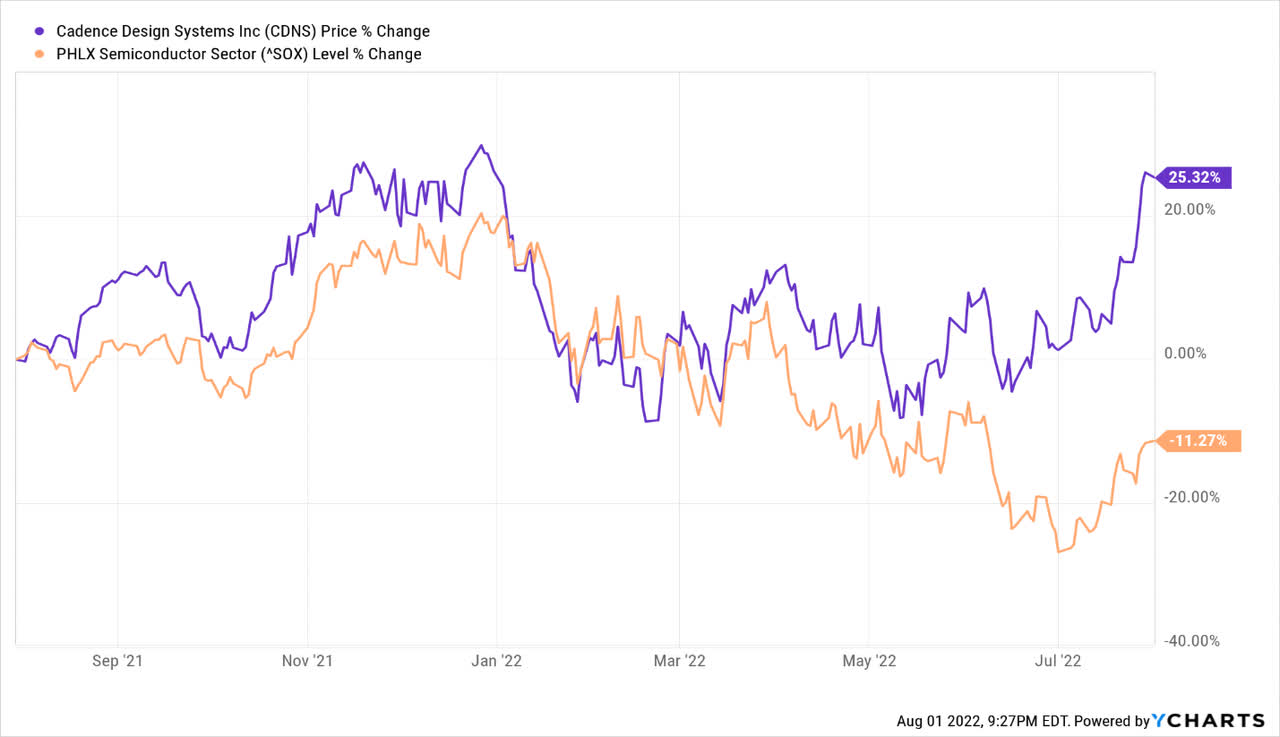

CDNS had an impressive run over the past five years. During this period, the stock appreciated 401%. Despite the downward draft within the semiconductor industry, CDNS has been up 25% over the past year. YTD, the stock is down around 1%. CDNS has still beaten semiconductor indices over the past year. We recommend investors buy into the chip design giant. The following graphs indicate CDNS stock performance over the past five years.

Ycharts

Ycharts

CDNS data by YCharts

Valuation

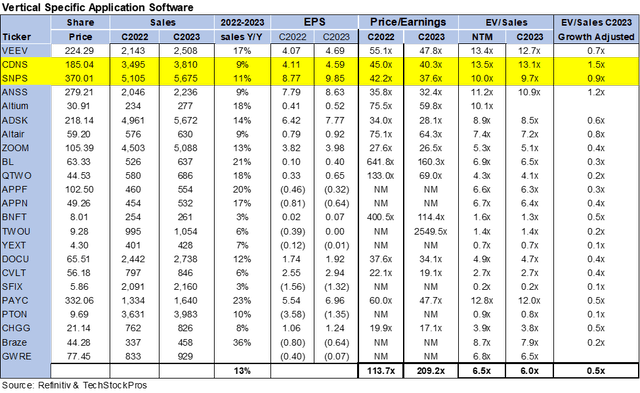

CDNS is trading at around $185 and is cheap relative to its peer group on a P/E basis. On the P/E basis, CDNS is trading at roughly 40x C2023 EPS $4.59 compared to the group average of about 209x. The stock is trading at about 13x EV/2023 sales versus the peer group average of around 6x. On a growth-adjusted basis, the company is trading at 1.5x C2023 compared to the average of 0.5x. We believe investors are willing to pay a higher multiple on stocks such as CDNS that have stable earnings and captive markets. The following chart illustrates the semiconductor peer group valuation.

Word on Wall Street

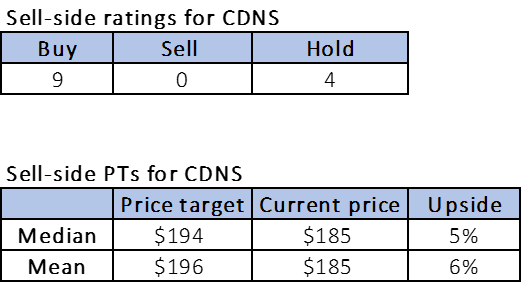

The market is buy-rated on CDNS. Of the 13 analysts, nine are buy-rated, and four are hold-rated. CDNS is trading at $185. The median price target is $194, and the mean price target is a bit higher at $196, for a potential upside of 5-6%. We expect the price targets to be raised as the company continues to beat and raise estimates. The following chart indicates CDNS’ sell-side ratings and price targets:

Refinitiv

Risks to our buy rating

CDNS is not risk-free. CDNS operates in a highly competitive industry characterized by rapid and constant technological change. CDNS’ growth depends on its ability to deliver the best and most optimized chip designs. Synopsys Inc is CDNS’ most significant competitor in the field. On the YTD metric, SNPS grew around 3% outperforming CDNS which grew less than 1% during the same period. We are not too worried about CDNS’ competition because both companies more or less dominate the chip design industry.

Nevertheless, even while there appears to be more than enough customers to go around, the chip design giants are at risk of customer consolidation. There are trends within the semiconductor industry of the combination of businesses or semiconductor businesses merging or acquiring one another. CDNS would be at risk of depending on fewer of its traditional semiconductor customers if this trend continues. We believe customer consolidation will ease as tech giants rush to make their own in-house chips.

What to do with the stock

We believe CDNS provides a favorable risk-reward because it feeds the demand for new chip designs. The company has been consistently beating expectations, and we expect the coming quarters will show more of the same. In its latest quarter, 2Q22, CDNS exceeded expectations by $0.11. We believe demand for new chip designs is CDNS’ primary growth driver. We are bullish on CDNS’ position within the EDA industry and recommend investors buy in.

Be the first to comment