Anchiy/E+ via Getty Images

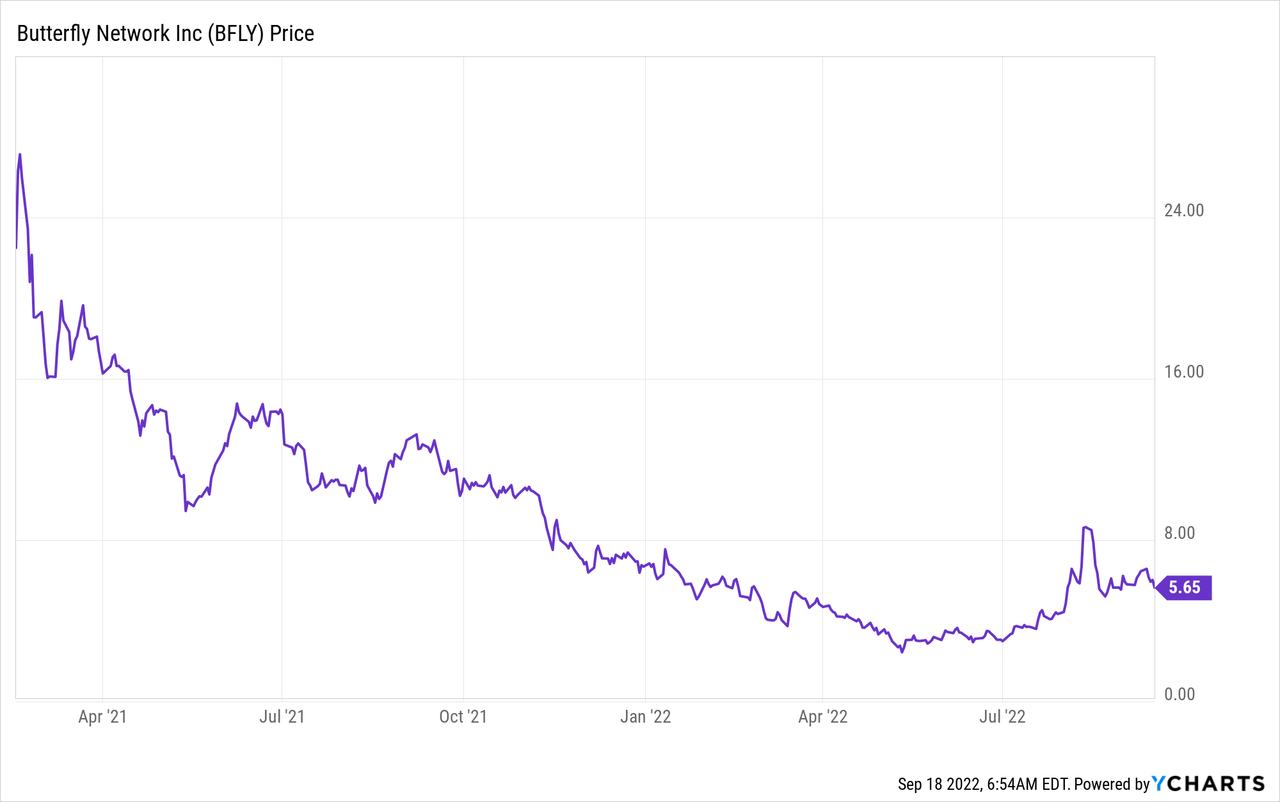

Butterfly Network, Inc. (NYSE:BFLY) has created a portable ultrasound device that is poised to democratize the medical device industry. The company raised $400 million from the Bill & Melinda Gates Foundation and early Tesla investor Baillie Gifford before going public in February 2021 via a SPAC merger. Since that point, the growth stock market has been butchered thanks to the rising interest rate environment. In addition, investor redemptions have battered many former SPACs [Special Purpose Acquisition Companies].

Butterfly Network saw its stock price slide down by 88% from its highs of $25 per share, to a $3 per share low in July 2022. But since that point, the stock price has popped by a blistering 88% as the company produced strong earnings for the second quarter of 2022. In addition, the global ultrasound devices total addressable market (“TAM”) is forecasted to be worth $12.5 billion by 2028, growing at a 5.3% CAGR over the period. Thus in this post, I’m going to break down the company’s business model, financials and valuation, let’s dive in.

Business Model

Butterfly Network was founded in 2011 by Dr. Rothberg, a scientist turned entrepreneur. The mission of the company is to enable “universal access to medical imaging” via its compact ultrasound device. This device works based on “ultrasound on a chip” technology which enables a portable device to display accurate imaging via a mobile app. In hospitals today, legacy Ultrasound machines are large bulky, and expensive. Many even have to be wheeled into hospital rooms due to their heavy weight and large size. This makes traditional Ultrasound not very popular in use cases where portability is required.

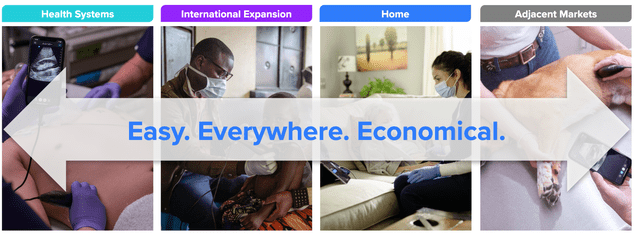

The applications for a portable device include; medical training, in-home health care, 3rd world country access, and even pet ultrasound scanning. According to a study, cited by the company field paramedics usually do not have access to ultrasound technology and are not trained in its use. However, with “limited training” they were able to utilize the Butterfly IQ device to scan patients and analyze images. Approximately 88% of these ultrasound images were accurate and one-third went on to be used in aftercare. In another study, nurse midwives could perform at the same level as trained sonographers with the Butterfly device.

Butterfly Network (Investor presentation)

Recently Butterfly has expanded its product across academic medical centers such as Baylor Scott & White in Texas. The company used a “land and expand” approach in which they started with critical care and emergency rooms, before setting out plans to roll out in nursing, obstetrics, and anesthesia. In the UK, Butterfly added Brighton and Brunel Medical to its education customer base. The company has also started to roll out its devices in Sub-Saharan Africa, supported by the Bill and Melinda Gates Foundation who are also early investors into the company (as mentioned prior). The product is already in Nairobi and there are planned shipments to South Africa for the second half of the year.

Butterfly Network has also scored key partnerships with distributors such as Zebra Medical in South Africa. In addition, to Novolog (Israel) and Abul Latif Jameel which has operations in the Middle East and India.

Growing Financials

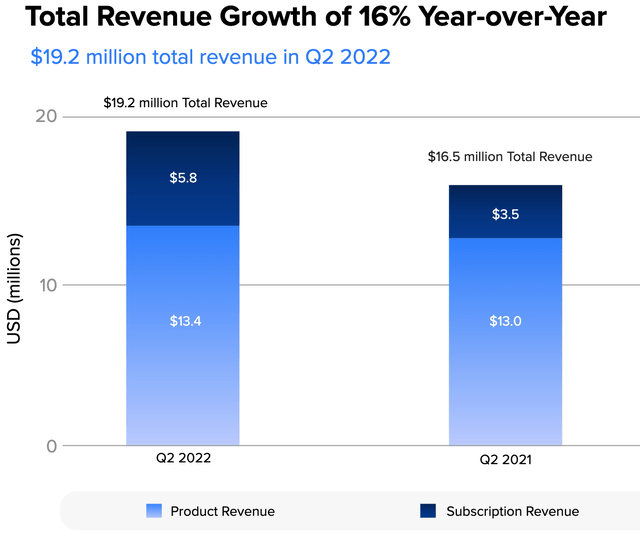

Butterfly Network generated strong financials for the second quarter of 2022. Revenue was $19.2 million which beat analyst estimates by $115k and increased by 16% year over year. This was the company’s highest quarterly revenue ever and popped by 23% quarter over quarter. Accelerating growth is always a positive sign especially sequentially. The company makes its revenue by selling its products and then a subscription for its software. This is a genius pricing model, as the subscription enables recurring revenue for many years ahead. In the second quarter, Product revenue was $13.4 million which increased by 3% year over year and was mainly driven by higher prices in the U.S. and globally. In addition, the company achieved greater Veterinary revenue, scoring a landmark partnership with PetCo to roll out the devices across all full-service Pet Care Centers. However, it should be noted that product sales were impacted by lower e-commerce or direct-to-consumer sales as the business transforms to focus more on enterprises. In addition, lower out-of-hospital performance was driven by a shift in support resources, which is expected to improve next quarter.

Revenue Growth (Investor presentation)

Subscription revenue demonstrated rapid growth of 66%, to $5.8 million. I also noticed subscription revenue increased to 30% of the total, which was up by 9% year over year and is a positive trend overall. This is the beauty of the model, as the more products are sold, the more recurring revenue will be generated over time both from new sales and renewals.

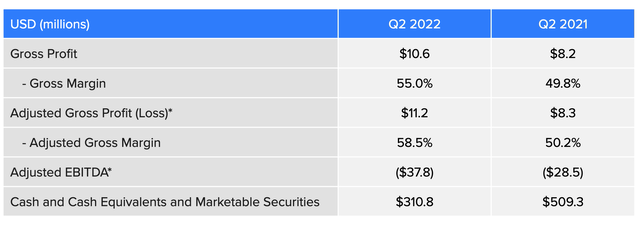

Butterfly Network generated solid Adjusted gross profit of $11.2 million, which increased by ~35% year over year. This was driven by higher subscription revenue which has higher margins than hardware sales. The company has also been focusing on improving manufacturing efficiency, although some inflation was seen in its material costs.

Normalized Earnings Per share [EPS] was negative $0.18, which beat analyst estimates by $0.09. In addition, Adjusted EBITDA produced a loss of $37.8 million, which was greater than the $28.5 million loss generated in the prior year. The good news is this loss was mainly driven by commercial and R&D investments, as the business improves its product and go-to-market plans.

Butterfly Network has a solid balance sheet with cash, cash equivalents of $311 million, in addition to just $32 million in total debt.

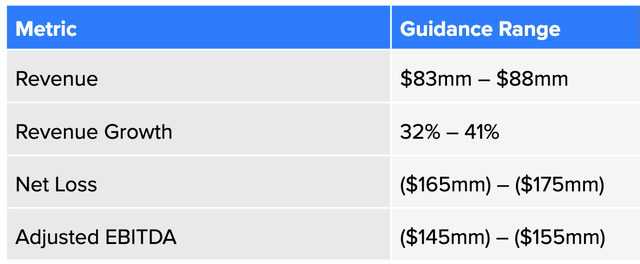

Moving forward, the second half of 2022 is expected to be strong for the company. With between 55% and 60% of their revenue forecasted to be generated during that period. In addition to a 45% to 55% growth rate for the full year, which is fantastic. This is expected to be driven by the business model transition to institutional purchases. Management is guiding for $83 million to $88 million in revenue in Q3,22. With a $35 million improvement in Adjusted EBITDA which is a positive and would demonstrate operating leverage starting to take hold.

Advanced Valuation

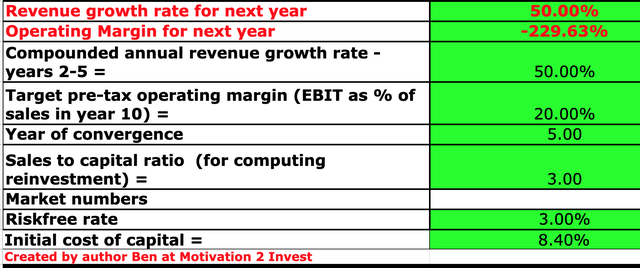

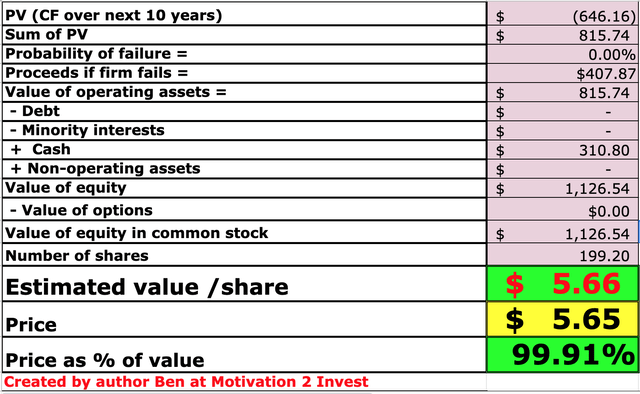

In order to value Butterfly Network, I have plugged the latest financials into my advanced valuation model which uses the discounted cash flow method of valuation. I have forecasted 50% revenue growth for next year, and 50% for the next 2 to 5 years. This is driven by management expectations and analyst estimates given the company’s institutional-focused business model.

Butterfly Stock valuation 1 (Created by author Ben at Motivation 2 Invest)

I have also forecasted the company’s operating margin to increase to an extremely healthy 20% over the next 5 years. This is a fairly optimistic forecast and takes into account a greater portion of higher margin software subscription revenue, in addition to tailwinds from the pet market. I have also capitalized R&D expenses to increase the accuracy of the valuation.

Butterfly stock valuation 1 (created by author Ben at Motivation 2 Invest)

Given these factors, I get a fair value of $5.66 per share, which is close to where the stock is trading at the time of writing and thus I will deem it to be fairly valued.

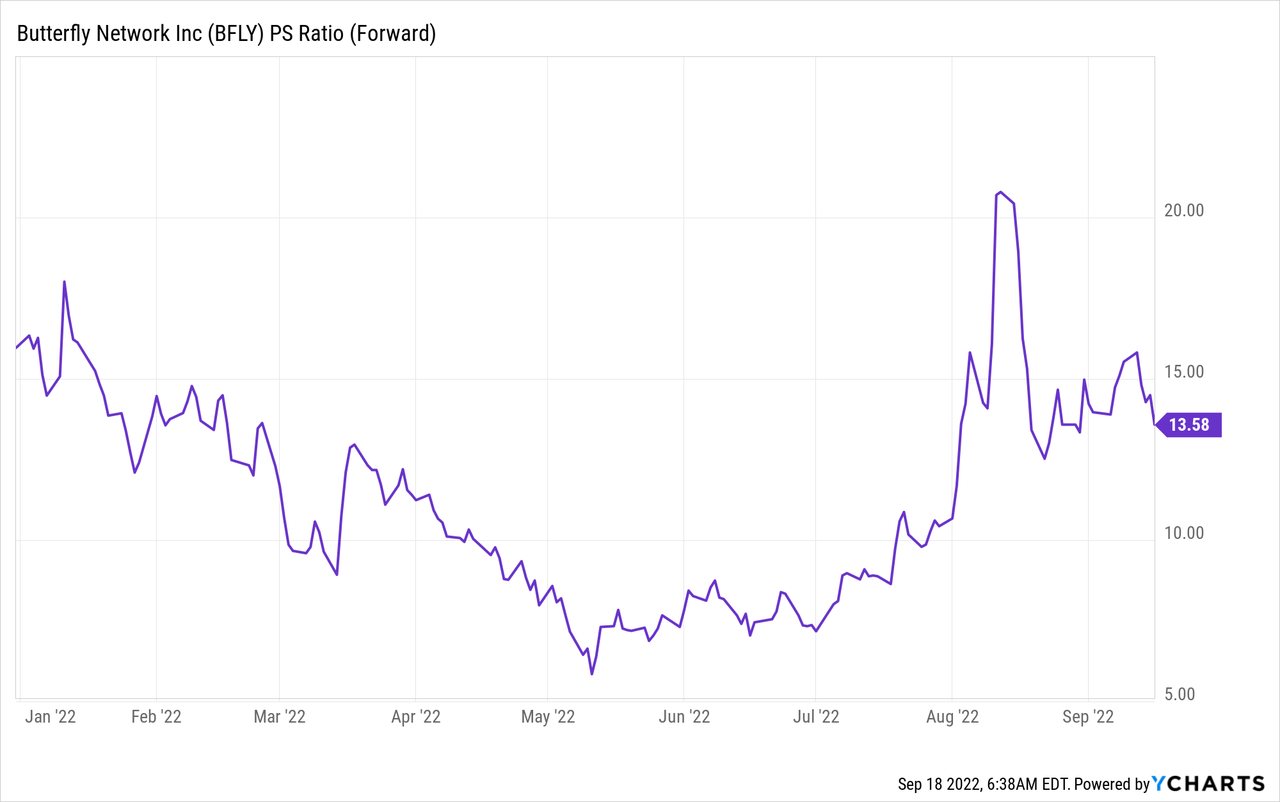

As an extra data point, Butterfly Network trades at a Price to Sales Ratio = 13.6, which is cheaper than historic levels above 20. However, the stock did trade at a cheaper valuation in May and June of 2022.

Risks

Valuation Not Cheap

Given the many opportunities in the stock market right now, the valuation for Butterfly Network is not cheap after the recent boom in stock price.

Competition

Despite Butterfly Network having a number of patents, I do see a lot of similar portable ultrasound devices on the market. Now although I cannot attest to the accuracy of these other devices, it is still a warning sign that the business may not have a “moat” around its technology.

Portable Ultrasound (Google Search)

Final Thoughts

Butterfly Network offers a portable ultrasound device that has a variety of use cases. The technology looks to best in class, as the company is backed by leading medical foundations such as the Bill Gates foundation. After the recent run-up in share price the stock is “fairly valued” at the time of writing, but it is not the cheapest it has ever been and thus I will label it as a “hold” with an entry point at ~$3 per share for a maximum margin of safety.

Be the first to comment