Robert Way

I wrote at the beginning of August how BYD Auto (OTCPK:BYDDF) was setting itself up to become a world super-power in the auto world. Since then the company has moved quite rapidly to fulfilling this potential. It is already the world’s largest supplier of EV’s, moving ahead of Tesla (NASDAQ:TSLA).

Its vertical integration strengths enable it to avoid the supply problems many auto companies have been experiencing. Sales have been rising at a rapid rate this year. Its medium to long-term attraction for investors is very strong in my opinion.

However in the short term its stock price may continue to suffer from the drip feed of stock sales by Warren Buffett’s Berkshire Hathaway (BRK.B)

The Company

My article in October provided relevant details of the main aspects of the company. So I will not repeat this in detail here.

In brief the vertical integration strengths of BYD and its wide product and geographic spread are its greatest assets. It is the world’s third largest lithium battery manufacturer. Indeed it expects to be exporting its “Blade” battery shortly to rivals such as Toyota (TM) and Tesla (TSLA). It may already have done so in fact.

Its battery expertise is a crucial advantage. It is reported that they have already undergone successful trials with a new sodium ion battery. Sodium is far cheaper than lithium and less flammable, but heavier. If BYD have made a breakthrough it would indeed be significant.

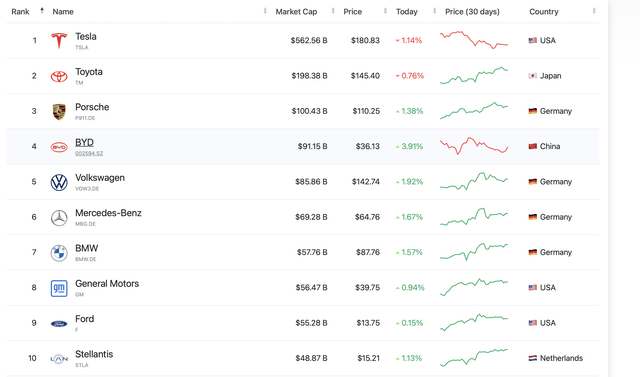

The company has the second highest number of employees worldwide of any auto company, at 418,700. The largest is Volkswagen at 641,900. It has the 4th highest market cap of any auto company, behind Tesla, Toyota and Porsche (OTCPK:POAHF).

It is the world’s largest manufacturer of EV’s. Six of the top ten EV models in the world are from BYD. It manufactures semiconductors. Its e-bus and e-truck network around the world assist greatly in adding autos to its e-bus and e-truck global network. It has 30 production sites for a range of inter-connected products around the world. it has recently placed orders to buy 8 PETC car and truck carriers, further to control its own destiny. Each vessel will have a capacity of 7,700 vehicles. That shows the intent of their export drive.

U.S. analysts have been slow to recognize BYD’s potential. However recent upgrades based on the potential of rising sales and improving profitability show they are finally seeing what is happening. Such upgrades are likely to interest U.S. investors more than anything else would.

In Q3 2022, BYD’s profit rose 350% year-on-year to 5.71 billion yuan ($800 million). It sold 538,704 units and is targeting 4 million next year. These will be manufactured from their base of 8 auto manufacturing sites around China. If the company really gets to 4 million vehicles next year, that will provide revenue of about $100 billion. A likely net margin of 5% would give them EPS of $1.72 and a PE ratio of 15. That will make analysts sit up and notice.

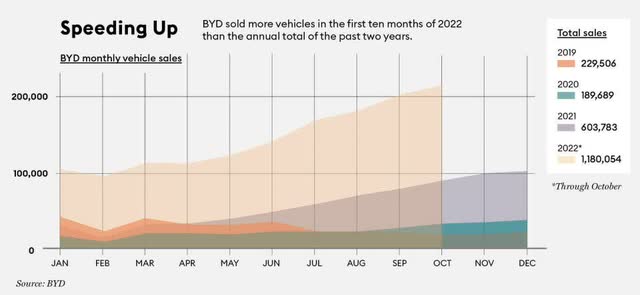

Its pace of sales growth is astonishing. The illustration below shows this:

In November the company sold 229,942 cars and 485 e-trucks in China. This was an increase of 83% year-on-year. It made it the largest manufacturer in the world’s largest auto market. Exports amounted to only 12,318 units according to some reports (I believe this may be an under-estimate). This was up from 9,259 units in October but still only a tiny proportion of sales. This number will accelerate rapidly in months to come based on orders already received.

The stunning growth is coming on the back of a healthy valuation for such a fast-growing company. My article in October detailed this.

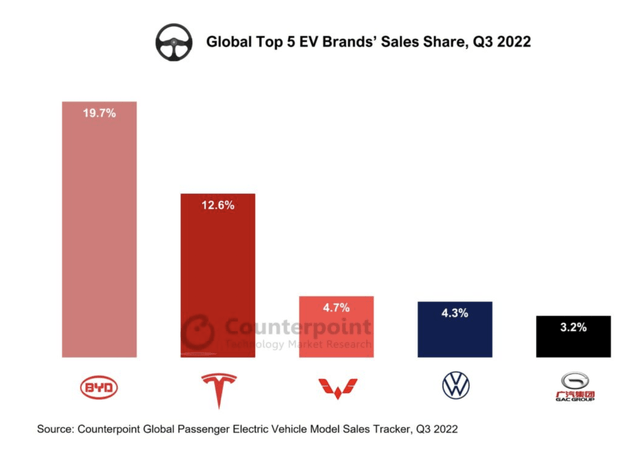

In Q3, looking at EV sales worldwide, BYD is by far the largest EV manufacturer, according to research company Counterpoint. This is illustrated below:

The company is already the world’s 4th largest auto company by market cap despite a recent decline in the stock price, as illustrated below:

BYD’s culture is very much an engineering one with a strength also in software. Tesla is very much software driven. Both of them are increasingly powerful as the old auto companies fail to come to terms with the transition. The ousting of Herbert Diess at troubled Volkswagen (OTCPK:VWAGY) is a stark reminder of this. His software initiatives caused many problems. The inertia of old auto companies is leaving them behind in the transition to EV’s. They struggle to cope with combining mechanical engineering skills with the new challenges of IT and digital technology

The Product Range

BYD’s product range is undoubtedly the widest of any EV manufacturer. It encompasses both full electric cars and hybrids, incorporating their new DM-i technology and their new “Blade” battery.

Their recently launched “Atto 3” model has been aimed specifically at the export market in Europe and Asia. It is pictured below:

Another recently launched model, the “Seal”, has been selling very well. It is illustrated below:

It is thought the company currently has a vehicle backlog of 700,000 units. It is expecting to increase monthly production capacity to 280,000 quite soon. That would in fact only give them an annual capacity of 3.36 million units when they are targeting 4 million for 2023.

Historically BYD have focused mainly on the lower end EV market. Their models have been gradually moving upmarket. In the first quarter of 2023 they are planning a new brand, “Yangwang”. This will be an upmarket range beginning with a luxury off-roader retailing at about US$117,000.

In addition they plan to rejuvenate the “Denza” brand. This is an upmarket brand manufactured in China in conjunction with Mercedes-Benz (OTCPK:MBGAF) which has so far had limited success.

In December the company has launched a mid-range 5-seater called the “Frigate”. Illustrated below it will retail at about US$35,000:

Europe

This is the continent that will be at the centre of BYD’s push to hit 4 million in sales next year. This year they have been setting up distributorships in country after country in Europe. Their Executive Vice-President Stella Li recently stated the company was looking to build one or maybe two car manufacturing plants in Europe (they already have two e-bus manufacturing plants there).

Other Chinese EV manufacturers are also targeting the continent. Companies such as NIO (NIO), Geely (OTCPK:GELYF) with their “Polestar” brand, XPeng (XPEV) and SAIC with their “MG” brand will probably thrive also on the back of China’s strong supply chain. BYD is by far the strongest though.

It has launched around Europe with 3 models. These comprise the “Han”, the “Tang” and the Atto 3. Norway was its initial trial market and early reaction was very positive. They have sold over 1500 units of the Tang model there. That is probably what drove the company to go strongly elsewhere in Europe at some speed.

In Israel they sold 2,333 Atto 3’s in just their second month of operations. That put them in third place for EV sales in the country.

South America

BYD already have assembly facilities and sales for their e-buses around the continent. BYD already have a solar panel factory in the country. This is an example of the advantages their vertical integration gives them over the competition. They have supplied taxi fleet orders in various countries. Now they are going full tilt at the consumer market.

Last month the company announced they hope to be building a $579 million plant in Brazil. This will be on the site of a Ford facility which was abandoned a few years ago. That seems like an apposite example of the new wave replacing the old. BYD have been encouraged by the new government of Lula da Silva though the project is still subject to final confirmation. Once again illustrating their vertical integration advantages they are additionally planning to manufacture bus and truck chassis there. They may also set up a lithium processing plant to ship back to their battery manufacturing operations in China. They expect to have 100 stores by the end of this year.

The opening ceremony featuring the “Song” model is illustrated below:

They have started selling their hybrid model Song and the all-electric “Yuan Plus” model in Colombia, Costa Rica, Uruguay and the Dominican Republic.

In November they announced the initial marketing of BYD products in Mexico. The target is to deliver 10,000 cars in 2023 and 30,000 cars in 2024. They are starting with the Han and Tang models, as pictured below:

BYD will not however be exporting to the USA for the time being. This is due to the subsidy rules there which are discriminatory to Chinese companies.

Asia

The company has produced new models specifically for sale in countries such as Japan, Thailand and India. Japan is interesting. The world’s third largest auto market has mainly resisted EV’s so far. The reaction to Tesla has been notably lukewarm there so far. BYD say they will start their drive there in Q1 2023 with the Atto 3 model. They will open 22 sales locations and expect to start deliveries in March. They already have a foothold in the market by dint of having 70% of the country’s e-bus market. The price of approximately $32,000 will under-cut the Model 3 from Tesla and the “Ariya” from Nissan.

They have recently opened up sales in Cambodia, Laos, Thailand, Vietnam, Malaysia and Mongolia. Singapore has been receiving various BYD models since the start of the year.

They exhibited at the recent Bangkok Motor Show and stated they will ship 5,000 Nos. of the model Atto 3 in the next few months. Thailand is historically the car manufacturing centre of S-E Asia. It may well become a manufacturing base for BYD in the near future and the centre of operations for S-E Asia. At the recent Bangkok Motor Show they exhibited a full suite of products rather than just a lead product. This is illustrated below:

The company exhibited their hybrid models the “Qin Plus DM-!” and the “Song Plus DM-!” using their new hybrid technology. These were in addition to the BEV models, the Tang, the Han, the “Dolphin” and the “Seal”. No other company gets close to offering this breadth of product.

A drive into the growing Australian market has started well. It is in second place in the EV space behind the ever-present Tesla despite having only just started operations there. In the month of November the Tesla Model Y was the top-selling EV with 1805 units. The BYD Atto 3 was second with 845 units and the Tesla Model 3 third with 391 units.

It is thought that BYD have an assembly line dedicated to 3,000 right-hand drive Atto 3’s every month for the Australian market. Starting in early 2023, it is expected that deliveries of the lower priced “Dolphin” and higher priced “Seal” will commence. The Seal is seen as being in direct competition with the Tesla Model 3 which is very popular in Australia.

Africa

This is unlikely to be much of a revenue market for BYD due to the continent’s low income level and electricity shortages. BYD does have distribution outlets in some countries such as Kenya, Mauritius and Zimbabwe. The company did recently supply an initial order for 15 e-buses to Kenya. This is another example of their vertical integration advantage opening doors for them.

A more fruitful path for might be illustrated by the recent MOU signed with a company in Morocco, JV Auto Nejima. Morocco has eyes on being an auto manufacturing hub for Europe. Citroen already has an operation there. It was rumoured a few years ago that BYD was looking at manufacturing in the country. Nothing came of it then. With the company’s new global expansion plans, this might be the time for it. The company has already Europe.

The Berkshire Hathaway Factor

It is well-known that Warren Buffett invested early in BYD. He has however been selling stock regularly over the past few months. The last trade I know of was in November when he sold 3.23 million shares for $80.16 million. Berkshire now own 15.99% of the company. That amounts to approximately $4.5 billion. They have reduced their stock ownership from 225 million shares to 175 million shares since July.

It is not known why they have been selling regularly this year. Indeed it is somewhat counter-intuitive as it has been causing a gradual lessening of the BYD stock price. Thus Berkshire get less return for their investment each time they sell. There is a general consensus that these stock sales will continue and this would in turn continue to hold down the price in a vicious cycle.

The 10 year stock chart for BYD is shown below from Seeking Alpha:

The decline from the peak reflects the effects of the Berkshire sale, and the general stock price hit this year. BYD’s own performance has in fact excelled in 2022. There is every reason to suppose the price will in time exceed previous highs to reflect the company’s ever improving sales and margins, once the world economy improves.

It is forecast that in 2024 the company will have an EPS of $5.24 and lower its PE ratio to 25x. Its net income margin should improve to 3.7% from 1.4% last year.

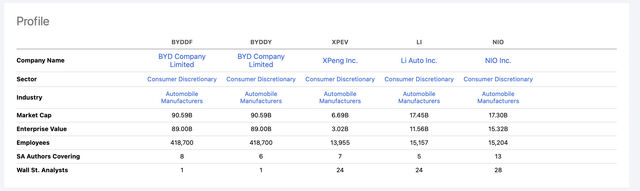

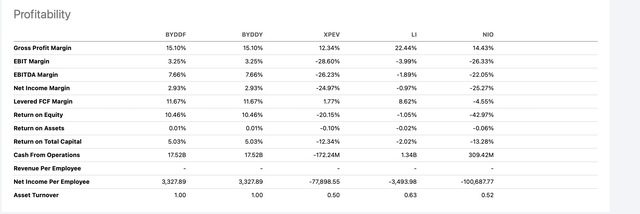

The company has the fourth largest market cap of any auto company, behind Tesla, Toyota and Porsche. It is very much leading the Chinese charge into the world at large as the detail below from SA Quant ratings illustrates:

Further figures show its valuation advantages:

This shows how it is very much the giant of the new Chinese manufacturers. The fact it is much less covered by analysts than its much smaller rivals shows how analysts tend to miss out on companies not directly quoted on U.S. exchanges (BYD is an OTC counter). This appears to be slowly changing.

Risks to the Thesis

* The No.1 risk is the political risk of China’s relations with the rest of the world. This is actually quite low as the market most affected would be the USA. That is a market which BYD is currently largely avoiding for the moment. China’s COVID situation is additionally a matter of uncertainty.

* Revenue will no doubt increase but if BYD fails to continue to improve its profit margins then the stock price could suffer. There is though every sign that at present profit margins are improving quite sharply.

* BYD’s expansion of course involves substantial future capex at a time of rising interest rates.

* It could be argued that the company is over-reliant on its visionary founder and CEO Wang Chuanfu.

Conclusion

Formerly BYD was a major ICE manufacturer. Now it concentrates its auto production solely on EV’s. It understands they are the undoubted future of the auto industry. They are experiencing stunning sales growth and improving profitability despite the fact that their main export drive is only just beginning.

Legacy automakers such as Ford (F) and General Motors (GM) face huge impediments. They need to ramp up major EV capacity whilst servicing huge debts and stranded assets.

BYD has sound financing for future capital investment. It has a strong (and rapidly growing) design range. Its vertical integration makes it very much master of its own destiny.

The Berkshire Hathaway situation is an impediment only in the short term. BYD is a strong Buy for the long-term investor.

Be the first to comment