adaask

Both Owl Rock Capital (NYSE:ORCC) and Ares Capital Corporation (NASDAQ:ARCC) are high-yield business development companies (i.e., BDCs) with investment grade balance sheets. Both are also considered among the best of breed BDCs, backed by leading alternative asset managers in Blue Owl (OWL) and Ares Management (ARES).

In this article, we will compare them side by side and offer our take on which one is a better buy at the moment.

Ares Capital Vs. Owl Rock – Balance Sheet

Both ARCC and ORCC have some of the stronger balance sheets in the BDC sector, enjoying investment grade credit ratings and plenty of access to capital at reasonable cost.

ARCC’s debt-to-equity ratio is currently 1.27x and has plenty of flexibility, with $4.5 billion of total available liquidity for ARCC (21.1% of its enterprise value).

ORCC’s debt-to-equity ratio is slightly lower than ARCC’s at 1.18x, and the company also has substantial liquidity of $2.1 billion (18.1% of its enterprise value).

Overall, we rate the balance sheet strength of both businesses to be roughly equal at the moment as we favor ORCC’s lower leverage ratio, but also like ARCC’s superior liquidity, which positions it to respond more opportunistically to market dislocations as well as support underlying holdings that may struggle in the expected upcoming recession.

Ares Capital Vs. Owl Rock – Business Models

ARCC has 45% exposure to first lien senior secured loans, 18% exposure to second lien senior secured loans, 17% exposure to equity investments, and 20% exposure to other loans and preferred equity. 73% of its investments are in floating interest rate debt, 10% are in fixed rate debt, 10% are in non-income producing assets, and 7% is in dividend-paying equity. Its overall weighted average yield on total investments is 9.6%.

Its industry exposure favors more stable cash flowing business models, including 23% exposure to software and 10% exposure to healthcare as its top two industries.

ORCC, meanwhile, has 72% exposure to first lien senior secured loans, 14% exposure to second lien senior secured loans, 9% exposure to equity investments, and 5% exposure to other loans and preferred equity. ~86% of its investments are in floating interest rate debt, with the remainder either fixed interest rate, dividend-paying, or non-income producing. Its overall weighted average yield on total investments is 10.0%.

Like ARCC, ORCC is also primarily weighted towards more defensive industries, with 13% exposure to software, 10% exposure to financial services, 9% exposure to insurance, and 7% exposure to food and beverage businesses as its top industries.

Overall, it appears that ORCC’s portfolio is more defensively positioned given its greater emphasis on debt and in particular first lien senior loans. Furthermore, its weighted average interest coverage ratio is 2.5x compared to ARCC’s weighted average interest coverage ratio of 2.0x. The non-accrual rate at ORCC is 1.0% at cost. The non-accrual rate at ARCC is 1.6% at cost. Furthermore, ORCC has greater exposure to floating interest rates than ARCC does, giving it greater upside in the current rising rate environment.

Ares Capital Vs. Owl Rock – Dividend Outlook

Both businesses are booming at the moment and experiencing strong earnings per share growth, which in turn is driving dividend growth.

On top of both companies paying special dividends moving forward, ARCC is expected to continue growing its dividend per share at a 3.7% CAGR supported by a 5.7% CAGR in earnings per share through 2024.

Meanwhile, ORCC is expected to grow its dividend per share at a 6.6% CAGR through 2024, while earnings per share are expected to grow at the same rate as ARCC’s (a 5.7% CAGR).

Both dividends appear to have attractive outlooks moving forward, barring a deep recession that would cause defaults to soar and interest rates to plummet. Both management teams have emphasized this rosy dividend growth outlook on their latest earnings calls.

ARCC:

We elected to raise the regular quarterly dividend from $0.43 to $0.48 per share because the company is now experiencing a higher level of core earnings, primarily due to the substantial increase in base rates. This increase, the largest quarterly increase in our company’s history, is our third increase this year and results in a regular dividend that is 17% higher than our regular quarterly dividend level at the end of 2021.

The higher base dividend that we are paying also reflects our positive outlook on our ability to generate this level of core earnings under a variety of interest rate and economic scenarios for the foreseeable future.

ORCC:

we are increasing our regular quarterly dividend. Our Board has declared a fourth quarter dividend of $0.33 per share, up $0.02 from our third quarter dividend of $0.31 per share. We also want to ensure our shareholders benefit from the consistent earnings we expect in excess of our regular dividend going forward. And as such, we are introducing a new quarterly supplemental dividend in addition to our regular dividend. For the third quarter, our Board has declared a supplemental dividend of $0.03 per share…The increase in our regular dividend reflects our confidence in the earnings power of the portfolio and positions us to evaluate further increases in the future, while the supplemental dividend provides additional predictable cash flow to shareholders.

While ARCC’s expected dividend growth rate is not as high as ORCC’s, it also has a much longer track record of paying out attractive dividends along with supplemental dividends. Furthermore, its expected earnings per share CAGR is identical to ORCC’s, so in this category we consider it to be a draw between the two companies.

Ares Capital Vs. Owl Rock – Valuation

ORCC’s valuation is considerably cheaper than ARCC’s across a variety of metrics:

| Valuation Metric | ORCC | ARCC |

| Price to NTM Normalized Earnings | 7.30x | 8.43x |

| NTM Dividend Yield | 12.2% | 10.7% |

| P/NAV | 0.81x | 1.00x |

The significant gap in valuation is rather surprising given that ORCC’s portfolio condition and positioning, its balance sheet strength, and forward growth and dividend outlook are very similar and arguably even better than ARCC’s. ORCC’s management highlighted the attractive valuation of its shares and their plan to address it on their latest earnings call:

ORCC’s Board authorized a new $150 million repurchase program, which replaces our previous program. Second, Blue Owl employees have opted to participate in an investment vehicle that intends to buy an additional $25 million of ORCC’s stock. In the near term, the company plan and the investment vehicle intend to purchase $75 million of stock in aggregate, a portion of which will be executed under programmatic 10b5-1 plans so they are able to continue buying after the trading window closes. Our Board and the Blue Owl employees believe it is an attractive time to be buying ORCC shares, and we value this alignment between the company to allow our employees and our shareholders…

we’re really frustrated by where the stock trades. Hopefully, that’s clear in our action and what we’re doing. And we have given visibility on earnings performance. And while there are attractive investment opportunities, we think it’s important that we also address the stock price and the stock buyback is a way to do that. And so we’re not going to shy away from it either. I would also add that, as I’ve said, — we’ve got employees of Blue Owl are also going to buy shares in the stock. And there’s a lot of — it was totally optional program that we got a very high participation rate in and they obviously know the portfolio quite well. So hopefully, that’s all read as a sign of confidence in what we’re doing…

I will tell you it’s the portfolio and the companies are doing, I think, meaningfully better than the way our stock is trading. Our stock is trading as if we’re having lots of issues in the portfolio, and we are not.

Investor Takeaway

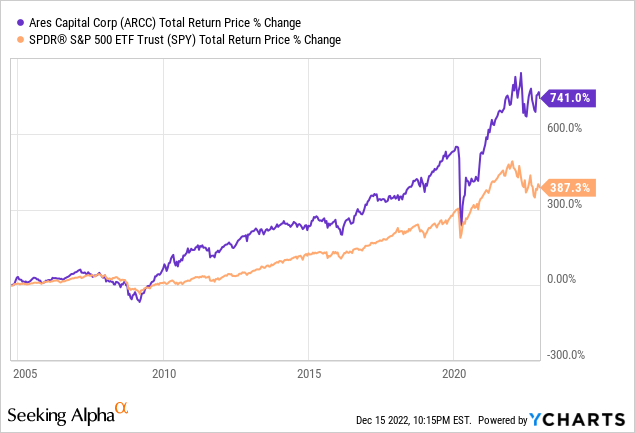

Overall, on a standalone basis, we think ORCC offers a superior risk-reward to ARCC at the moment. However, a big positive for ARCC is that it has a much lengthier public track record than ORCC does, which shows management’s ability to navigate different economic conditions and to truly underwrite at a superior level:

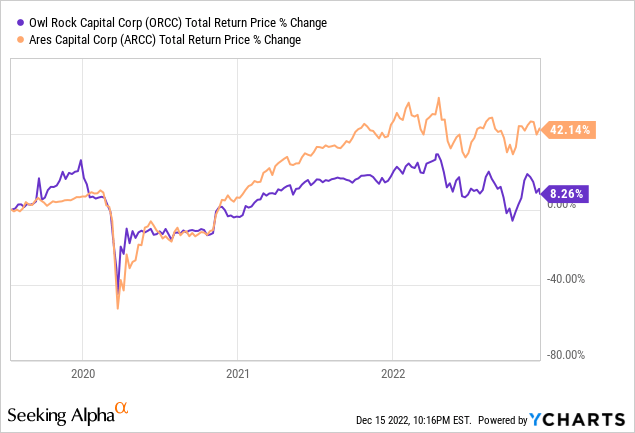

In contrast, ORCC has struggled during its young life as a publicly traded company and has massively underperformed ARCC over that time span:

Furthermore, we prefer OWL to ARES as an investment vehicle at the moment and are long OWL, but not ARES. As a result, given the diversification benefits that holding ARCC over ORCC provides to us due to our position in OWL and ARCC’s superior track record, we have chosen to be long ARCC instead of ORCC at the moment, even though we think both are attractive investment opportunities at the moment. You can read our full ARCC investment thesis here.

Be the first to comment