Rawf8

Earnings of BOK Financial Corporation (NASDAQ:BOKF) will likely plunge this year due to lower mortgage banking income and losses on derivatives booked during the first half of the year. Further, the provisioning will likely increase, which will drag earnings. On the other hand, strong commercial loan growth and moderate margin expansion will lift the bottom line. Overall, I’m expecting BOK Financial to report earnings of $6.83 per share for 2022, down 24% year-over-year. Compared to my last report on the company, I’ve increased my earnings estimate as I have slashed my provision expense estimate. For 2023, I’m expecting the company to report earnings of $7.88 per share, up 15% year-over-year. The year-end target price suggests a small downside from the current market price. Therefore, I’m maintaining a hold rating on BOK Financial.

The Topline to Continue Full Steam Ahead

The loan portfolio grew by a remarkable 3.0% in the second quarter of 2022, or 12% annualized, which beat my expectations. The management mentioned in the earnings presentation that it expects loan growth to approach a double-digit rate for the full year of 2022. In my opinion, this target can be achieved thanks to healthy pipelines and growth momentum. Commercial real estate (“CRE”) commitments grew by 7.5% during the second quarter, as mentioned in the conference call. The management expects these commitments to translate into balance sheet growth over the next several quarters.

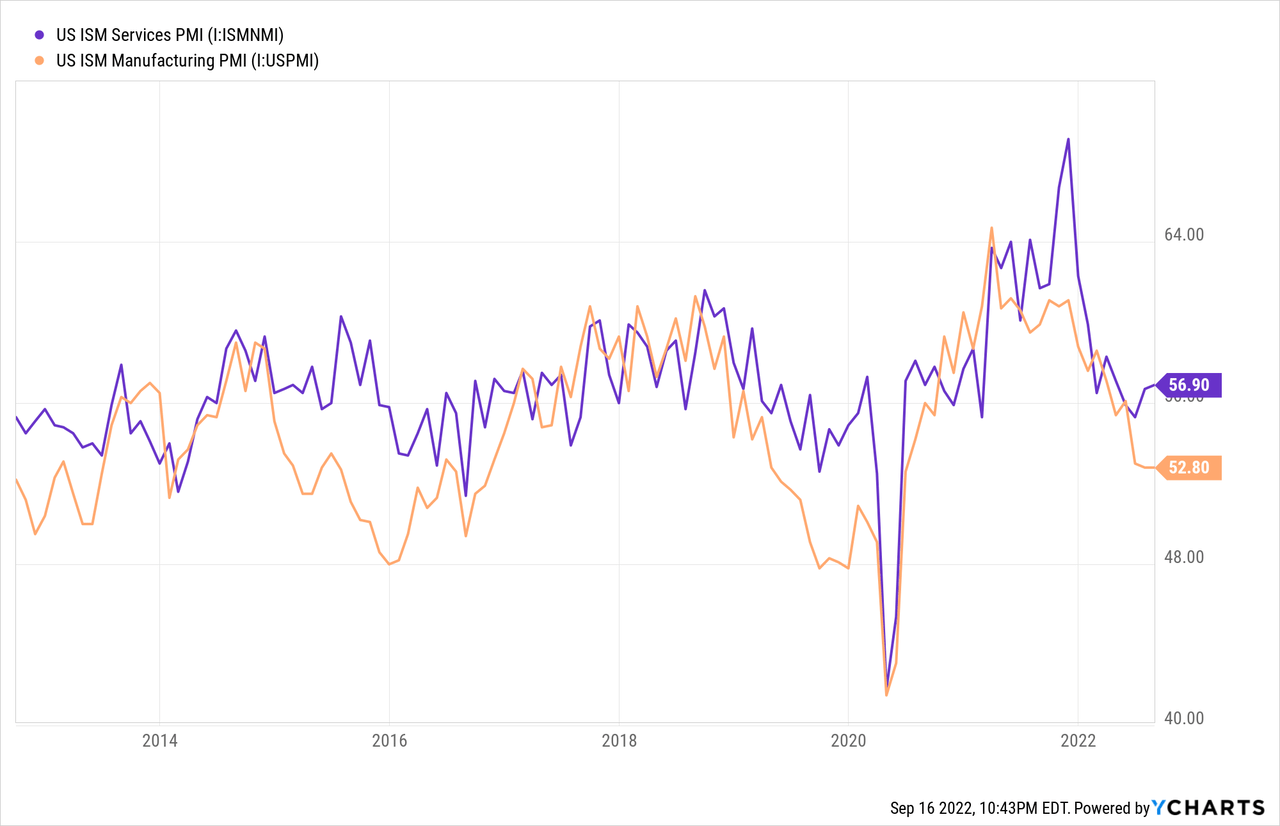

Further, economic factors will sustain loan growth. BOK Financial operates in several states across the Midwest and Southwest. Further, the company focuses on commercial and CRE loans. Therefore, the purchasing managers’ index is a good gauge of credit demand. Both the manufacturing and services PMI indices are still in expansionary territory, which bodes well for loan growth.

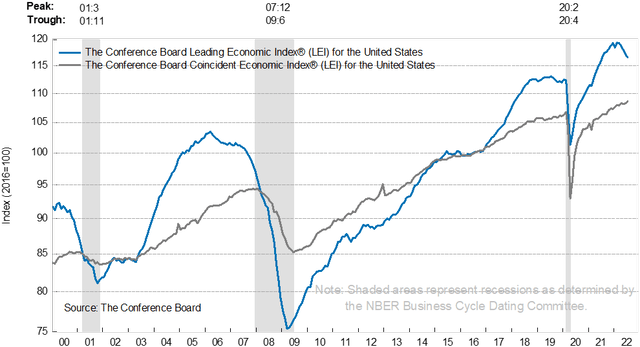

On the other hand, the U.S. leading economic index is persistently on the downtrend, which is bad news for loan growth.

Overall, I’m expecting the loan portfolio to increase by 2% in the last two quarters of 2022, or 8% annualized. Beyond 2022, I’m expecting loan growth to slow down to 6%, which is closer to the historical norm.

In my last report on BOK Financial, I estimated loan growth of 7.1% for 2022. I’ve increased my loan growth estimate due to the second quarter’s performance and the management’s updated guidance. At the same time, I’ve reduced my estimates for other earning assets as such high loan growth should crowd out the growth of securities. The following table shows my balance sheet estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |||||

| Financial Position | ||||||||||

| Net Loans | 21,449 | 21,540 | 22,619 | 19,949 | 21,900 | 23,244 | ||||

| Growth of Net Loans | 26.7% | 0.4% | 5.0% | (11.8)% | 9.8% | 6.1% | ||||

| Other Earning Assets | 12,348 | 15,451 | 18,924 | 24,950 | 16,689 | 16,689 | ||||

| Deposits | 25,264 | 27,621 | 36,144 | 41,242 | 38,774 | 40,348 | ||||

| Borrowings and Sub-Debt | 7,419 | 8,621 | 3,821 | 2,494 | 878 | 913 | ||||

| Common equity | 4,432 | 4,856 | 5,266 | 5,364 | 4,932 | 5,318 | ||||

| Book Value Per Share ($) | 66.5 | 68.2 | 75.8 | 78.2 | 73.1 | 78.8 | ||||

| Tangible BVPS ($) | 48.7 | 51.7 | 59.1 | 61.6 | 56.4 | 62.1 | ||||

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

||||||||||

Apart from loan growth, the topline will receive significant support from margin expansion during the second half of 2022. Due to the concentration on commercial loans, around 70% of the total loan book is made up of variable-rate loans, according to details given in the 10-Q filing. As a result, the average loan yield is quite sensitive to rate hikes. Meanwhile, the management expects the deposit beta to be at a moderate 30%, which is close to the beta observed during the previous up-rate cycle.

Due to the combination of the loan and deposit books’ rate sensitivity, the margin is quite sensitive to interest rate changes. According to the results of the management’s interest rate sensitivity analysis given in the presentation, a 200-basis points hike in interest rate could boost the net interest income by 5.19% in the first year, and 12.14% in the second year of the rate hike.

Considering these factors, I’m expecting the margin to grow by 20 basis points in the second half of 2022 before stabilizing in 2023.

Resumption of Provisioning Likely from the Third Quarter

BOK Financial reported zero provisioning in the second quarter of 2022, for a second consecutive quarter, which surprised me. The management expects continued strong loan growth to lead to a resumption of provisioning in future quarters, as mentioned in the presentation. Further, the possibility of a recession will force the management to build up its reserves. The heightened inflation also does not bode well for the financial health of borrowers; therefore, the management will likely want to increase provisioning for loan losses.

Overall, I’m expecting the net provision expense to make up 0.07% of total loans (annualized) every quarter till the end of 2023, which is the same as the average net provision expense from 2017 to 2019.

In my last report on BOK Financial, I estimated a net provision expense of $15 million for 2022. I’ve slashed my net provision expense estimate to $8 million mostly because of the second quarter’s surprise. Further, I’ve reduced my estimate for the second half of the year as I am now more optimistic than before.

Non-Interest Income to Decrease the Earnings for this Year

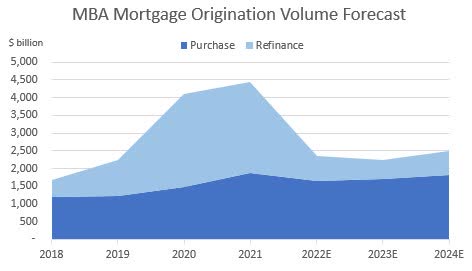

Non-interest income will most probably be much lower this year relative to last year because mortgage refinancing activity has plunged as market interest rates have risen. The following chart shows the Mortgage Bankers Association’s forecast for refinancing and purchase volume.

Mortgage Bankers Association

Moreover, the large losses booked on derivatives and fair value option securities during the first half of the year will lead to lower non-interest income this year relative to last year. I’m not expecting these losses to recur in future quarters.

On the other hand, the anticipated loan growth and slight margin expansion will likely support earnings through the end of 2023. Overall, I’m expecting BOK Financial to report earnings of $6.83 per share for 2022, down 24% year-over-year. For 2023, I’m expecting the company to report earnings of $7.88 per share, up 15% year-over-year. The following table shows my income statement estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |||||

| Income Statement | ||||||||||

| Net interest income | 985 | 1,113 | 1,108 | 1,118 | 1,123 | 1,194 | ||||

| Provision for loan losses | 8 | 44 | 223 | (100) | 8 | 16 | ||||

| Non-interest income | 617 | 694 | 844 | 756 | 594 | 684 | ||||

| Non-interest expense | 1,028 | 1,132 | 1,166 | 1,178 | 1,116 | 1,176 | ||||

| Net income – Common Sh. | 446 | 501 | 432 | 614 | 461 | 532 | ||||

| EPS – Diluted ($) | 6.63 | 7.03 | 6.19 | 8.95 | 6.83 | 7.88 | ||||

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

||||||||||

In my last report on BOK Financial, I estimated earnings of $6.54 per share for 2022. I’ve increased my earnings estimate as I’ve slashed my provision expense estimate.

Actual earnings may differ materially from estimates because of the risks and uncertainties related to inflation, and consequently the timing and magnitude of interest rate hikes. Further, a stronger or longer-than-anticipated recession can increase the provisioning for expected loan losses beyond my estimates.

Maintaining a Hold Rating

BOK Financial has a long-standing tradition of increasing its dividend every year. Given the earnings outlook and the payout trend, I’m expecting the company to increase its dividend by $0.01 per share to $0.54 per share in the fourth quarter of 2022. The earnings and dividend estimates suggest a payout ratio of 27% for 2023, which is close to the five-year average of 30%. Based on my dividend estimate, BOK Financial is offering a forward dividend yield of 2.4%.

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value BOK Financial. The stock has traded at an average P/TB ratio of 1.50 in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| T. Book Value per Share ($) | 48.7 | 52.1 | 59.1 | 61.6 | ||

| Average Market Price ($) | 95.7 | 81.2 | 60.2 | 90.6 | ||

| Historical P/TB | 1.96x | 1.56x | 1.02x | 1.47x | 1.50x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $56.4 gives a target price of $84.8 for the end of 2022. This price target implies a 7.5% downside from the September 16 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 1.30x | 1.40x | 1.50x | 1.60x | 1.70x |

| TBVPS – Dec 2022 ($) | 56.4 | 56.4 | 56.4 | 56.4 | 56.4 |

| Target Price ($) | 73.5 | 79.1 | 84.8 | 90.4 | 96.0 |

| Market Price ($) | 91.6 | 91.6 | 91.6 | 91.6 | 91.6 |

| Upside/(Downside) | (19.8)% | (13.7)% | (7.5)% | (1.4)% | 4.8% |

| Source: Author’s Estimates |

The stock has traded at an average P/E ratio of around 11.5x in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| Earnings per Share ($) | 6.63 | 7.03 | 6.19 | 8.95 | ||

| Average Market Price ($) | 95.7 | 81.2 | 60.2 | 90.6 | ||

| Historical P/E | 14.4x | 11.5x | 9.7x | 10.1x | 11.5x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/E multiple with the forecast earnings per share of $6.83 gives a target price of $78.3 for the end of 2022. This price target implies a 14.6% downside from the September 16 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 9.5x | 10.5x | 11.5x | 12.5x | 13.5x |

| EPS 2022 ($) | 6.83 | 6.83 | 6.83 | 6.83 | 6.83 |

| Target Price ($) | 64.6 | 71.4 | 78.3 | 85.1 | 91.9 |

| Market Price ($) | 91.6 | 91.6 | 91.6 | 91.6 | 91.6 |

| Upside/(Downside) | (29.5)% | (22.1)% | (14.6)% | (7.2)% | 0.3% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $81.5, which implies an 11.1% downside from the current market price. Adding the forward dividend yield gives a total expected return of negative 8.7%. Hence, I’m maintaining a hold rating on BOK Financial.

Be the first to comment