BRENT CRUDE OIL (LCOc1) TALKING POINTS

- Treasury yields continue to push higher, restricting brent crude upside.

- NFP in focus.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

BRENT CRUDE OIL FUNDAMENTAL BACKDROP

Brent crude oil is trading higher this morning after a tough few sessions post-FOMC as advancing U.S. Treasury yields have given the dollar upside support. Despite the ballooning USD, brent crude has held up relatively due to favorable inventory data including both API and EIA weekly stock releases.

Recommended by Warren Venketas

Get Your Free Oil Forecast

The focus for today is the Non-Farm Payroll (NFP) data print which is expected at 200K. Although the correlation between ADP employment change and initial jobless claims are hardly anything to go by, a print higher than 200K could see brent crude trading lower by the end of the trading day. To close off Friday’s session, Baker Hughes rig count numbers which have been on the decline, may provide some backing for crude oil prices should this trend continue.

Source: DailyFX economic calendar

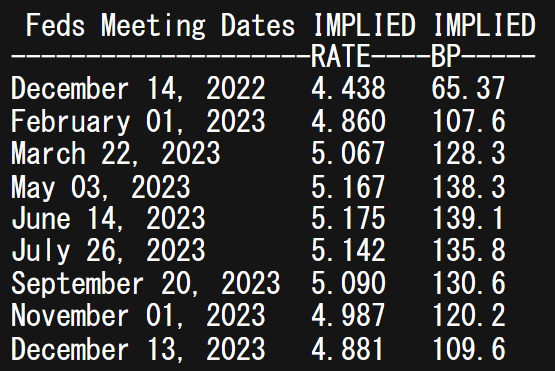

Looking at money market pricing on Fed interest rate probabilities in the table below, the terminal rate has risen to 5.175% in June after a peak of 5% in May just earlier this week. The consequent effect of this should this hold medium-term should limit crude oil gains. It will be interesting to see how OPEC+ reacts to these additional headwinds come the December meet and whether they may look at further output cuts.

FEDERAL RESERVE INTEREST RATE PROBABILITIES

Source: Refinitiv

TECHNICAL ANALYSIS

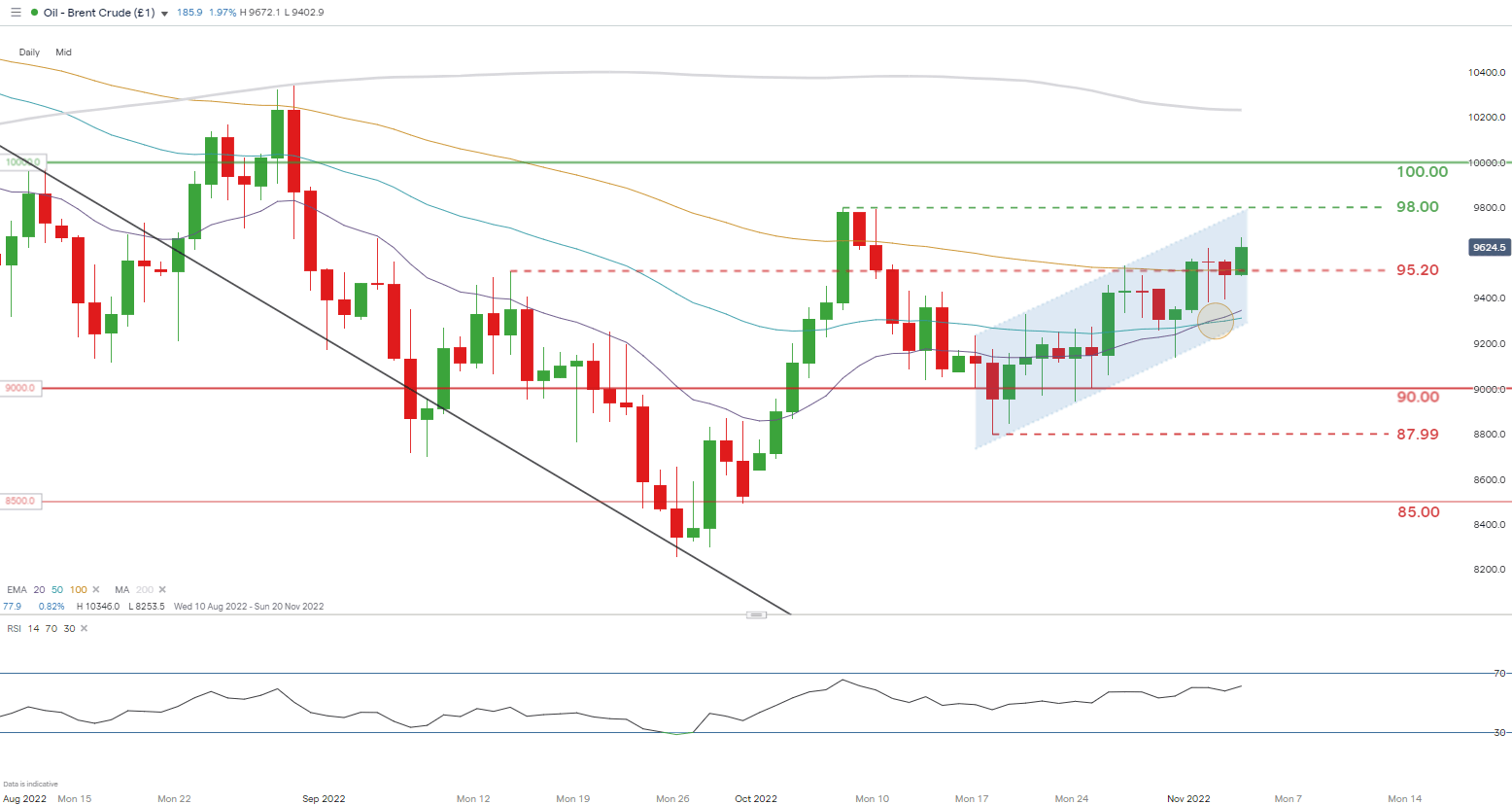

BRENT CRUDE (LCOc1) DAILY CHART -UNDATED

Chart prepared by Warren Venketas, IG

Daily brent crude price action remains within the developing bullish channel (blue) with impetus from the 20 and 50-day EMA bullish crossover (yellow). Today’s NFP result is key for short-term directional bias with a close below 95.20 and the 100-day EMA possibly negating any bullish momentum.

The RSI reading is approaching overbought territory and could suggest impending downside for brent crude.

Key resistance levels:

Key support levels:

- 95.20/100-day EMA (yellow)

IG CLIENT SENTIMENT: BEARISH

IGCS shows retail traders are NET LONG on crude oil, with 58% of traders currently holding short positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment resulting in a short-term downside bias.

Contact and followWarrenon Twitter:@WVenketas

Be the first to comment