atakan/iStock via Getty Images

A recession is all but certain to hit the U.S. economy in 2023. The yield curve has inverted quite sharply, companies are announcing layoffs of workers, major economic bellwethers such as the housing industry and automotive industries are arguably already in a recession, and the Federal Reserve seems bent on continuing to raise interest rates for at least the next few months.

As a result, now is the time to batten down the hatches in your portfolio. One of the best ways to do this is to buy high quality, well managed real estate (VNQ) on sale. In this article we discuss two great picks for doing just that in Realty Income (NYSE:O) and STAG Industrial (NYSE:STAG).

Realty Income

O is a great fit for a portfolio looking to batten down the hatches for a recession because it has a phenomenal balance sheet, a battle-tested recession-resistant business model, excellent management, and a very impressive track record.

Its A- credit rating is one of the best in the REIT sector, giving it a cost of capital advantage over many of its competitors when going after attractive investment opportunities. Its A- credit rating is warranted given its well-laddered debt maturities with an over 6-year weighted average term to maturity for its notes and bonds. It is also weathering the rising interest rates well given that only 12% of its debt is floating rate. Its fixed charge coverage ratio is very conservative at 5.5x with liquidity of over $2.5 billion, enabling it to cover any unexpected expenses that may pop up with ease.

Its conservative triple net lease business model has proven its mettle through numerous economic cycles, including the COVID-19 outbreak and ensuing lockdowns as well as the Great Financial Crisis. Over time it has further reduced risk and improved its profit margins by amassing immense economies of scale. Today it is the largest publicly traded triple net lease REIT with a portfolio consisting of 11,733 properties and 1,147 tenants operating across 79 industries.

Its portfolio remains very defensively positioned today with nearly 9 years as its weighted average lease term and 43% of its rent coming from investment grade tenants.

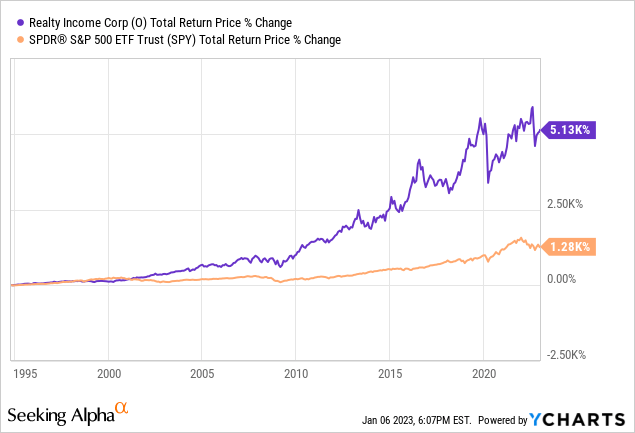

Management’s skill is evidenced by the REIT’s phenomenal track record of growing its dividend for 26 straight years (making it a Dividend Aristocrat) and growing its FFO per share in 25 out of the past 26 years. As a result of all of these qualities, it should not be surprising that its total return performance has absolutely crushed the S&P 500’s (SPY) since going public:

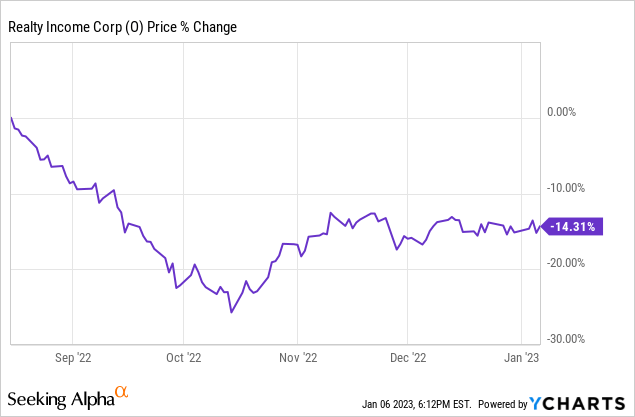

Last, but not least, O is now available to investors at a reasonable price thanks to its recent share price dip:

Its EV/EBITDA is 17.13x at present, well below its five-year average of 19.41x. Its P/AFFO is 16.02x, also well below its five-year average of 18.52x. Finally, its dividend yield is 4.8%, well above its dive-year average of 4.4%.

With recession around the corner and interest rates likely to peak in the near future, now might be a great time to add O to your portfolio if you are a risk-averse investor.

STAG Industrial

STAG is another great fit for portfolios concerned about recession. The sector is enjoying strong tailwinds from the increasing demand for warehouses and other industrial space stemming from the rise of e-commerce and growth in the onshoring trend in the wake of growing geopolitical tensions and fracturing across the world.

This strength was evident in STAG’s Q3 results where it reported lease-over-lease cash rent growth of 13.6% and same-store cash NOI growth of 5.6%. Cash rent growth for new leases during Q3 was 19.4% and for lease renewals rent rates rose 9.5%. This growth momentum should help blunt some of the headwinds from a potential recession.

On top of its current growth momentum, STAG’s business model gives it additional margin of safety against economic hard times. Instead of going after the most expensive properties, STAG is an industrial real estate value-add investor. It typically targets properties in secondary markets that may have various issues that weaken its market value such as above average vacancy rates, short remaining terms on leases, and/or deferred CapEx. As a result, it can often buy these properties for less than they are worth and then leverage its scale, cost of capital, and industry contacts and know-how as advantages in creating value in the properties. This means that it enjoys a wide margin of safety in its investments, giving it greater downside protection in each individual investment in the case of a recession.

STAG also has a large growth runway ahead of it, with a current share of just 0.7% of its total target asset universe. With strong returns being generated on its investments, STAG has been focusing on retaining its cash flow to maximize its ability to capitalize on the opportunities in front of it. This means that its dividend is quite safe even if a recession were to hit thanks to its AFFO payout ratio of just 75.6% and an FFO payout ratio of just 66.4% in 2022.

Another aspect of STAG that makes it a good fit in a recession is its strong balance sheet as evidenced by its investment grade (BBB) credit rating. With a low ~30% LTV, $874 million in liquidity, and only 2% of its debt being secured by its assets, the company has a lot of flexibility in its balance sheet. Furthermore, it pretty much has only fixed rate debt, which means that it is seeing little increase in relative interest expense during this period.

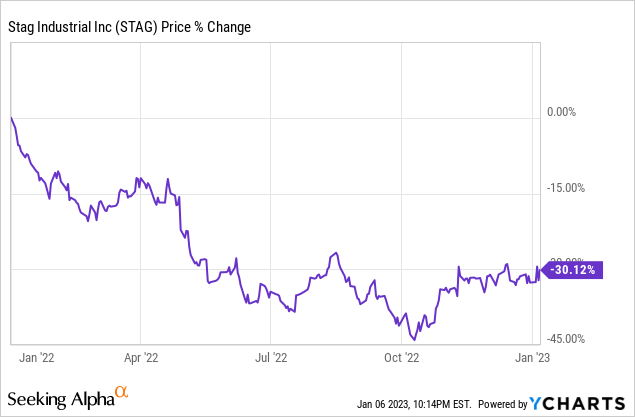

On top of these numerous strengths, the stock also looks attractively priced. Its current P/FFO and P/AFFO ratios are 14.99x and 16.62x, respectively. Meanwhile, its five-year average P/AFFO ratio is 16.11x and its five-year average P/FFO ratio is 17.37x. On top of that, its EV/EBITDA is only 16.72x compared to its five-year average EV/EBITDA of 17.36x. Its P/NAV ratio of 0.92x also indicates a discount, especially given that it has historically traded in-line with its NAV.

Between its attractive industry and business metric fundamentals, strong balance sheet, more defensive orientation to its business model, and value proposition, STAG is another great choice for fortifying a portfolio against an impending recession. Given the latest dip in the share price:

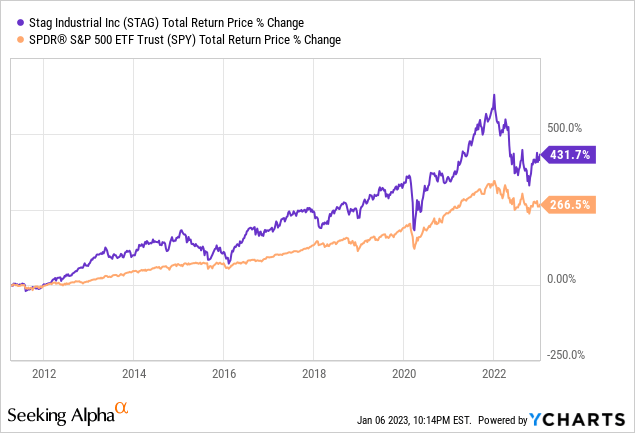

And its impressive long-term track record of outperforming the market handily:

Now looks like a good time to add shares.

Investor Takeaway

O and STAG are two high quality real estate businesses that are on the bargain rack after 2022’s sell-off. Meanwhile, with a recession likely coming and interest rates poised to peak and possibly even begin falling this year, now looks like an excellent time to position your portfolio to profit with defensive names like these. We are investing in similar stocks as these at High Yield Investor as we prepare our portfolio for the coming recession.

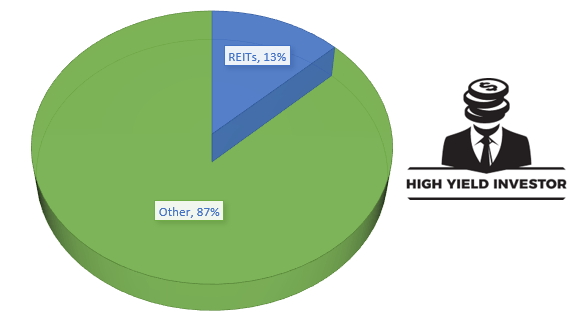

REITs (High Yield Investor)

Be the first to comment