Dimitrios Kambouris

Introduction

In early December 2021, I published my analysis on Norilsk Nickel (OTC:NILSY) with a “Neutral” rating. In it, I talked about how bright the company’s prospects seem to be in terms of the quality and structure of its assets (revenue segments), but how great the risks are in terms of the quality of the company’s top management.

However, as the sad events of history have shown, foreign investors have lost a lot of money, not because of the realization of the risk of “bad management”, but because of geopolitics and country risks. Since the start of the war in Ukraine, NILSY depositary receipts are no longer traded, and Western investors have neither the ability nor the desire to buy Russian assets, no matter how great the potential opportunity is.

The uniqueness of NILSY lay in the particular composition of the company’s assets, which were expected to bring huge profits to investors within the market economy at the beginning of a new commodity bull cycle. However, since the Russian market economy has strong echoes of militarism and totalitarianism, this theoretical potential did not work there. Therefore, in my opinion, investors should look for other companies with similar assets and better management – having learned from bitter experiences, they should focus primarily on representatives of the civilized world. One such company among the major analogs of NILSY is Glencore PLC (OTCPK:GLCNF).

Elon Musk wanted to buy 10-20% of Glencore but refused to

The Financial Times reported this a few days ago, citing unnamed sources familiar with the matter. According to journalists, Tesla (TSLA) talked about buying 10 to 20% of Glencore last year and continued negotiations in March this year, when the Swiss company’s chief executive, Gary Nagle, visited the automaker’s factory in Fremont, CA. Now we know that the deal fell through because of the environmental impact of Glencore’s coal business. However, the negotiations lasted long enough to ignore the whole case.

All industrial companies, especially those involved in the production of batteries, are currently experiencing serious problems with the supply of so-called battery metals (nickel, cobalt, lithium, etc.). Everyone deals with this problem differently.

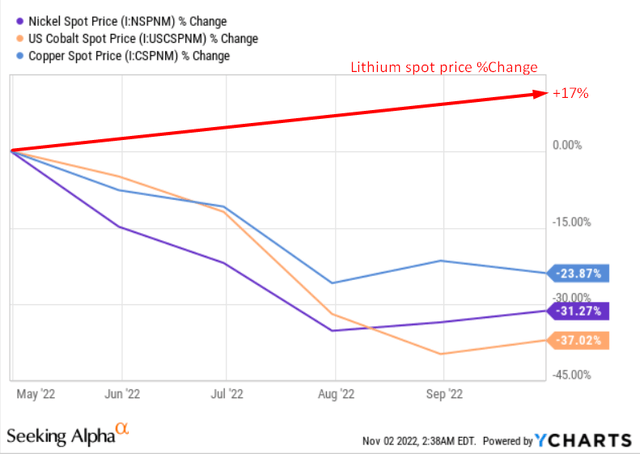

In recent months, Tesla has concluded some contracts with BHP Group (BHP) and Vale S.A. (VALE) for the supply of nickel. Nickel is one of the most important metals for producing electric vehicles, the prices of which have been unpredictable recently due to an imbalance in the global market for battery metals. The same unpredictability of price takes place, for example, with cobalt and lithium.

A vital component in most electric-vehicle batteries, lithium is becoming one of the world’s most important commodities. Prices have soared to unprecedented levels as demand forecasts keep growing, leaving automakers scrambling to secure future supplies.

Yet until fairly recently, it’s been almost impossible to trade. Prices would be fixed in long-term private contracts between the handful of dominant suppliers and their customers, with no need for middlemen. Now, the surging demand is shaking up the way that lithium is bought and sold: Many supply deals have become dramatically shorter – with floating prices linked to the spot market – while exchanges from Chicago to Singapore are experimenting with new futures contracts.

Source: From Bloomberg [October 29]

Elon Musk also signed a contract with Glencore to supply 6,000 tons of cobalt to an automobile factory in Shanghai – that was back in early 2020. Despite all these contracts, Tesla and other companies specializing in electric cars (read: soon all car companies) continued to have problems with the supply of refined lithium, cobalt, and nickel. That’s why Elon tweeted in early April 2022 that Tesla might get “into the mining and refining directly at scale unless costs improve.”

Apparently, the “costs” situation” has improved since that tweet, with FT talking about Musk’s desire to stop negotiations with Glencore – environmental pollution as a cause seems less compelling, in my view.

Ycharts, Investing.com, author’s calculations

Be that as it may, the mere fact that Elon Musk wanted to buy Glencore and not, say, BHP or Vale, is good food for thought.

Assets diversification is a long-term benefit of Glencore

The company’s portfolio mix also stands out from its peers, offering a leading position in key battery metals, including copper and nickel.

Barclays Research, October 28 [with author’s notes]![Barclays Research, October 28 [with author's notes]](https://static.seekingalpha.com/uploads/2022/11/2/53838465-16673677423435001.png)

As we can see from a recent study by Barclays, BHP and (RIO) are more focused on iron ore, while Freeport-McMoRan (FCX) is a pure copper company, without sufficient diversification.

At the same time, we see that a fairly large part of Glencore’s business is the extraction and sale of energy resources – primarily coal. This gives the company an advantage in the short term, while broad diversification into metals mining offers many opportunities in the long run, according to Barclays’s analysts.

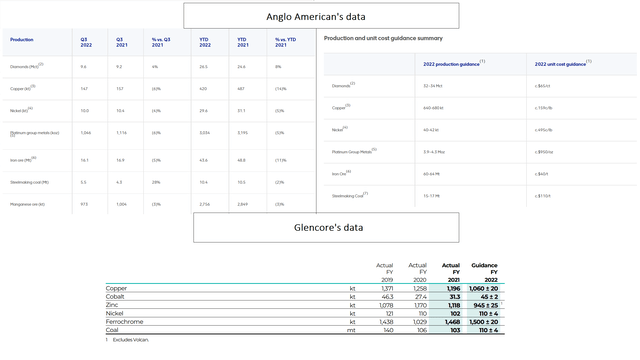

However, the company that comes closest in terms of diversification – Anglo American (OTCQX:AAUKF) – also has a significant coal mining operation. The difference between them becomes clear in a more detailed comparison of their business segments and the production guidance figures for FY2022:

Anglo American’s and Glencore’s recent production data

Glencore produces significantly more nickel (by 2.7 times, based on FY2022 guidance) and is generally similar to NILSY in business segments, being its more reliable Western counterpart:

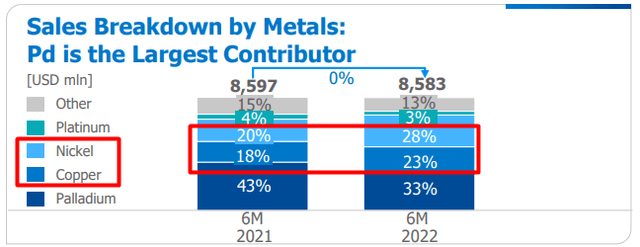

NILSY’s sales breakdown, author’s notes

However, unlike NILSY, which is heavily dependent on the price of palladium – the key metal for ICE engines rather than EV batteries – Glencore is more focused on copper and zinc, outside of its coal business.

Thanks to growth in its Marketing segment, the company increased its adjusted EBITDA and EBIT by 119% and 191% year-on-year, respectively, in H1 2022.

Glencore upgraded its Marketing EBIT guidance and now expects an H2 2022 Marketing EBIT “likely exceeding $1.6B” – this implies a +30% upside to BBG’s consensus of ~$1.2B. Glencore already exceeded its annual EBIT guidance of $2.2 – 3.2B, with $3.67B EBIT reported in H1 2022.

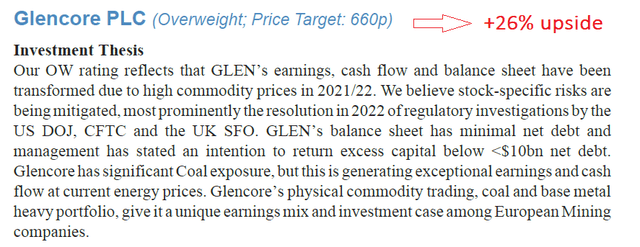

Thanks to the successful trading of commodities, Glencore again received an overweight rating from J.P. Morgan analyst Dominic O’Kane, who issued the following investment thesis on October 28:

JPM, October 28, author’s notes

Glencore’s valuation also looks tempting

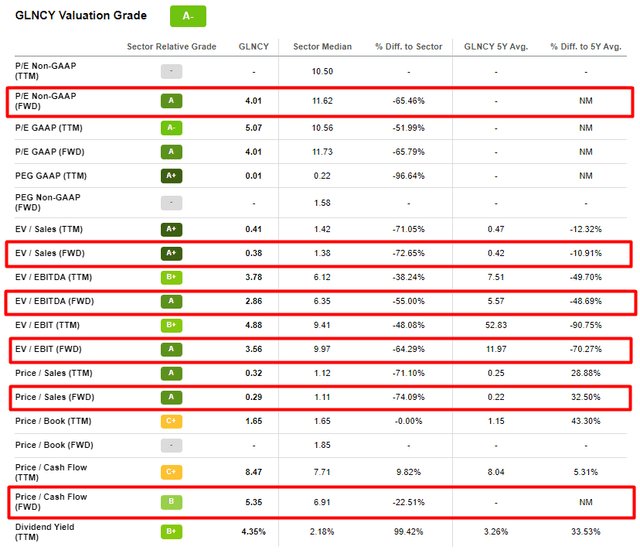

The company is ranked as the top diversified metals and mining stock based on Quant’s screener by Seeking Alpha (a sample of 43 companies in the industry), and in many respects, this high ranking is explained by quite attractive valuation multiples, which are 2 to 4 times lower than those of Materials companies.

JPM agrees with Seeking Alpha’s quant ranking system, as Dominic O’Kane writes in the study I mentioned above:

Glencore trades on mark-to-market 2023/24E 2.4x/1.9x EV/EBITDA, 26%/30% FCF yield, which is a significant discount to Rio Tinto and BHP (both Neutral) and the ~10-year average EV/EBITDA for UK Diversified Miners of ~6x.

Source: From JPM’s report, October 28

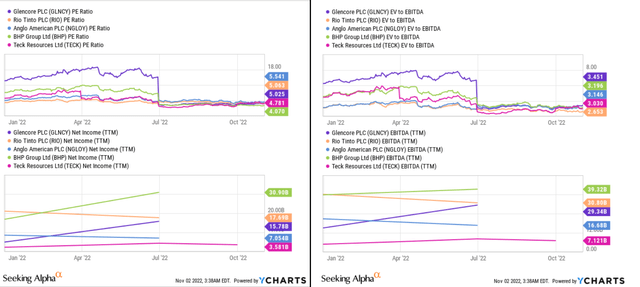

I also agree with Dominic and SA’s quant ranking, as the discount to Rio and BHP can be seen even in the growth momentum of the companies’ financials against the backdrop of TTM valuation levels – Glencore is obviously increasing its growth much faster than its peers, still having relatively average TTM valuation multiples:

Risks and Takeaway

My thesis involves certain risks, of which anyone wishing to buy Glencore shares at the current levels should be aware:

- A decline in commodity prices, as Glencore has more leverage to commodity prices than its UK-listed diversified mining peers;

- Adverse changes to tax, legislation, and other operating conditions in unique countries where the company operates, including the Democratic Republic of Congo, Kazakhstan, and New Caledonia;

- Negative resolutions to regulatory and tax uncertainties are pending, in particular, investigations by the Swiss Attorney General’s Office and the Dutch Public Prosecutor’s Office.

Be that as it may, I believe Glencore compares favorably to its same-sized peers in terms of asset quality and diversification, which should be the most important factor in both the short and long term due to the ongoing energy crisis and the continuation of the new bullish cycle in commodities.

This is indirectly confirmed by the fact that Elon Musk chose this company among some others to have direct access to battery metals for Tesla’s facilities. Why does not he buy a few smaller companies or continue to develop his own projects in the industry? I think he was aware that Glencore is best positioned in terms of assets/scale and has more efficient management than the rest of the group to realize its potential and make life easier for Tesla.

In my opinion, the decline in metal prices that we have been witnessing since the beginning of the year is only temporarily delaying the inevitable. The deglobalization processes in the world, as well as the development of alternative energy and electric vehicles, will boost demand for non-ferrous metals in the next decade – this concerns cobalt, zinc, lithium, copper, nickel, and some other, rarer metal types. Therefore, the ~2x of 2024 EBITDA Glencore is currently trading for represents an excellent opportunity for long-term investors to gain high-quality exposure to the global processes described above.

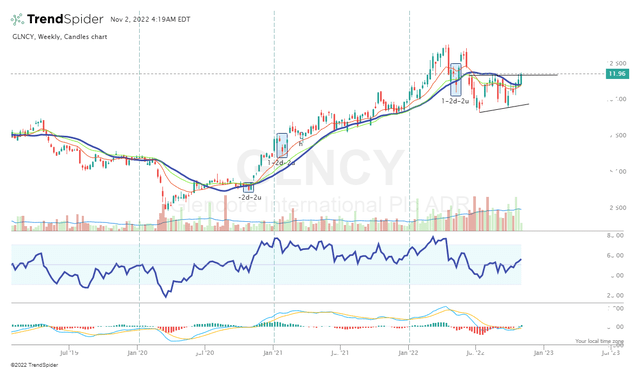

I recommend buying Glencore at current prices after the recent technical breakout on the weekly chart:

Please share your thoughts in the comment section below. Thanks for reading!

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top Ex-US Stock Pick competition, which runs through November 7. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment