YinYang

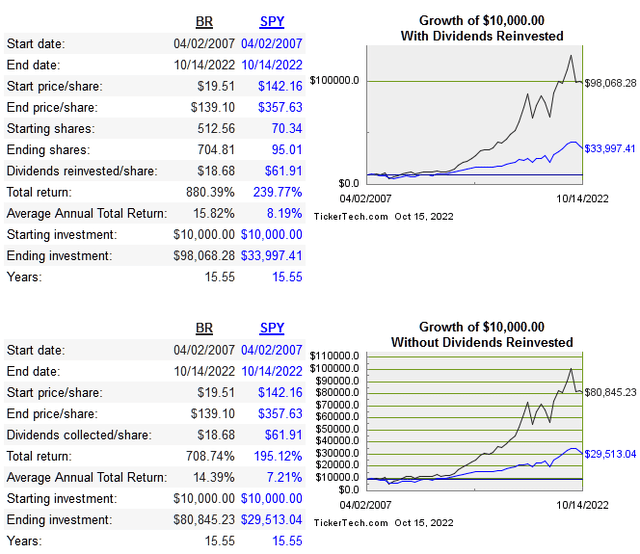

Broadridge Financial Solutions (NYSE:BR) began as the brokerage division of Automatic Data Processing, Inc. (ADP) back in the 1960s, and was spun out as an independent company in 2007. Their two segments are Investor Communication Solutions and Global Technology and Operations with the former bringing in 75% of revenue. The core business facilitates proxy voting for millions of shareholders worldwide. The share price since IPO is below:

The return on capital metrics are below:

|

Company |

Revenue 10-Year CAGR |

Median 10-Year ROE |

Median 10-Year ROIC |

EPS 10-Year CAGR |

FCF 10-Year CAGR |

|

BR |

9.5% |

31.5% |

16.2% |

16.7% |

4.5% |

|

8.1% |

51.9% |

49.3% |

12% |

7.9% |

|

|

9.4% |

7.1% |

3.9% |

-7.9% |

15.7% |

|

|

14.2% |

20.2% |

9.7% |

2% |

14.3% |

|

|

29.8% |

9.6% |

4.2% |

25.2% |

29.5% |

Capital Allocation

BR is a serial acquirer, having purchased over 40 companies along the way, with their biggest being the purchase of Itiviti in 2021 for $2.1 billion USD. There hasn’t been enough time to see if this acquisition paid off, so it will be worth monitoring.

Below we look at how much FCF is generated and how it is used.

|

Year |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

20222 |

|

FCF |

238 |

220 |

334 |

365 |

362 |

312 |

556 |

544 |

500 |

539 |

370 |

|

Dividends Paid |

78 |

86 |

97 |

122 |

138 |

152 |

166 |

211 |

241 |

262 |

291 |

|

Shares Repurchased |

52 |

239 |

130 |

302 |

120 |

343 |

277 |

398 |

69 |

22 |

23 |

|

Net Acquisitions |

72 |

0 |

91 |

210 |

58 |

455 |

108 |

355 |

339 |

2,604 |

13 |

They use a fairly balanced approach as you can see, continually acquiring companies and paying an increasing dividend. The dividend has been raised consecutively for 15 years. Buybacks ranking lower as a preference, especially the past few years. As always, I prefer a sustained repurchase strategy that reduces share count when free cash is stable and returns on incremental capital aren’t worth reinvestment. As for track record, it’s hard to argue that capital allocation has been poor given the long-term stock performance.

Risk

The returns on capital have been declining lately and their moat might be possibly eroding. So the biggest risk is actually mean reversion of the returns on capital. This is exactly the type of scenario I try to avoid, looking at a company with very good returns in the past and starting a position at the moment that mean reversion really kicks in.

Long term debt has more than doubled since 2020, currently at $4 billion USD while revenue is only $5.7 billion. So long as this rate of debt doesn’t increase, it won’t provide a drag but there could definitely be a lower rate of dividend increase to divert into debt repayment. BR did aggressively pay down debt in 2020 and 2021, and can do it again in the future. I don’t like the debt levels but right now it’s not a big risk considering the strong and consistent cash flows along with revenue still growing at almost double digits. .

Valuation

Shares are currently down 24% from their peak last year, which is much better than many bigger names that were the high flyers in 2021. I wouldn’t consider it a discount. Below is a comparison of price multiples:

|

Company |

EV/Sales |

EV/EBITDA |

EV/FCF |

P/B |

Div Yield |

|

BR |

4.5 |

23.7 |

70 |

11.7 |

2% |

|

SMCYY |

3.7 |

13.2 |

26.2 |

6.7 |

1.7% |

|

FIS |

3.8 |

10 |

12.2 |

1 |

2.4% |

|

FISV |

4.7 |

13.6 |

33.1 |

1.9 |

n/a |

|

SSNC |

3.6 |

10.1 |

15 |

2 |

1.7% |

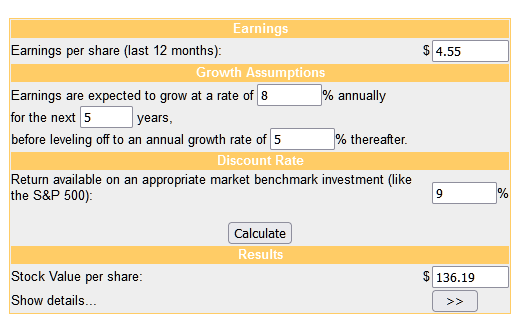

I do consider EV/FCF to be the most important of all these multiples. This is essentially what the acquirer of this entire business would get back in free cash flow if purchased wholly today. While I do like the consistent FCF the company has generated long term, it doesn’t deserve a premium like this relative to competitors. Below is the dcf model:

money chimp

This business is what I would consider to be a very good business, but just on the cusp of being a legitimate high-quality company. At current prices, I can’t see a high probability of the fundamentals plus the multiple growing enough to outperform.

Conclusion

Since becoming an independent company in 2007, BR has clearly been a very good company which is reflected in the long-term share performance. The biggest issue now is whether future returns will trend downward from here. In general, I like the use of capital and think growth will continue but at slower rates.

For this level of quality, I don’t like the valuation right now given the risk of mean reversion giving current investors average returns from the future starting right now. This isn’t the same as long time shareholders who are considering selling, in which case it depends on the cost basis but BR is not egregiously overvalued right now. It’s simply not cheap enough to warrant future growth and returns on capital at high enough rates.

Be the first to comment