Sean Gallup

Stocks that are leveraged to economic strength in one way or another have been destroyed this year. When you couple that with stocks that thrive in low-rate environments, you get a truly horrendous perfect storm. That’s how perennial market leaders like Alphabet (NASDAQ:GOOG) end up losing a third of their value, which is exactly what happened earlier this year.

Alphabet has sold off with the rest of the advertising stocks such as Snap (SNAP), Meta (META), Pinterest (PINS), etc. Obviously, the damage has been much more severe with those names, but that’s because they don’t operate a monopoly in one of the world’s largest business, which Alphabet enjoys with Google. As Alphabet was dragged down – unfairly in my view – and the fact that internet stocks are now back in favor on Wall Street, Alphabet is a screaming buy.

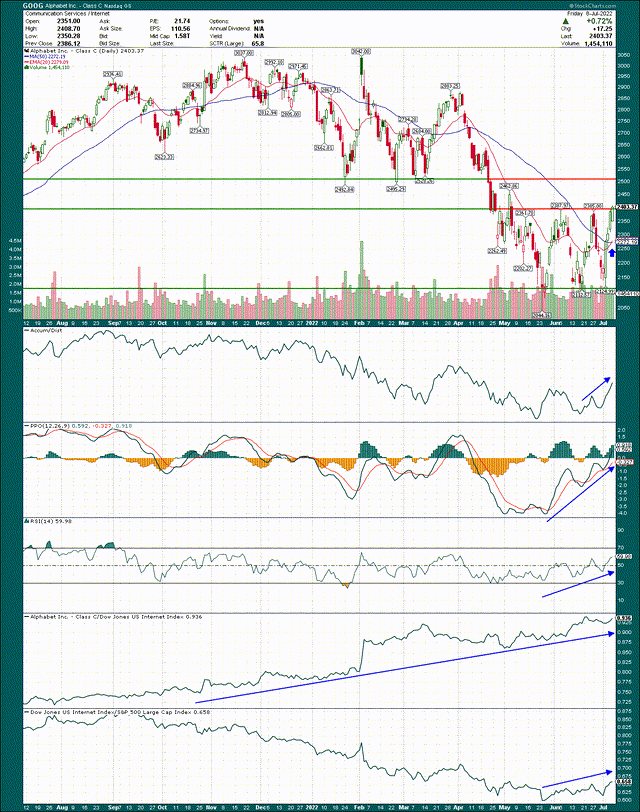

Let’s begin with the chart, which shows a sizable consolidation that Alphabet is going to break this week, or very shortly thereafter.

I’ve drawn in the lines for the consolidation and they correspond roughly to $2,100 and $2,400. Those are your lines in the sand when it comes to trading around the consolidation, but in this case, I think Alphabet has consolidated enough that you just want to hold it, rather than risk missing the big move to the upside.

The reason is because all of the indicators look great at this point for the bulls. The accumulation/distribution line has turned sharply higher, indicating big money is buying dips rather than selling rips.

The PPO has exploded higher, indicating not only seller exhaustion, but outright bullish momentum. This is the kind of thing we see at key bottoms, which generally lead to sustainable rallies. The 14-day RSI is showing the same thing.

Alphabet has outperformed its peers for a long time, which surprises no one. But importantly, internet stocks are finally gaining some ground on the broader market, which hasn’t been the case for some time. While internet stocks are far from a leading group right now, I believe the opportunity is there for them to become exactly that, and Alphabet is a proven winner in the group.

Finally, perhaps one of the most bullish things on this chart is the fact that the 20-day EMA has just crossed over the 50-day SMA. This happens when the trend has changed, and we know that it occurred several months ago when the stock topped out. The reverse is happening now, and these lines should become support on the way up, just as they were resistance on the way down.

Given the momentum we’re seeing, I think the odds of Alphabet breaking out sooner than later are very high, but even if this one is rejected this week, buy Alphabet on the pullback at the 20-day EMA.

Let’s now take a look at the fundamental case for Alphabet to see if it’s more than just a bottoming stock.

Recession pain priced in

We all know about Alphabet’s businesses, which include search, YouTube, Cloud, Network, and its venture capital fund Other Bets. The Search business is by far the largest by whatever metric you want to use, and it’s also the one that is reliant upon businesses wanting to spend money advertising. That’s why the stock fell so sharply into the middle of 2022, but as we know, the Search business is essentially a monopoly, and given that, it’s so large that it isn’t as cyclical as other advertising platforms. That’s why Alphabet shares haven’t fallen nearly to the extent other advertising stocks have, and why there’s significant upside from here.

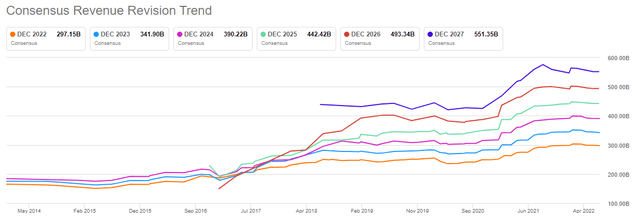

Seeking Alpha, revenue revisions

We can see with revenue revisions that analysts have made downgrades for several months, but there are two important points I want to make. First, revisions downward are very small in magnitude, and nothing like the ~30% decline in the share price we saw. Second, they’ve flattened out in recent months, as you’d expect given that a recession is generally priced in before it arrives. The upside of this is that now that estimates are lower, which means sentiment is weaker, and that estimates have flattened out, it would take a new shock to move them meaningfully lower again. That means the path of least resistance is higher, and that’s exactly when we want to buy the stock.

Keep in mind also that Alphabet has grown its ad business through all kinds of headwinds before, all of which looked much worse than the current environment. These include the “ad-pocalypse” from 2020 and 2021 following COVID lockdowns, where ad spending fell off a cliff in unprecedented fashion. But you wouldn’t know it by looking at the below.

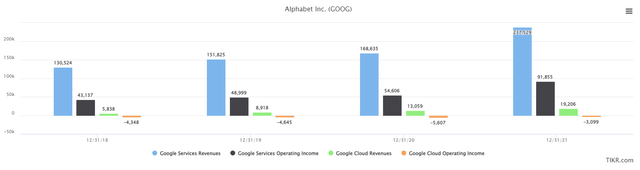

This is annual revenue by segment for Google Services and Google Cloud, as well as operating income for both, in millions of dollars.

Services revenue just moves higher over time, as it doesn’t seem to matter what’s happening in the economy. If search revenue can survive the malaise that followed the initial COVID outbreak, I literally can’t think of anything else that could threaten it.

But what about pricing? Well, that was fine too, with 2020 operating income for the segment moving up 11% in 2020, in the face of a 100-year pandemic. Last year it was up 68%, and while that’s obviously unsustainable, it reinforces my point that if you’re worried about a recession’s impact on Alphabet, you’re worried about the wrong thing.

Now, one potential tailwind that’s coming in the near-term, other than continued global domination of search, is the company’s Cloud business. Obviously, Alphabet has been investing very heavily in Cloud capabilities, both by acquisition and by spending internally. It has consumed a huge amount of cash in recent years, but it’s growing strongly, and is near breakeven. We saw this model with Amazon’s (AMZN) AWS, where the company spent billions of dollars at a loss until it gained sufficient scale, and now it’s a huge cash cow. While Cloud won’t be as important to Alphabet’s operating income as AWS is to Amazon, simply removing this headwind is, in and of itself, a tailwind.

The point is that Alphabet being sold off with economically sensitive stocks, including advertisers, is rather missing the point that this company isn’t like other advertisers, and as such, shouldn’t be treated that way.

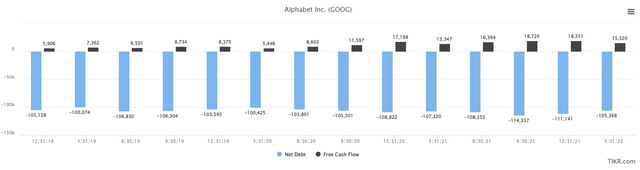

Another tailwind is the company’s ample spending on buybacks, which it can do because it has one of the cleanest balance sheets on the planet.

Net cash has been over $100 billion for years, and remains as such today. But as we can see, the company is also producing $15 billion to $18 billion in new net cash per quarter, which it is largely spending on share repurchases. While that may not seem like much in the context of a $1.6 trillion market cap, it means there’s a constant buyer of the stock, and in big quantities. In addition, it steadily reduces the share count over time, juicing EPS via a lower float.

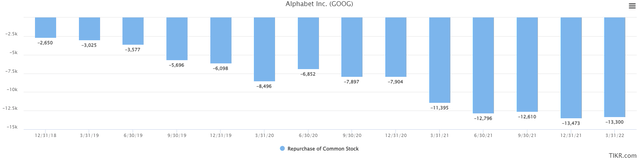

Here’s what it looks like in practice.

Remember these are quarterly numbers, so Alphabet is buying roughly $200 million of its own stock every trading day at the moment. Not bad.

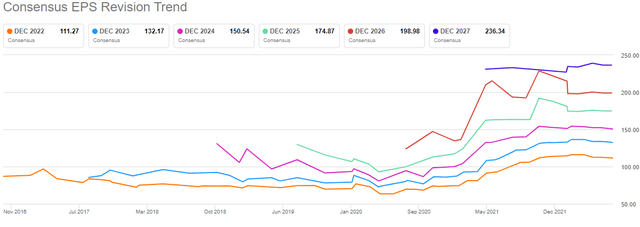

This all boils down to EPS projections, and we can see they have a similar trajectory to revenue. While you might expect that given Alphabet’s superior margins, the share price is not behaving like EPS is intact.

The minor downward revisions are much smaller than what the share price has priced in, and that’s where the opportunity is today. I won’t read the chart to you, but the point here is that estimates continue to go up and to the left, and there is ample space between the years, indicating strong growth over time. What more could you want?

How about a cheap valuation?

We have that as well with Alphabet, as the stock has been punished too severely for actual conditions. Below we have price to adjusted forward earnings for the past five years to give us some context on the current valuation.

It’s very obvious what’s happening here, which is that Alphabet is actually just as cheap as it was during the worst of the COVID selling 2+ years ago. It traded for ~26X earnings pre-COVID, and ~30X after COVID, but is 21X today. There is simply no way to reconcile that, and it means the stock is far too cheap. For a business that continues to grow at high-teens rates every year, and literally has what amounts to a monopoly on a business billions of people use on a daily basis, this valuation is just begging to be bought.

Could the environment for advertising deteriorate further? Sure, anything is possible. But you have to ask yourself if a valuation that is equal to that of the worst of the COVID selling makes sense when we’re not facing a new pandemic and the uncertainty that brings. It seems plain to me that Alphabet has become far too cheap, and that once it breaks out from the consolidation noted above, we could easily be off to the races to at least 25X forward earnings. That would be ~20% higher from here, and that looks to me to be just the start.

Be the first to comment