staticnak1983/E+ via Getty Images

The BlackRock Science and Technology Trust (NYSE:NYSE:BST) is technology-focused fund offering exposure to pre-IPO investments that are typically not available to retail investors. It also pays an attractive 10.2% current yield that is funded from realized gains and call writing. During bull markets, pre-IPO investments can add significant torque to a portfolio, as companies typically go public at multiples of their private valuations. Unfortunately, the IPO market is currently shut and private investments are being marked down aggressively. I would stay away from the BST fund until the market environment improves and the IPO market re-opens.

Fund Overview

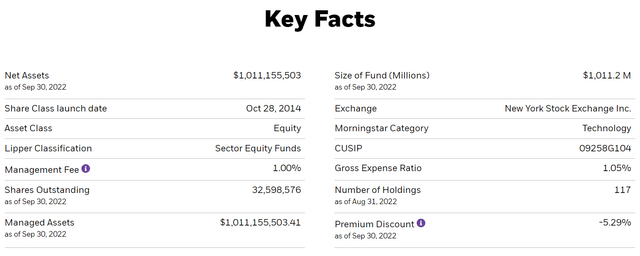

The BlackRock Science and Technology Trust is a closed-end fund (“CEF”) that primarily invests in companies in the science and technology sectors in any market capitalization range, including private investments. The fund has $1.0 billion in assets and is trading at a 5.3% discount to NAV (Figure 1).

Figure 1 – BST Key Facts (blackrock.com)

Strategy

The BST fund’s investment objective is to provide income and total return through a combination of current income, short-term realized gains, and long-term capital appreciation. To achieve its investment objective, the fund invests in companies that have the potential for rapid and sustainable growth from the development and use of science and technology. The fund also employs covered call option strategies to generate income.

Portfolio Holdings

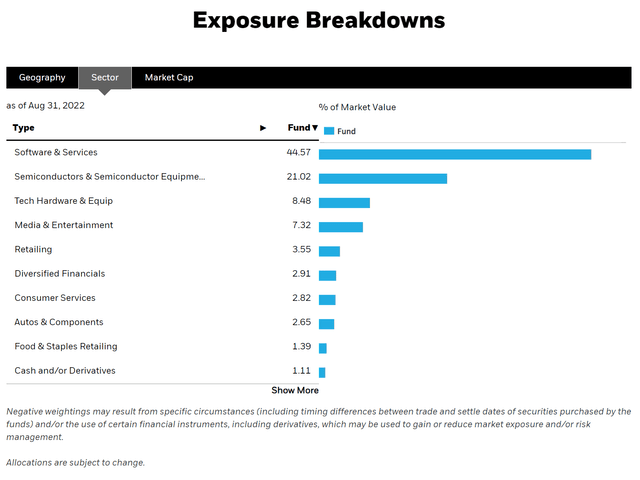

The BST fund’s portfolio breakdown resembles that of a typical technology fund, with the majority of the fund’s assets invested in software (45%) and semiconductor (21%) companies (Figure 2).

Figure 2 – BST Sector Allocation (blackrock.com)

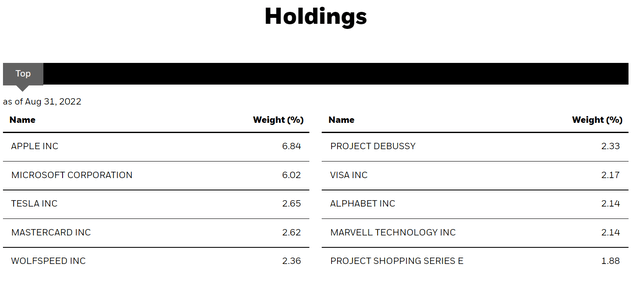

The top 10 holdings also show many familiar names such as Apple Inc. (AAPL), Microsoft Corporation (MSFT), and Tesla Inc. (TSLA) (Figure 3). The top 10 holdings are very typical of similar technology funds… wait wait wait. What is Project Debussy? What is Project Shopping Series E?

Figure 3 – BST Top-10 Positions (blackrock.com)

BST Offers Exposure To Private Investments

Unlike technology funds that invest purely in publicly traded securities such as the ARK Innovation ETF (ARKK), the BST fund invests a significant portion of its assets in private securities, typically pre-IPO rounds of technology companies such as Klarna, Databricks, and ByteDance. This is an interesting feature of the BST fund that could be appealing to some investors, as pre-IPO investments are typically not available to retail investors.

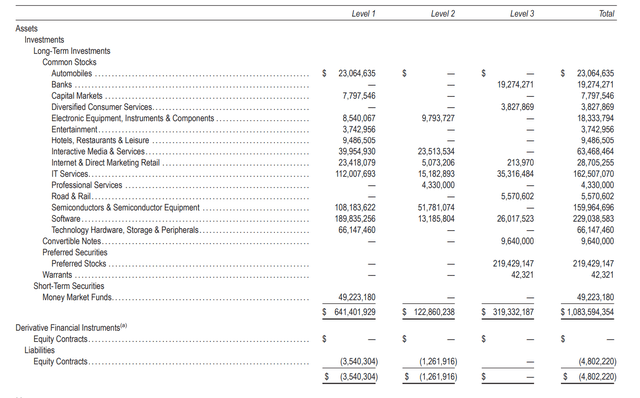

Although the fund does not disclose the exact percentage of private securities in its marketing documents, we can infer this figure from the fund’s semi-annual report, which shows the fund has 29.5% of its assets classified as Level 3 assets at the end of June, 2022 (Figure 4).

Figure 4 – BST Level 3 Assets (BST June 2022 Semi-Annual Report)

Private Investments Are High Risk High Reward

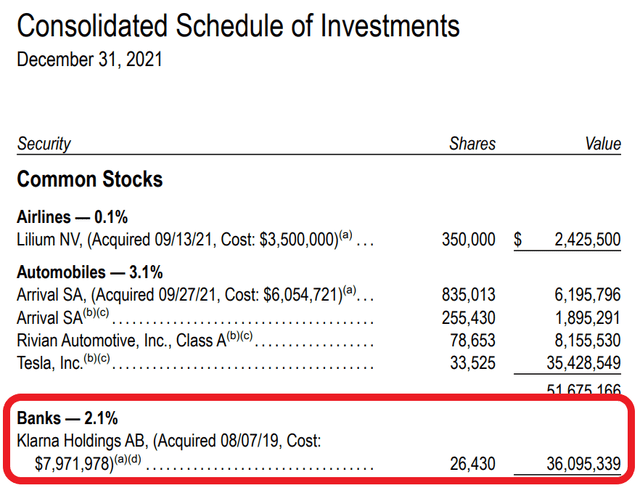

In bull markets, pre-IPO private investments can offer phenomenal returns. For example, the BST fund has an investment in Klarna, a private Swedish company that pioneered the Buy-Now-Pay-Later (“BNPL”) business model. At December 31, 2021, BST’s investment in Klarna was valued at $36 million, a 350% increase from the initial cost of $8.0 million in less than 18 months (Figure 5).

Figure 5 – BST Fund Klarna Valuation, December 31, 2021 (BST 2021 Annual Report)

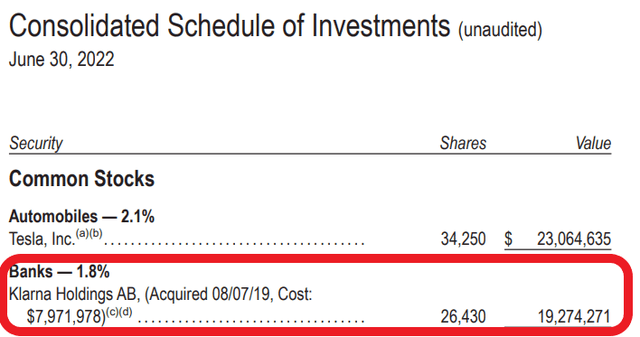

However, when markets turn south, as they have done in 2022, private investments can also be marked down dramatically. As of June 30, 2022, the same investment was marked at only $19.3 million, almost halved from the December valuation as Apple announced its own version of BNPL service (Figure 6). Klarna’s valuation is likely to have fallen further post the June semi-annual report, as it recently completed a financing round at 85% of its June 2021 valuation.

Figure 6 – BST Fund Klarna Valuation, June 30, 2022 (BST June 2022 Semi-Annual Report)

Returns

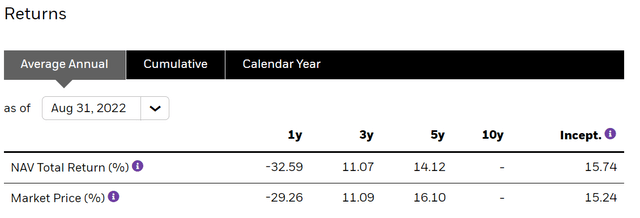

Overall, the BST fund has generated strong historical investment returns. Even including a disastrous YTD performance of -30.6% to August 31, it still has a 5-Yr average annual return of 14.1%, versus 11.7% for the S&P 500 Index in the comparable time period (Figure 7).

Figure 7 – BST Fund Returns (blackrock.com)

However, BST has underperformed the Technology Select Sector SPDR Fund (XLK), which has generated a 5-Yr average annual return of 19.5% to August.

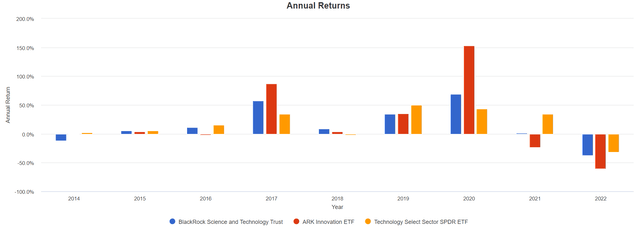

Comparing BST to ARKK and XLK

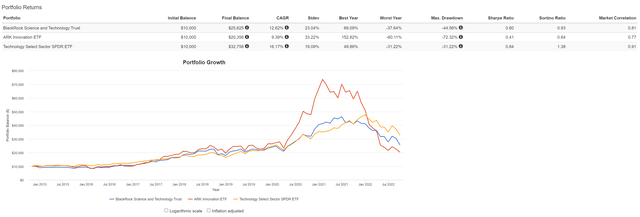

In fact, if we analyze BST’s performance against the ARKK ETF, and the XLK ETF, we can see a number of interesting observations. First, in the time period analyzed (November 2014 to September 2022), the XLK has outperformed both the BST and ARKK, with a CAGR return of 16.2% vs. 12.6% for BST and 9.4% for ARKK. XLK also has much lower risk, with volatility of 19.1% vs. 23.0% for BST and 33.2% for ARKK. XLK’s maximum drawdown is 31.2%, while BST’s maximum drawdown was 44.6% and ARKK’s maximum drawdown is 72.3% (Figure 8)

Figure 8 – BST vs. ARKK vs. XLK (Author created using Portfolio Visualizer)

What I find most interesting in the above comparison is that the fund with the highest single year return of 153% (“ARKK”), also has the lowest CAGR return. In contrast, XLK’s return was ‘only’ 44% in the year ARKK generated 153%, but it has a far higher CAGR return because it doesn’t have the 70%+ drawdown that ARKK is currently experiencing. This is like Aesop’s fable, The Tortoise and the Hare, where the tortoise ultimately wins because of it’s slow and steady advance (Figure 9).

Figure 9 – Annual Returns BST vs. ARKK vs. XLK (Author created using Portfolio Visualizer)

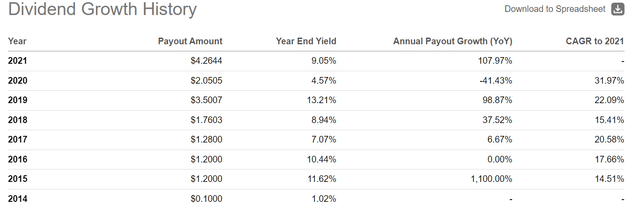

Distributions & Yield

The BST fund pays a distribution of $0.25 / month, which translates into a current yield of 10.2%. BST’s monthly distribution has grown strongly, from $0.10 in 2014 to $0.25 currently, or 14% CAGR.

Figure 9 – BST Historical Distribution (Seeking Alpha)

The fund has also periodically paid special dividends, as the fund must pay out all realized gains in each fiscal year. The most recent special dividend of $1.5584 / share was paid in 2021.

As technology companies typically do not pay dividends, BST’s distribution is funded with the writing of calls and realized gains on investments. 100% of the distributions YTD are designated as funded by net realized long-term capital gains.

Fees

Fees for BST are relatively modest, with a 1.0% management fee rate and a 1.05% gross expense ratio. For comparison, the XLK ETF has a 0.10% gross expense ratio.

Risks

The biggest risk I see with the BST fund is its heavy exposure to private investments that are illiquid and hard to value. The fund currently has ~30% exposure, as implied by its Level 3 assets. While investments in pre-IPO securities can add a lot of torque during bull markets, as companies typically go public at multiples of their private valuations, during bear markets, they can also plummet as the IPO market becomes closed off and companies are forced to raise private financing in ‘down rounds’ like Klarna did recently. Currently, the IPO market is experiencing a deep freeze, as only $4.8 billion in IPO financing has been raised in H1/2022 vs. $155 billion in 2021.

Fortunately for BST, it’s CEF structure means it has the ability to hold its private investments until the market environment improves. This is because closed-end funds do not have inflows and outflows like traditional mutual funds or ETFs. CEF shares trade on an exchange just like a regular stock. When investors want their money, they sell their shares to someone else. Since investor funds are not redeemed, there can be no forced liquidation of private and illiquid investments.

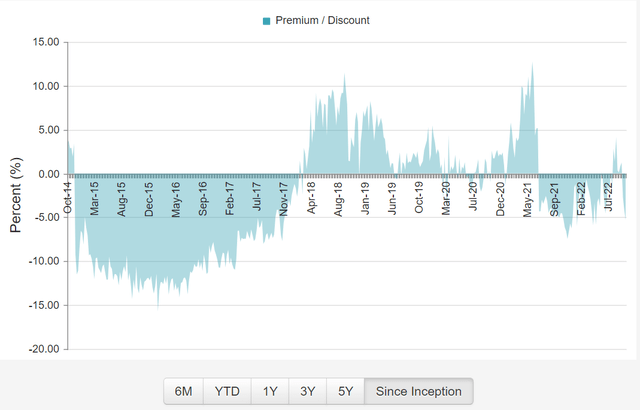

The worst that can happen to a CEF is it trades at a significant discount to the fund’s NAV. Currently, the BST fund is trading at a 5.3% discount to its NAV. In the past, the discount has reached as high as 15% (Figure 10).

Figure 10 – BST Premium and Discount to NAV (CEFconnect.com)

Conclusion

In conclusion, The BlackRock Science and Technology Trust is a technology-focused fund that offers exposure to pre-IPO investments that are typically not available to retail investors. It also pays an attractive 10.2% current yield that is funded from realized gains. During bull markets, pre-IPO investments can add significant torque to a portfolio, as companies typically go public at multiples of their private valuations. Unfortunately, the IPO market is currently in a deep freeze and private investments are being marked down aggressively. I would stay away from the BST fund until the market environment improves and the IPO market re-opens.

Be the first to comment