Getty Images/Getty Images News

Thesis

On October 18th BYD (OTCPK:BYDDF) stock jumped as much as 7% in the Hong Kong trading session (Reference: 1211 BYD) after the company reported that net income for Q3 2022 could almost quadruple versus the same period one year prior, citing strong consumer demand. Notably, BYD’s upbeat forecast comes at a time when global investor sentiment towards China-based equities turns ultra-cautious, and at a time when the company’s most famous western investor – Warren Buffet – is reportedly selling down his stake. But as I have argued in a previous article, and what BYD’s recent Q3 statement highlights, sentiment does not accurately reflect the EV maker’s long-term growth story.

I continue to believe that investors should appreciate any price weakness as a buying opportunity. For reference, BYDDF stock is down about 40% from all-time highs. But YTD, the stock has performed in line with the broad market.

Profits Expected To Quadruple

On Monday October 17th, BYD said that profits for Q3 are expected to jump by as much as 333% to 365% versus the same period one year earlier. This would imply that from July to end of September, the company generated a net-income of about $764 million to $820 million.

BYD’s strong results defy a depressed economy in China, and were delivered the same day as when China unexpectedly delayed the publication of GDP data (arguably a signal that further highlights the thesis that economic growth in China is slowing). Such a dispersion, in my opinion, clearly highlights the resiliency of BYD’s business model: In the September quarter, BYD reportedly delivered 538,704 ‘new energy vehicles’, an increase of almost 200% versus Q3 2021.

As estimated by the China Passenger Car Association, BYD now claims an astonishing 29.7% market share in China’s new energy vehicle market – an opportunity that is expected to grow at a 25% CAGR through 2025. (Source Bloomberg Terminal, EV Intelligence Primer).

Poised For Even More Growth

In 2022, BYD has achieved three major growth milestones: First, BYD delivered more new energy green vehicles than Tesla (TSLA). Second, the sales volume of BYD’s EV battery unit surpassed those of LG Energy Solution – which means BYD’s battery unit only trails China-based CATL. And third, BYD overtook Volkswagen as the third most valuable auto company, now trailing only Tesla and Toyota (TM).

But BYD’s growth story is far from over. In fact, the company has only recently started to expand in international markets, including Europe and Southeast Asia. Although it remains to be seen how the company can compete in Germany – against the engineering excellence of Mercedes, BMW, and the Volkswagen conglomerate -, a presence in India, Vietnam and Thailand is poised to open a multibillion-dollar opportunity. Investors should consider that the latter markets are home to almost 2 billion of cost-conscious customers, who might prefer a lower-cost EV over the more ‘unattainable’ Tesla, BMWs and Porsches.

That said, investors should consider that on the backdrop of strong government support for green mobility, paired with a vertically integrated production chain and cheap labor, BYD may sell cars at a much cheaper price range than western competitors. While the cheapest Tesla claims as much as $47.000, the cheapest BYD demands less than $30.000.

Target Price Estimation

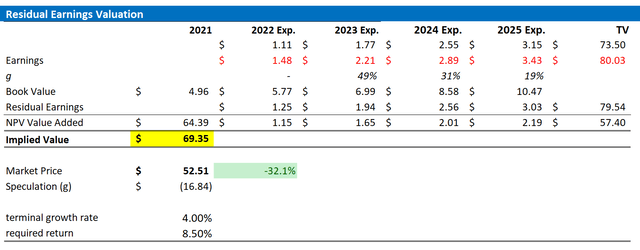

Following an unexpected strong Q3, I upgrade my residual earnings model for BYD to account for preliminary consensus EPS upgrades. However, I continue to anchor on an 8.5% cost of equity and a 4%, terminal growth rate (one percentage point higher than estimated nominal global GDP growth).

Given the EPS upgrades as highlighted below, I now calculate a fair implied share price of $69.35, versus 66.50 prior (BYDDY reference).

Analyst Consensus Estimates; Author’s Calculation

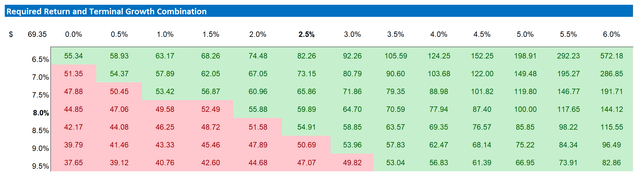

Below is also the updated sensitivity table.

Analyst Consensus Estimates; Author’s Calculation

Risks

As I see it, there has been no major risk-updated since I have last covered BYD stock. Thus, I would like to highlight what I have written before:

Most notably, BYD is based in China and generates its sales almost exclusively within China. Accordingly, the ongoing economic challenges in China, including the real estate crisis, zero-covid policy, and slowing economic growth will add a transitory headwind to BYD’s near-term outlook. Moreover, although the CCP currently acts favorably toward EV companies, this may change in the future – as the tide turned quickly on leading tech/internet giants. Investors should also consider that competition in the EV space is heating up, as new start-ups (NIO (NIO), XPeng (XPEV), Lucid (LCID), Baidu (BIDU)) and legacy car markets (Volkswagen (OTCPK:VWAGY), General Motors, Toyota (TM)) are pushing into the market. As a consequence, the EV business might be less attractive from an economic perspective, despite a strongly growing market. Finally, since Warren Buffett has started selling parts of his stake in BYD, investor confidence remains depressed. If Buffett would continue selling, I think it is likely that the BYD share price will experience more downward pressure.

Conclusion

Reflecting on BYD’s massive profit surge for Q3, which was clearly somewhat unexpected given the multifaceted challenges for the Chinese economy, I am confident to reiterate a ‘Buy’ rating for BYD stock. Although BYD’s valuation is not cheap based on 2022 numbers, the valuation is definitely attractive when accounting for growth. On the backdrop of EPS upgrades, I now calculate a fair implied share price of $69.35 (BYDDY reference).

Be the first to comment