Don White/iStock via Getty Images

Note: All amounts discussed are in Canadian dollars except the price movement of the OTC traded security, which is in US Dollars.

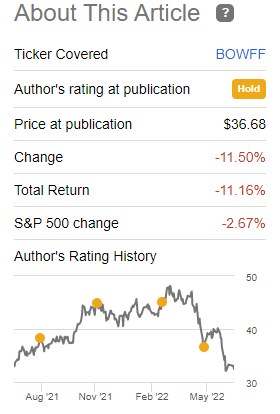

When we last covered Boardwalk REIT (OTCPK:BOWFF) (TSX:BEI.UN), we were still scouting for an entry. Our rationale was that the risks of interest rates moving higher were real, but the bears were pressing their luck this deep below NAV. Still, standing aside turned out to be the second-best move (after shorting), and Boardwalk continued to move lower.

Interest Rate Worries Are Real (Seeking Alpha)

After a lot of consideration (yes, there are 4 neutral ratings in the pic above), we are finally stamping a “buy” over here. We give you our rationale below.

1) Key Risk Close To Discounted

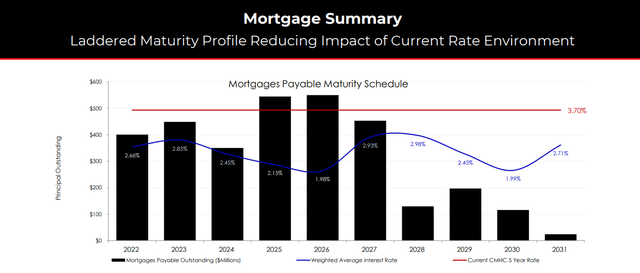

Interest rates have moved up substantially and pressured the narrative around Boardwalk. As one of the more heavily indebted REITs, Boardwalk was always going to be more exposed, and you will find this “caveat emptor” in almost every single Boardwalk article we have penned. Boardwalk had another issue and that was that its weighted average interest rates were already very low. So a move higher was going to hurt Boardwalk far more than its peer group. In 2023, we have about $375 million maturing at 2.85% rates and in 2024 we have about $350 million at 2.45% rates. 2025 and 2026 also look bad with more than $1.1 billion million at just 2.07% on average.

Current CMHC rates are higher than what Boardwalk had shown at the end of Q1-2022, and we would look for a 4% plus refinancing rate today. If we assume that each year gets refinanced 2% higher, we are looking at a cumulative $36 million interest expense expansion, by end of 2026. Boardwalk’s revenues are expected to be more than $500 million in 2023 with net operating income or NOI of about $300 million. Modest revenue hikes (2% a year) through this time frame can offset these interest rate pressures. Let’s also keep in mind that Boardwalk has a low payout ratio and is retaining $100 million of cash a year after dividends. That cumulative $400 million will be deployed in new assets or can be used to reduce debt being refinanced each year. So, at present, we think the market has priced in the rapid rise in interest rates and there should be less negative surprises on that front.

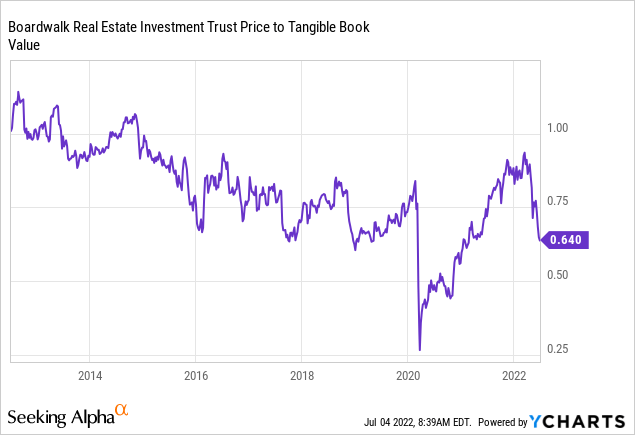

2) Valuation Is Extremely Compelling

Boardwalk is trading about 30% lower than our NAV estimate. It is trading 36% below Boardwalk’s internal numbers.

This is a substantial buffer and one that is rather unusual with energy prices this high. Boardwalk operates in the Canadian oil belt primarily and employment there has been strong with wages rising consistently. We think wage inflation should average above 4% and that should allow Boardwalk to pass on similar rent hikes. The NAV to rise from these levels, even accounting for some cap rate expansion.

3) Housing Market Bust Will Help Boardwalk

While interest rates are hitting Boardwalk’s bottom line and should do so for the foreseeable future, they are also helping in another way. The sky-high property market has been rendered unaffordable to the vast majority of prospective buyers, and they are likely to look at apartment renting as the most plausible solution.

It appears as though a number of other Canadians feel similarly. According to a recent survey conducted by Canada Life, an insurance and financial services company, nearly 50 percent of respondents who rent said they expect to do so indefinitely, or are unsure when they will buy a home.

“There is a certain pessimism about being able to enter the housing market right now,” Paul Orlander, Canada Life’s executive vice-president of individual customer, told CTVNews.ca on Thursday in a telephone interview. “The challenges right now around the housing market are making it difficult for most renters to see how they would, in a five-year timeframe, transition from renting to homeownership.”

Source: CTV News

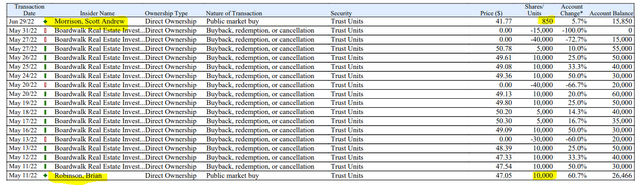

4) Insiders Stepping Up

We weigh insider information last, as we don’t believe it adds value until all the other pieces are in place. Here, we think they are, and it was nice to see two different insiders expanding their ownership.

Verdict

Our last change in rating on Boardwalk was in August 2021 (see Mission Accomplished) as we moved to a hold. The stock is 15% lower and the NOI is higher. Our primary risk is better discounted today, and we are seeing valuation get to an appealing aspect. Boardwalk’s low payout ratio gives it a lot of flexibility, and it can deleverage with cash flow. It does not hurt that insiders are seeing value as well. We are upgrading this to a buy with a $48.00 CAD price target for BEI.UN ($37.50 for BOWFF, OTC security). Key risk remains that interest rates move even higher and further than our pessimistic assumptions.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment