Systemic mastocytosis – overview

Source: Blueprint

Systemic mastocytosis [SM] is characterized by an excessive buildup of mast cells, typically, in the bone marrow or skin. Mast cells mediate inflammatory responses. There are five variants of SM which are grouped in two: Indolent systemic mastocytosis [ISM] and smoldering systemic mastocytosis [SSM] | Advanced systemic mastocytosis.

Indolent systemic mastocytosis

Blueprint Medicines (BPMC) is developing avapritinib for indolent systemic mastocytosis. Indolent systemic mastocytosis, or ISM, makes up 70% of all SM cases. ISM is a less severe form of SM with median overall survival measured in decades. ISM is characterized by skin lesions, “flushing, dyspepsia, diarrhea, recurrent anaphylaxis or persistent bone pain, neuropsychiatric symptoms, and fatigue” (Source: UpToDate).

Management

ISM patients are informed to avoid “triggers”, meaning, anything that could exacerbate an allergic reaction (e.g. stress, infection, some medications, insect bites) and, thus, increase mast cell production. Currently, there are no FDA-approved drugs for ISM. Symptoms are addressed as they arise.

Avapritinib for ISM

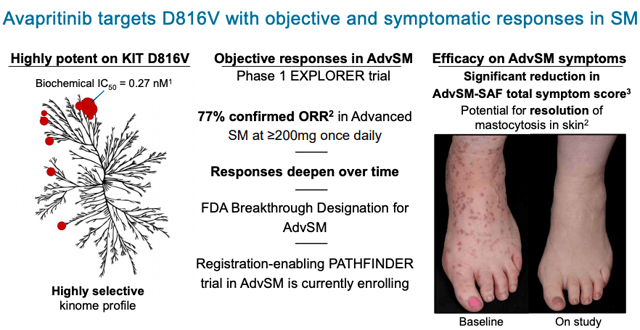

Avapritinib is a kinase inhibitor that has been extensively studied in advanced SM & GIST populations.

Source: Blueprint

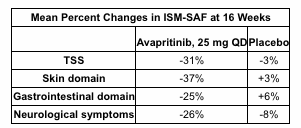

Blueprint recently revealed phase 2 data in ISM:

In Part 1 of the PIONEER trial, patients treated with avapritinib showed a statistically significant mean decline of approximately 30 percent in total symptom score at 16 weeks, as measured by the Indolent SM Symptom Assessment Form (ISM-SAF), and reductions in symptom scores have deepened over time. In addition, patients treated with avapritinib achieved consistent improvements across objective measures of mast cell burden and patient-reported quality of life. Avapritinib was well-tolerated with no patients discontinuing treatment due to adverse events.

Source: Blueprint

Analyst thoughts

Analysts had very positive opinions on Blueprint Medicines following ISM data:

Morgan Stanley:

Blueprint announced PhII data from avapritinib (ISM) data showed drug to be both effective & importantly with a fairly pristine safety profile. This sets the stage for Part 2. Positive PIONEER update should bring investors back on board for ISM, if anyone is paying attention: We believe the Avapritinib update for ISM is a positive for Blueprint. Although, the news could get lost in the volatility of the coronavirus market dynamics. BUY, PT 103.”

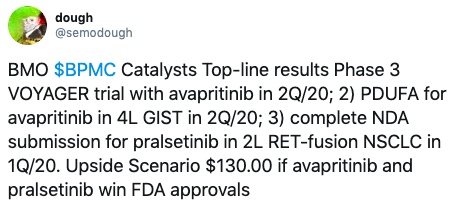

BMO Harris:

Upgrading to outperform on avapritinib potential in ISM. Bottom Line: think that compelling 16-week results reported yesterday from Part 1 of on-going PIONEER trial evaluating avapritinib for treatment of indolent systemic mastocytosis (ISM) significantly de-risk likelihood of eventual FDA-approval in this indication. Model for increased likelihood of avapritinib clinical success in SM, low company financing risk, and an attractive entry point, increase our target price to $89 from $74 and upgrade shares to Outperform.”

Source: Twitter (@semodough)

Upcoming catalysts:

My thoughts

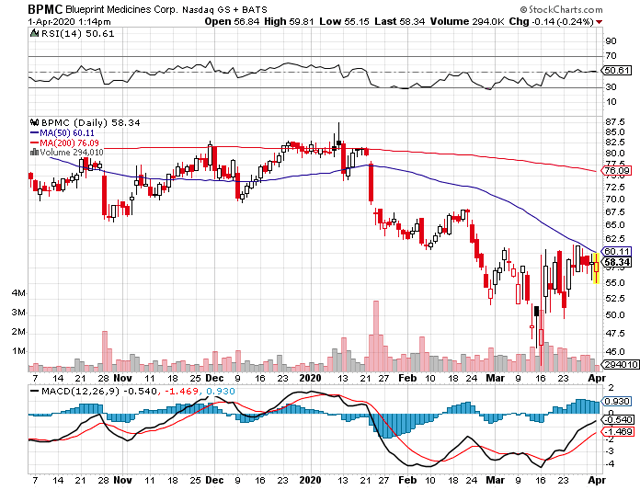

Blueprint’s ISM data is pretty significant. Like Morgan Stanley predicted, the market reaction was muted by coronavirus fears:

Furthermore, competition exists for the indication. For example, masitinib (phase 3 drug), from AB Science (OTCPK:ABSCF), has shown a lot of potential in SM. Both will likely share the population. On the surface, Blueprint’s avapritinib appears to be a more tolerable drug, fit for long-term dosing that would be likely in a population like ISM.

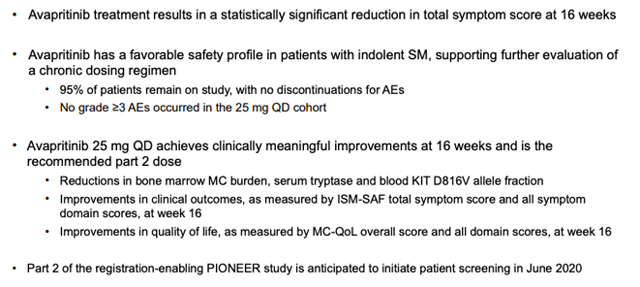

The company summarizes:

Source: Blueprint

Financials

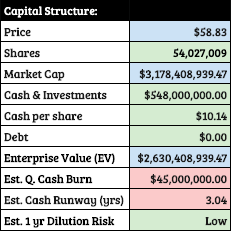

The company recently conducted a raise in January, which I proposed at the time as being a “necessary desperation” despite the advent of its products to market. Prior to January, their capital structure looked like this:

The raise added ~$325M to cash & investments and will, hopefully, be sufficient to avoid having to dilute in the future with the help of avapritinib-related revenue. So, Blueprint should have a cash runway into 2022 even aside from incoming revenue.

Conclusion

SM provides another $1B market opportunity for Blueprint’s avapritinib. Blueprint has struggled in the recent months due to GIST competition (DCPH) and regulatory setbacks, but its conservative $3.1B market capitalization (~$2.4B enterprise value) doesn’t seem to take into account opportunities like the one presented above. Additionally, Blueprint’s library of drugs is bound to make up for any deficiencies that have harmed its stock in recent months. I view these current stock prices as favorable entry points for interested investors and I suspect that stock in Blueprint will bounce back considerably when the overall market wakes again.

Risks include efficacy/safety concerns, regulatory setbacks, dilution, competition, market headwinds, etc.

Disclaimer: The intention of this article is to provide insight, not investment advice. While the information provided in this article is intended to be factual, there is no guarantee and prospect investors are encouraged to do their own fact-checking and research before investing in a company. One must also consider one’s own financial standings, risk tolerance, portfolio diversification, etc. before making a decision to buy shares in a company. Many of my articles detail biotechnology companies with little or no revenue. These stocks are, therefore, speculative and volatile. Even when prospects seem promising, there is no predicting the future. Losses incurred may be significant.

I present and update my best ideas & biotech research only to subscribers of my exclusive marketplace, The Formula. I also maintain a model portfolio of my top biotech ideas which outperformed the market (XBI, IBB, SPY) by over 16% in 2019!

Try a free, no-risk 2-week trial today.

Disclosure: I am/we are long BPMC. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment