Bruno Vincent

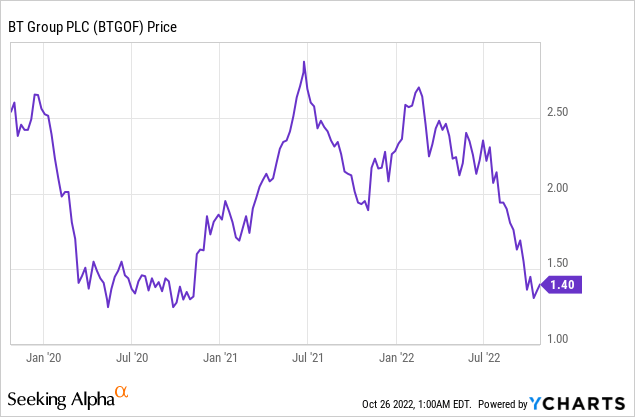

BT Group Plc (OTCPK:BTGOF) is down to its mid-2020 level of $1.40 when Covid-led uncertainty played havoc in global stock markets as shown in the charts below.

This time around high inflation and economic slowdown risks are even higher as high oil prices increase operating costs for the company and cause its enterprise customers to have less disposable income. As a result, there has been some despair among investors who have shied away from the stock, but the fact that the company reinstated dividends at the end of last year indicates confidence.

Also, given the importance of telecommunications in the digital age, namely for our modern society to function together with the fact that third-quarter earnings are to be announced on November 3, this thesis will provide an update on the finances and priorities, for a company that remains largely undercovered on SA.

First, I provide some insights into the economic situation in the U.K.

Recession Risks, Financial Inclusion and Revenues

The probability of a recession in the Eurozone has increased as private sector activity has suffered from continued contraction in the July-October period. In the U.K, there has been a change in country leadership but economic uncertainty still reigns as the new prime minister has an uphill battle on the fiscal front.

However, things are far from being rosy in other parts of the world too as the U.S. also faces the possibility of a recession. Along the same lines, a hawkish Federal Reserve has pushed the dollar up threatening to destabilize monetary conditions in the majority of the world’s economies, many of whom have to seek help from the International Monetary Fund or friendly countries in order to balance their national budgets.

All these woes raise the question of whether people have the capacity to pay their utility and telecom bills.

In the U.K, the government has been subsidizing the power bills and, the U.K with a score of 56.9 is in a better position to tackle the problem of financial inclusion. This is about providing citizens with access to affordable financial services like insurance, and payment systems which put them in a better position to face higher living costs. Thus, with global downturn fears becoming more evident, BT, the largest provider of fixed-line, broadband, and mobile services in the U.K. with over 18 million customers, stands a better chance of not seeing its debtors’ list grow.

Along the same lines, with European countries having the lowest mobile data pricing compared to the U.S. Canada, or even China, they have more leeway to increase tariffs for their retail customers in case the economic situation deteriorates drastically.

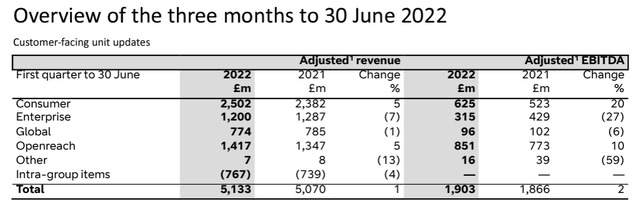

In this respect, one of BT’s challenges has been falling revenues since 2018. This trend has been reversed through a 1% revenue growth in the first quarter of 2023 or Q1 (ending in June 2022) compared to the same period last year, helped by improved pricing, consumer strength, and Openreach.

Q1-2023 Financials (www.bt.com)

Now, Openreach which is the subsidiary managing the company’s fiber business is growing rapidly at 35% in terms of the installed base, from 2.6 million premises last year to around 3.5 million this year. As for mobile, the telco’s 5G network covers more than 55% of the country’s population.

The competition and BT’s Priorities

However, this has not prevented mobile revenues from dropping by 75% year-on-year following Virgin Media, a joint venture between Liberty Global (OTCPK:LBTYA) and Telefónica (TEF), migrating away from BT. Now, Virgin Media is an MVNO or mobile virtual network operator which used to lease BT’s physical mobile network in order to provide telephone and internet services to its clients.

Its departure represents a big loss but, this does not mean that BT’s MVNO strategy faces obsolescence. On the other hand, as part of a revamped enterprise strategic focus, the company has inked several MVNO deals with companies like Tango and plan.com as provided by the company’s executives during the Q1 earnings call.

Looking at the industry, Virgin Media’s exit from BT’s network shows the high level of competition prevalent in the U.K telecom market where there are four mobile operators with Virgin Media migrating to two of them, namely Telefonica and Vodafone (VOD). The fact that this was done before an agreement has been concluded has prompted BT to look for a £24.6 million court settlement.

Thinking aloud, BT has grown revenues by 1% despite the MVNO’s exit and facing competition in the fiber market amid adverse economic conditions all point to the fact that the company is making progress on its five priorities which are pictured below.

Five Priorities (www.seekingalpha.com)

I first look at Consumer growth.

In this case, driven by a record number of fiber connections together with converged services, there was strong growth in the consumer business. This is an area where investors can also expect a lot of development, as the slower part-copper and part-fiber networks are replaced by gigabit-capable broadband fiber, which can support data-intensive applications like online video streaming. Therefore, there are prospects for providing value-added services on top of fiber while higher-speed connectivity remains a national priority. as the country accelerates the pace of digital transformation.

Segmental Revenues

Acceleration has also been seen in the Mobile segment, where the average monthly usage increased by 150% after being depressed a year earlier by Covid lockdowns grappling down much of Europe and the world. Thus, with a pickup in travel throughout the world, there should be more income from international roaming and related data.

Pursuing further, consumer strength in both mobile and fixed-line led to an increase in sales by 5% in Q1, also favorably impacting EBITDA by 20% as shown in the chart below. These were also helped by a rise in annual contracts in April plus substantial revenues from sporting events.

Q1-2023 Segment Results (www.bt.com)

On the other hand, the enterprise segment, which also happens to be BT’s second priority (five priorities table above), exhibits a more mixed picture with high inflation eating into corporations’ disposable income, prompting many to delay projects. Still, there are some long-term opportunities with digital transformation as evidenced by the partnership with MTN, a pan-African telco for Business to Business (B2B), which capitalizes on BT’s years of experience in enterprise solutions including managed services and cybersecurity.

Furthermore, in addition to sales growth, the 2% progress in the bottom line, as shown in the table above, was made possible through tight cost control and lower (indirect) payment of mobile commissions.

Valuations and Key Takeaways

Now, these results show that the strength of the Consumer has offset the weakness in Enterprise, with Openreach (the third priority), which generated one-third of total revenues in Q1 providing some cushion against further disruption in economic conditions. Here, I have in mind, fiber connectivity as an enabler of the secular trend of digital transformation staying in constant demand.

Going forward, demonstrating the ability to adjust pricing without necessarily facing higher levels of churn in the highly competitive environment is another positive for BT. In this respect, BT Halo which is an add-on to existing fiber packages provides a certain degree of product differentiation over competitors by enabling automatic switch-over to 4G in case of connectivity problems.

Pursuing on a positive note, according to a customer satisfaction survey carried out by the Office of Telecom in May, BT had the second call wait time at 55 seconds, well ahead of competitors Vodafone with 90 seconds and O2 with 239 seconds.

These all mean that the telco incumbent deserves a better share price.

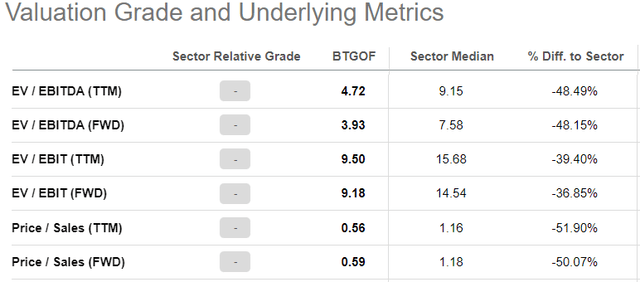

Talking valuations, it is undervalued with respect to peers by 37% to 50% as per the table below. Hence, adjusting for a 20% increase for the trailing Price to Sales of 0.56x translates to a P/S of 0.7x (0.56 x 1.25) or a target share price of $1.75 based on the current share price of $1.40.

Valuations Metrics (www.seekingalpha.com)

Therefore, BT is a buy, as from a “dumb telco”, it is now transitioning to an “Always Connected” digital transformation enabler. This sets the tone for the fourth priority which is to transform the cost base through improvement in productivity through a strategy based on digitalization, automation, and reskilling of its workforce.

This said, do expect a lot of volatility in the share price, as in addition to news updates about the economy and competitors, BT’s stock is also subject to fluctuations when French telco tycoon Patrick Drahi tries to increase his stake in the carrier, or the management fails to reach an agreement with the trade unions. For this matter, industrial actions by workers may become more frequent as the company continues to bring cost savings, and targets £2 billion of those by 2025.

However, investors can rest assured that contingency plans remain in place to minimize disruption during strike actions, with the dividend reinstated on basis of an initial one billion pounds of cost reduction being achieved one and a half years before the target date.

Moving to the fifth and final objective of capital allocation, the company has forged an agreement with Warner Bros. Discovery (WBD) enabling it to save around £100 million in yearly costs while broadcasting 27% more games. This demonstrates a high level of financial discipline.

Finally, there may be short-term pains mostly due to the enterprise segment when second-quarter results are announced next week, but I am bullish because of the progress seen in BT’s five priorities, while the management remains firmly motivated to achieve cost reduction objectives.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top Ex-US Stock Pick competition, which runs through November 7. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment