PhonlamaiPhoto/iStock via Getty Images

Introduction

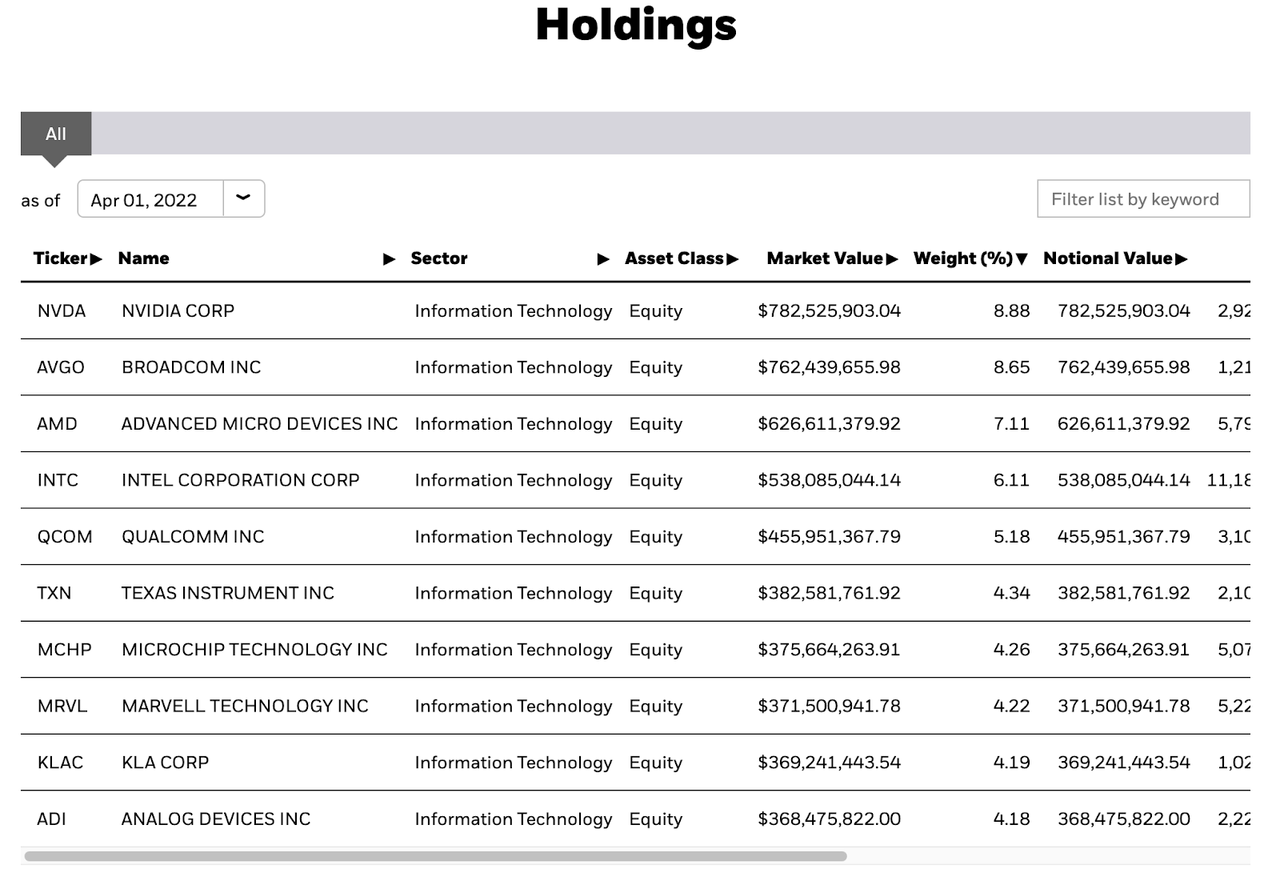

On Seeking Alpha and on my Social Media channels, I focus very heavily on U.S. and China technology names that have significant press coverage. One company that is relatively low profile but holds significant importance in the health of the technology rebound is Broadcom (NASDAQ:AVGO). I believe that any durable rally in the Nasdaq (QQQ) must be accompanied by strength in semiconductors. And inside the semiconductor ETF SOXX, Broadcom is the 2nd largest component.

In this article, I will discuss why I believe Broadcom’s outlook continues to be positive, and what their latest fundamental updates mean for the semiconductor industry and the technology rebound we are currently witnessing.

Quick Introduction of Broadcom and High-Level Investment Context

In one sentence to describe Broadcom, the company is essentially a conglomerate in the semiconductor industry, providing support in data centers, wireless infrastructure, broadband, and networking services. A sample list of its largest customers include Apple, HP, IBM, FB, GOOG, and Cisco where Broadcom provides custom data center services that often have few choices for substitutes.

In the Q1 2022 technology selloff, Broadcom’s shares fell significantly along with other semiconductor names and stocks in the growth theme.

In today’s market, where there are many names that have very rich valuations or have business models that are susceptible to high inflation and weak consumer confidence, Broadcom is one of the few companies within the S&P 500 that offer significant diversification in its business model while being relatively insulated from the inflationary narratives that the markets are currently facing.

On top of its strong growth profile, Broadcom also offers investors a yield of 2.6%, which gives it the rare title of being a growth compounder and a dividend growth stock as well.

Broadcom’s Latest Fundamental Outlook

Due to tight supply chain dynamics (due to the zero covid policy in China), Broadcom’s semiconductor backlog grew 14% quarter over quarter and the company guided Q2 2022 revenues of $7.9 billion above consensus of $7.42 billion on strong semiconductor growth and stable infrastructure software.

In terms of its 2023 outlook, the company sees a positive growth outlook with strong order and backlog visibility of $25 billion (which is up 14% quarter over quarter and 119% year over year), given that enterprise spending is still strong in cloud and broadband.

This results in the company forecasting to generate approximately mid 20% revenue growth throughout 2022. Seeing 30% growth year over year, its networking business continues to see strong demand in its products (Tomahawk 4 / Jericho 2). In addition, the company’s ASIC chip business to Google, Facebook, and Microsoft continues to be very robust and the FAAMG companies’ continued commitment to enterprise spending is a tailwind for Broadcom. The company’s infrastructure software revenue of $1.8B was up 5% year over year driven by strong recurring revenue and high renewal rates. This is demonstrated through a higher gross margin of 75.5% that is above consensus along with EPS of $8.39 beating consensus of $8.13

CEO Hock Tan continues to remain modest in his industry forecast and cooled down expectations for a change in long-term industry growth rates despite the growing use cases of silicon to be used across a variety of end markets. He and the management team reiterated support for shareholder returns and repurchased $2.7 billion of shares.

Latest Industry Trends and Commentary in Semiconductors

The WSTS semiconductor industry data was recently published for February 2022. We witnessed February industry sales accelerate to nearly 48% year over year (~25% if you exclude memory). The report notes strong industry pricing (35% year over year) driven by strong end market demand coupled with tight supply dynamics. The report is consistent with Micron’s latest quarterly outlook where the company discussed strong demand and pricing in their DRAM and NAND markets.

More specifically, here are a couple of additional data points from the WSTS report:

-

Month over month, February sales increased 23%

-

Year over year, there was stronger pricing at 35%

-

Unit shipments were down 2% month over month but up 11% year over year

This industry data supports the narrative that demand continues to be strong while the supply chain issues are problems that will still take more time to resolve itself.

Broadcom Is An Exceptionally Important Component inside SOXX and Nasdaq 100

Broadcom doesn’t get as much media press cover as the traditional newsletter stocks, but it would be wise to place this name in your watchlist because it is a bellwether for the semiconductor industry. Historically speaking, any durable rebound in the technology sector is usually led by Chips. I specifically focus on the health of AMD, NVDA, AMAT, LRCX, MU, and AVGO to understand broader sector trends.

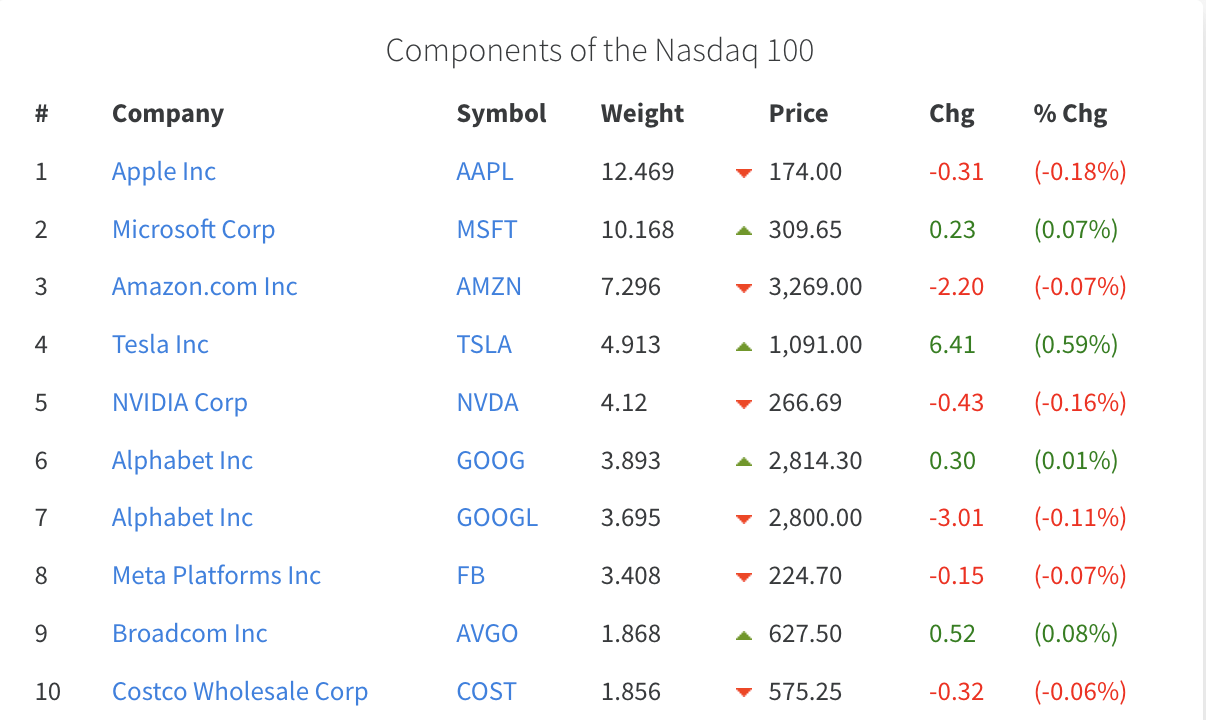

Broadcom is #9 inside the Nasdaq 100 and #2 inside the Semiconductor SOXX ETF. In other words, a positive fundamental outlook in Broadcom adds to the credibility of the tech rebound that we have been seeing. While I am a fan of Tesla (retail’s hottest stock which I regrettably do not own), hot retail stocks like Tesla cannot drive a durable rebound inside the Nasdaq.

I view Broadcom’s business model with its B2B end markets as much more representative of enterprise spending and gives us clues on the R&D appetites of mega cap names like AAPL, FB, GOOG, and MSFT. Weakness in Broadcom’s outlook portends weaker confidence in enterprise spending, which is a significant portion of business activity inside Nasdaq-listed companies.

Slickcharts

iShares

On Fed Rate Hike, Valuation, Recession Concerns

Broadcom’s valuation has never been inexpensive in the market given its market leadership position. While there are many ways to value the company, I almost always use simpler metrics like earnings or sales multiples.

On a sales multiple, Broadcom trades at roughly 9.4X sales. On the surface, that seems expensive given the hawkish environment we’re in. In comparison to other high-valuation stocks like ZM (9.2X) or PINS (7.3X) as examples, Broadcom’s valuation is not considered to be expensive given their market-leading position along with their strong end market demand dynamics.

I believe we are in an environment where choosing market leaders with exceptionally strong business models will lead to better risk-adjusted returns. Given where we are in the economic cycle with the yield curve having flattened and inflation causing the Fed to be more hawkish, Broadcom fits the type of profile of companies that tech investors should be studying and placing on their watchlist given its strong fundamental profile (if they don’t already have a position).

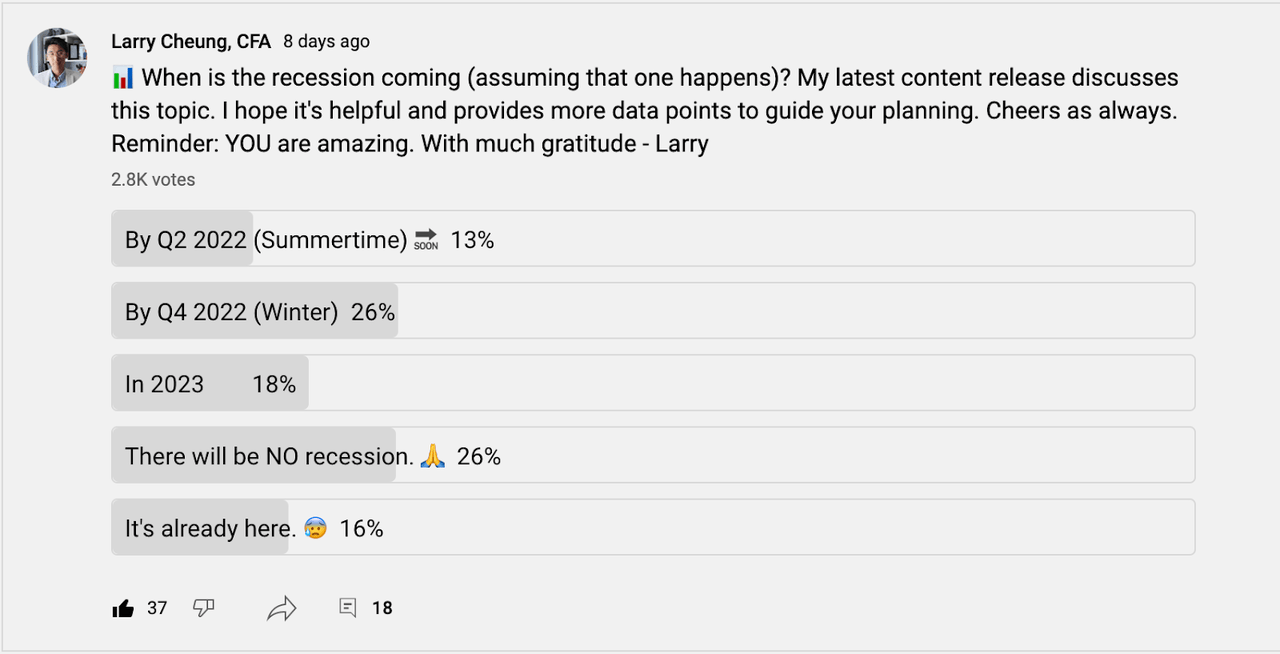

I recently ran a poll on my YouTube Channel’s Community Tab. Out of 2.8K retail investors, only 26% believe there will be no recession. Added with the economic data (PMI, Consumer Confidence, Yield Curve Inversion) publicly available, the retail market has essentially convinced itself that a recession is inevitable. For this reason, it is especially important to position in names that have durable, diversified business models and strong industry outlooks.

Youtube (@LarryCheungCFA)

I have only a very small position in Broadcom, and will look to slowly and strategically purchase more Broadcom shares in the event of any further market dislocation.

Impressively enough, AVGO never even breached its 200-Day Moving Average during the Q1 2022 technology sell off. Its 50-Day Moving average sits in the 590-600/share price range. I’ll most likely modestly add to my positions should AVGO approach those levels.

Trading View

Risks to consider and concluding thoughts

Broadcom’s CEO Hock Tan reiterated that market participants should not be too quick to fundamentally re-rate the industry growth rate’s CAGR materially higher given that the semiconductor industry is potentially near a cyclical peak along with signs of maturity in several end markets.

As the supply chain shortage starts to resolve itself, Broadcom and other semiconductor companies need to manage their inventories and lead times with great execution or they risk distorting the supply/demand dynamic which could impact future pricing.

From a company-specific perspective, Broadcom is less affected by the usual cyclical themes inherent in the semiconductor industry like Micron with memory prices as an example. Broadcom’s reach into segments such as broadband, data centers, networking, and wireless essentially make it a proxy market-wide for enterprise spending. Watching for a weaker appetite in enterprise spending and R&D investment levels will help investors understand Broadcom’s outlook.

Broadcom’s combined growth profile, diversified business model, and dividend growth outlook make a strong case for investors who are looking for growth companies with the right attributes in today’s investment environment.

Be the first to comment