mycan/iStock via Getty Images

Investment Thesis

In our first report dated 12th October 2021, we concluded that Broadmark (NYSE:BRMK) did not deserve a buy rating at USD 10.02 per share, but if the share price falls below asset value, it might represent a good entry point. Now, after a 49% share price correction at USD 5.11, we are revisiting BRMK, factoring in a recessionary scenario to check whether it presents a good entry point.

BRMK seems extremely attractive because of its book value, but we believe it is not reason enough to invest. Although we like the equity story, we believe BRMK will not be able to efficiently deploy its capital in the current macroeconomic scenario. Since those assets will not be able to generate any cashflows, the discount to book value might be justified, and it will not deserve a buy rating for the time being.

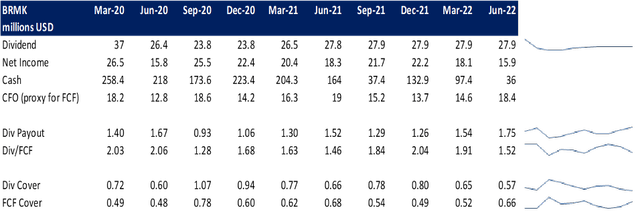

Dividend Policy Sustainability

Our analysis of BRMK’s dividend policy shows that it is unsustainable, and a dividend cut is on the cards.

As shown in the below table, dividend payout is consistently above one in the previous ten quarters, with dividend over FCF being even more than two on some occasions.

In the first half of 2022, they have already paid $0.42 per share of dividends, which is 31.25% higher than their distributable income per share of $0.32.

So, because of the slower loan book growth (which we expect to further slow down due to macro factors and coverage ratios consistently lower than one), we think it’s just a matter of time to see a consistent dividend cut.

Asset Value

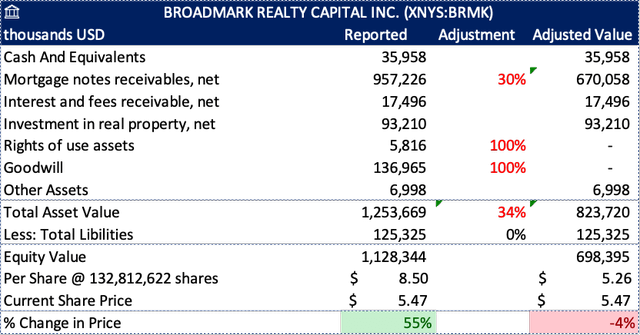

Using the asset valuation model, we have calculated the value of Broadmark’s assets after some adjustments.

We wanted to assess where BRMK stands in asset value without any type of intangible assets so for this purpose we have deducted the goodwill in full. We have also deducted rights of use assets since they relate to leases and being conservative, we only wanted to assess the value of owned assets.

Looking at the macroeconomic picture we believe a short-term recession is on the cards. To account for this we made an adjustment to Mortgage Notes Receivables reducing them by 30%.

The table below shows such adjustments. It gives us a valuation of $5.26 which is just 3.9% lower than the current market value of $5.47.

Using the asset valuation model, we have calculated the value of Broadmark’s assets after some adjustments.

We wanted to assess where BRMK stands in asset value without any Intangible assets, so we have deducted the goodwill in full for this purpose. We have also deducted rights of use assets since they relate to leases, and being conservative, we only wanted to assess the value of owned assets.

Looking at the macroeconomic picture, we believe a short-term recession is on the cards. To account for this, we adjusted Mortgage Notes Receivables, reducing them by 30%.

The table below shows such adjustments. It gives us a valuation of $5.26, which is just 3.9% lower than the current market value of $5.47.

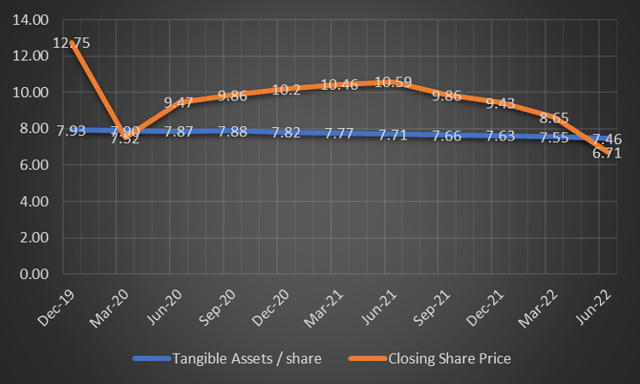

The table below shows how BRMK’s share prices have fared against the tangible book value per share at the closing dates of the previous ten quarters. We can see that tangible book values have provided a positive spread for the share price. Still, on the last earnings call, Management provided an update on their strategy in the current environment. “One part of the strategy shift will be that there could be times when we determined that exiting a loan in default or foreclosed property with a principal loss and reinvesting that capital into income-producing loans is the most favorable outcome. Ultimately, the goal is to generate strong cash flows and earnings, so we will utilize this strategy as we work to maximize performance.” stated the company.

Another strategy shift comes from their initiation of Mezzanine loans, which are inherently riskier than the ones Broadmark was previously deploying. As we already explained that they would have difficulty in efficiently deploying their capital, so to compensate for this, BRMK is now turning its attention to the riskier class of loans.

With management hinting at their willingness to take a loss on principal value and their initiation of mezzanine loans, no one knows what will be in the future the magnitude of such adjustments. Still, the market is now discounting the loan book by 30%, as observed in the asset value section. So, a discount on current book values is not very surprising, and this positive historical spread between tangible book values and market prices seems rightly not holding.

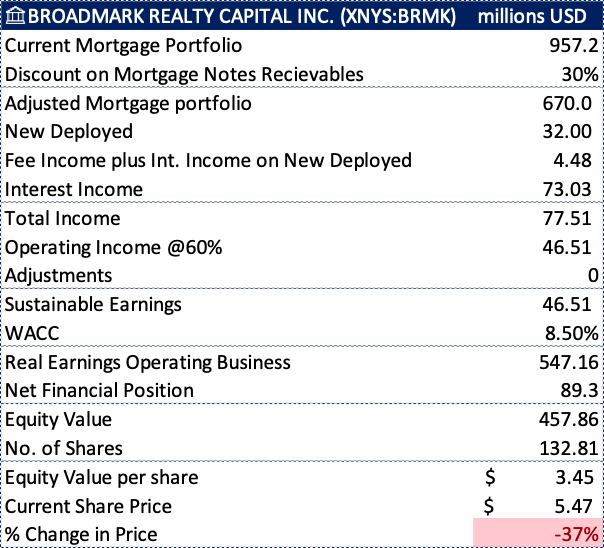

Real Earnings Model

We have calculated the real earnings using the stress factor of 30% to our mortgage loans portfolio.

We have assumed that there will be $32m new deployed mortgages at which BRMK charges an upfront fee plus interest payments which we are assuming to be 14%.

On the remaining portfolio we are assuming BRMK to earn an interest of 10.9% giving us the total Annual Income of $77.51m.

With the expected increase in foreclosed assets and with slowing real estate market BRMK will incur additional costs in managing these properties squeezing margins. Adjusting for these, we are assuming a 60% operating margin.

Using a WACC of 8.5% and adjusting for Net Financial Position we get the real earnings per share of $3.45.

In companies like BRMK, asset value is mostly higher than earnings value because of the inherent efficiency problems like the inability to have all capital deployed at the same time.

Moat Investing

Scenario Analysis

We have performed a scenario analysis on the main value driver affecting our valuation, i.e., Adjustment to mortgage notes receivables.

The table below helps us understand how BRMK’s asset value per share and real earnings per share perform under different stress scenarios.

Conclusion

Even with all the adjustments, the asset value is just below the share price. Still, BRMK will not be able to efficiently allocate its capital in the current high-interest rate macroeconomic environment, which has made the mortgages expensive. Since these assets will not be able to produce cashflows, the discount to the present book values is justified.

We believe the discount to book values will further surge since they initiate mezzanine loans, and riskier future cashflows are not fully priced in the market.

Dividend Policy needs to be changed to make them more sustainable; a dividend cut is on the cards in my opinion.

Therefore, we will still give a hold rating and wait for the catalyst in the form of a dividend cut or improvement in the market for construction loans before reconsidering our position.

Be the first to comment