Darren415

This article was first released to Systematic Income subscribers and free trials on Nov. 14.

In this article, we catch up on Q3 results from the business development company Blackstone Secured Lending Fund (NYSE:BXSL). BXSL is currently trading at a dividend yield of 10% and a valuation of 93%.

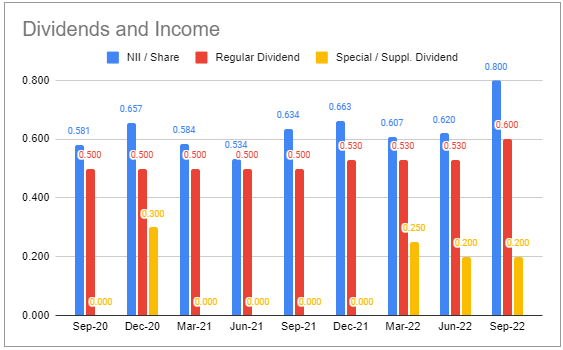

The company outperformed the sector for the third quarter in a row, i.e. every full quarter of its life as a public entity. It raised the base dividend in September, however, because its previous special dividends (used to support the stock over lock-up expiries) have fallen away, the total dividend actually fell, resulting in a comically high 133% dividend coverage – well ahead of its target of 100-125%. With additional income increases in the pipeline, we expect more dividend hikes over the coming quarters. We continue to hold BXSL in our Core and High Income Portfolios with a Buy rating.

Quarter Update

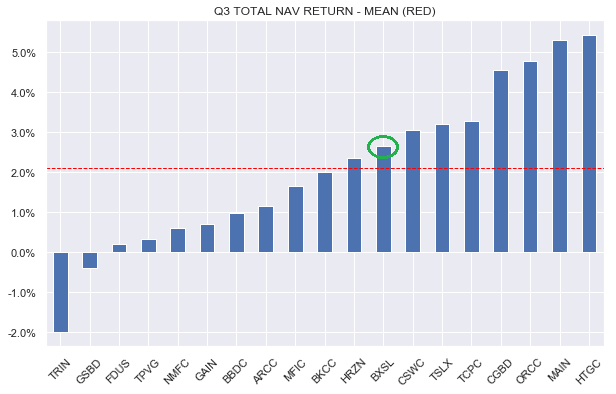

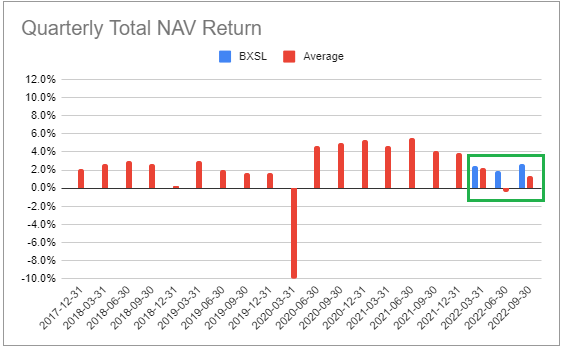

BXSL delivered a total NAV return of 2.7% over Q3, outperforming the sector once again.

Systematic Income

Net investment income jumped 29% to a record high.

Systematic Income BDC Tool

BXSL repurchased $164m of shares at close to a double-digit discount, driving $0.09 of NAV accretion or close to half a percent of NAV. During Q4, the company repurchased an additional $47m of shares at an average price of $23.65 or about 2% below current levels. The buyback program has reached full capacity and we don’t expect further sizable programs, particularly as lock-up expiries are long behind us.

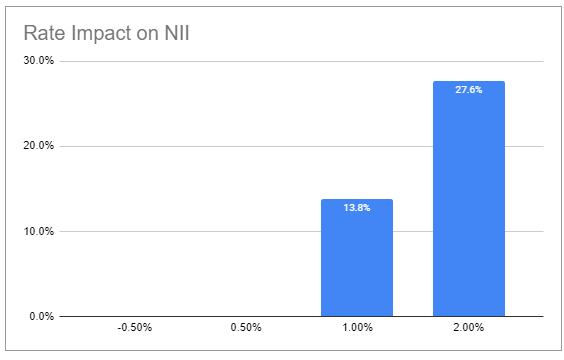

Income Dynamics

Nearly 100% of the company’s assets are floating-rate – well above the sector average – while 42% of its debt is floating-rate – a touch below the sector average. This creates a powerful combination to continue to drive net income even higher. This combination also results in a relatively high net income beta to rising rates which is close to 3% above the sector average.

Systematic Income BDC Tool

It’s also important to emphasize that there is a lot of catch-up remaining in net income. For instance, the average base rate accrued over Q3 was just 2.5% versus 3.5% at quarter-end and 4.3% at the time of the management call. In other words, even when short-term rates stop rising, there will be a significant net income tailwind over a couple of additional quarters.

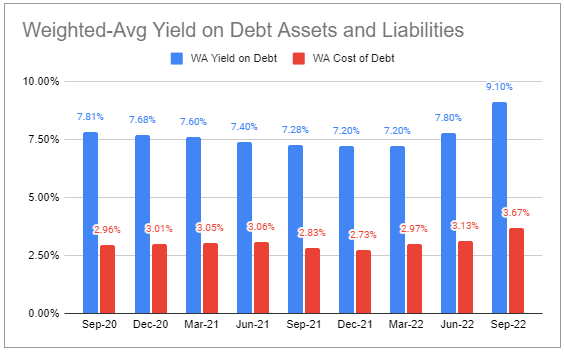

Weighted-average asset yield jumped to 9.1% while interest expense rose at a slower pace to 3.67%. BXSL maintains a below-average level of interest expense due to its strong credit profile and timely refinancings. Close to 90% of its fixed-rate debt is in bonds with maturities in 2026 and beyond which gives BXSL a terrific edge in the sector, allowing it to keep interest expense lower for longer.

Systematic Income BDC Tool

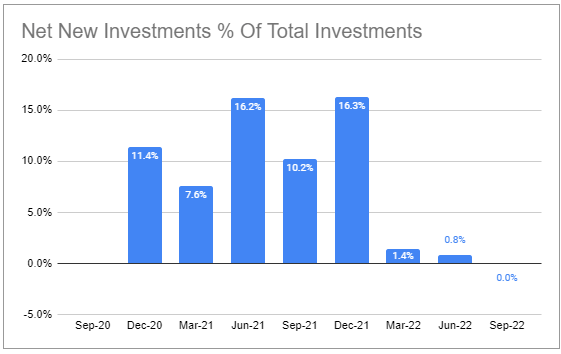

Net new investments have been running fairly light. This is likely due to the previous share buybacks as well as a somewhat elevated level of leverage.

Systematic Income BDC Tool

Portfolio Quality

Non-accruals remained at zero. 98% of the company’s investments are in first-lien secured loans with 95% of these loans are to companies held by sponsors which have access to their own equity capital to support their holdings.

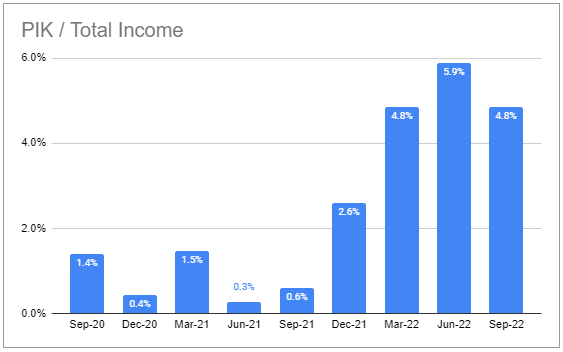

PIK fell slightly and is a touch below the sector average.

Systematic Income BDC Tool

Management have guided that interest coverage was 2.7x for the last 12 months and 2.2x based on Q3 rates with an expected trough at 1.8x based on current forward rates. This is low but not critical, particularly as the portfolio EBITDA grew 5% QoQ vs. 2% for public loans using the S&P leveraged loan index as a benchmark. About 2% of the portfolio has interest coverage below 1x.

The company’s sector tilt emphasizes sectors with a low historical default rate such as Technology and Healthcare – two sectors that are also popular with many other BDCs.

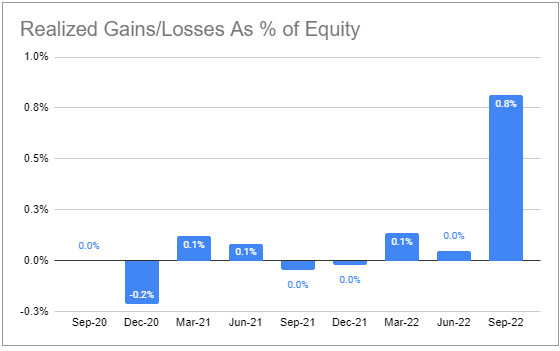

The company’s nearly 100% first-lien portfolio profile means it doesn’t have the lottery ticket upside of some of the venture-linked BDCs, however, at the same time it also has, arguably, less potential downside and a lower NAV beta. Its net realized gains have been wrapped around zero which highlights its ability to conserve value – an attractive feature in the current market environment.

Systematic Income BDC Tool

Valuation And Return Profile

BXSL does not have a long track record as a public company. For the three full quarters for which there is data, the company has outperformed the broader sector.

Systematic Income BDC Tool

Separately, the company has delivered a total NAV return of 10% since inception (in 2019 as it appears from filings) with positive net cumulative realized gains. This would put it above the average return in the sector.

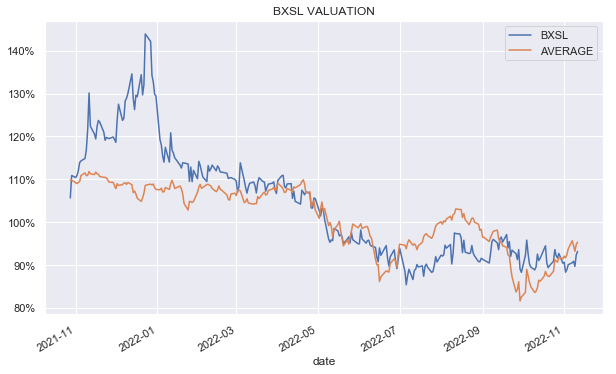

The company’s valuation has been all over the place – extremely high when it IPO’d and now slightly below the sector average.

Systematic Income

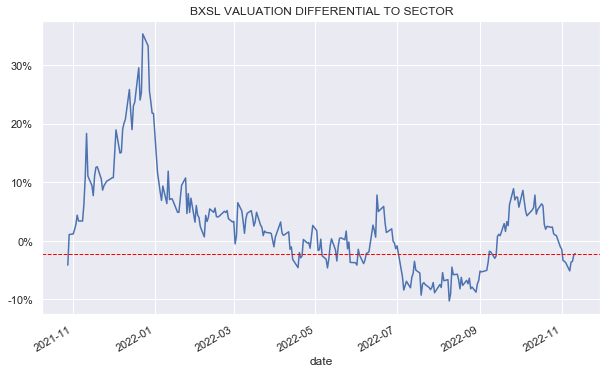

This chart shows the company’s relative valuation versus the sector average more clearly.

Systematic Income

We initiated a position in BXSL in May of this year as its valuation moved slightly below the sector average. We then rotated out in June when its valuation ran up close to a double-digit premium versus the sector and then entered a new position in July when its valuation reached a nearly double-digit discount versus the sector average. As the stock recovered in September and October, we downgraded the stock to Hold and we have recently upgraded it to Buy again after it moved to a 4% discount versus the sector average. As of this writing, it is trading 3% below the sector average valuation which looks attractive given its history of outperformance.

Takeaways

BXSL remains an attractive core holding in a BDC portfolio given its no-drama profile of higher-quality allocation, shareholder-friendly fee structure, low level of interest expense and a continued lack of non-accruals.

The company’s very high dividend coverage and high income beta to rising short-term rates means it is very likely to keep raising its dividend, whether through the base dividend or additional specials.

It is currently trading at a valuation below the sector average despite putting up above-sector average returns. This is another reason it remains a Buy-rated stock in our Portfolios.

Be the first to comment