LPETTET/iStock via Getty Images

Investment Recommendation

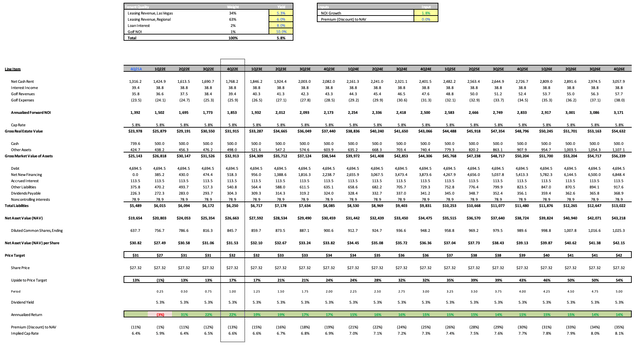

I recommend a BUY rating for VICI Properties Inc. (NYSE:VICI) with a price target of $32, representing a 22.4% total return over the next twelve months. VICI shareholders are poised to see 10-12% of low risk total returns for the foreseeable future through a combination of: (1) dividends, (2) low risk internal growth, and (3) reinvested retained cash flow. This total return potential can scale up significantly in years that VICI is able to execute on accretive externally funded growth, similar to 2022 where I expect a total return in excess of 20%.

Near term, positive catalysts for the stock include: (1) VICI being upgraded to investment grade by ratings agencies and (2) potential for inclusion in the S&P 500 index after VICI closes on its pending acquisition of MGM Growth Properties (MGP).

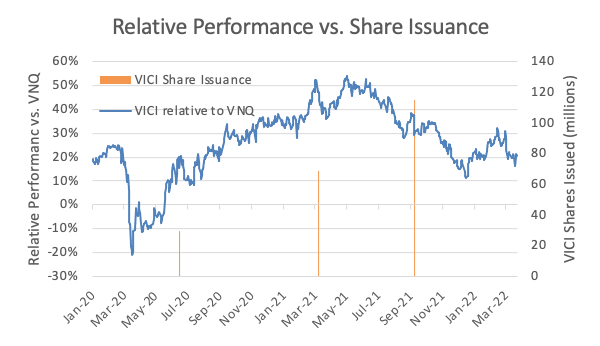

VICI has underperformed the Vanguard Real Estate Index Fund ETF (VNQ) by -8.4% since the company executed the largest common equity follow-on ever by a REIT in September 2021, creating an opportune point of entry to purchase VICI shares at a price that is at an -11% discount to its Net Asset Value (NAV).

Source: Google Finance, Public company filings.

Potential Catalysts

- VICI is upgraded to investment grade by ratings agencies, resulting in a lower cost of capital for VICI going forward (positive).

- After VICI’s size is significantly increased after the acquisition of MGP, VICI is admitted into the S&P 500, leading to increased demand from passive index investors (positive).

- Elevated inflation causes VICI’s inflation-based escalators to kick in resulting in best-in-class internal growth in the near term (positive).

- Increased competition for gaming real estate leads to declining cap rates that diminishes VICI’s external growth advantage (negative).

Company Background

In October of 2017, VICI launched as an experiential Real Estate Investment Trust (REIT) that buys the land and real estate of casinos and experiential venues and leases the real estate back to the tenant on a net leased basis. Iconic properties in VICI’s portfolio include Caesar’s Palace and The Venetian in Las Vegas as well as premiere regional gaming assets. Over the past four years VICI has grown at a breakneck pace as it has announced $29bn of acquisitions and raised $12bn of equity, more than any other REIT in America over that period.

Prior to the pandemic, I often heard investors debate the cyclical risk of gaming assets and how these assets would fare during the next economic downturn relative to traditional net lease REITs (e.g., Realty Income (O)) which invest in commodity like single tenant assets. This debate was especially pertinent for VICI, which derived 31% of its revenue from the Las Vegas Strip in 2019 – Las Vegas casinos are typically thought of as being more cyclical than regional casinos.

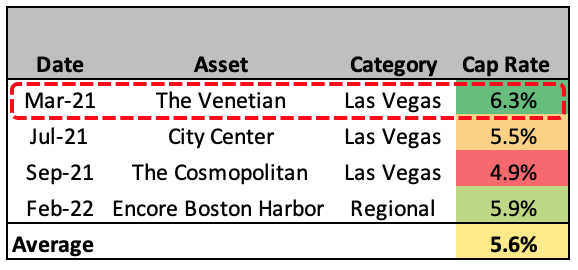

This debate at least in my mind has largely been settled as VICI was able to collect 100% of its cash rent on time throughout the COVID pandemic to date. These rent collections occurred on time and in cash despite VICI’s properties being closed during lockdowns brought on by the pandemic. I think that the stalwart performance of gaming real estate assets during the pandemic is leading to a re-rating as recent Las Vegas and regional transaction comps indicate that valuations have increased relative to one year ago when VICI announced its intent to acquire The Venetian at a 6.25% cap rate.

Source: Public company filings.

AFFO / Share Accretion of 8% from MGP Acquisition

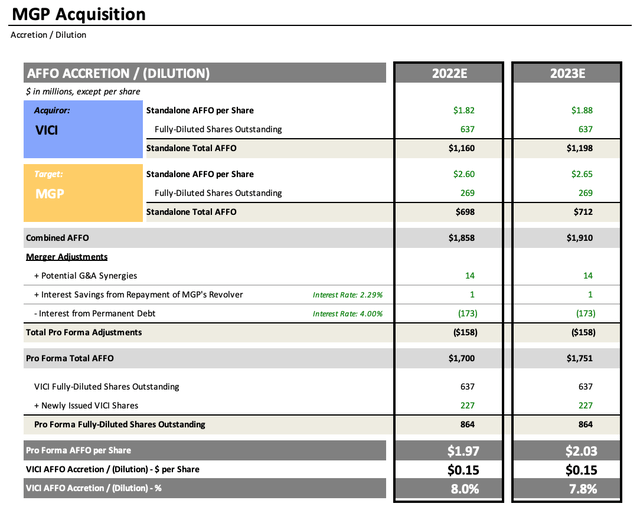

On August 4, 2021, VICI announced its intent to acquire MGM Growth Properties for $17.2bn (pricing was based on where the respective stocks were trading at the time of announcement). The disclosed acquisition cap rate of 5.8% is lower than where VICI has been acquiring historically and may have caused some investors to conclude that the transaction would add little value. Running the AFFO accretion / dilution math and accounting for synergies and a lower cost of debt, I estimate that the pending MGP acquisition will generate $0.15 of AFFO / share upon closing. Based on VICI’s run-rate AFFO / share this represents an accretion of 8%.

Source: Public company filings, Analyst estimates.

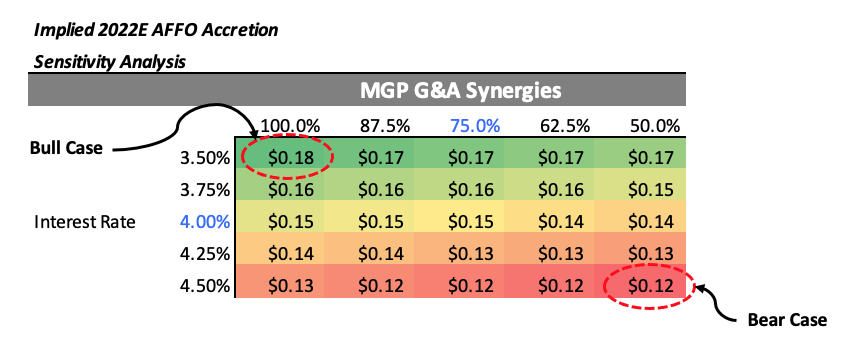

The primary levers of accretion consists of: (1) the percentage of MGP G&A that will be eliminated as a result of the acquisition and (2) where VICI can issue the ~$4bn of permanent debt capital needed to fund the acquisition (VICI has already raised the equity portion at $29.50 / share). Management believes that the transaction will result in a minimal need to increase VICI’s standalone G&A, and I therefore assume that 75% of MGP’s G&A will be eliminated.

Furthermore, as management also believes they will be able to issue debt into the I-Grade debt market, VICI should be able to issue 10 year unsecured paper at ~4% on the ~$4bn of permanent debt that VICI will need to raise. Based on these assumptions, VICI should see Base case AFFO / share accretion of $0.15 with a Bull and Bear case of $0.18 and $0.12, respectively. While VICI management provided 2022 AFFO / share guidance of $1.80 – $1.84, this does not include the pending MGP acquisition, but does include all of the dilution associated with the transaction. Additionally, while management has not provided guidance on the transactions accretion to AFFO, I think the seemingly low 5.8% announced cap rate may be leading investors to underestimate its accretion potential.

Source: Analyst estimates.

Recent Share Price Weakness Technical in Nature

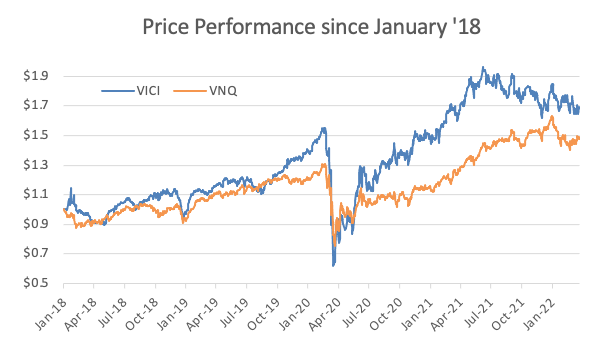

Since January 2018, investors who held VICI’s stock earned a cumulative total return of 68.7%, or a compound annual total return of 13.2%, beating the Vanguard Real Estate Index Fund ETF over the same time period by 20.5% on a cumulative basis and 3.4% on a compound annual basis.

Source: Google Finance.

Unlike traditional net lease REITs that acquire many small single tenant retail assets in any given year, VICI acquires very large assets that allow VICI to substantially move the needle on earnings with just one transaction. The large and chunky nature of VICI’s acquisitions, makes it difficult to match fund acquisitions. This results in a period of dilution after the shares are issued followed by accretion after the acquisition closes.

VICI’s cumulative relative performance has declined to 20% today from a peak of 54% in May of 2021. This underperformance coincided with VICI raising 115mn shares of equity in September 2021 (an increase of 22%) in order to fund the pending acquisition MGP, which management expects to be immediately accretive to AFFO.

I think the recent weakness in relative share price performance is largely technical in nature and likely due to the equity overhang that was created by VICI’s offering in September 2021, the largest single REIT offering in history. I therefore think now represents an opportune point of entry as VICI’s share price has underperformed on a relative basis ahead of an acquisition that should generate 8% of accretion to AFFO / share.

Source: Google Finance, Public company filings.

Balance Sheet

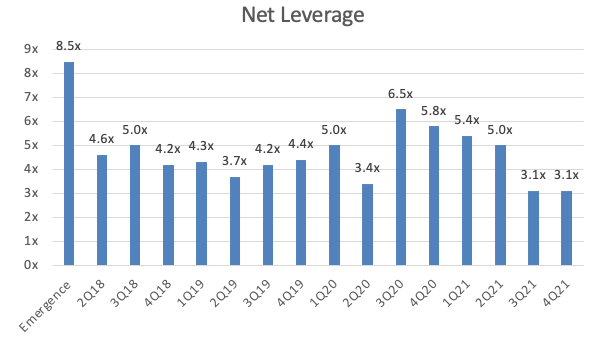

VICI has taken its balance sheet from 8.5x EBITDA of secured debt at emergence to 3.1x EBITDA of unsecured debt as of 4Q21, as management has over equitized its balance sheet ahead of its pending acquisition of MGP which is expected to close in 1H22. Pro forma for the recently closed acquisition of The Venetian and the pending acquisition of MGP, management expects 5.8x net leverage, which is below the 6.0x level that ratings agencies like to see in order to issue an investment grade rating.

Source: Public company filings.

In regards to VICI’s pending acquisition of MGP, S&P issued the below statement:

The acquisition will improve VICI’s scale and tenant diversity such that it could support a greater level of leverage at a higher rating if the company finances the acquisition with a mix of equity and debt that leads to pro forma leverage of about six times or below and we could raise our rating to BBB-.

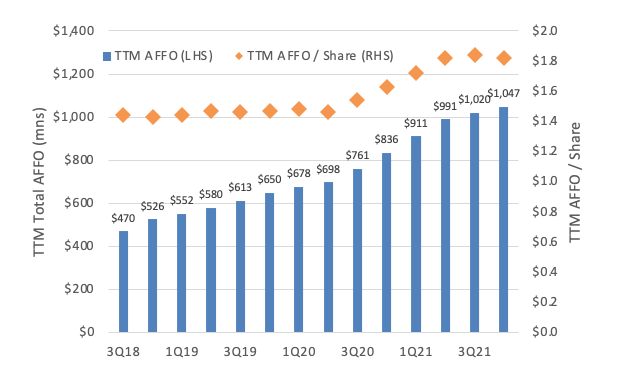

Despite a deleveraging trend over the past four years, which is dilutive to per share earnings as debt is swapped for equity, VICI has still managed to grow TTM AFFO / share by a CAGR of 6.9%. While VICI has historically issued debt in the high yield market, management has mentioned that they are confident that they will be issuing debt in the investment grade market when they raise the greater than $4bn of debt to fund the acquisition of MGP. Once VICI has achieved an investment grade rating, organic AFFO growth should increase as: (1) management no longer sees a need to deleverage the balance sheet and (2) debt costs improve.

VICI has been able to grow total TTM AFFO by 26% over the last four years, resulting in a TTM AFFO / share CAGR of 6.9%. While per share growth has lagged total AFFO recently and quarterly AFFO / share has actually declined by >2.0% sequentially over the past three quarters, VICI has already issued all the equity it will need for its pending acquisition of MGP, meaning that the dilution should reverse itself when VICI completes the acquisition.

Source: Public company filings.

In 2019 when VICI last issued 10 year unsecured debt, VICI issued debt at a G-Spread (yield spread to 10 year treasuries) of 289bps. In the same year I-Grade rated net lease peer Realty Income issued 10 year unsecured debt at a G-Spread greater than 150bps inside of where VICI did. While most REITs are likely to see increasing debt costs as 10 year treasuries have climbed to their highest level since 2019, I estimate that VICI’s declining G-Spread will offset the rise in the risk free rate, allowing VICI to issue debt at a cost that is lower than its current weighted average cost of debt.

Assuming VICI can issue investment grade rated debt at a G-Spread of 150bps, VICI should be able to issue 10 year unsecured debt at ~4%, which compares favorably to VICI’s current weighted average interest rate of 4.1% as of 4Q21.

Source: Public company filings, Analyst estimates.

Components of Shareholder Returns

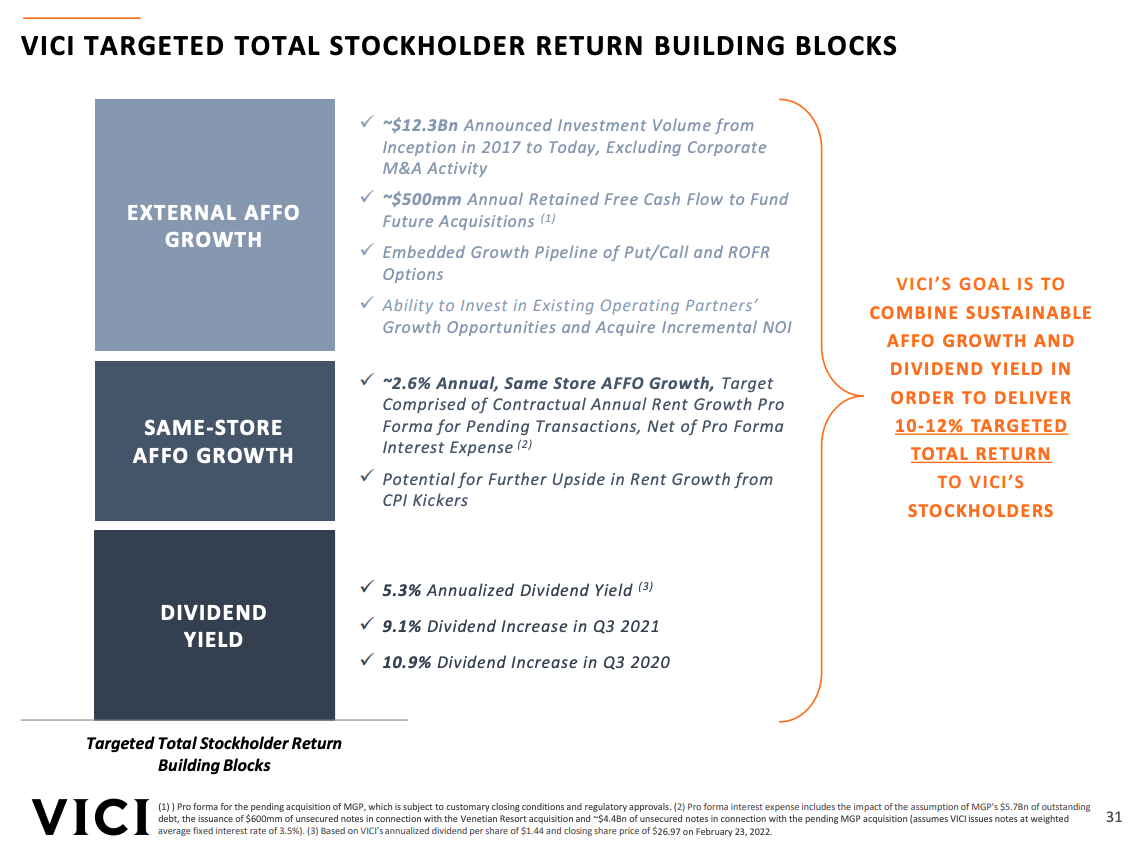

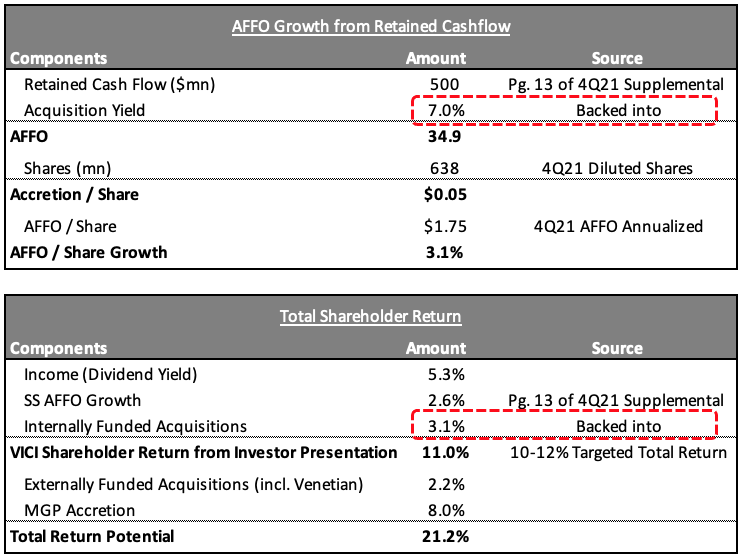

On page 31 of VICI’s most recent investor presentation, management lays out the three building blocks if its 10-12% targeted total return: (1) dividend yield, (2) internal growth, and (3) external growth funded by $500mn of retained cash flows.

Source: Public company filings.

VICI’s dividend yields 5.3% and is well covered with an AFFO payout of 82%, despite raising the dividend by 9.1% in 3Q21. VICI’s levered internal growth of 2.6% is low risk given the predictable contractual nature of VICI’s rent escalators along with VICI’s stalwart performance during the pandemic where VICI was able to collect 100% of its cash rent on time throughout the COVID pandemic to date.

Subtracting the dividend yield (5.3%) and internal growth (2.6%) from the total return midpoint of 11% leaves 3.1% derived from investing VICI’s $500mn of retained cash flow. Utilizing the pieces of the external growth puzzle indicates that management believes they can invest this $500mn of retained cash flow at a 7.0% cap rate.

Interestingly, this 10-12% total return completely ignores the potential for externally funded acquisitions which is somewhat puzzling given that VICI announced a record $21bn of acquisitions in 2021. VICI’s external growth trajectory is dependent on the willingness of the public markets to provide VICI with low cost capital as well as the volume and yield levels of potential acquisition opportunities. While externally funded acquisitions are inherently less certain than other components of VICI’s target total shareholder return, the fact that VICI has announced $29bn of acquisitions since emergence, demonstrates management’s ability to execute on accretive externally funded growth.

Source: Public company filings, Analyst estimates.

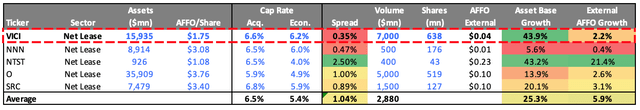

I anticipate VICI will close $7bn of acquisitions in 2022 (excluding MGP) at a 6.6% cap rate resulting in AFFO / share growth of 2.2% from externally funded acquisitions. VICI’s 6.6% acquisition cap rate consists of the $4bn acquisition of the Venetian at a 6.25% cap rate in 1Q22 and $1bn of acquisitions at a 7.0% cap rate in the remaining three quarters of the year. 2.2% of AFFO accretion from externally funded acquisitions as well as an additional 8.0% from the acquisition of MGP, results in a total shareholder return in excess of 20% over the next 12 months.

Source: Google finance, Public company filings.

Valuation: Undervalued in Light of Recent Gaming Real Estate Comps

On February 15, 2022, Realty Income, the largest net lease REIT by market cap which was founded in 1969, entered into the gaming real estate asset class when it announced its intent to acquire the Encore Boston Harbor from Wynn Resorts in a sale leaseback transaction at a 5.9% cap rate. The fact that a blue-chip bellwether REIT like O, which has arguably the highest quality portfolio in the net lease sector, has entered into the gaming real estate asset class is likely to be viewed by investors as an affirmation of the institutionalization of gaming real estate. While an institutionalization of an asset class usually results in lower accretion levels due to richer valuations, it also suggests that VICI could be undervalued.

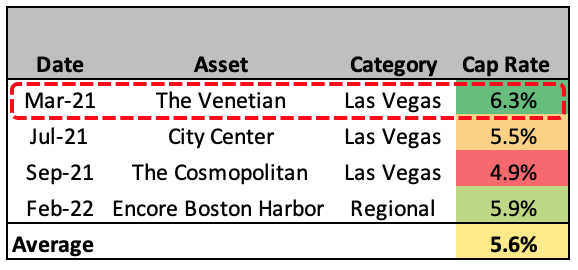

On VICI’s 4Q21 earnings call, management noted that since VICI announced its intent to acquire The Venetian (the largest hotel and casino on the Las Vegas Strip and the second largest hotel in the world) at a 6.25% cap rate, two other Las Vegas assets, City Center and The Cosmopolitan, have transacted at a 5.5% and 4.9% cap rate, respectively, indicating that cap rates have compressed since VICI announced its intent to acquire the Venetian just one year ago.

Source: Public company filings.

Unlike hotels which have quality categories based on stars, gaming doesn’t yet have a quality hierarchy making the market very inefficient and rife for alpha generating opportunities. Given these recent comps and the fact that VICI’s Caesar’s Palace in Las Vegas is likely considered of similar quality, I think VICI’s Las Vegas assets would likely transact at a 5.25% cap rate today. Given O’s recent announced acquisition of the Encore Boston Harbor (a regional asset) at a 5.9% cap rate, I ascribe a 6.0% cap rate to VICI’s regional assets.

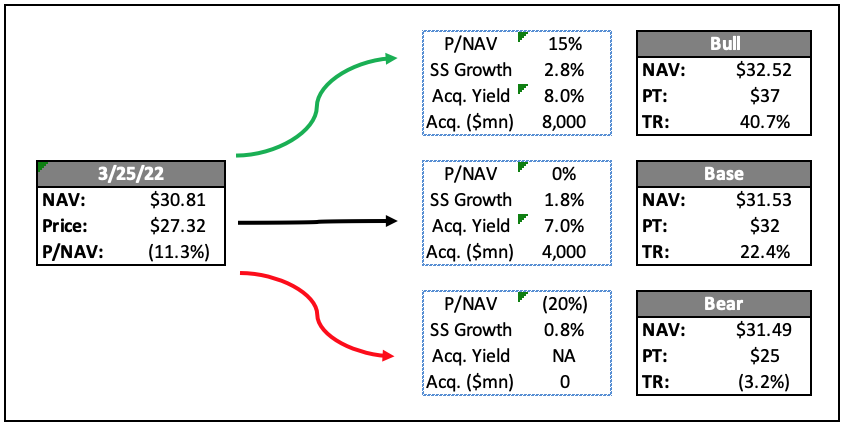

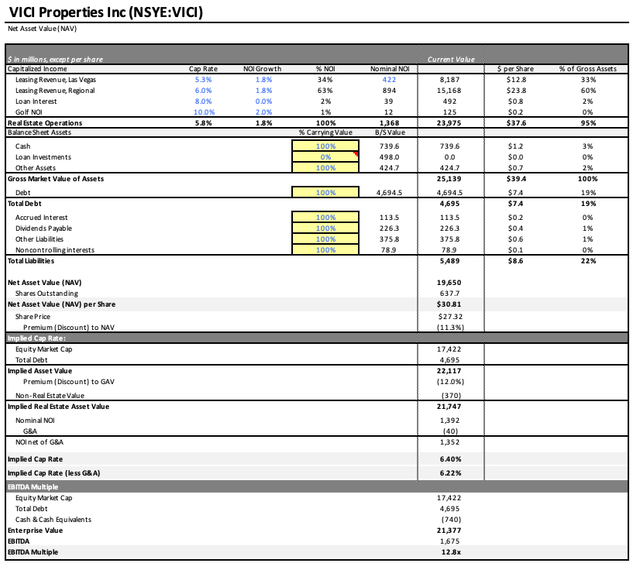

I estimate VICI’s current Net Asset Value (NAV) as of 4Q21 (not including the Venetian transaction which closed in early 2022 or MGP) is $30.81. This would indicate that VICI is currently trading at a -11.3% discount to its NAV.

Source: Google Finance, Public company filings, Analyst estimates.

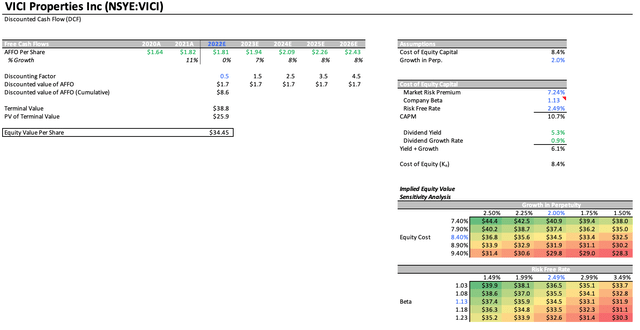

On a Discounted Cash Flow (DCF) basis, I estimate the intrinsic value of VICI’s future cash flows is $34.45, indicating that VICI currently trades at a -21% discount to its intrinsic value. This estimate includes $2bn of annual acquisitions, and is likely conservative given it includes all the shares issued to fund the acquisition of MGP, but none of the corresponding cash flows.

Source: Google Finance, Public company filings, Analyst estimates.

As mentioned above, the institutionalization of gaming real estate is likely to increase competition for gaming assets leading to lower cap rates. Now that O – which has a lower cost of capital than VICI – is also pursuing gaming real estate, there is a possibility that VICI could get outbid by entities with lower capital costs. In the event that VICI completely lost its external growth advantage, VICI could be acquired by a REIT with a lower cost of capital or be acquired by an institutional investor that could take on more leverage than public markets permit.

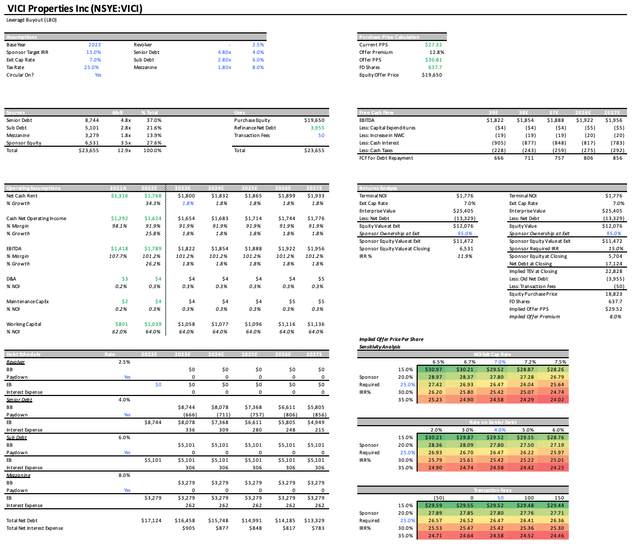

Assuming no additional acquisitions, constant capital costs, and a financial sponsor that is willing to buyout VICI at its NAV of $30.81 (a 12.8% premium to VICI’s current share price) an acquirer should generate a levered return of 11.9% over the next five years by acquiring VICI’s assets and leveraging them to a 70% Loan To Value (LTV). While I think the most likely scenario is for VICI to continue its strategy of growing its asset base on an accretive basis, VICI’s safe and predictable net lease cash flows along with the stalwart performance of these cash flows during the pandemic, VICI could be an appealing target for a financial sponsor that is willing and able to take on significantly more leverage than public investors will tolerate.

Source: Google Finance, Public company filings, Analyst estimates.

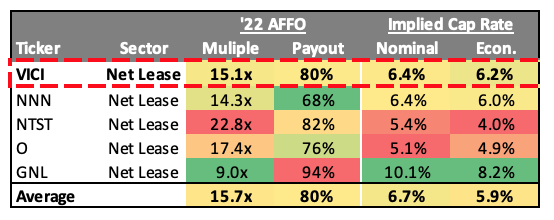

In terms of AFFO multiple, VICI trades in line with traditional Net Lease REITs (i.e., NNN, O, NTST, GNL). In terms of AFFO growth, I estimate that VICI will be able to grow AFFO / share by a CAGR of 6.0% over the next five years through a combination of internal and external growth.

Source: Google Finance, Analyst estimates.

On a forward basis, VICI should grow its NAV / share to over $42 by 2026 (a CAGR of 6.5% over the next five years). To arrive at a twelve-month price target of $32, I think VICI is likely to see its share price converge with its NAV as public investors realize that the market value of VICI’s assets have increased based on recent gaming real estate transaction comps. This $32 price target represents a 22% total return from current levels, consisting of a 17% capital return and a 5% income return.

Source: Public company filings, Analyst estimates.

Bull Case

$37 price target represents a 40.7% total return and assumes VICI’s stock trades at a 15% premium to its NAV, 2.8% SS NOI growth, and $8bn of real estate acquisitions at an 8% acquisition yield.

Base Case

$32 price target represents a 22.4% total return and assumes VICI’s stock trades in line with its NAV, 1.8% SS NOI growth, and $4bn of real estate acquisitions at a 7% acquisition yield.

Bear Case

$25 price target represents a -3.2% total return and assumes VICI’s stock trades at a 20% discount to its NAV, 0.8% SS NOI growth, and no real estate acquisitions.

Source: Google Finance, Analyst estimates.

Conclusion

I believe VICI has a number of ways to generate above average total returns in the 10-20% range for the foreseeable future. After several months of underperforming for technical reasons, public markets should eventually reward the company with a valuation that is in line with its NAV based on recent gaming real estate transaction comps and positive near term catalysts, resulting in a total return in excess of 20% over the next twelve months.

Be the first to comment