Editor’s note: Seeking Alpha is proud to welcome Mark Van Mater as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

nicoletaionescu/iStock via Getty Images

I now like value stocks that are trading below their historic P/E ratio more than growth stocks in today’s market situation. The stock market often overreacts to news and events temporarily giving investors good entry points. Having screeners programmed and ready to run daily can help you find bargains. Investors need to have a strong list of requirements to avoid buying stocks that are below their historic P/E ratio for good reasons.

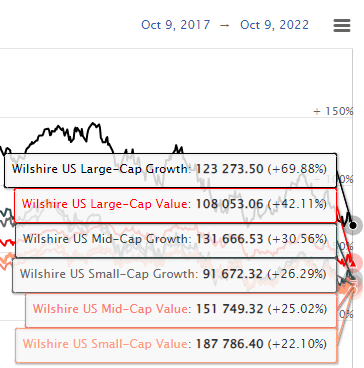

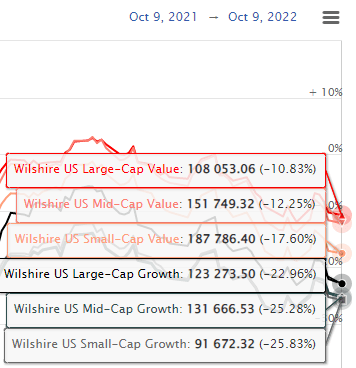

Growth stocks did outperform value stocks for the past 5 years.

longtermtrends.net

But now, value stocks have outperformed growth stocks for the past 12 months.

longtermtrends.net

Buying smaller amounts so that you can reduce your average price if the stock goes lower is a good strategy since no one is perfect at buying the lowest point. If you want to end up with a position of 400 shares in a particular stock, try buying only 100 or 200 to start. I often build my positions in an individual stock a little at a time because there are many things that can cause your favorite well researched stock to go a little lower. This strategy can reduce your risk as you average in lower price shares and make it easier to pull the trigger making smaller dollar commitments with several trades rather than one large trade.

When my stocks move up or down during a particular day or week, I am first looking at how they moved relative to the S&P 500. It has been said that more than 50% of a stock’s movement is usually dependent on the movement of the overall market. I’ve found this to be true in my experience, which helps me greatly when making buy and sell decisions.

I actually prefer higher-beta stocks since they generally provide higher options premiums when selling covered calls. About 70% of my portfolio are higher-beta stocks with a one-year beta that is between 1.2 and 2.0. Carefully selected higher-beta stocks can help you outperform the market if you also have a strong list of requirements to avoid the wrong stocks.

No one knows for sure where the stock market is going. It has been said that if anyone knew for sure what would happen only 5 minutes into the future, they could rule the world. So, what are we left with to make decisions? There are clues that lead to what the higher probabilities are. History can provide a framework for possible market direction but cannot provide absolute answers for why the stock market moves. I am currently looking at the following to help me understand where the market may go.

- S&P 500 History and Prediction

- P/E Ratios

- Interest Rates

- Inflation & Raw Material Costs

- Supply Chain Problems

- Currency Risk

- Midterm Elections

S&P 500 History and Prediction

First, the stock market has always gone up if you take a long enough view. The tough part is holding on when it goes down and patiently waiting for positive returns. Sometimes it is time to sell and stand aside waiting for better prices, but many do not get back in and miss what could be rapid upside. I believe it is important to keep enough cash outside of the stock market for whatever a person needs for the next 2 years. It’s hard to say when the next recession or pandemic may occur. My current thoughts are that the S&P 500 may end 2022 near 3,850 and 2023 near 4,300 partially due to the reasons below. I rest easier because I have a strong sense that the S&P will be higher 2 years from now.

I’ve added the green Fibonacci lines using the high and low of the past 5 years for the S&P 500. It’s interesting to note how the market pauses or bounces off of these Fibonacci lines. They can be one clue as to where the stock market may be going. The stock market could still go lower and maybe touch the 3,250 level but my opinion is we eventually go higher for the reasons in this article. Fibonacci levels can also be a predictor for most individual stocks.

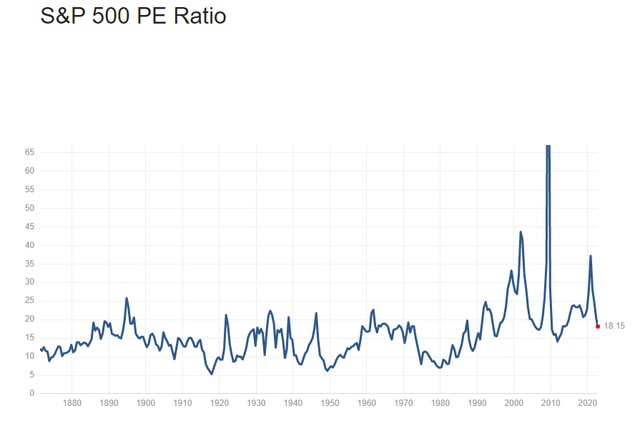

P/E Ratios

One of the most important factors to know for individual stock prices is what are earnings per share and where are they likely to go in the future. The P/E ratio may have averaged near 15 before 1990 but after 1990 the average has been above 20 and it is now near 18.15. This clues me in on the probability of the stock market eventually going higher by the end of 2023 and 2024. Some think corporate earnings will decline in 2023 and/or 2024, possibly bringing the stock market lower. I agree this is possible, but my opinion is that the stock market is more probably higher in the next 2 years either by increased corporate earnings or by the market assigning a P/E that is higher than today.

Interest Rates

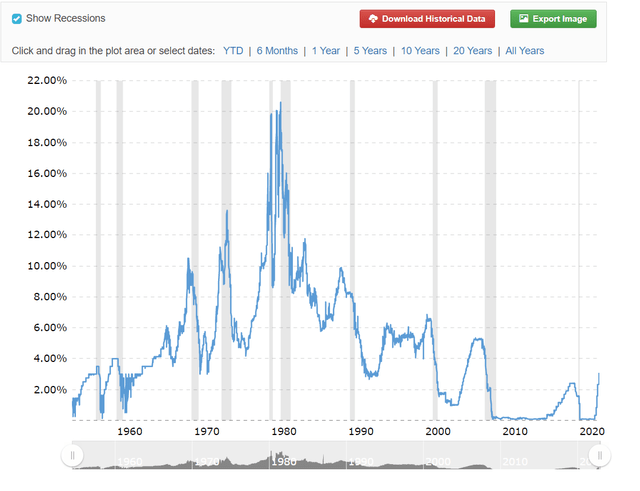

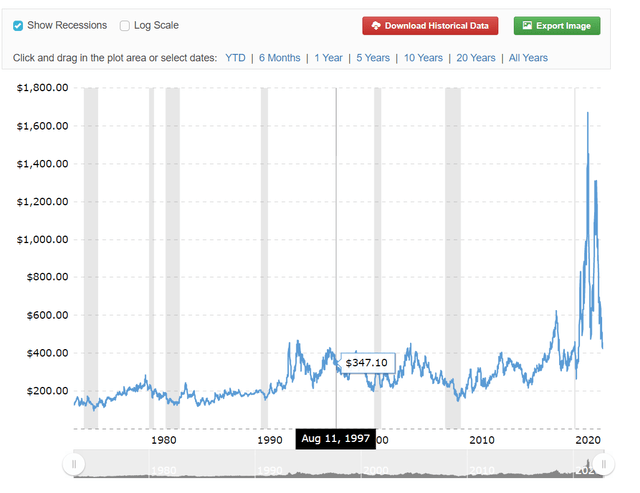

The Fed Funds Rate, which is the amount banks charge each other for overnight lending, is now just over 3%. Rates have shot up very quickly this year, but they are still low compared to history.

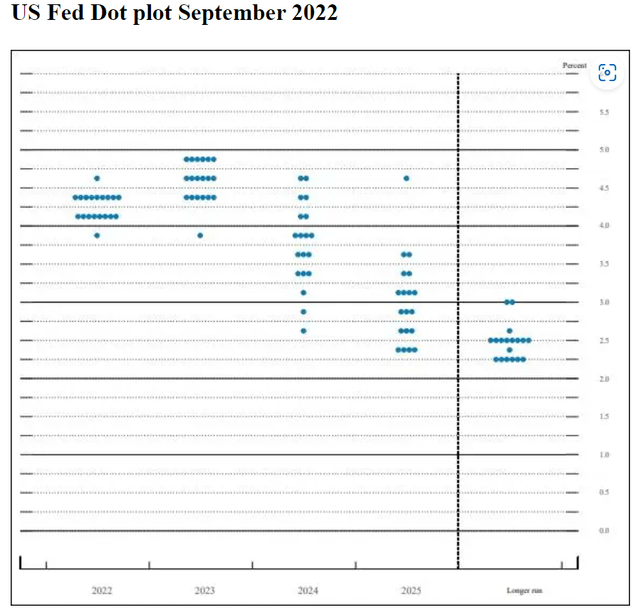

The dot plot shows that the Fed currently expects the rate to peak below 5% next year before declining in 2024. This gives me a further clue that the stock market is probably going higher. Yes, interest rates have shot up quickly from almost zero, but they are not expected to go to the highs during the 1970’s and 1980’s.

So why do interest rates matter to the stock market? It is because companies usually need to borrow money to expand their business and the interest rate expense on their current debt may go higher leaving less profit for shareholders. Many of the smarter companies have already financed years into the future at low rates even if they don’t currently need the cash.

Also note that when the USA raises interest rates, money flocks here unless other countries raise their rates accordingly. Some people are happy if they can get a 4% return on a one-year treasury bill. This can be a drag on the stock market as some may reduce their stock holdings while increasing their CD, bond, and treasury holdings.

Inflation & Raw Materials

Inflation is currently about 8% and can wreck a company’s profits as its costs go up and earnings go down. However, many companies have raised their prices to cover increased costs. Looking at a stock’s operating margin trend can be a good indicator. It seems to me that some companies have raised prices even more than cost increases to be sure they are not left behind. Some companies which do not have pricing power have trouble raising prices since consumers may decide to look for competitive prices from other companies, delay purchases or not buy at all depending on the product.

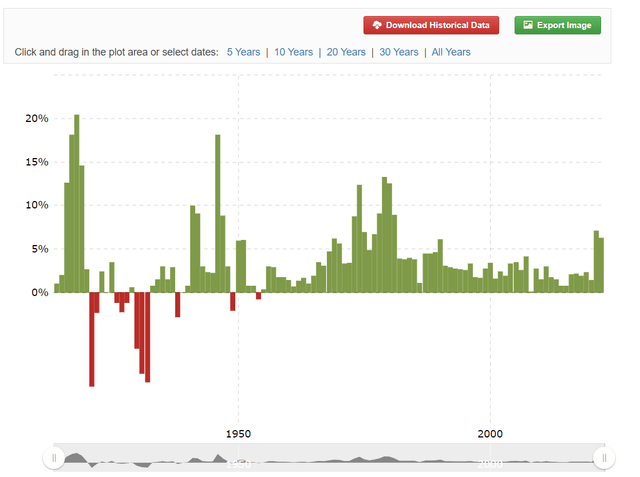

Inflation is difficult and it will take years not months to bring it back down to 2% or 3%. The clue here is that some raw material prices seem to have already peaked and are headed down again. Not much improvement is seen in the food categories yet. Labor and other employment costs such as healthcare will probably not show any improvement anytime soon. I suspect that the stock market will react positively as inflation starts to decline from 8% as long as it seems to be heading lower.

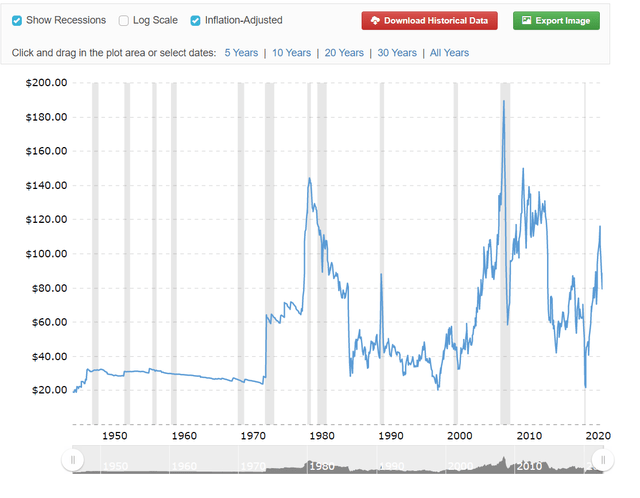

Lumber prices are already back down near their pre-pandemic level. The current price of lumber as of October 12, 2022, is $490.10 per thousand board feet.

The price of oil is now below peak levels. The current price of WTI crude oil as of October 12, 2022, is $87.25 per barrel. The price of oil is very difficult to forecast but Credit Suisse currently predicts oil to average $85 per barrel in 2023 followed by $80 in 2024.

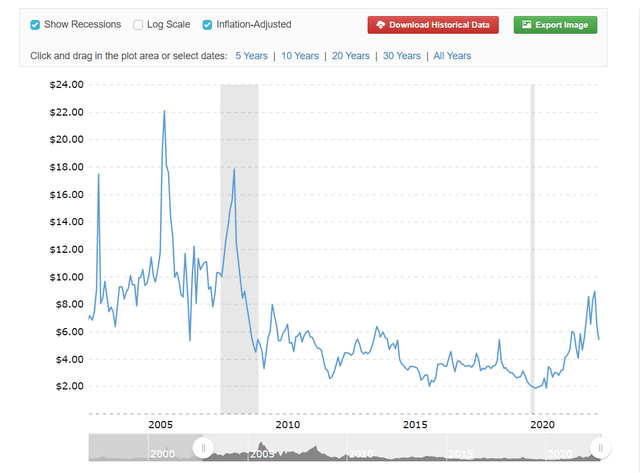

Natural gas prices are also showing some decline. The current price of natural gas as of October 04, 2022, is $5.40.

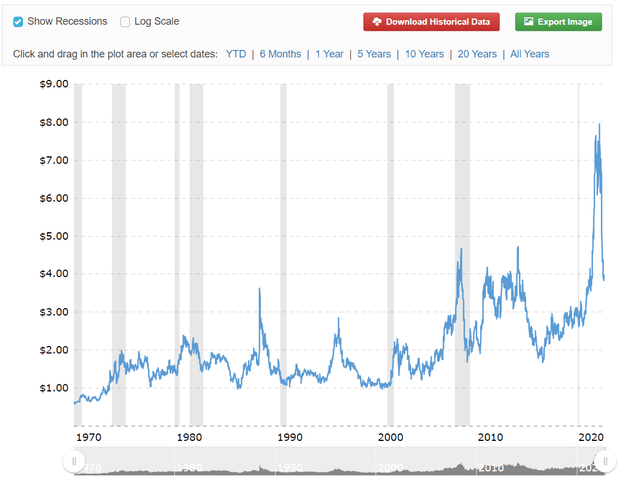

The current price of oats has fallen from peak levels and as of October 07, 2022, is $3.9950 per bushel.

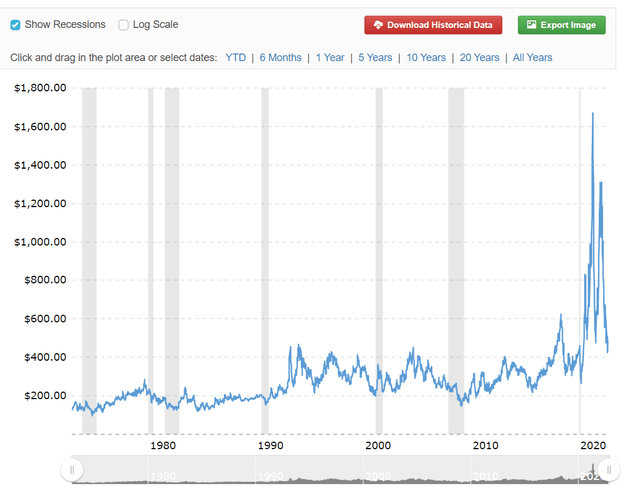

Copper prices have also peaked. The price shown is in U.S. Dollars per pound. The current price of copper as of October 12, 2022, is $3.41 per pound.

Supply Chain Problems

I listen to quarterly earnings calls for all of the 30 stocks I own. Investors can learn a lot by what management presents on those calls and how they react to what questions are asked by analysts. The degree of impact is different depending on the company, but supply chain problems are mentioned on almost all of my conference calls. The clue here is that supply chain problems were reported on the last earnings calls as not getting any worse or improving somewhat, albeit slowly. Lack of workers and material shortages during the pandemic were top of the list followed by unusually high transportation costs. In general, it seems low inventory levels are now starting to be replenished and the increase in transportation costs are just starting to show at least a reduction in the rate of increase. Transportation costs are still very high in comparison to the past several years.

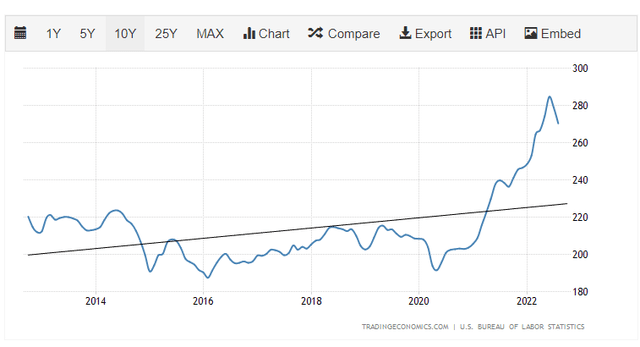

According to US Government statistics, the costs for all forms of transportation grew rapidly during the pandemic over the past two years.

Companies in the Financial, Energy, Utilities, Real Estate and Communication Services sectors are generally likely to have less supply chain problems.

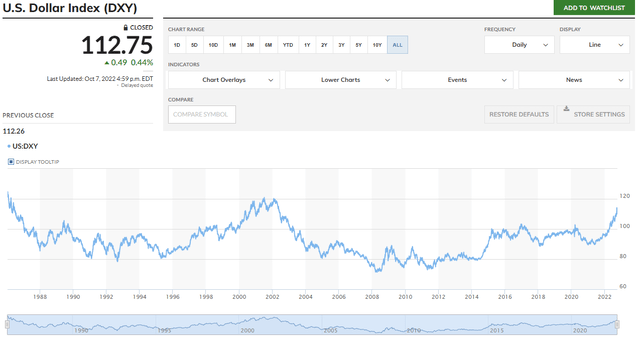

Currency Risk

This happens when a company sells in a foreign market and then the value of the local currency declines, or when a company buys in a foreign market and then the value of the local currency there rises. The value of the US Dollar is now near all-time highs. You can see in the chart below that the US Dollar was higher than today in 1986 and also from 2000 to 2002. The clue here is that the US Dollar is already near all-time highs for the past 35 years and if history is any guide, it may begin to decline in the next several years making US goods more price competitive overseas. I do agree that foreign currency will continue to be a topic on earnings calls and a drag on corporate earnings at least for the next few quarters. Picking stocks with very little business outside the USA can mitigate this risk.

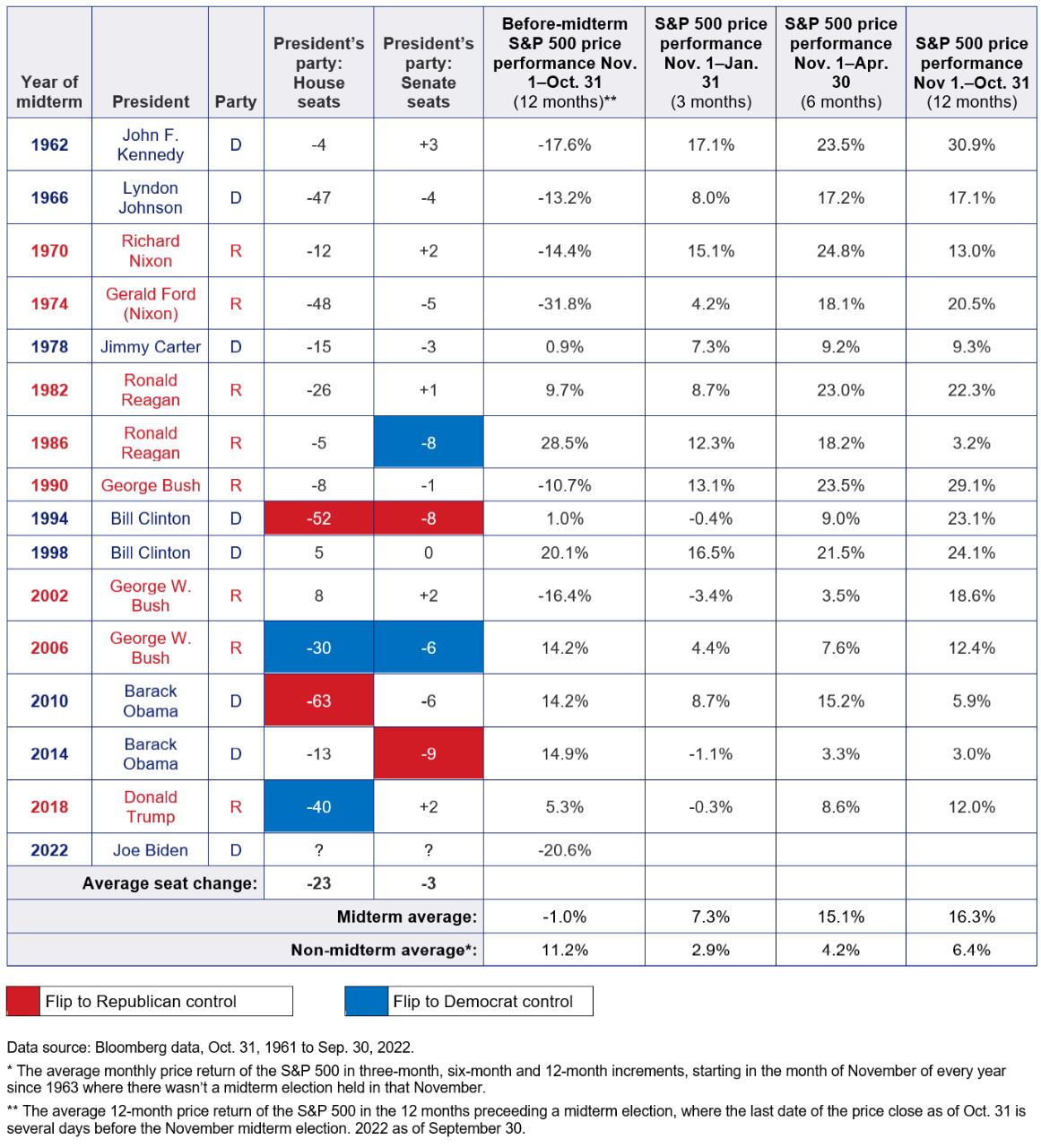

Midterm Elections

We are only one month away from midterm elections. Midterm elections can leave government power more divided causing less money to be spent. Investors intuitively like gridlock.

The clue here is that the S&P 500 has historically outperformed in the 12-month period after a midterm election, with an average return of 16.3%. The last time the S&P 500 Index produced negative returns during the 12 months after a midterm election was 1939.

www.usbank.com

Takeaway

This is still a good time to invest if you have a strong sense that the S&P will be higher 2 years from now like I do. I now like value stocks because they are outperforming growth stocks. I see P/E ratios, interest rates, inflation, raw material costs, supply chain problems, currency risk and midterm elections as reasons why the market may go higher based on history and a belief these things will eventually improve.

You can still collect dividends and covered call premiums while you wait for market improvement if you pick the right stocks. Picking stocks with very little business outside the USA can mitigate currency risk. Companies in the Financial, Energy, Utilities, Real Estate and Communication Services sectors are generally likely to have less supply chain problems.

Be the first to comment