Black_Kira

I am personally catching up with the review of many growth stocks that have seen their share price obliterated over the past year and a half in search for good opportunities. A prime example of that is C3.ai, Inc. (NYSE:AI), an enterprise software maker that clearly entered the public market at the perfect time. The shares of the company were indeed immediately picked up by the crowd in early 2021 and shot up to incredibly high valuations, only to be shortly after sold consistently until the current price of $12 per share, down a staggering 92% from all-time highs. Does it mean the company is now cheap? Well, after reviewing it, I honestly could not find any compelling reasons why an investor would want to own shares of C3.ai instead of other software companies with much better scale and growth profiles. Let’s see more in detail why I think that is the case.

Improving operations through the use of AI

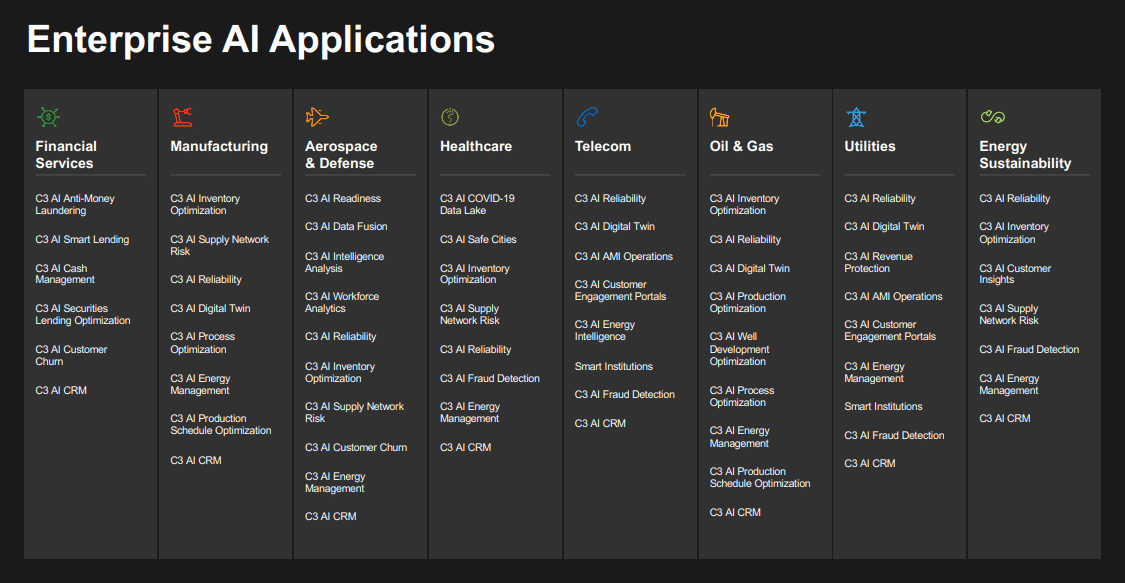

C3.ai suite of applications (C3.ai Annual Report)

C3.ai, as the name suggests, is a company fully devoted to artificial intelligence software. The company develops cross-industry applications that are then sold to its customers based on a Software-as-a-Service mode. These pre-built applications are implementable in one to six months, and are ultimately customizable by the end customer; in addition, the company also sells access to the C3.ai Application Platform, a toolkit that enables customers to easily create custom application on a low-code or no-code basis, meaning that the end customer does not necessarily need to be an expert programmer in order to create applications. The applications can then be deployed not only internally, but also integrated with all the biggest cloud infrastructure available on the market.

C3.ai generates revenue from subscriptions and professional services. Subscription is the bulk of the revenue and consists typically of three years contracts. In addition, a portion of the revenue is also usage-based, meaning that the company will also benefit if the customers are growing themselves, which as a result would ideally push them to utilize more C3.ai services. Recently, the company has pivoted its business model to rely much more on the consumption based model rather than simply on the subscription fee, a model that over the years has been successfully implemented by companies such as Twilio (TWLO), Snowflake (SNOW), Amazon Web Services (AMZN) and many others. I believe the shift makes sense as C3.ai generally targets very big clients, and goes after very big contracts; a consumption-based model can be very beneficial if the company lowers the entrance barriers to its platform, but benefits if the enterprise customer adopts more services and uses them more; nevertheless, a business model pivot inevitably adds some execution risk to the picture.

What I find interesting is that subscription’s GAAP Gross Margin was on average around 75%, which is very healthy overall but not that high if compared with gross margins usually seen in the SaaS space. Definitely something to monitor for the future, as a gross margin improvement would be an early indication of the company reaching some meaningful scale. Professional services revenue is oftentimes meaningless for SaaS companies, as it reflects services that companies offer to facilitate the software implementation and to ultimately favour the closing of the deal. Very differently than other SaaS companies, C3.ai actually sells these professional services at around 50% gross margins, which is impressive as generally SaaS companies offer these services at negative margins. No meaningful growth will ever come from professional services revenue, but good to see the company operating them judiciously nevertheless.

Recent performance spells trouble ahead

The company’s most recent quarter definitely did not please investors. Q1 2023 saw C3.ai’s Revenue coming in at $65.3 million, up 24% YoY and GAAP Net Income of negative $71.9 million, much worse than the loss of $37.5 million posted in the same quarter a year ago. Gross profit margin actually contracted to 71.82% overall due to a contraction especially in Subscription gross margin, which went from 80% a year ago to the current 76% due to headcount growth compared to the same period the year before. The company is far from being profitable also on a Free Cash Flow basis, having recorded negative cash from operations every year since 2019. In the quarter, the company recorded negative $38.5 million in cash from operations and a whopping $15.5 million in Capital Expenditures, way overblown compared with historical average for the company (sub $1 million of quarterly CapEx) due to the build-out of the new company headquarters.

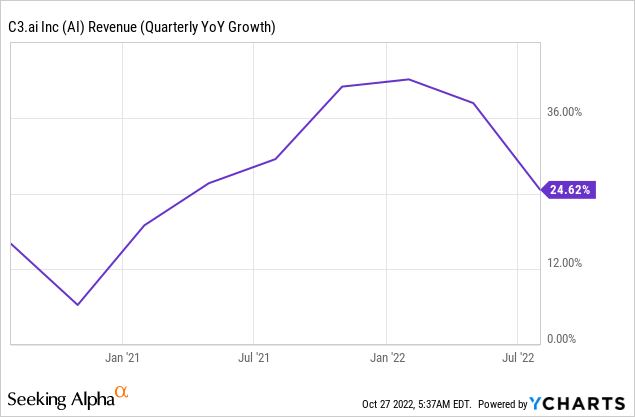

Overall, the company has clearly experienced revenue growth slowdown primarily due to macro headwinds: companies world-wide are tightening their budget and C3.ai is experiencing difficulties in attracting new customers as they are generally expecting a recessionary environment going forward. Below, an extract from the latest earnings call:

Our customers and prospects appear to be expecting a recession, and we are seeing customer purchasing behavior consistent with that expectation. It appears to us that this market downturn could be significant. So we have put into place a combination of measures that will allow us to not simply weather this downturn, but to emerge a stronger, more rapidly growing company with greater market share and greater market presence. The measures that we have implemented include a restructured, more productive enterprise sales function, an enhancement of our strategic partnering model, several new product offerings, a new consumption-based pricing model and an acceleration of our path to profitability.

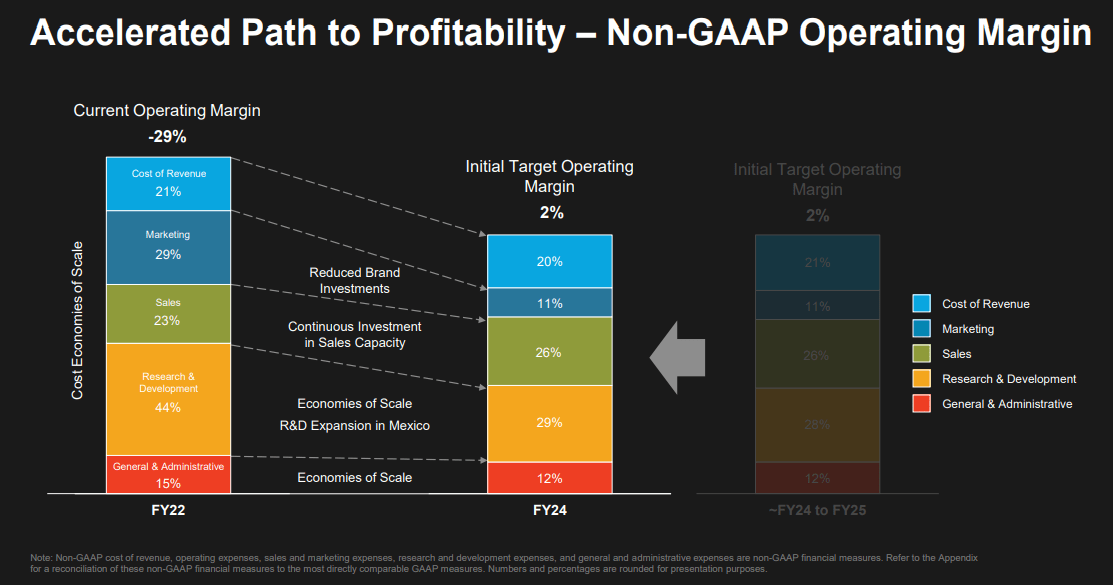

Management’s response to the tough times ahead appears very decisive, and for good reasons: C3.ai works with a very limited number of big customers (the company added in the quarter just 31 new contracts), hence any slowdown in the sales cycle will inevitably have big repercussions. It will be increasingly hard for C3.ai to justify a major expense for their software when the customers are cutting budget for discretionary spending. Therefore, management is cutting a lot of expenses themselves to preserve cash, which in turn has accelerated the path to profitability: initially projected between FY2024 and FY2025, now it should be achieved by FY2024 thanks to reduced operational spending.

C3.ai Earnings Report

On the bright side, the company’s balance sheet is in excellent shape, with $907 million of cash and short-term investments and no debt. Based on the liquidity position alone, there does not seem to be imminent risk of C3.ai going bust, raising hope that eventually the company will be able to reach scale.

There are many risks for investors

I believe that there are too many risks to consider in relation to an investment in C3.ai, even at the depressed price levels seen lately. I personally don’t like when companies have very high customer concentration as in C3.ai’s case: as per the latest Annual Report, one customer accounted for 31% of total revenue, while three separate customers accounted for 32%, 13% and 12% of accounts receivable. Such a high concentration means that if C3.ai loses one of its top clients, it will have huge repercussions on the entire business. Considering how uncertain the macro economy is, C3.ai might find itself without some of its customers even with no faults of its own.

Moreover, despite operating in the SaaS space and having all the bells and whistles of the classic growth tech companies, C3.ai never really reached very high revenue growth rate even during 2021, and the rate is now already slowing quite considerably. This has to be expected given the nature of the business, however, this adds further risk that revenue might grow much slower than other software peers.

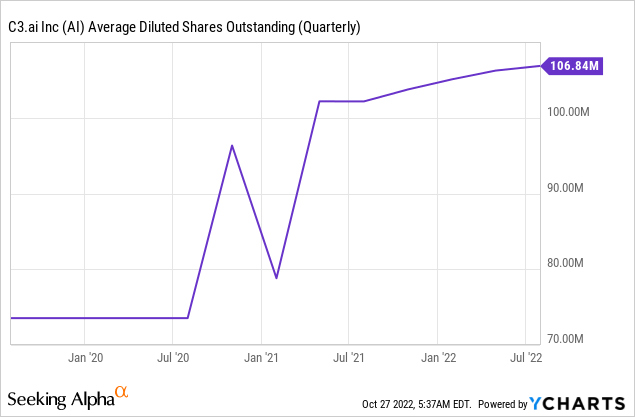

YCharts – Seeking Alpha

Despite a sub-par growth profile, the company is still massively relying on stock-based compensation, causing dilution to current shareholders. In the latest quarter, C3.ai issued shares for $53.6 million due to SBC compared to $65 million of total revenue, a pretty staggering amount that has diluted shareholders at an average rate of 4.5% YoY in the past 3 quarters. With the stock down 92% from all-time highs, the company might necessarily dilute shareholders at a faster rate going forward just to maintain constant compensation packages for its employees, or facing the possibility of high attrition in the workforce.

YCharts – Seeking Alpha

Not attracting even at current valuation

Valuation is honestly a complicated puzzle. Gone are the crazy times of Price to Sales ratios of 80 seen in early 2021 when the stock first came public. Now, C3.ai trades at 5.11 P/S, which is still not that cheap considering all the risks. No other valuation metric can be used as the company is far from optimized for profitability, and also it still generates negative cash from operations. Management is targeting 2% of operating margin for 2024: by assuming, probably optimistically, 20% revenue growth for FY2023 and FY2024 the company will generate that year $362 million of revenue. By calculating then $7.2 million of FY2024E operating profits, it means that the company is currently trading at Price to 2024 Operating Profits of 158. Even by assuming 0% tax rate and other expenses, this seems an insane ratio in my opinion for a company that has yet to prove much in the public market. I think that there are far better opportunities available today for long-term investors.

Be the first to comment