courtneyk

Braze Stock Got Hazed Tuesday

To some, the holy grail of brand marketing is a holistic view of one’s customer and an ability to touch the customer across all of their possible interaction points, which may include (but are certainly not limited to) mobile apps, SMS messages, e-mails, and website touchpoints. After more than a decade in business, Braze (NASDAQ:NASDAQ:BRZE) offers a mature software platform that aims to give marketing teams this kind of comprehensive customer engagement “power”, based on the founding team’s original vision of transitioning marketers to more of a direct-interaction, mobile-first model of thinking when it comes to their consumers.

With Monday’s Q2 FY ‘23 results highlighting revenues of $86.1M, representing growth of 55% versus the prior period, the company would seem to have a good solution for a good market. Although, you wouldn’t know that from Tuesday’s stock market action which saw BRZE shares get absolutely hammered, falling more than (19%) to close at $35.18.

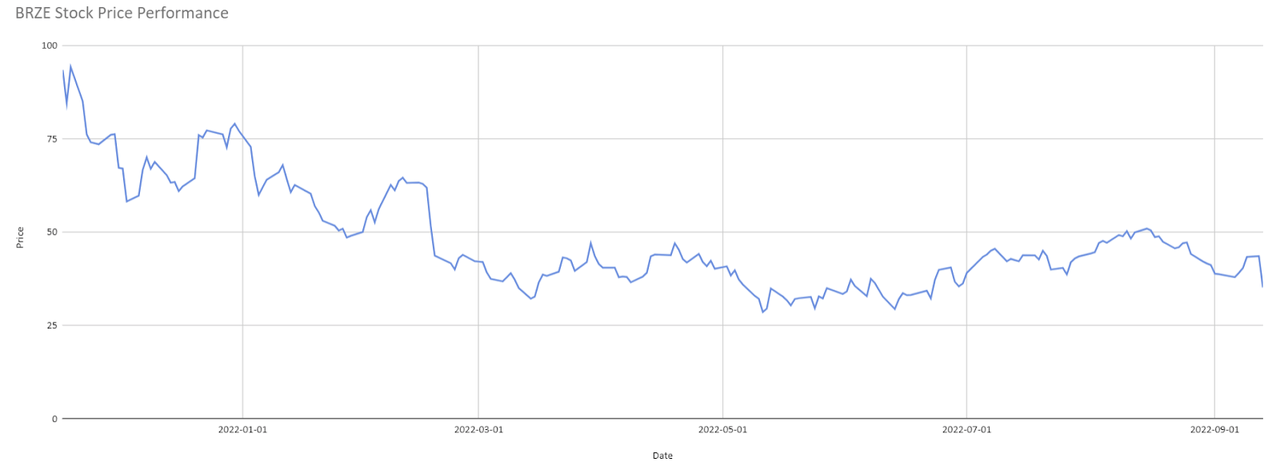

Figure 1: BRZE Stock Price Performance (Yves Sukhu)

With Tuesday’s drop, long BRZE investors are down more than (50%) year-to-date (“YTD”).

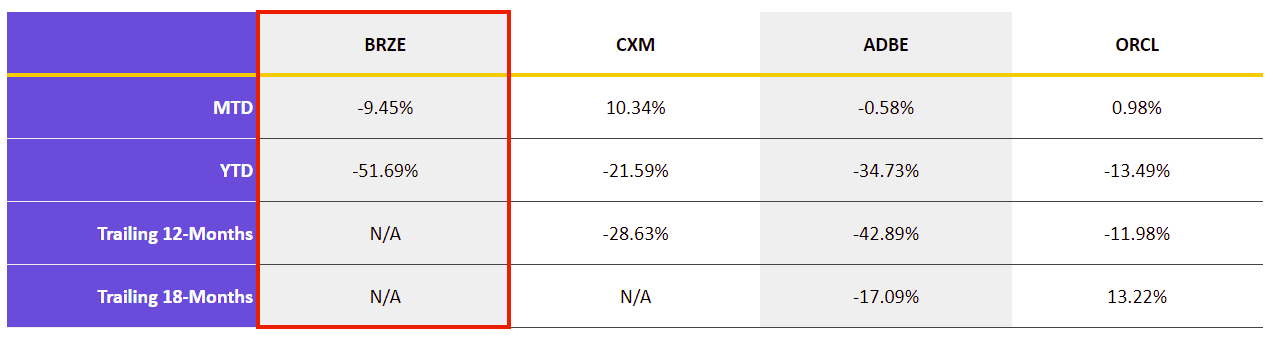

Figure 2: BRZE and Selected Competitor Performance (Yves Sukhu)

Notes:

-

Data as of market close September 13, 2022.

Generally, I maintain a pattern of avoiding tech startups like Braze for all the typical reasons that investors like me avoid tech startups: no earnings, high SG&A, a fuzzy pathway to profits, etc. However, I wrote an article a few months back on BRZE competitor Sprinklr (CXM), whose Q2 FY ‘22 earnings and related data hinted at a more enduring business model as compared to most other tech startups – in my opinion, of course. Given the nature of the market that BRZE and CXM participate in, I think there is an interesting (albeit speculative) possibility for BRZE when considering their underlying data layer technology. I’ll present that “interesting possibility” in just a moment…

But First, Let’s Talk Q2 FY ‘23

For the most part, BRZE painted a good picture Monday when presenting Q2 FY ‘23 results. Quotes below are taken from BRZE’s Q2 FY ‘23 earnings call transcript unless otherwise noted.

-

As already mentioned, net sales grew 55% versus the prior period to $86.1M. Subscription revenue made up ~95% of revenues.

-

GAAP gross margin improved 180bps to 68.2% versus the prior period. Non-GAAP gross margin was 69.3% in the quarter, with an improving trend noted by CFO Isabelle Winkles who explained that “[over] the past several years, [the company has] been successful in improving…gross margins by…realizing economies of scale in…technology infrastructure costs as well as personnel efficiencies related to customer support functions. Therefore, [BRZE is] raising [the]…non-GAAP long-term gross margin target range from 65% to 70% to 67% to 72%.”

-

Net retention rates of 126% and 130% across all customers and customers with annual recurring revenue (“ARR”) of $500,00 or more, respectively.

-

Non-GAAP operating loss of ($0.16) per share beating consensus estimate of ($0.20).

-

70% growth in high-value customers. BRZE ended the quarter with 139 customers with an ARR of $500,000 or more, versus 82 in the prior period. Total customers increased to 1,599, growing ~43% versus Q2 FY ‘22.

-

Expanding relationships with key global service integrators (“GSI”). Management noted that their relationship with large service integrators, like Accenture and WPP, are evolving. With GSIs in many cases maintaining access to the C-suite in key customers, service integrators represent an important growth channel for BRZE.

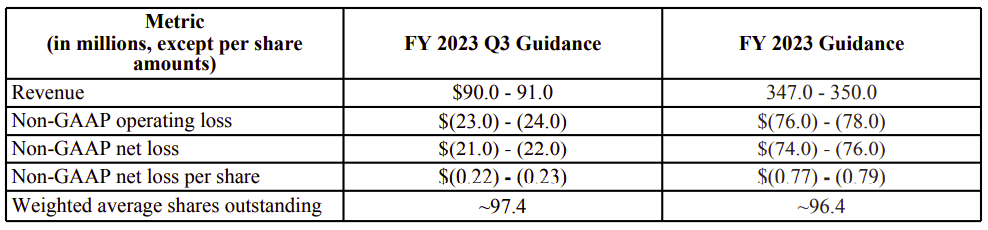

Along with the review of Q2 FY ‘23 performance, management provided a snapshot of Q3 FY ‘23 and FY ‘23 guidance:

Figure 3: BRZE Q3 FY ‘23 and FY ‘23 Guidance (BRZE Earnings Release Q2 FY ’23)

Obviously, something beyond Tuesday’s general market carnage caused BRZE shares to sink. I think there were likely a few risks that investors picked up on during Monday’s earnings call:

-

Macroeconomic pressures. Like so many other software vendors at the moment, BRZE management noted that sales cycles are taking longer, additional approvals are often required to sign deals, and the average contract value (“ACV”) is compressing.

-

Top-line growth is slowing down. The bottom-end of Q3 FY ‘23 guidance of $90M represents ~40% growth versus $64M in Q2 FY ‘22. Moreover, revenues grew 58% between FY ‘21 and FY ‘22. Even using the high-end of FY ‘23 guidance, revenues are only expected to grow ~47% versus $238M in FY ‘22. Although, in management’s defense, current FY ‘23 guidance is above the range of $338M – $342M presented at the beginning of the fiscal year.

-

Expansion in large customers is slowing. During the earnings call, management explained that, expectedly, their large, high-value customers contribute the majority of sales, noting that “…as of July 31, [they] contributed 55% to…total ARR compared to a 50% contribution as of the same time last year.” However, the net retention rate among customers with an ARR of $500,000 dipped a bit to 130% in the quarter versus 135% in the prior period. While the change is certainly not “the end of the world”, some investors may be worried that an ongoing slowdown may be unfolding within BRZE’s large customer category.

-

Spending more to sell less. BRZE’s SG&A spend jumped to 51% of revenues in the quarter versus 46% in Q2 FY ‘22 while, at the same time, average deal sizes are getting smaller. Obviously, the economics of spending more to sell less don’t work over the long term.

-

Sales team productivity issues. Management echoed some frustrations with respect to their sales team that mirror comments from Smartsheet (SMAR) management during their own Q2 FY ‘23 earnings call not too long ago. Along the lines of my skepticism expressed in a separate article on SMAR’s Q2 FY ‘23 results, I’m not sure I completely buy BRZE management’s narrative on sales team issues. They note (as did SMAR) that new sales reps are taking a longer time to ramp. As with SMAR, I can’t help but wonder if that issue is a mask for challenges elsewhere in the business. But, either way, management assures investors they are deploying new training programs to get newer reps up-to-speed as fast as possible.

With the perspective of selling environment pressures, sales productivity challenges, and increasing SG&A expense, it is easier to “swallow” the market’s decision to send the stock into a tailspin Tuesday.

Could Snowflake Be a Potential Suitor for Braze?

As already mentioned, I generally tend to steer away from tech startups like Braze. However:

-

They are in a well-defined (in my view) multi-billion market characterized by a strong CAGR. There is a clear need for brands to shift from legacy advertising (e.g. radio spots, television commercials, etc.) to direct-to-consumer assets (leveraging BRZE’s own wording).

-

A good proportion of their customer base is characterized by large deal sizes. The nature of the solution/market attracts key GSIs who can help BRZE penetrate their existing large customers to an even greater extent, as well as “open the doors” to new, key customers. CXM, and their strong ACV, is further evidence that the market itself can support large deals.

-

They are generating a lot of valuable data.

Number 3, above, is the most important for me. All of the data involved with a given brand’s interactions with its customers – across all its various channels – can be captured. All of this information can then be analyzed to design better campaigns, determine which channels are working better than others, etc.

It so happens that BRZE’s data layer is based on Snowflake (SNOW). Which leads me to speculate: Could SNOW potentially acquire BRZE down the road?

There is a clear synergy between BRZE and SNOW. All the customer data that the BRZE platform creates acts as a pull-through for more SNOW infrastructure and services within a given customer account. It seems logical that SNOW could benefit from owning a platform like BRZE to drive more core SNOW business, just as ORCL developed its applications business years ago to pull-through more database sales.

According to Yahoo Finance data, SNOW has nearly $4B in cash and relatively little debt. On the surface, they would seem capable of making an offer for BRZE whose enterprise value as I write this is $3.6B.

What would SNOW potentially offer for BRZE? Of course, I really don’t know; and BRZE is still expensive by traditional metrics – although less so when compared to other tech players.

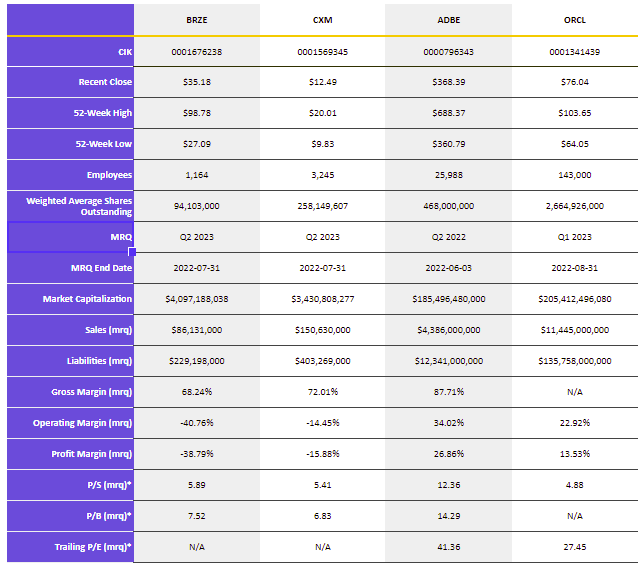

Figure 4: BRZE and Selected Competitor Statistics (Yves Sukhu)

Notes:

-

Data as of market close September 13, 2022.

-

* P/S, P/B, and trailing P/E multiple data from Yahoo Finance using BRZE MRQ data of 04/30/22; CXM MRQ data of 04/30/22; and ORCL MRQ data of 05/31/22.

-

BRZE sales, liabilities, and margin data from/calculated using Q2 FY ’23 earnings release data.

To reiterate, I am speculating here and I don’t know anything beyond what I’ve presented in this report. In fact, contrary to my suggestion that an exit may be a possibility, BRZE management suggest they are working to build out a durable business and are seeking “…to be approximately 20% in the long term from an operating profitability standpoint.” As usual, I’m a bit skeptical with respect to management’s remarks on profitability, particularly as they are struggling to attain any kind of economy of scale with sales. On that point, I certainly would not be surprised if a suitor steps in should shares continue to fall.

My Take

To be clear, I wouldn’t go gambling on BRZE stock based on anything I said in the previous section because – again – I am just speculating. That being said, a number of analysts came out swinging Tuesday and reiterated their support for the company, with many increasing their price targets for the firm.

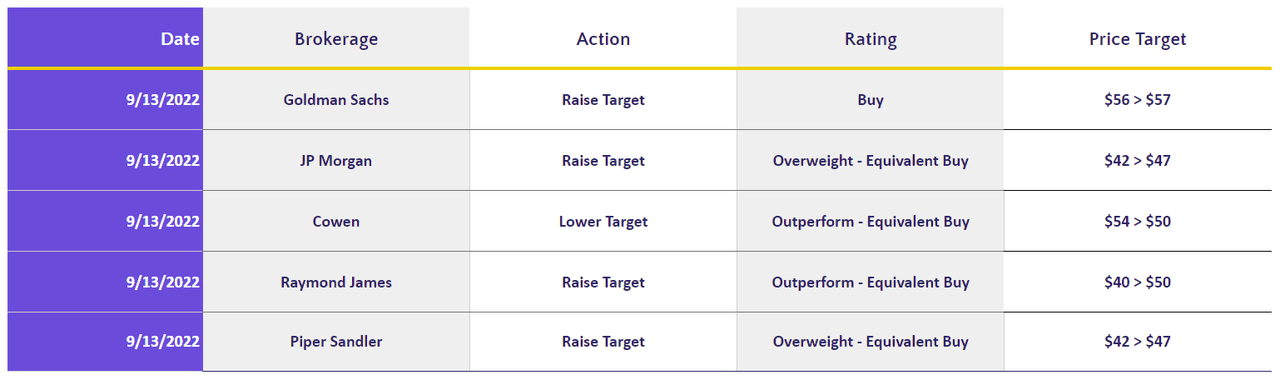

Figure 5: BRZE Analyst Ratings (MarketScreener)

The average of the price targets in Figure 5 is $50.20, about 28% above Tuesday’s close. So, shares might hold some good upside if the analysts are right.

As mentioned at the outset, what BRZE (and CXM and others) provide is something of a holy-grail in brand marketing. When I started selling enterprise software over 20 years ago, my first (software) employer had us selling a solution to address this exact business case! Unfortunately, it was basically junk and, in some ways, ahead of the technology available at the time. Obviously, technology today being much more advanced, BRZE has a compelling value proposition built around time-to-value and self-service, with BRZE users able to do much of their own “heavy lifting” via the design of the software (e.g. GUI-based, user friendly, etc.). Of course, BRZE, and peers like CXM, will always face competition from smaller, point-product players that attack the low-end of their deal funnel. However, as CEO Bill Magnuson outlined on Monday’s earnings call, there is an opportunity cost associated with cheaper solutions.

BRZE has a good, if imperfect, story. Maybe it is one whose next chapter is better written under a strategic acquirer.

Be the first to comment