U.Ozel.Images

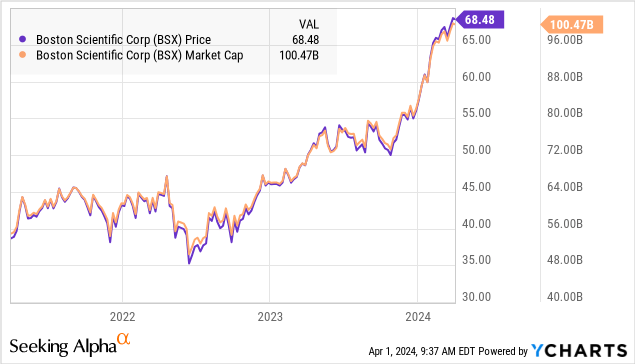

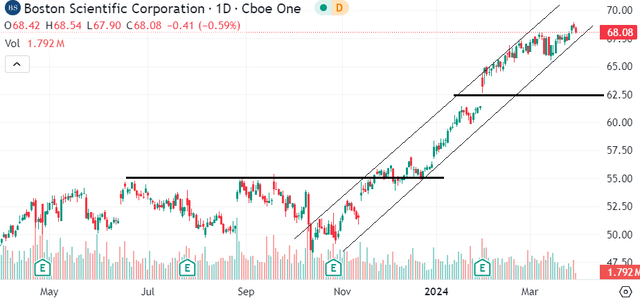

Boston Scientific (NYSE:BSX) has reached a market capitalization of $100 billion into “mega-cap” status following a spectacular 40% rally over the past year. The story has been a string of quarterly earnings exceeding expectations, with the medical devices leader capturing a growth resurgence.

Recognizing significant long-term opportunities and overall solid fundamentals, we believe some caution towards the stock is warranted at the current level ahead of the upcoming Q1 earnings report. In our opinion, the challenge here considers what are now tough comps against a record 2023 while valuation appears pricey next to industry peers.

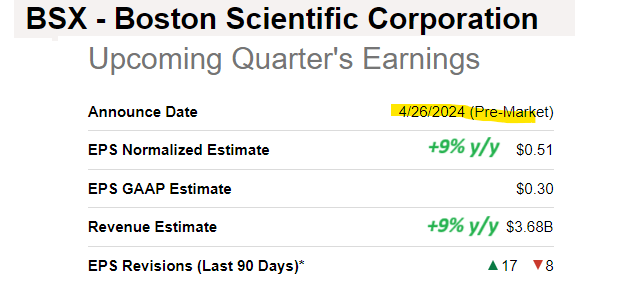

BSX Q1 Earnings Preview

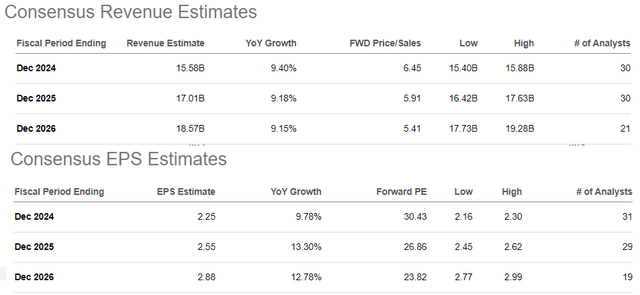

BSX is set to report its fiscal 2024 Q1 earnings on April 26th. The current consensus estimate is for revenue of $3.7 billion and EPS of $0.51, both representing a ~9% increase over the period last year. These estimates are largely in line with management guidance from the last Q4 report.

Seeking Alpha

The setup into the new year starts with a top-line growth slowdown or moderation, at least compared to a stronger 2023 which benefited from the early launch of new products.

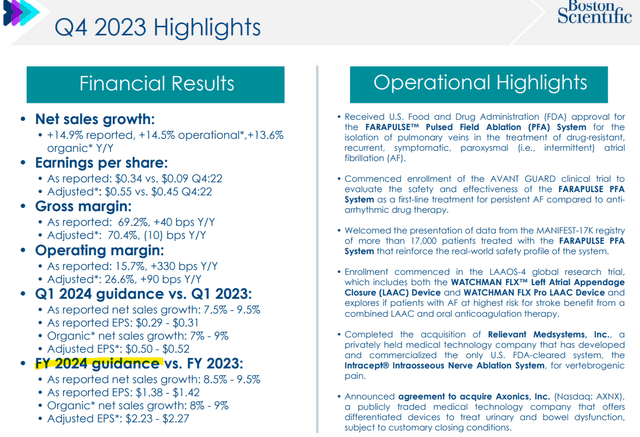

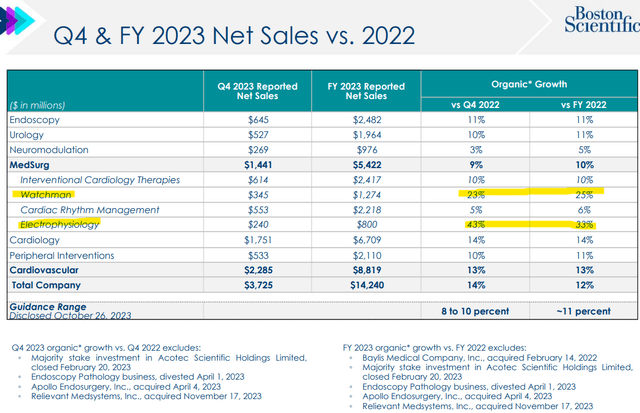

In Q4, EPS of $0.55 climbed by 22% year-over-year reflecting both 14% organic sales growth while the adjusted operating margin of 26.6% improved by 90 basis points. This included some lower cost pressures and easing supply chain disruptions, which was a headwind in 2022.

At the same time, the adjusted gross margin at 70.4% ticked slightly lower from 70.5% in Q4 2022 reflecting the shifting sales mix. Management anticipates 2024 adjusted gross margin to end up relatively flat from 2023 levels, pressured by investments toward manufacturing capacity.

The FDA-approved “Watchman FLX Pro” and “POLARx” within the Cardiovascular segment have been growth drivers, with sales up 23% and 43%, respectively.

Management notes that patient utilization for these platforms across the U.S. and global regions last quarter has been strong, with some of that momentum getting carried over into 2024.

The latest company development is the FDA approval for the “FARAPULSE” pulsed field aviation system announced in January. During the earnings conference call, management explained that its launch has been incorporated into the 2024 guidance, with a stronger impact expected in the second half of the year.

Separately, the company’s $3.7 billion acquisition of Axonics, Inc. (AXNX) announced in January was recently approved by shareholders, and we expect to hear more about that transaction with the Q1 report.

For the full year 2024, the guidance is for net sales growth between 8.5% and 9.5%, while the EPS target of $2.23 to $2.27, if confirmed, represents a 9% annual increase at the midpoint. Compared to free cash flow of $2.4 billion in 2023, management sees that level around $2.0 billion for 2024.

What’s Next For BSX?

From a high-level perspective, Boston Scientific is well-positioned to capture secular tailwinds in the healthcare sector with increasing demand for diagnostics and treatments in areas like Cardiology, Endoscopy, and Urology from a globally aging population. By all accounts, business is good.

That being said, the issue here is that the guidance for 2024 isn’t necessarily impressive. We can point to the gross margin, which appears to have plateaued even with the recent new product launches, as well as the outlook for softer free cash flow generation this year as suggesting trends are normalizing compared to an exceptional 2023.

With the stock already up 18% year-to-date, it’s going to take something special over the next few quarters for BSX to sustain the recent bullish momentum. We’re skeptical on that point.

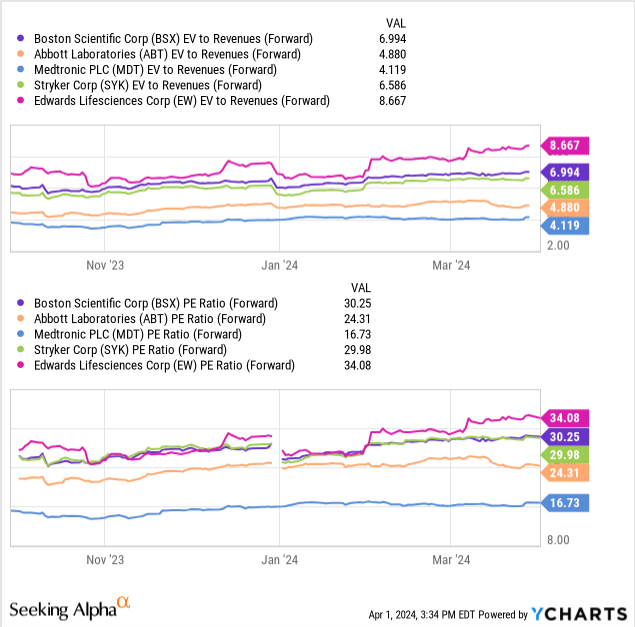

Simply put, this outlook for sales growth to average just under 10% through fiscal 2026 may not be good enough to support a significantly higher growth premium compared to the current 30x forward P/E.

We note that outside of Edwards Lifesciences Corp. (EW), BSX trades at a premium to major competitors like Medtronic plc (MDT), Stryker Corp. (SYK), and Abbott Laboratories (ABT) across most valuation multiples.

With an understanding that any comparison here is tricky given each company’s varying specialization, the argument we make is that it becomes harder to justify a significantly wider spread in an environment where BSX growth is moderating under double digits.

We’d like to see a bigger leap in margins and a re-acceleration of growth to make a case that BSX deserves to be priced more like EW, which is more concentrated on the Cardiovascular side of the business that is seen as a more valuable market compared to BSX’s diversified profile.

From the stock price chart, the big breakout for BSX was at the start of the year, when shares climbed above the tight range under $55.00 it had traded at for much of 2023. There is also a gap above $62.50 from the Q4 earnings report, which we believe should work as an important area of technical support for the foreseeable future.

Final Thoughts

We rate BSX as a hold, with a base case that shares consolidate recent gains with the current price of $67.50, and a 30x forward P/E represents fair value in our opinion.

To the upside, the bullish case will be centered on the company’s ability to exceed expectations starting with this upcoming Q1 earnings report. Monitoring points include the trends in margins as well as sales from high-profile Watchman platforms and early FARAPULSE data.

On the other hand, just matching guidance this quarter could open the door for renewed volatility if it implies organic growth momentum has slowed. We’d also say that Boston Scientific remains exposed to the global macro picture. A deterioration of economic conditions could pressure the demand outlook and lead to a deeper selloff in the stock as a risk to consider.

Be the first to comment