vitpho

The US home construction industry recovered quickly after 2020’s challenges and was among the top-performing market segments in 2021. The sizeable initial decline in mortgage rates, combined with more at-home activity and government stimulus efforts, led to immense increases in home values, property upgrade investments, and new construction activity. One company that has benefited tremendously from that trend is the construction supplier Builders FirstSource (NYSE:BLDR), rising well over 300% from its “lockdown lows.”

I was very bullish on BLDR in early February of 2020, before the virus was a public issue – though I had warned of that risk regarding the stock. The stock declined dramatically during the initial market drop but is still up by around 170% since the article was published. Critical reasons for my bullish outlook at the time were Builders’ strong vertical integration, relatively low valuation, and a surge in construction activity.

Builders FirstSource is highly dependent on macroeconomic conditions. The stock appears to have a low valuation today with a “P/E” of 3.7X; however, it is exceptionally cyclical and may face years of losses and low earnings if conditions shift. When I covered the stock last, the primary reason for my bullish sentiment was the need for more small single-family homes as more young people entered the home-owning market. The extreme decline in mortgage rates caused this trend to surge. However, the sharp rise in inflation and the related rise in mortgage rates has changed the situation dramatically. Today, home prices and sales are starting to decline, but since construction costs are not (due to inflation), home builders are in a problematic situation.

While there is a lot to like about Builders FirstSource, I am no longer bullish on the stock and am moderately bearish. In my view, many investors may be underestimating the depth and length of the reversal in construction activity and how it could negatively impact Builders for a prolonged period. Builders have managed immense profit margin growth over the past two years, but if those margins return to normal, the stock’s valuation would be pretty high. The company’s many acquisitions and lack of significant financial obligations are attractive from a long-term perspective, but the stock may face a more significant downside over the coming months.

A Realistic Look At The Construction Market

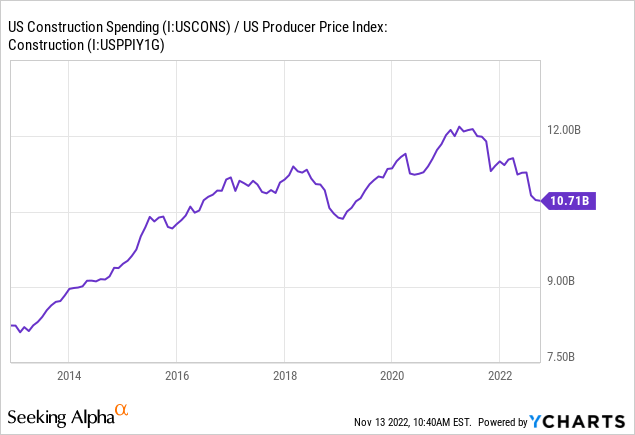

Builders FirstSource operates mainly under the winds of the economy. The company has wisely reinvested profits into a diversified portfolio of acquisitions and reduced its debt, lowering its overall exposure to a construction recession – but it is a risk that is impossible to mitigate entirely. Indeed, today there is not much of a “risk” of a construction recession, but an observable reality. See PPI-adjusted construction spending below:

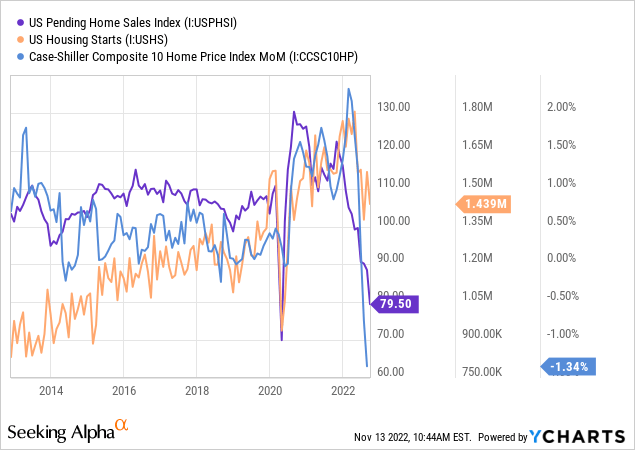

Real construction spending peaked in mid-2021 and has declined considerably since. Total construction activity has risen marginally, but that is primarily due to increased prices, not increased demand. I expect this trend will continue over the coming year due to growing signs of a more considerable slowdown in the property market. Interestingly, in mid-2021, when real construction activity peaked, home prices, housing starts, and pending home sales were also at an apex. See below:

Home prices are declining as sales collapse under higher mortgage rates. Building permits are still elevated, signaling continued demand for construction products, but they are seemingly on the verge of a sharp decline. Building materials, labor, and other costs are still relatively high while prices are reversing lower, making it very difficult for property developers to profit. In the short run, I expect most developers will continue to build those projects they have already planned, meaning Builders FirstSource may not see significant losses soon. However, even if the reaction is delayed, a decline in home prices and sales will negatively impact construction activity, inevitably hitting Builders FirstSource’s profitability.

Nationally, homes are as unaffordable today as they were at the peak of the real estate bubble in late 2006. The critical difference is that today’s change is primarily due to mortgage rates, not home prices – though that is still a significant factor. The US homeownership rate has improved but is still low enough that new homes could be needed. Of course, the US (as an aggregate) is certainly not in a “housing shortage,” considering “people per household” is at an extreme historical low, and the US population is essentially not growing.

These demographic factors are essential for Builders FirstSource from a long-term perspective. The “baby boomer” generation is large and tends to own larger homes than the younger generations. As that group continues to reach retirement age, more will inevitably look to downsize, and some may follow traditional norms and move in with children (see retirement savings ‘crisis’). As such, the overall need for more residential homes may be lower than it was years ago. If inflation continues to raise living costs, there could be more multi-generational homes (either for young people living with parents or retired people living with children). Given the lack of new births and the rise in deaths, the long-term demand for new homes may be relatively low regardless of affordability.

How Builders FirstSource Will Be Impacted

Builders FirstSource cannot escape economic conditions but may evade its worst effects. Overall, I believe the data and trends clearly illustrate a growing decline in construction activity stemming from a sharp decrease in affordability. Importantly, there is a relatively significant lag from the initial losses in home sales to construction spending, as most developers plan projects well in advance. Most spending today is based on economic conditions and projections from a year ago. As such, it is reasonable to expect Builders FirstSource will not see its sales or EPS decline until six to twelve months after the property slows.

Analyst projections generally account for this situation, giving the stock an EPS estimate for 2022 of $17.9, falling to $6.9 in 2023 and remaining near those levels. With those projections in mind, BLDR’s more long-term forward “P/E” is closer to 9.5X. In my view, that is a fair valuation for the firm if we do not consider the possibility of an even more significant decline in EPS. Its current projection largely centers around the reversal in its profit margins and a slight decrease in sales. In my view, it is more likely the company’s profit margins will experience a more considerable decline.

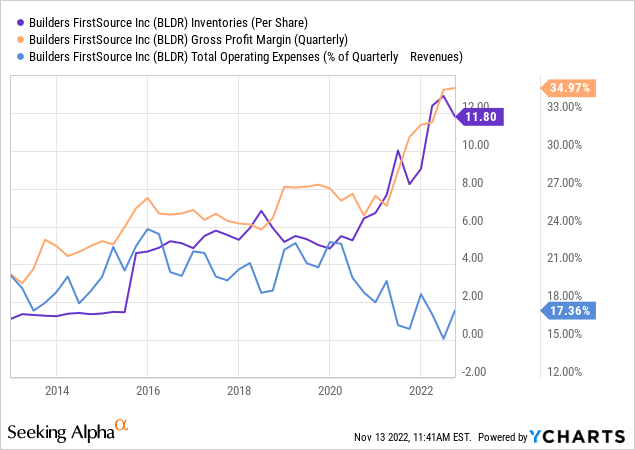

Builders FirstSource has had temporarily high gross profit margins due to the large US shortage of building products coming out of 2020. Since it was among the few with sizeable inventories, the company has sold products for much higher prices than it paid. However, today it is purchasing new products at elevated costs and is starting to face negative pressure on sales while its inventory level is very elevated. In my view, this situation opens the door for large price cuts that will push its gross margins back below 27% and potentially as low as 23% (in a recessionary condition). Further, like most firms, the company reduced its operating costs during lockdowns – a trend that could reverse as operations normalize. See below:

If the company’s gross margins fall to a range of 23-27% while its operating costs-to-sales rise to a range of 19-22%, then Builders’ operating margins would fall to an expected range of 1-8%, much closer to its historical norm. Assuming no change in sales, $196M in interest costs, and a 23.5% tax rate, Builders FirstSource’s income would likely be around $605M per year (at a 4.5% operating margin) or an EPS of ~4.13$. That is my base-case EPS projection for the stock, giving it a higher forward “P/E” of 16X based on my new estimate.

Of course, during the 2008 housing market crash, Builders FirstSource had chronically negative operating margins for about five years until 2013 and saw its sales slide by around two-thirds of its original value. It is essentially impossible to value the company based on such conditions. The company has also taken measures that change its risk exposure, such as cleaning its balance sheet while making strategic acquisitions. Still, most of its sales come from core items like lumber and other high-cost products that require significant new construction activity for sustained sales. As developers face lower selling prices, I imagine they will be far more price-sensitive as they’re strained on both ends (as inflation increases costs while home sales fall). At this point, it seems unlikely Builders FirstSource will face a situation akin to 2007-2012, but it is certainly not off the table. Thus, I believe BLDR has greater downside exposure than that assumed in my EPS estimate.

The Bottom Line

Overall, I believe BLDR is a relatively high-risk stock with minimal upside potential and extensive downside exposure. It is in a highly cyclical industry, and a great deal of data and trends indicate construction activity will slow for some time. This factor may be obfuscated by BLDR’s strong EPS growth in recent years, but that is mainly due to one-off conditions that exogenously increased its profit margins to an unsustainable level.

Given my $4.13 EPS projection and a 10X “P/E” valuation, I believe BLDR would be closer to an appropriate value at $41 per share. That said, if general economic and construction market conditions continue to deteriorate, the stock could fall far lower as it has huge exposure. To some extent, BLDR’s exposure is more considerable than homebuilders because of its inventory and overhead levels, so it could face many years of losses if a large construction slowdown occurs. Suppose my long-term outlook regarding demographics and the housing market proves correct. In that case, BLDR’s business model may need to change dramatically to adjust for a more long-lasting decline in construction activity.

While I do not believe BLDR is a great short opportunity, I think the stock is best avoided and believe it is likely to decline in value over the next year. Its recent earnings were strong, but that was mainly due to the long lag period between property market trends and construction spending. Thus, it may face big negative surprises in 2023.

Be the first to comment