AvigatorPhotographer

Note: I have covered Borr Drilling Limited (NYSE:BORR) previously, so investors should view this as an update to my earlier articles on the company.

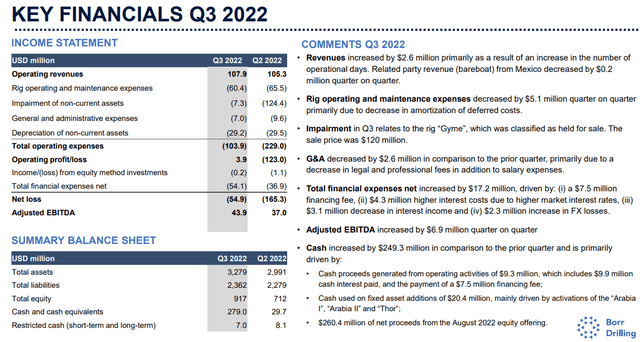

Last week, junior offshore driller Borr Drilling Limited, or “Borr,” reported Q3 results largely in line with expectations:

In addition, the company raised full-year Adjusted EBITDA guidance:

We have previously guided our Adjusted EBITDA estimate for full year 2022 to be between $115 million and $140 million. However, based on our 2022 performance thus far, we currently estimate Adjusted EBITDA in excess of the higher end of that range.

Please note that the company’s Q3 financial statements do not fully reflect recent debt management progress:

In October 2022, we concluded agreements with our secured creditors to extend the secured debt maturing in 2023 to 2025, in accordance with our previously announced agreements in principle with our secured creditors. As part of these agreements, the Company extended the debt maturity for its shipyard delivery financing arrangement with PPL and maturity of its secured debt facility with Hayfin to 2025; deferred the delivery dates for two of its newbuild rigs at Keppel Shipyard to 2025 and agreed to sell three newbuild rigs which the Company had previously agreed to purchase from Keppel to an undisclosed third-party. In October 2022, the Company repaid the outstanding balance of its Syndicated Facility and New Bridge Facility with proceeds from a new $150 million bilateral facility fully drawn down provided by DNB Bank ASA, an existing lender in the previous facilities, and also using a portion of the proceeds from the equity offering in August 2022 in which the Company raised gross proceeds of $274.9 million. Also as part of our refinancing of our secured debt we have repaid $30 million principal of our loan to Hayfin (and are required to repay an additional $15 million principal amount of this loan in the fourth quarter) and repaid $14 million of amounts owed to our shipyard creditors.

However, management abstained from reiterating previously communicated 2023 Adjusted EBITDA expectations of $290-$330 million and providing any real updates on the eagerly awaited refinancing of $350 million in convertible notes despite the January 31 deadline approaching rather quickly.

After being poked on the issue by an analyst on the conference call, management pointed to a potential mix of new secured and unsecured debt to address the convertible bond in a timely manner.

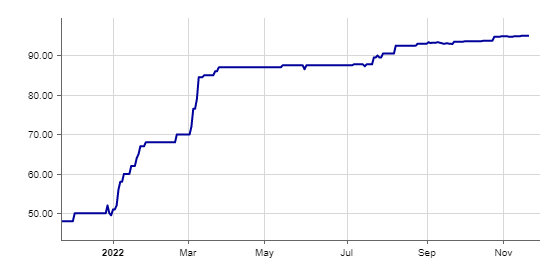

That said, with the bonds currently trading near face value after dipping below 10% in early 2020, I still expect a successful refinancing rather than additional asset sales or another equity raise.

Boerse Frankfurt

In addition, with just a little over a month left, Borr will likely miss out on its previously stated target to have the entire fleet contracted by the end of the year. Once again, it took an analyst question for management to address the issue on the conference call:

(…) Obviously, there is a large variety of tenders that we have our two remaining rigs on offer. But it is also a time where we want to make very sure that we don’t take a day rate that is not in line where we see the market or not in line with the investments that we have made on the units. So it is going to be a balance between making sure that we get the appropriate day rate for the units. But clearly, the opportunities are still there, and we’ll continue to pursue them until the end of this year, and if necessary, beyond that. (…)

Bottom Line

Despite Borr Drilling raising expectations for the company’s full-year Adjusted EBITDA performance, I was somewhat disappointed by management’s execution during the quarter, as Borr neither addressed the convertible debt nor secured sufficient contracts for its remaining idle rigs.

Consequently, management abstained from reiterating previously communicated targets for Adjusted EBITDA next year.

But given ongoing, strong industry conditions and recent geopolitical tailwinds, I remain confident in the company’s ability to address its remaining short-term debt maturities without the need for more asset sales or substantial shareholder dilution.

Even when assuming no further recovery in the jackup market, Borr Drilling is likely to generate substantial amounts of free cash flow in 2024, which bodes well for management’s stated intent to initiate a dividend by that time.

At this point, I remain positive on the entire industry, including leading U.S. exchange-listed players like Seadrill (SDRL), Valaris (VAL), Noble Corp. (NE), Diamond Offshore Drilling (DO), Transocean (RIG), Helix Energy Solutions (HLX) and offshore drilling support providers like Tidewater (TDW) and SEACOR Marine Holdings (SMHI).

That said, given the recent rally in Borr Drilling’s shares, investors should consider waiting for a pullback to initiate or add to existing positions.

Be the first to comment