laughingmango/E+ via Getty Images

Booking Holdings Inc. (NASDAQ:BKNG) is probably the only website or app I use to book my hotels. I’m a very frequent business traveler and frequent traveler. From time to time, I tried to book directly on the hotel’s website to save a buck, but it wasted tons of my time, making it more complicated, and in the end, it wasn’t worth it.

Booking.com is the largest online travel agency focusing solely on hotels worldwide. It has a massive moat that others cannot easily copy.

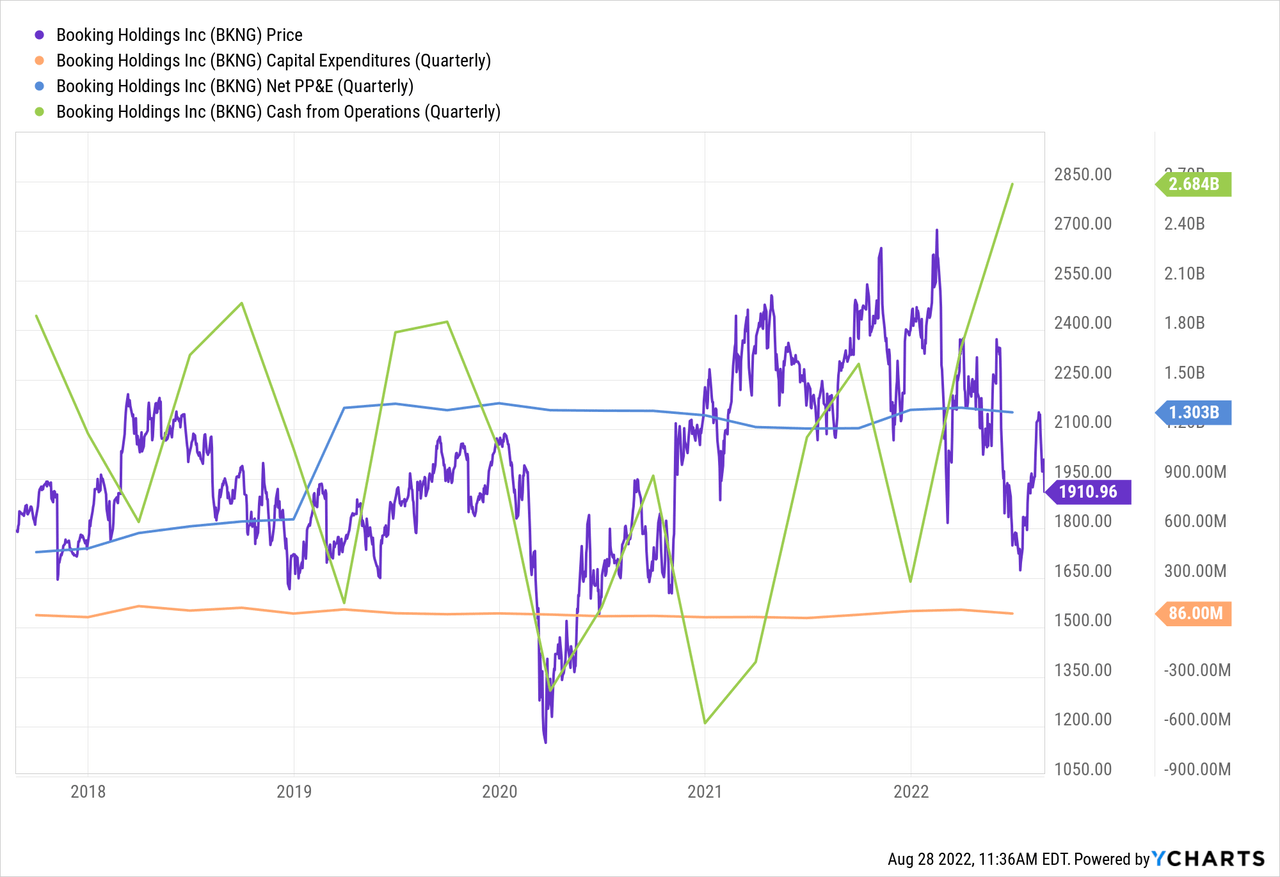

It’s a fantastic business that works after the agency model. It’s capital-light and scalable.

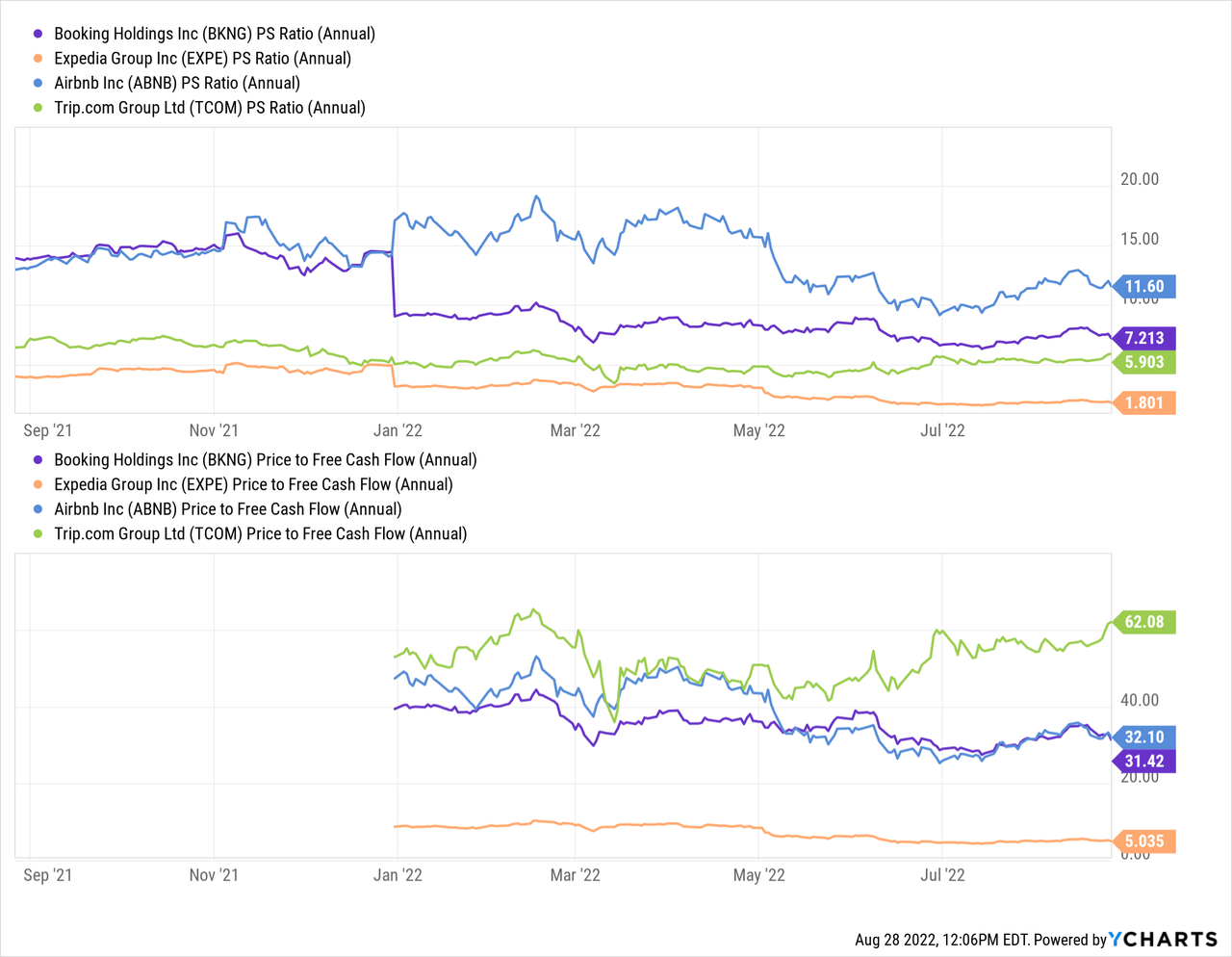

Booking’s valuation is high. Compared to its peers in the OTA business, its valuation is among the highest, even compared to the recent addition of Airbnb (ABNB). The high valuation could be justified as Booking.com is enjoying the fruits of its network effects in the hotel industry. After two years of lockdown, people want to travel and explore the world. With high inflation, the desire is muted, so that we might be a bit early going all in on Booking.com, but it should be on investors’ radar.

The Hotel Business and Booking’s Network Effect

A competitive advantage of scale results from two interrelated topics. First, the size of the company’s advantage relative to its competitors, and second, the type of advantage that results from the comparative advantage.

When a user like me considers a hotel in a city, it’s a complex decision that includes price, location, amenities, and ease of booking. The hotel industry is fragmented, and especially in Europe, Asia, Latin America, Africa, and the Middle East, there are not the same big players that my friends from the U.S. frequently use. The U.S. is concentrated around a few large hotel chains.

When I fly to Croatia, Austria, or any other European or Asian country, my go-to platform is, by default, Booking.com. The product/service complexity on the demand side and the fixed-cost requirements on the supply side are strong moats.

Evidence showed that more listings on a lodging service site like Booking.com attract more travelers and drive higher occupancy rates. This strengthens the demand side network effects for Booking.com further.

In conclusion, Booking.com benefits from its global brand and strong supply side networking effects. Every new listing increases the relative attractiveness of the business, which in turn attracts more users (like me), making successful competitive attacks unlikely.

Investment Framework

Like my article about Stanley Black & Decker (SWK), I’d like to rate Booking.com based on my investment framework. Definitely check out that article; it’s a deep-value contrarian opportunity.

Invest in companies with a track record

Booking.com has a fantastic track record of growth and market expansion. It’s a global brand and uses mainly an agency model for hotel bookings. It’s capital-light and enjoys supply-side networking effects.

Invest in businesses that operate in industries that are not prone to change quickly

Booking.com operates a straightforward business model. It connects users with hotels. The demand-side complexity provides a moat against new competitors in the industry. A new competitor would need to operate globally as travelers rarely check their city for hotels. They want to travel somewhere else. So the risk of local competition, like in the case of Uber Technologies (UBER), is low. A new competitor would need to accumulate thousands of offerings on a global scale. Booking Holdings Inc.’s platform is simple and provides all the necessary features users, like me, need.

Booking.com’s services are essential for travelers within the fragmented hotel industry. Each user has a unique demand for a hotel. Some want a great view, others a hotel with a kitchen and others are on a tight budget. Paying through Booking’s platform provides security for the user and accountability for the hotels.

The latest disruption to the industry was Airbnb. Airbnb added a whole new layer of offerings to the platform – the sharing industry. Booking.com is slowly making it easier for private offerings to enter the platform. Apart from that, the industry is simple and doesn’t change rapidly.

Buy companies under distress in industries under distress

Even though Booking.com had some tough quarters during the pandemic’s beginning, its capital-light operating model allowed it to go through those times with bravado.

It’s not under distress compared to, for example, Stanley Black and Decker. Still, it’s a tough environment due to higher energy prices, inflation, and consumers’ focus on necessities instead of luxury travel.

The travel industry has a murky outlook due to rising energy prices and inflation per se.

Buy businesses that have a durable competitive advantage or moat

We discussed this topic at the beginning of this article. Booking Holdings Inc. has a wide and strong moat due to networking effects on the supply-side and demand complexity on the demand side.

Buy businesses at a discount to their intrinsic value

This one is tricky because Booking Holdings Inc. is not trading at low valuations. The market knows it’s a fantastic business that keeps its valuation high.

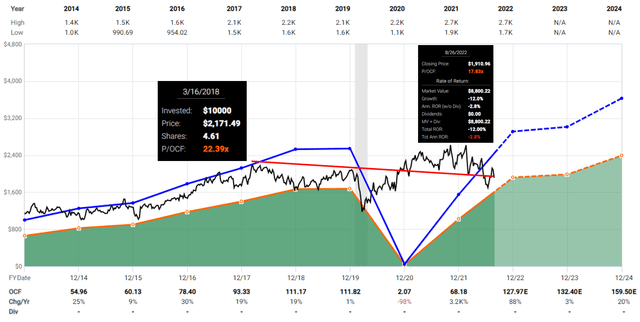

Booking.com Historical Valuation Fastgraphs (fastgraphs)

Since its pre-pandemic high of $2171 with a price to operating cash flow ratio of 22.39, Booking Holdings Inc. dropped to $1910 and a P/OFC ratio of 17.83. The short-term outlook is murky, which makes it hard for the market to evaluate the price.

Over the long term, Booking.com has all the requirements for steady growth and is currently trading at the lower valuation range.

Buy businesses with low risk and high uncertainty

Booking Holdings Inc. operates as OTA in the hospitality industry. While the hospitality industry can be risky, Booking.com has the privilege of operating as an agent for hotels. That means that it operates capital-light and is worldwide scalable.

Its platform benefits from supply-side network effects becoming more attractive with each new hotel joining the platform.

Booking Holdings Inc.’s business is very low risk.

The short term outlook in the travel industry is not very clear – over the short term, it’s associated with high uncertainty. Especially entering the winter months, we don’t know how the Covid-19 cases will evolve and if countries will increase travel barriers again.

Conclusion

Booking.com is a capital-light business operating as an online travel agency focusing only on the hospitality industry.

It enjoys a deep and wide moat due to its worldwide acknowledged brand, supply-side networking effects, and demand-side complexity.

Its valuation is high compared to its peers, and the outlook of the travel industry is murky at best. Over the short term, there can be some pain for investors in the industry, but over the long term, Booking.com will persist and continue to offer its platform to users like me.

I put the stock on my “eagle-eye” watchlist. To add it to my low-volatility portfolio, I must first find an appropriate company I’d like to remove. You’ll find out when I add it by checking out my model portfolio on Google sheets.

I always welcome constructive criticism and open discussions. Please feel free to comment or PM me about my calculations and/or sources that I use in my articles.

Be the first to comment