gerenme/iStock via Getty Images

Stocks are a great way for patient and savvy investors to accumulate great amounts of wealth over time. In other words, the stock market is one of the world’s greatest vehicles for the transfer of wealth from those with a short-term horizon to those with a long-term mindset (i.e., time arbitrage).

This brings me to Brixmor Property Group (NYSE:BRX), which again has traded down due to general concerns around the economy and rising rates. This article highlights what makes the current down pricing a good opportunity to layer into this shopping center name, so let’s get started.

Why BRX?

Brixmor Property is one of the largest shopping center REITs in the U.S., owning and operating a high-quality portfolio of 379 retail centers covering 67 million square feet. Its properties are well-located and spread throughout 118 metropolitan statistical areas, and are diversified across over 5,000 national, regional, and local tenants.

Unlike shopping malls, which have suffered from plenty of headline risk in recent years, BRX’s open-air shopping centers are centered around thriving communities and are essential in nature. This is reflected by the fact that its centers are primarily anchored by e-commerce resistant discount retailers and top grocers such as TJ Maxx (TJX), Kroger (KR), Dollar Tree (DLTR), Publix, and Ross Stores (ROST).

Meanwhile, BRX’s portfolio is demonstrating very sound fundamentals, with same property NOI growth of 6.7% YoY during the second quarter. This was driven by high tenant demand for its properties, as reflected by blended rent spread of 14.6% on new and renewal leases during the second quarter, including an impressive 34% spread on new leases.

Moreover, BRX saw a sequential increase in leased occupancy to 92.5%, including small shop leased occupancy of 87.7%. I generally view small shop occupancy in the 80% – 85% range as being good, and 85% – 90% range as being great.

Looking forward, I see continued room for improvement, as BRX has a development pipeline that’s not yet fully leased, as this represents a 150-basis point drag on occupancy. As such, I would expect for the occupancy ratio to further increase as developments come online.

Moreover, BRX’s balance sheet is improving, as it recently got an upgrade to a solid BBB credit rating from Fitch, up from BBB- previously. It also maintains plenty of flexibility to fund its developments, with $1.2 billion of liquidity comprised of cash and undrawn credit capacity, and has no debt maturities until 2024.

Recent concerns about the health of the consumer balance sheet and penny-pinching have turned many investors off from the retail segment. However, BRX’s properties have proven so far to be rather resilient, and management remains rather confident in its centers in the current economic environment with the uptick in the portion of rent it receives as a percentage of sales, as noted during the Q&A session of the recent conference call:

Q: How would you characterize your shopper base and what are the tenants saying? Is it strength across everywhere? Are you seeing any cracks?

A: Well, you have seen really strong traffic levels, which have continued and which we find to be very encouraging. At the same time, our tenants are reporting strong sales across the board. In fact, you noticed that we picked up some percentage rent in the prior quarter, reflecting the strength of traffic and the sales volumes that our tenants have been achieving, including tenants in the value segment.

What I’m most encouraged by is the continued real-time demand of tenants to open up new stores. So they understand very well where the consumer is and are investing more in their most profitable channel, which is the store. So as you think about our traffic levels, as you think about the tenant demand, as you think about the forward leasing pipeline and you think about the consumer hanging in there, we feel pretty good.

Lastly, I see value in BRX at the current price of $22.12 with a forward P/FFO of 11.3 and a 4.3% dividend yield. The dividend is very well protected by a 49% payout ratio (based on Q2’22 FFO/share of $0.49), and I see strong potential for a dividend raise at the November declaration date, as BRX had done at the same time last year.

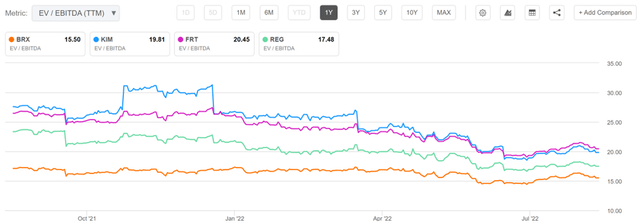

Moreover, BRX’s valuation compares favorably to that of its large peers Kimco Realty (KIM), Federal Realty Trust (FRT), and Regency Centers (REG). As shown below, BRX carries an EV/EBITDA of 15.5, sitting well below that of all three peers.

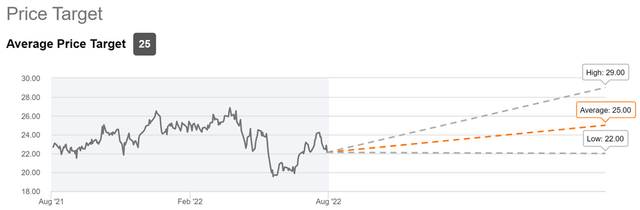

Sell side analysts have a consensus Buy rating on BRX, with an average price target of $25. This translates to a potential one-year 17% total return including dividends.

BRX Price Target (Seeking Alpha)

Investor Takeaway

In summary, I believe that BRX is a large buy under-the-radar REIT that’s well-positioned for the future. The company has a strong development pipeline, a resilient portfolio of properties, and a solid balance sheet. Moreover, the valuation looks attractive at the current price, particularly when compared to its large peers. As such, I believe BRX represents an easy choice at present for value and income investors seeking exposure to quality retail real estate.

Be the first to comment