AntonioSolano

Shares of financial services company Block (NYSE:SQ) soared last week after it provided better than expected results regarding revenues and earnings. Block’s shares have broken out to the upside last week as well, chiefly due to Block’s strong execution in the Cash App business. Cash App remains Block’s fastest-growing business and could soon overtake Square regarding revenue contribution. I believe Block represents solid value for FinTech investors and the stock is looking more promising than at the beginning of the year!

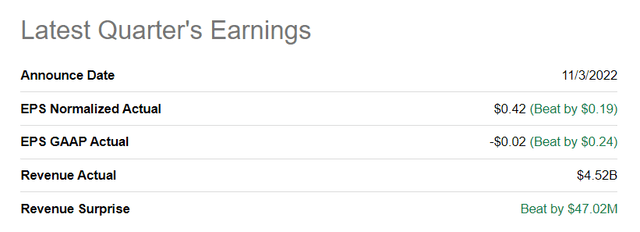

Block beat estimates for the third-quarter

The financial services company reported revenues of $4.52B for the third-quarter which beat the consensus prediction by $47M. Regarding adjusted EPS, Block reported $0.42 for Q3’22 which beat the prediction of $0.23 easily.

Seeking Alpha: Q3’22 Results

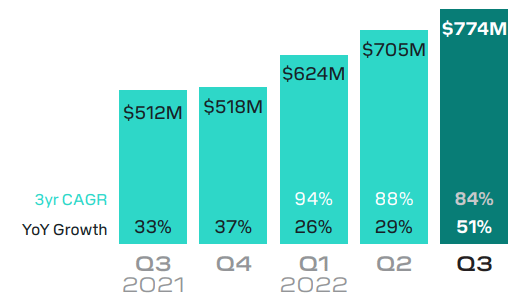

Cash App: Block’s Money Maker

The biggest business driver for Block is the Cash App which is the FinTech’s signature product. The Cash App is a mobile payment service that makes it super easy for users to send and receive funds from friends, family, and associates. The Cash App has been a huge success for Block and customers love using it. In the third-quarter, the Cash App posted a gross profit of $774M, showing an increase of 51% year over year. No other business segment is growing as quickly for Block than the Cash App.

Source: Block

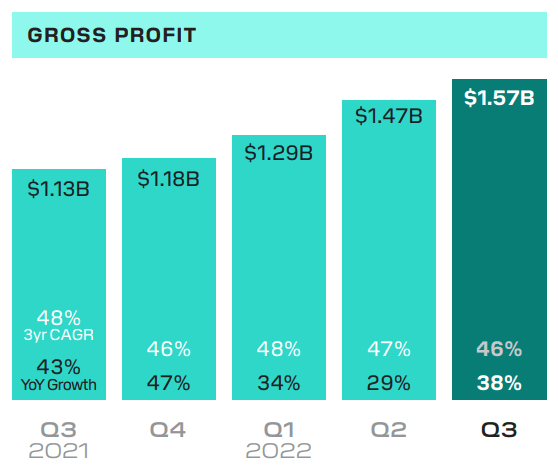

In the third-quarter, Block generated a combined gross profit of $1.57B of which $774M related to the Cash App and $783M to Square which includes Block’s point-of-sale hardware and software. Block’s total gross profit increased 38% year over year and growth was driven chiefly by Block’s Cash App. The FinTech also beat expectations of $1.53B in gross profits as more customers are using the Cash App and bring more money into the Block ecosystem. I believe the Cash App segment is set to overtake Block’s Square segment regarding gross profit contributions due to stronger growth and accelerating customer adoption. Block still generated a $15M loss in the third-quarter but the FinTech is just at the cusp of becoming profitable.

Source: Block

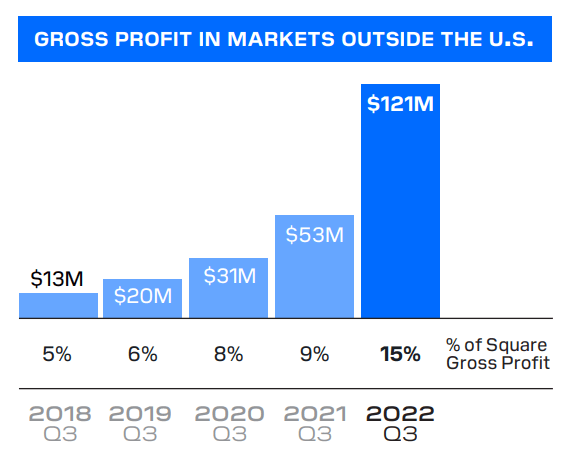

International growth opportunity

A larger percentage of Block’s gross profits is coming from markets outside of the US, implying that Block has an attractive international growth opportunity. According to Block, about 15% of the FinTech’s gross profit, or $121M, came from markets other than the US. Adjusting for buy now pay later services, about 11% of gross profits were achieved outside of the US in the third-quarter.

Source: Block

Valuation

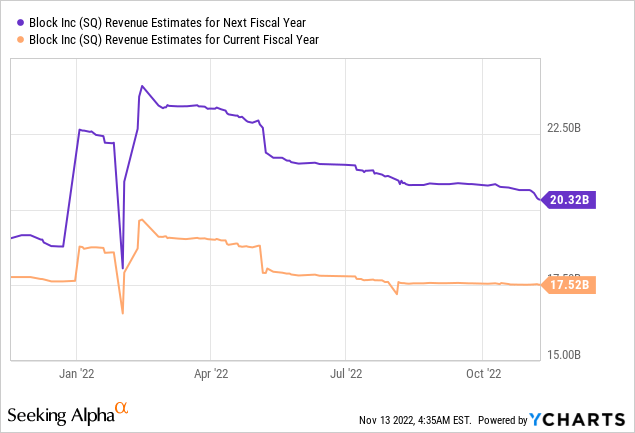

Block is projected to have revenues of $17.5B in FY 2022 and $20.3B next year which calculates to a year over year top line growth rate 16%. Block’s revenue estimates have dropped lately, however, as investors are pricing in slower growth after the COVID-19 pandemic that has boosted the FinTech space for about two years.

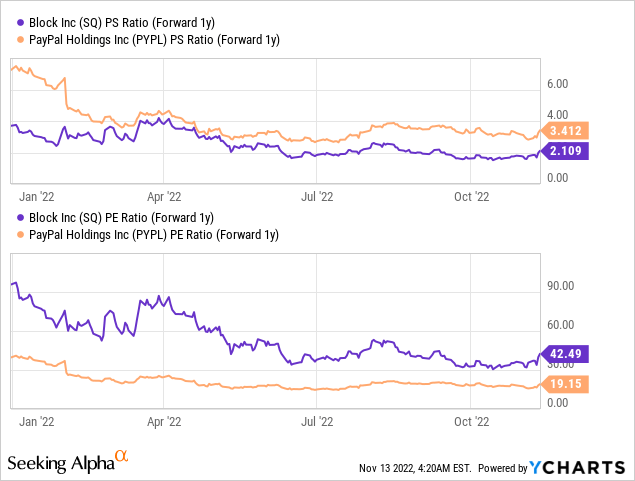

Based off of revenues, Square has a P-S ratio of 2.1 X which is slightly lower than PayPal’s P-S ratio of 3.4 X. However, PayPal is cheaper based off of earnings which is likely due to PayPal already being solidly profitable while Block is still making losses. PayPal’s P-E ratio is 19.2 X while Block is trading at an earnings multiplier factor of 42.5 X.

Breakout

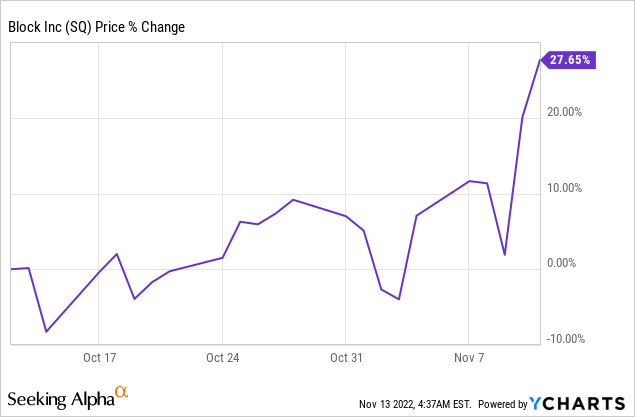

Shares of Block have broken out of their trading range after Q3’22 earnings, in part because results were better than expected and investors see a path to profitability for the FinTech. In the last month, shares of Block have soared 28% and investors may see more upside if Block continues to ride its Cash App success.

Risks with Block

The biggest risk for Block possibly relates more to investor sentiment than anything else. The company appears to execute well and the Cash App is Block’s crown jewel that benefits from growing customer adoption and strong growth. However, slowing revenue growth during a recession as well as investors’ losing interest in FinTechs are risk factors that go beyond Block’s commercial business. Block itself must grow into profitability, otherwise investors may decide to focus on those FinTechs that are already wildly profitable, such as PayPal.

Final thoughts

Block had a great third-quarter and the Cash App once again outperformed expectations. The Cash App has been Block’s biggest winning product and the segment continues to see strong customer interest and growth. Block is just about to turn profitable which could be a major boost for the stock price as well. While Block is not cheap, based off of revenues or earnings, the Cash App clearly has a lot of potential and strong execution could drive shares of Block into a new up-leg as well!

Be the first to comment