JGalione

Investment Thesis

BYD (OTCPK:BYDDY) has emerged as a leading player in the Chinese EV market. What’s more, the company is focused on international expansion as well. Although BYD, like other EV makers, is facing near-term headwinds and supply chain challenges, the company looks extremely well-placed to grow in the long term. It has been growing its revenue rapidly over the years. Correction in the stock this year offers an attractive entry point for long-term investors.

Operations

BYD is a Chinese company involved in designing, manufacturing, and selling automobiles, rechargeable batteries, and mobile handsets. The company is also involved in developing urban bus and rail transportation. It has been in the market for more than 25 years, growing rapidly over the years. It is also the only automaker in the world that makes its own batteries and chips. BYD has established factories in over 30 industrial parks across 6 continents operating in the auto, renewable energy, electronics, and rail industries. It offers comprehensive new energy solutions with a goal of zero emissions. Recently, the company discontinued its Internal Combustion Engine, or ICE, vehicle production to focus completely on New Energy Vehicles.

China’s Automobile Industry

In 2022, China saw a rise in Covid-19 cases sporadically, which aggravated tension in industry and supply chains. In the meantime, China’s economy suffered from shrinking demand and supply shock pressures, which weakened consumers’ confidence and expectations. The Covid-19 outbreak in Jilin and Shanghai, shortage of chips, and inflationary pressures made the automobile market more challenging. To overcome such difficulties, the government introduced new policies which helped the automobile companies.

According to the China Association of Automobile Manufacturers data, the country’s automobile production and sales numbers in the first half of 2022 were down by 3.7% and 6.6%, respectively. On the other hand, New Energy Vehicle production and sales volume numbers increased by 109% and 93% on a year-on-year basis in H1 2022. Technological advancement, industry upgradation, and an increase in oil prices contributed to the increase in NEV production and sales.

According to the International Energy Agency, of the 6.6 million EVs sold worldwide in 2021, 3.3 million were sold in China. EV sales in China doubled in 2021 from 2020.

Financial Summary

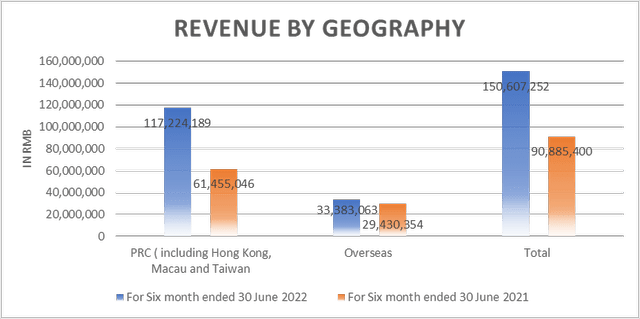

In the first half of 2022, the company recorded revenue of RMB 150,607 million with a year-on-year growth of 66%. Revenue from the automobiles segment stood at RMB 109,267 million and grew by 130% year-on-year. On the other hand, revenue from handset components and assembly services amounted to RMB 41,070 million and fell by 4.7% on a year-on-year basis. Profit belonging to shareholders of the parent company also increased by 206% on a year-on-year basis as compared to H1 2021. This was due to rapid growth in the NEV business. Gross profit margins for the period increased by 75% and improved by 12% year-on-year as compared to the same period last year.

Over the ten-year period, BYD’s revenue mix has remained quite constant. The automobile segment contributes more than half of the company’s total revenue. More than a third of the company’s revenue comes from handset components and assembly services. The remainder is generated by the sale of rechargeable batteries and photovoltaics.

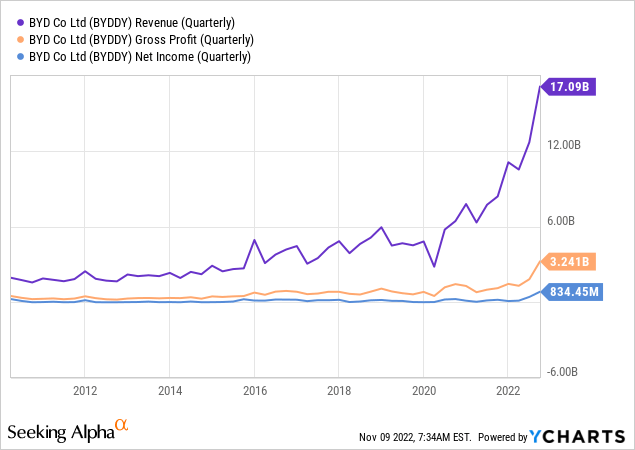

Over the past 10 years, quarterly revenue has grown by 476%. Quarterly gross profit and net profit have also improved over the period.

BYD

Revenue from PRC which includes Hong Kong, Macau, and Taiwan grew by 90% and 13% respectively year-on-year in H1 FY 2022.

BYD

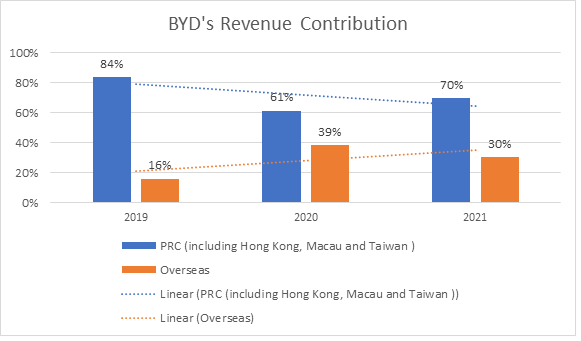

However, the contribution from PRC region towards revenue has decreased since 2019 as the company started introducing models overseas.

Sales

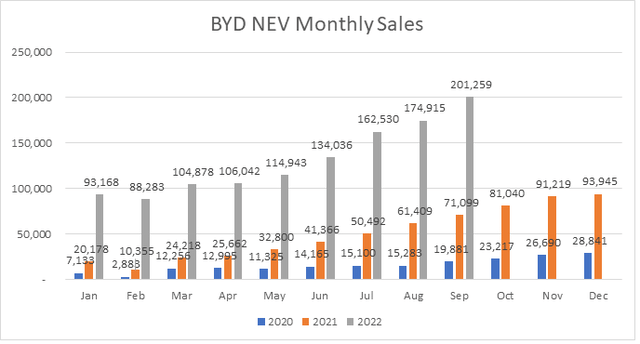

BYD contributed about one-third of China’s New Energy Vehicle sales in the month of July. BYD’s retail sales in July stood at 158,957 units. It sold 80,991 Battery Electric Vehicles and 81,223 Plug-In Hybrid Electric Vehicles in July.

BYD

BYD’s NEVs consists of passenger car and commercial vehicles. From the above data, it is indicated that BYD auto monthly sales surpassed the 200,000-unit mark for the first time in September. The sales number was up by 183% from 71,009 units in September 2021 to 201,259 units in September 2022. Also, there was a 15% month-on-month increase in sales in September.

The Battery Electric Vehicle sales comprised of 47% of the total monthly NEV sales. BEV monthly sales stumbled a bit in the month of February and March 2022 but showed strong growth thereafter. PHEV sales stood at 106,032 units in September and went up by 214% over the same period last year.

Although sales numbers look attractive, BYD is sitting on a huge order backlog. The company has 7,000,000 units of backlog in hand with a waiting time of 4-5 months. The company intends to achieve monthly delivery of 2,80,000 units by the end of this year.

Valuation

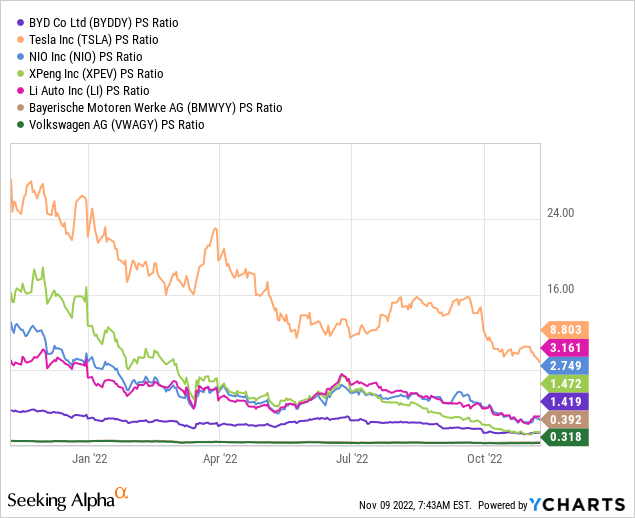

Chinese automakers such as BYD, XPeng (XPEV), Li Auto (LI), and NIO (NIO) have PS ratios that are relatively higher than the traditional automakers. However, the ratios for NIO and Li Auto are higher than those of BYD.

In a year, BYD’s PS ratio decreased from 5.83 to 1.41. This was due to a drop in share price and a rise in sales.

Is BYD Ready to Overtake Tesla?

EV Volumes

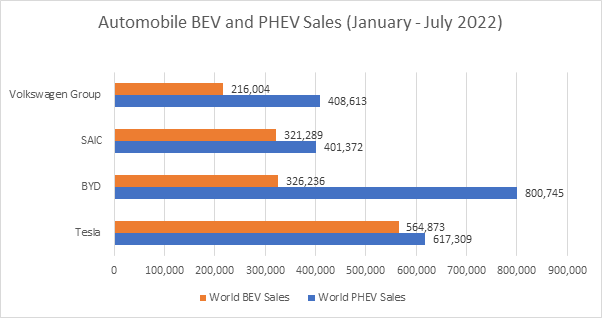

If we look at the world BEV and PHEV numbers, BYD exceeds Tesla (TSLA) by 200,000 units. But this is not the case for global BEV sales.

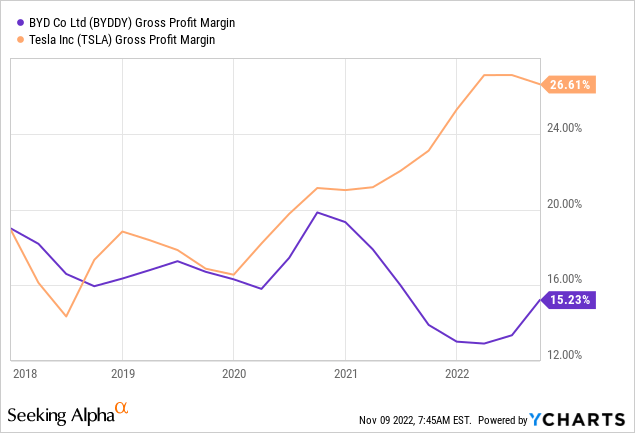

Although BYD PHEV sales numbers look appealing, its revenue and profit are still less compared to Tesla. Tesla is more inclined towards selling models with higher prices, whereas BYD operates more in the mid-priced market segment. This offers Tesla high gross margins in comparison to BYD.

Risks

Changes in government policy regarding EVs remain a key concern for EV firms, including BYD. Making profits without government subsidiaries is difficult for EV makers. In the absence of lucrative subsidies, Tesla would probably have been the world’s sole profitable EV maker.

Another source of concern for all automakers is semiconductor shortage, which is unlikely to be resolved before 2023. BYD is also exposed to foreign exchange risk. The price of raw materials is fluctuating dramatically due to short-term supply and demand imbalances, putting severe strain on the supply chain.

Global Growth Ambitions

BYD hopes to rule the world car market by 2030. China’s largest NEV car manufacturer is planning to expand its presence in 45 major cities in Brazil by the end of the year. This would be done through partnering with local dealers in Brazil. The company plans to target 100 designated dealers in Brazil by 2023.

In September, the company entered the European market by launching three new electric vehicle models – the Atto 3, Tang, and Han. It also plans to enter 20 more European countries in the near team. Atto 3 deliveries have already started in Australia, New Zealand, and Singapore. The company also plans to enter the Japanese market with Atto 3 by early 2023.

The company plans to expand into 7 different Australian cities by the end of this year. In addition, VEMO, the largest new energy transportation operator in Mexico, has ordered thousands of BYD DIs. BYD is working with VEMO to promote electric transformation in Mexico.

The company has announced that it will set up a manufacturing plant in Thailand for producing 1,50,000 passenger cars on a yearly basis for 2024. It plans to enter the premium auto market by launching of BYD R, a luxury sedan and high-end SUV by June 2023.

Conclusion

In the first half of 2022, to satisfy expanding market demand, BYD improved the layout of all NEV manufacturing parts and rapidly boosted production capacity. Despite continuous advances in delivery speed, backlogs continue to rise to unprecedented heights, and delivery pressure remains. The company made some adjustments to its model prices in H1 2022 to mitigate the impact of cost increases induced by raw material price increases. Looking at production numbers, BYD is in a strong position to cater to the pending demand.

Its profit margins are likely to improve as the company is focused on improving its production numbers. An increase in production allows the company to take a cost advantage going forward.

BYD plans to continue enhancing its technology, offer more competitive goods, and adhere to its development plan in the future. The company plans to continue entering agreements with worldwide dealers in order to increase its footprint in the Netherlands, Sweden, Germany, Thailand, and Costa Rica. It intends to continue investing in low-carbon innovations in the worldwide public transportation system. It also aims to develop a worldwide green mobility system and accelerate the transition to a low-carbon society. The business is also using its technology to assist cities in the development of low-carbon rail transit systems such as “SkyRail” and “SkyShuttle.”

Overall, there is a lot to look forward to from BYD. The company’s strong position in the rapidly-growing Chinese market, its low-cost advantages, and international growth ambitions make the stock appealing.

Be the first to comment