imaginima/E+ via Getty Images

Boxed, Inc. (NYSE:BOXD) completed its go-public transaction with a SPAC and now stands on its own as a publicly traded company. Since the first day of trading on December 9, 2021, BOXD performed very well, rising nearly +50% to a record high stock price of $14.7 in the first month of trading.

However, the gains quickly dissipated as the macro environment changed, with the Fed signaling tighter monetary policy and bond yields rising aggressively. Public investors don’t appear impressed with Boxed prospects to grow and create value. By February 2022, BOXD was already trading below its IPO price. And as the progressed, the stock made new all-time lows of ~$8.0.

As of this writing, the stock rebounded and is now trading just shy of its $10. The chart below shows the stock moves since the IPO date.

Seeking Alpha

This article will touch on the company fundamentals and the outlook going forward, including operating performance and balance sheet. The article has a particular focus on the latest earnings results, along with the acquisition of MaxDelivery.

For a basic review of Boxed, check out our previous article, which discusses the basics of the IPO and business.

Boxed reported earnings for Q4-2021, and the results were underwhelming from a profitability standpoint, despite showing strong progress in some areas of the business.

In short, performance was mixed, with some positives and negatives.

The Positives

Gross margin improved by +625 basis points in the fourth quarter, and a little more than +400 bps for the full year. Improving gross margin is one of the many factors that Boxed strives to achieve, and we’re seeing such improvement. Gross margin for the year ended at 18.0%, with a run-rate of 20.4% in Q4. Boxed targets mid-20% gross margins over time, so there should be more upside here.

Boxed also reported strong results in its software segment, which performed particularly well, generating $20.3M in revenue, more than the expected $12M. The software business did very well in Q4, and it is set up to do even better as its key customer (AEON – a large retailer in Asia) appears to be exploring ways to expand the partnership.

The software segment is probably the most important positive data point because this business was non-existent in 2021. Growth in software segment should be strong going forward, but keep in mind this business accounts for only ~11% of total revenue.

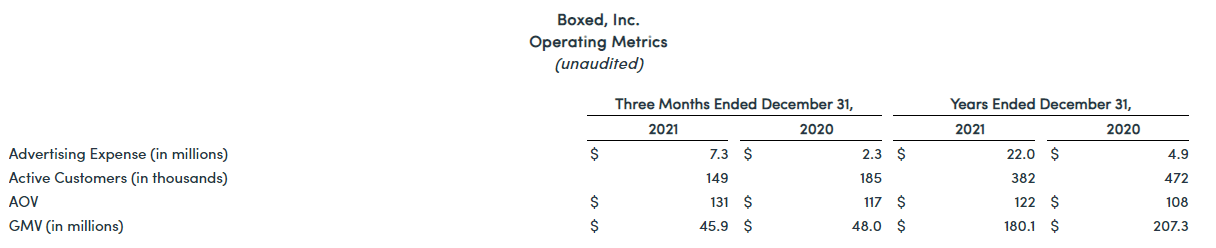

AOV (average order value) improved to $131, which is +12% higher than last year. This is good because it shows customers are increasingly willing to buy more from Boxed.

It is hard to say whether AOV growth is organic, or the result of heavy advertising expenditures. Boxed has been spending aggressively on advertising and expects to keep doing so. Advertising expenditures can prove to be a good investment, assuming Boxed can gain loyalty from customers. But it is not guaranteed.

The Negatives

We believe the negatives outweigh the positives for now, and that is a key reason that prevents us from buying the stock. Let’s go through them.

Boxed retail business suffered a decline in revenues, despite adopting a strategy to invest aggressively to grow revenues (and burn cash in the process). None of those are positive factors, and both are key reasons for us to be skeptical about investing in Boxed.

Adjusted EBITDA (a measure of profits) showed a loss during 2021, and Boxed expects to keep losing money operating the business. There is no business in the world that can operate at sustained losses forever. This is a huge problem because without profits, or growth, it becomes extremely difficult to value the business.

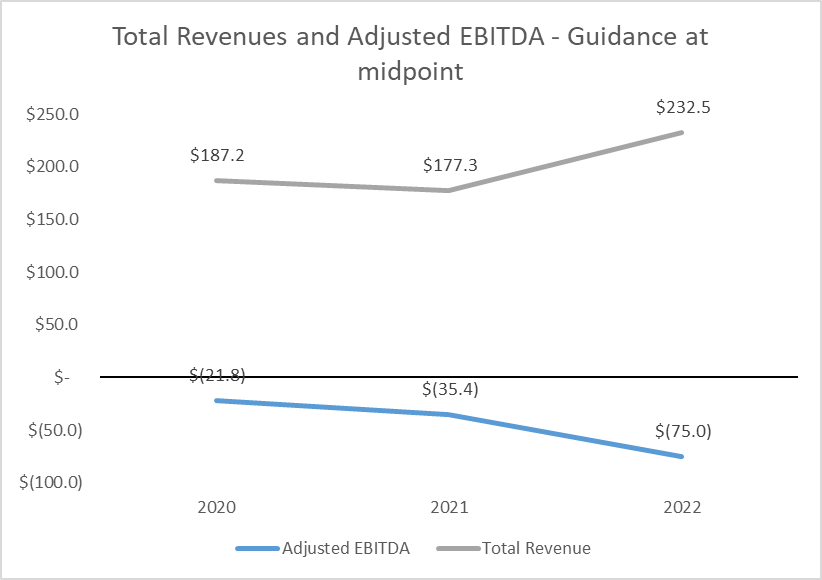

Boxed reported an EBITDA of $21.8 million loss in 2020, and $35.4 million in 2021. This metric is getting progressively worse with an expected loss of $75 million in 2022, at the midpoint of guidance (range of $70 to $80 million). The chart below illustrates the point, showing revenue and EBITDA guidance (midpoints) for 2022.

Company Financials, Author

Guidance for the full year 2022 was also underwhelming, with revenues expected to be in the $220 to $245 million, which is much lower than the expected $360 million shown in the go-public presentation. Boxed is tracking below its goals. Furthermore, Adjusted EBITDA is expected to be negative for the full year. Boxed expects to report EBITDA loss in the $70 to $80 million range.

In addition to EBITDA losses, GMV (Gross Merchandise Value) and the number of active customers declined in Q4 and full year. Full year GMV was $180M, but this number is supposed to be growing. This is another disappointing data point that suggests the business is facing challenges.

Below is a summary of the operating metrics for Q4 and full year. The rise of AOV is the only positive, whereas GMV and active customers are moving in the wrong direction. Importantly, these results should be viewed alongside the incremental ~$17 million in advertising expenses.

Earnings Report

MaxDelivery Acquisition

Boxed announced the acquisition of MaxDelivery, which is a pure-play online grocery store that serves the New York City market. MaxDelivery has been operating since 2004 and processed more than 2 million orders to-date, so it should be well-known in NYC. This acquisition should give Boxed a nice pipeline of new customers.

Furthermore, MaxDelivery and Boxed should drive interesting synergies by integrating Boxed micro-fulfillment technology (a.k.a. software segment) along with increasing MaxDelivery average order value, which is ~$100 and below the core retail business. Integrating Boxed technology could turn out a great winner for customers and the business, as it should allow operating margins to rise due to higher efficiency of Boxed proprietary software and hardware.

The acquisition isn’t a huge risk-taking from Boxed because the purchase price is manageable. Boxed paid a total of $8.7 million, comprised of $4 million cash + $3 million in equity (circa 267K shares to be issued) + $1.7 million contingent on hitting certain financial metrics.

For a company with market cap of ~$700 million, this acquisition is relatively small, and could pay off big depending on the success of integrating the two businesses. Integrating a small acquisition won’t be nearly as hard as integrating a large M&A transaction, so it should be smooth.

We’ll need to see a few more quarters of performance before gaining conviction that MaxDelivery acquisition will indeed create value. For now, it looks interesting, but we acknowledge integration will take time before meaningfully adding value.

Balance Sheet

The balance sheet looks stable and cash rich, but that’s just because a lot of cash was raised during the IPO. The problem is the balance sheet can quickly deteriorate if Boxed burns through all its cash this year without any profits to show for, especially considering the convertible debt at 7% interest that is out of the money (conversion price is $12 per share) and a term loan that carries variable interest rates at LIBOR + 8.5% (in a rising interest rate environment).

The company shows a total of $120 million in debt at relatively high interest rates. The silver lining is that these debt obligations mature in 2025 (term loan) and 2026 (convertible note), so Boxed won’t probably face a huge liquidity event over the next couple of years. However, with rising interest rates, and zero expectations of generating a profit, the term loan can quickly become problematic.

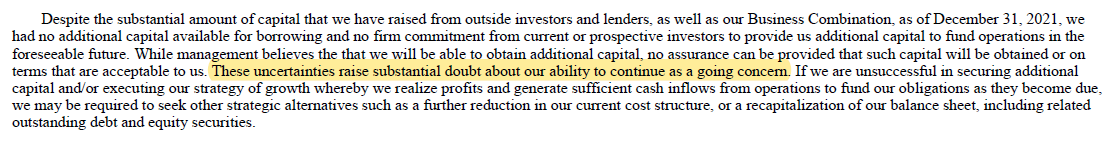

The outlook for the balance sheet does not look good. With cash on hand at $105 million, total debt of $120 million, and zero expectations of generating positive cash flows, we’re seriously thinking that Boxed may be pushed to do another equity issuance. This is well explained in Boxed’s annual report, where I highlighted one sentence highlighting going concern risk.

Form 10-K

Investor Conclusion

Boxed is a difficult company to invest in, mainly because of its lack of profits and concerning balance sheet. We’ll see what the next few quarters bring, and how Boxed manages to invest its excess cash on hand as well as the integration of MaxDelivery.

We would like to get more positive on Boxed given the CEO appears to be highly driven and charismatic, but the economics of the business prevents us from being bullish on this stock. The software segment is attractive, but it’s still a small portion of the total company, so it’s not a compelling enough reason to invest.

Despite the improvement in gross margins, the rise in AOV, and the acquisition of MaxDelivery, the most important indicators that drives value creation are not there. Adjusted EBITDA will be negative, and Boxed will keep burning cash to grow the business.

Simply said, Boxed is investing capital at negative returns, and that’s not a good deal. It is highly uncertain what will happen to the company (and the stock) once all the excess cash is burned.

This level of uncertainty could drive the stock to lose more value over time, and therefore it is better to watch from the sidelines. We’re not convinced about a short position either, but this stock is more of a candidate for shorting than going long.

Be the first to comment