Sundry Photography

There are two impressive pieces to Broadcom’s (NASDAQ:NASDAQ:AVGO) success: The ability to grow semiconductor revenue at extraordinarily high growth rates in this environment and its continued consistency in free cash flow as a percent of revenue. The confidence in the upcoming quarter was reassuring, while other semiconductor companies slash their guides precipitously. Earnings reinforced my conviction of Broadcom being one of my strongest portfolio holdings, and so I’ve determined a price point where I would add.

It’s not hard to see semiconductors suffering due to macroeconomic forces. Look no further than Nvidia (NVDA), Micron (MU), Western Digital (WDC), and Intel (INTC) and their weak reports and guides for the current quarter. It’s been nothing less than awful in terms of the level of disappointment. But then you have companies like Texas Instruments (TXN) and Broadcom, which continue to see strength in their sectors, and you’re drawn in for a closer look.

Let me start with the cash flow strength.

Cash Flow Freely Flowing

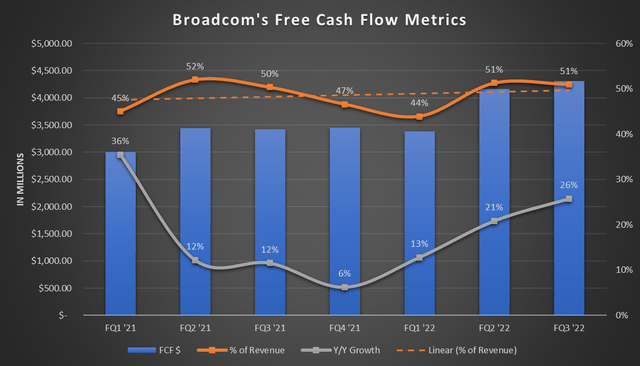

Free cash flow has been a dominant aspect of Broadcom’s financials. Its ability to efficiently use capital has never been more evident than its growing FCF each quarter over the last year. This is where the robust dividend comes from, along with its ability to churn out M&A almost regularly.

Chart mine, data from Broadcom’s earnings press releases

The chart above shows a clear upward trend for FCF as a percent of revenue (orange dashed line). This stable and improving trend proves Broadcom’s efficient use of cash and very low capex. And after slowing toward the end of last fiscal year, the year-over-year growth of FCF has picked up handsomely. Compare it to revenue growth of 24.9% and 22.6% in the previous two quarters, and the margin expansion becomes clear.

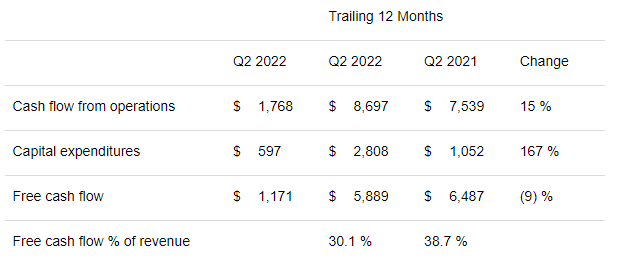

FQ4 free cash flow will continue to grow as long as the company hits its guidance. I estimate it will produce $4.5B in free cash flow during the current quarter, growing 27% year-over-year. This is very strong growth, while peers aren’t expecting to see this kind of strength themselves. Even Texas Instruments, which showed a strong quarter and guide, is still seeing weaker trends in free cash flow as a percent of revenue due to higher CapEx needs. However, even cash flow from operations (which does not include CapEx) of 15% growth compares to Broadcom’s 25% growth.

Texas Instrument’s FQ2 ’22 Press Release

Management’s policy is to return 50% of last year’s FCF in the form of a dividend. Since the dividend is tied to the prior year’s FCF, it’s easy to see the dividend growth in advance. Therefore, you can peg the dividend growth to the FCF growth with realistic accuracy, acting as another catalyst for the stock. All in all, management’s approach to free cash flow through its lean capex business and capital return program put it high on the attractive list.

Growing Semiconductor Revenue

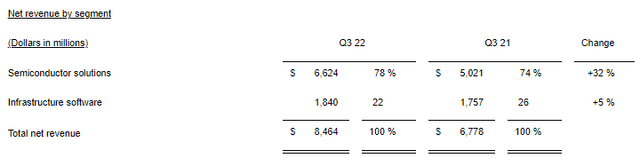

You wouldn’t know it by looking at Broadcom’s semiconductor division, but there has been weakness in the semiconductor space. AVGO’s FQ2 report showed 32% growth in the semiconductor division, while its infrastructure software division grew 5%.

Broadcom’s FQ2 ’22 Earnings Release

And the company expects the semiconductor business to be strong in the upcoming quarter, as noted by the CEO’s statement in the earnings release.

We expect solid demand across our end markets to continue in the fourth quarter, reflecting continued investment by our customers of next generation technologies in data centers, broadband, and wireless.

– Hock Tan, CEO, Q3 Earnings Report

I’ll be conservative and say semiconductor solutions will grow 23.3%, making up 78% of overall revenue, the same as FQ3, with software growing 6% instead of 5% in the reported quarter. This is based on the $8.9B guidance. Any beat of $8.9B only increases semiconductor growth in the current quarter. Even a $50M beat means semiconductor revenue growth will jump to 24%.

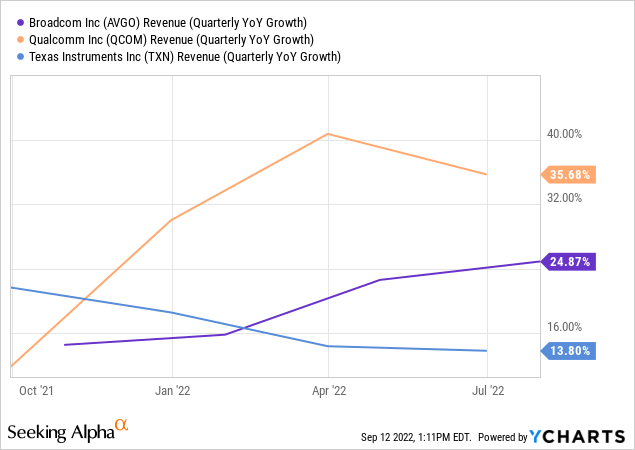

This is obviously a slowdown from FQ3’s 32%, but to remain strong in a mid-20s growth rate is fantastic in this tough environment. Compared to TXN and Qualcomm (QCOM), Broadcom shows up in the middle of both in revenue growth over the last year, but QCOM missed consensus for guidance for the current quarter.

Texas Instruments expects 6%-14% growth for its current quarter, while Qualcomm expects growth of 18%-27%. Meanwhile, Broadcom expects 20% revenue growth from its guide of $8.9B. Broadcom’s peers expect a more material slowdown than it based on their guidance midpoints.

Broadcom’s business strength has generated impressive, but not surprising, financial returns. The question is, where would I buy more? It comes down to the valuation.

Best Levels To Buy It At A Value

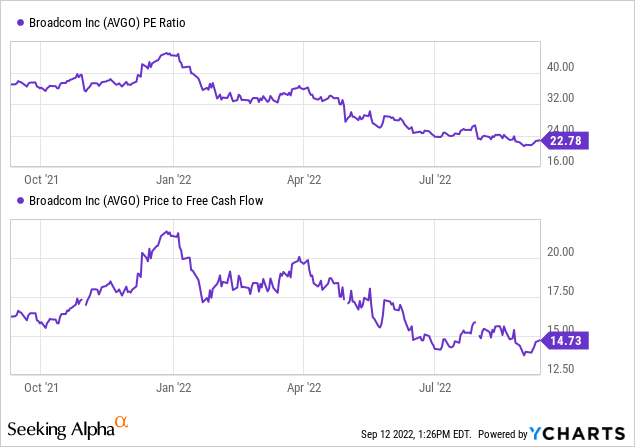

When I bought Broadcom in 2019 at $273, the trailing P/E ratio was ~18.3. Its price-to-free cash flow was 13.2 at the time. Today, the P/E ratio and P/FCF are not far off from those levels.

If I were to buy exactly at 18.3 or 13.2 ratios, respectively, the stock price would be about $458 – about 13% lower from Monday’s trading. And I’m willing to compare my 2019 purchase to today due to the differences in growth. In 2019, revenue growth had slowed to single digits, while today’s market is factoring in 20%-30% growth with near similar valuations. I also was buying on an intermediate upswing in the stock, different than today, where it has been moving in a relatively volatile fashion.

I wouldn’t scoff at a position in AVGO if I weren’t already nicely weighted toward it. I may add it to some of my retirement accounts as the dividend is still plentiful, yielding around 3.3% and growing nicely each year. And, with this year’s dividend growth expected to be more than the last due to the accelerating year-over-year growth in free cash flow, it continues to be enticing.

Strength In Troubling Times

When one thinks semiconductor, one thinks of volatile end-markets and cyclical upheavals. But when you look at Broadcom, which serves mostly the enterprise, industrial, and infrastructure sectors, you realize there’s far less business volatility. Now, it’s understood Broadcom is only 78% semiconductor-focused, but the growth is undeniable within the division.

What’s often overlooked is the company’s 71% gross margin on its semiconductors. Regardless of having a 22% software infrastructure division, its leading division is as strong as any in the business and arguably one of the best. With its valuation being at relative lows, the stock, except for moments of volatile excursions higher, trades at a nominal average for most of the last few years.

Taking a sober look at the valuation, the VMware (VMW) acquisition is weighing a bit on the company as it takes on additional debt and finishes the deal with the dilution of shares. This is likely why it trades at what otherwise appears to be a fair valuation. However, Hock Tan has done transformative things in the business to assimilate his prior acquisitions. As a result, once the deal closes, the stock should start trading higher as it adds 37% more revenue at an 82% gross margin to its top line.

And if you’re concerned about the semiconductor business weighting up until then, the company is clearing any bars set in its way. So it only gets better moving forward for Broadcom, even with a teetering economy weighing on broader semiconductors.

Be the first to comment