NoDerog

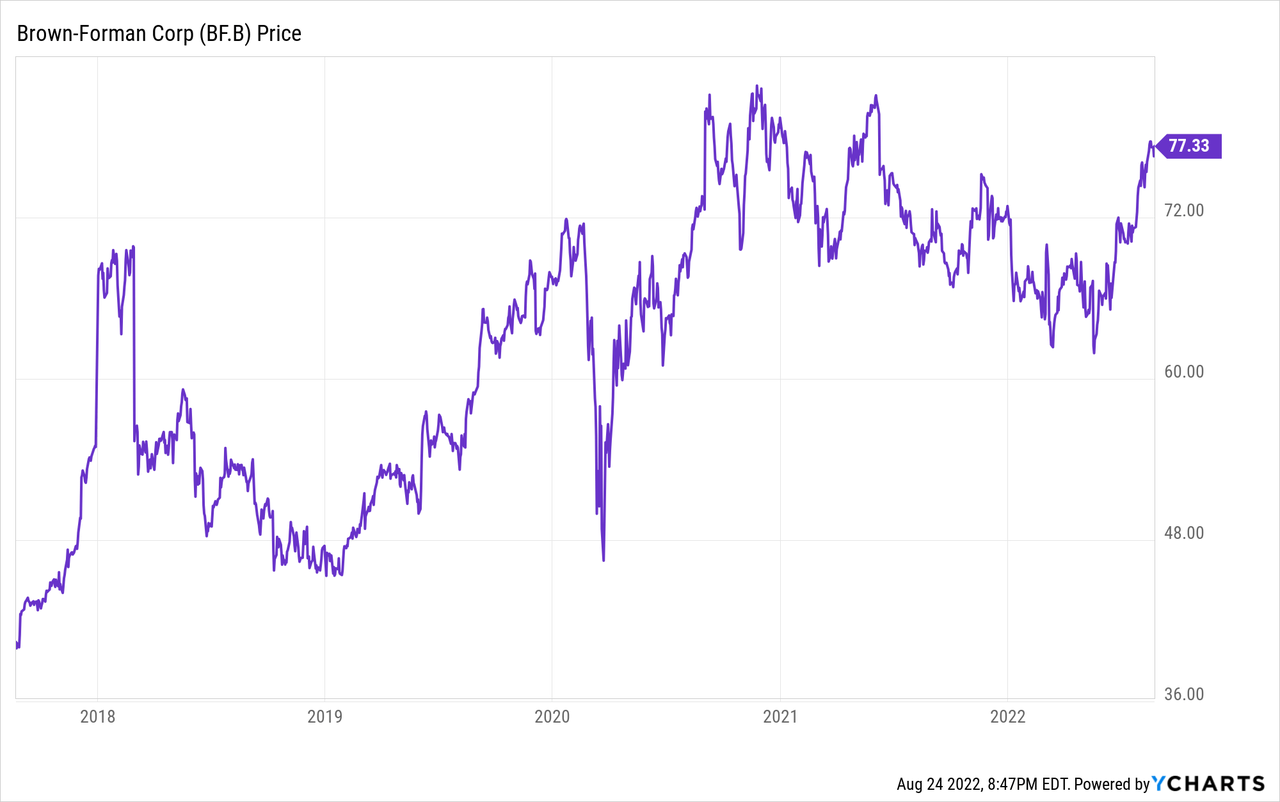

Brown-Forman (NYSE:BF.A) (NYSE:BF.B) is back. The leading whiskey and tequila producer has seen shares come roaring back this summer following a spring slump. BF stock now finds itself at 52-week highs and approaching its record high set back in late 2020:

As is often the case with this company, the rally has some folks calling BF stock overvalued and looking to sell. My first article on BF stock way back in 2016 sought to refute claims that BF shares were then overvalued and poised to underperform going forward. Since 2016, the stock has doubled as the business keeps humming along.

It’s worth updating on the long-term view. Today, I make the argument that BF stock is still at an acceptable valuation. To follow up on that, if valuation isn’t my concern, what should B-F holders be thinking about as risk factors?

Don’t Worry About Brown-Forman’s Valuation

Most articles and analysis of Brown-Forman will focus on the company’s P/E ratio. Many people say the company’s P/E ratio is too high and thus dismisses the stock out of hand.

However, this has historically been a big mistake. B-F stock traded, on occasion, above 30x earnings in 1990, 1998, 2004, and the vast majority of 2014 onward to today. Shares topped 40x earnings at one point in 2006. The company has long maintained a premium valuation ratio.

Buying in 1990, during one of those periods of high valuation, still turned out amazing: $10,000 invested in the firm at that point would be worth $390,000 today.

Even buying BF stock at a lofty 40x earnings in 2006, right before the great financial crisis, would have still turned $10,000 then into $55,000 today. If a company is the best in its field and remains so for a long period of time, seemingly excessive starting valuation takes care of itself in due time.

BF stock is near the top end of its historical valuation range today, and shares recently hit new 52-week highs. Admittedly, this isn’t the ideal time to buy the stock. But there’s hardly any need to panic about the valuation either. I bought more Brown-Forman shares this spring back when the stock was closer to 52-week lows, and I’ll buy more the next time BF shares experience a correction. The right strategy with this firm has generally been to accumulate on dips and hold tight when it is ripping.

I’d also point out that BF is underearning recently due to assorted problems from the pandemic, tariffs, and disruptions with the tequila supply chain. I believe true ongoing earnings power is close to 20% above current levels, which puts the company’s P/E and other valuation metrics near historical medians.

To be clear, I’m not arguing BF stock is a value today. Far from it. I didn’t think it was particularly cheap in May even when I was buying in the low $60s. But for a company that earns gross margins north of 75% (backing out distribution costs as its peers do), I’m content to pay a low 30s P/E ratio.

Jack Daniels is one of the world’s most iconic brands, and Brown-Forman stock is an infinite duration bond on whiskey sales with surprisingly robust growth on top of the starting free cash flow yield. BF stock perpetually looks overvalued to many folks because they underestimate how strong and persistent the company’s brands and economics truly are.

Morningstar also agrees with this take. They see Brown-Forman’s operating margins rising by as much as 500 basis points over the next five years as current headwinds subside. Morningstar’s fair value calculation pegs BF’s value at $75, or 38x current earnings. That might be a bit more aggressive than I would be; I’d prefer to buy shares under $65 at the moment. That said, when Brown-Forman so quickly and so reliably increases its fair value, overpaying by a few bucks won’t ruin the thesis.

Risks To Brown-Forman

I have little concern about Brown-Forman’s valuation. The stock is almost always “expensive” on traditional valuation metrics and yet shares have outperformed for decades despite that. High-quality businesses with huge profit margins and continued growth tend to deserve a premium multiple.

So, what could go wrong?

One possible threat is craft beverages. However, my understanding is that Brown-Forman is less at risk of this than many peers. That’s in large part because the company’s spirits have higher barriers to entry. Whiskey needs to be aged, often for many years, before becoming a valuable product.

A craft start-up on a shoestring budget doesn’t want to sit on inventory for a decade before generating any revenue. It’s much easier to go into clear spirits or beer when revenue can be generated almost immediately after launch.

Meanwhile, in tequila, there’s a different barrier to entry. Namely, that to be official product, it has to come from a certain region of Mexico. And, said input for tequila, agave, takes years to grow and has been in short supply lately. Due to a variety of local issues, bringing new agave supply online has been a slow process, and this has curtailed the ability of providers to ramp up tequila production.

Big producers, such as Brown-Forman and Becle (OTCPK:BCCLF) — which makes Jose Cuervo — are at an advantage due to their operating scale and long-running relationships with local stakeholders. Brown-Forman and other tequila players have seen dramatic margin pressure in recent years due to the agave issues. However, that’s, in my view, a better problem to have than outright overproduction as we’ve seen in other areas such as hard seltzers.

Another risk is the shift to digital advertising. I’ve heard that industries with particularly high margins are slower to adopt new marketing and distribution options since the old method works so well. When you’re making 60+ cents of margin every dollar of liquor you sell, what’s the rush to upset the apple cart? My understanding, however, is that spirits companies including Brown-Forman could be doing a lot more with new branding and marketing tactics. Potentially this could leave an opening for newer more nimble brands to come into the market.

An additional risk comes in acquisitions and management decisions. Alcohol companies typically spend little on R&D. But, instead, they often acquire upstart brands as a form of quasi-R&D to get new market opportunities, celebrities, or product formats on board. Brown-Forman has historically been highly disciplined in its M&A unlike, say, Diageo (DEO) which has been known to splash its cash around. However, a bad deal could always throw things off for the company.

Related to that, Brown-Forman usually gets the highest valuation in the industry since it is the best-run and highest-margin operator in its category. That’s great for long-term holders, of course. However, any slippage in results could lead to valuation compression. Diageo, itself a great but not quite Brown-Forman class business, fell to under 20x earnings in the mid-2010s following a couple of questionable acquisitions and management decisions. Any change in Brown-Forman’s strategic plan would require close monitoring as the starting valuation gives less room for error.

Finally, there is a possible though hard to quantify risk from recreational cannabis. Some studies have shown no impact from cannabis legalization on alcohol sales, other studies have shown drops ranging into the low double digits. Marijuana won’t be legalized everywhere (particularly outside the U.S. and remember Brown-Forman has a large emerging market business). But, there’s some risk here of a slowdown in spirits growth from the new leisure competitor.

Share Class Details: A-Class Shares Are Preferable Today

It’s worth checking in on the price differential between the two classes of outstanding Brown-Forman stock.

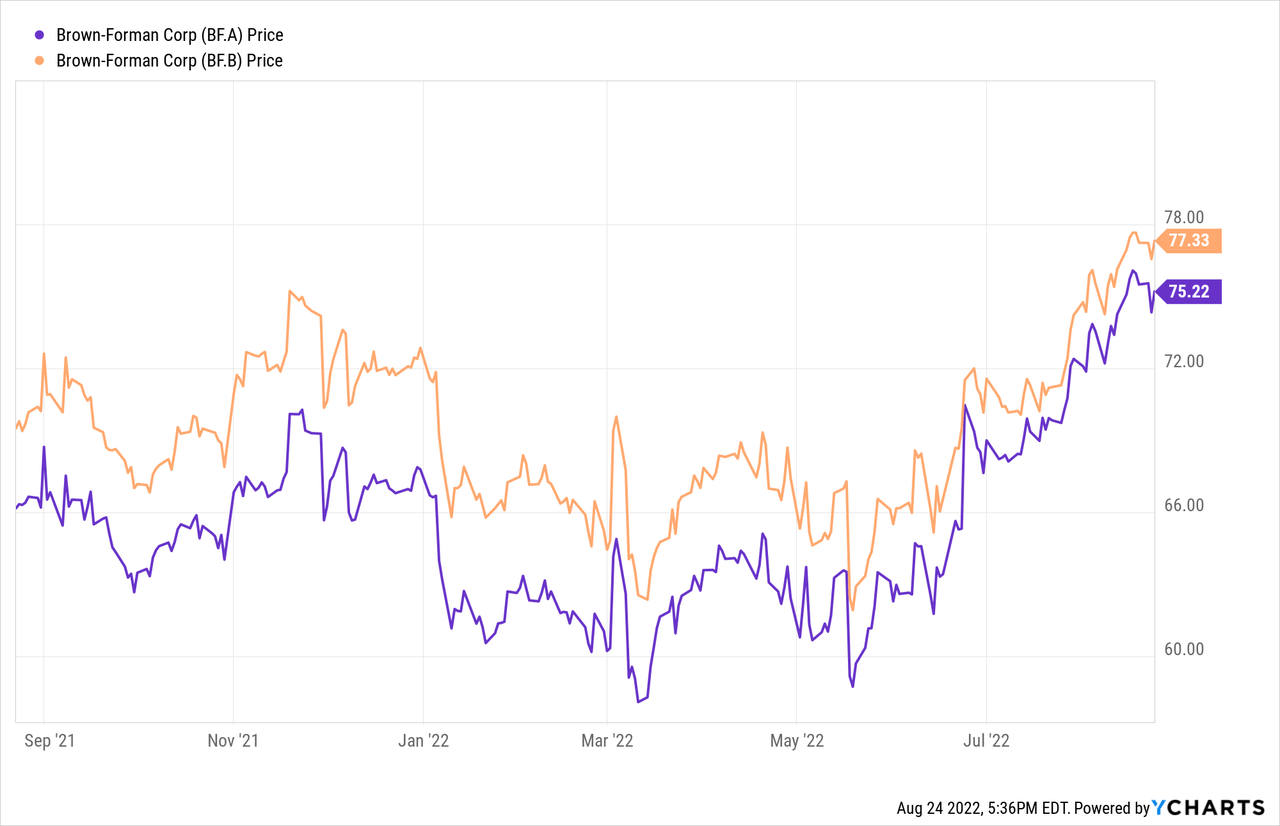

There are the A shares, shown in purple below, along with the B shares which are shown in orange:

As of August 24, the B shares are trading at a $2, or roughly 3% premium, to the A shares.

This is a counterintuitive result. After all, the only difference between the A shares and the B shares is that A class shares have voting rights whereas the B shares do not. The shares are otherwise the same including paying out equivalent dividends. Thus, a Brown-Forman share with a voting right should be worth more than one without voting privileges, since all else is equal. Instead, the voting shares are currently at a $2 per share discount.

What’s causing this disparity? It’s due to liquidity. The B shares are far more widely traded and are generally the shares included in index funds and ETFs. Meanwhile, the A shares are closely held with insiders controlling a big chunk of them. The market is willing to pay a premium for the liquidity of the B shares. For long-term investors, however, the A shares offer a better value, giving more ownership in Brown-Forman, plus voting rights, with the only tradeoff being lower trading volume.

Historically, the A shares have sometimes traded at a premium to the B shares, such as when it was rumored that Constellation (STZ) might bid for Brown-Forman a few years ago. While there are no guarantees, I wouldn’t be surprised if the A shares swing to a premium again at some point in the future. That being the case, for owners of the B shares, there is a strong case for considering potentially swapping them to A shares unless the tax liabilities associated with that would outweigh other gains.

Brown-Forman’s Bottom Line

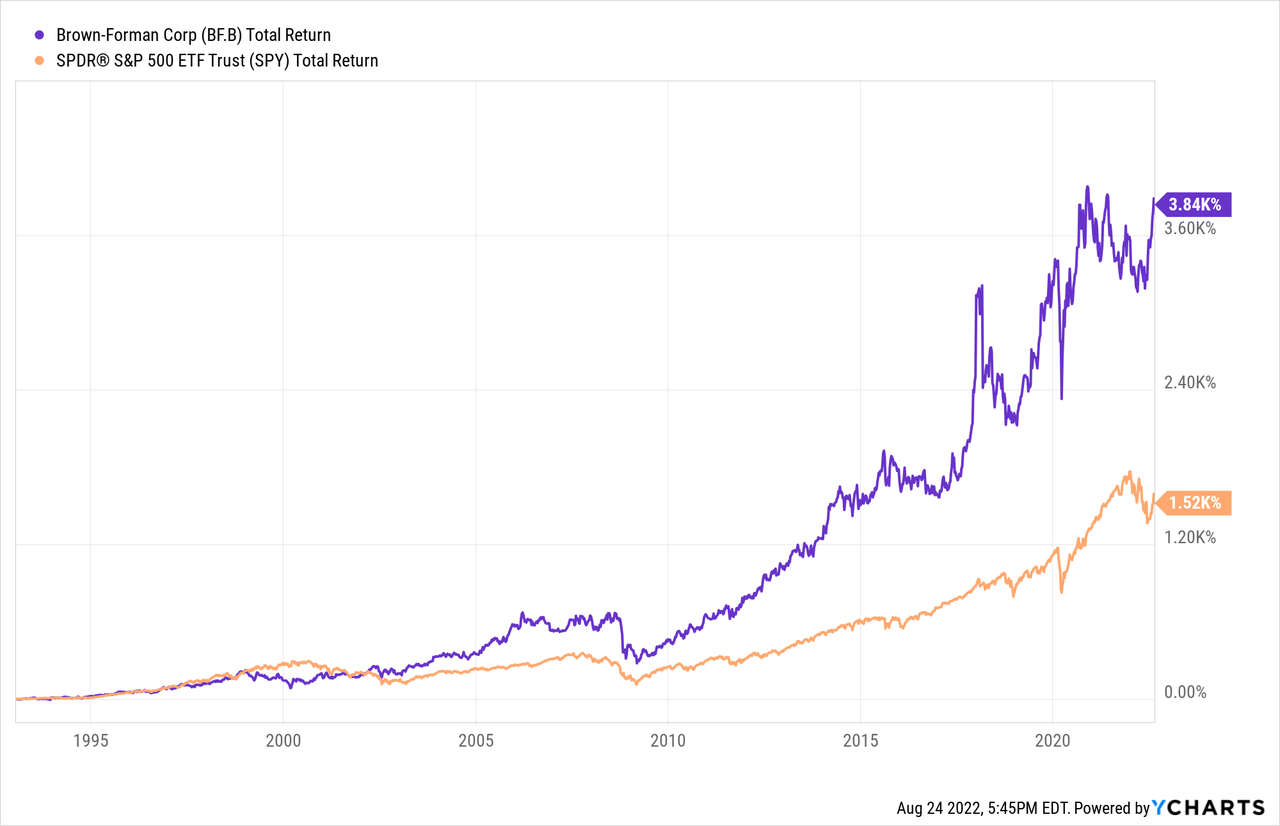

For long-term investors, there’s rarely if ever been a good time to sell BF shares. The stock has been one of the most consistent long-term performers in the S&P 500:

Over the decades, B-F stock has more than doubled the total return of the S&P 500, and with less volatility along the way.

Brown-Forman is the rare defensive recession-proof stock that can still produce much better returns than the index as a whole. As such, I buy more BF shares every time the stock is available at 52-week lows. And I never sell them even when it rallies. This probably isn’t the most opportune time to add to a Brown-Forman position, but don’t let the valuation fears scare you out of holding this amazing company.

Be the first to comment