naphtalina/iStock via Getty Images

Blackstone Secured Lending Fund

The Blackstone Secured Lending Fund (NYSE:BXSL) went public this year, but the closed-end fund (“CEF”) was established four years earlier to build a record of accomplishment. Blackstone Inc. (BX), the parent company, is an asset manager with $951 billion under management. BXSL is an externally managed fund regulated under the business development company (“BCD”) provisions of the Investment Company Act of 1940.

BXSL investments total $9.7 billion. The company has $1.1 billion and cash and funds for future investment. The business has $4.2 billion in equity and $5.5 billion in debt.

Fund Strategy

BXSL clients are mostly private, diverse businesses where the debt is not large. Their average loan to value is 47%. In a situation like this, the customer does not have a strong incentive to get a better deal by finding money on his own. BXSL debt is fixed cost, while the clients borrow at floating rates. The average cost of debt to BXSL is 3.7%. with an average maturity of 3.9 years. In the third quarter, the average client loan rate was 9.1%. This spread produced a net investment return of 12.4%. The clients are diverse with no customer representing more than 4% of the loans. The largest industry is software at 15%, Healthcare is 12%, and professional services, insurance and commercial services are all 8%.

In the third quarter, investment income was $227 million, while Blackstone fees were $25 million in that quarter. The fund placed new loans of $272 million and arranged new debt of $235 million. They also repurchased or returned $606 million of shares. The fund needs to find new clients to replace those who outgrow the fund and negotiate new loans at low interest rates. The asset value per share is about $25.75. The fund pays out all the earnings in regular and special dividends, so the stock price does not vary very much. The company has also purchased shares when the price of the share dropped below the average selling price.

BXSL emphasizes the value they bring by searching for low-risk profitable clients. They have 172 clients, and none of them are nonaccrual accounts. 97.9% are first lien senior loans. This client base generates minimal risk. It also generates high costs to make this happen and the high costs are from high Blackstone fees. The high returns justify the high fees.

The price of the stock grew from around $30 to $22 on July 5th. Since that time, the stock has slowly increased and partly because of the buybacks that hold the price up. Given the increasing earnings, the stock price is likely to stabilize around $24 but not increase much. For the investor, the gains will come from the combination of regular and special dividends. The regular dividend is 10% of the stock price, and the special dividend pushes that return above 10%.

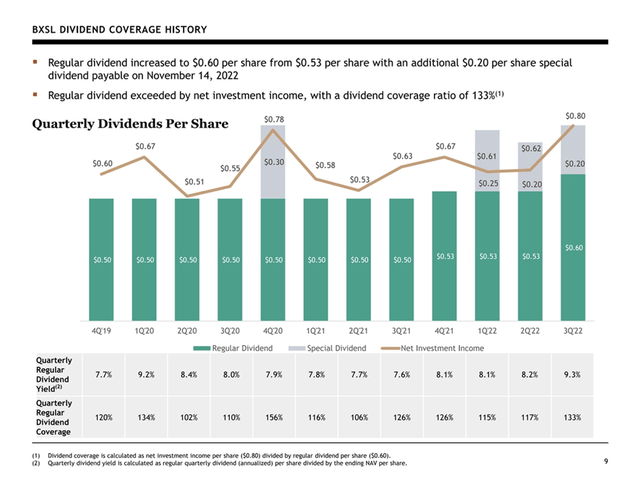

The chart below compares the regular and specials to the net investment income per share. The investment income and special dividends illustrate the funds’ performance.

BXSL (BXSL)

Risks and Opportunities

As interest rates increase, BXSL earnings go up because the interest rate is floating. The interest rates are largely fixed, so the profit increases. The company has the advantage of an average maturity rate of 3.9 years. It will need additional loans in 2023 that are at a higher rate of interest, but its average return should increase.

Should inflation begin to decrease, the floating rate will decrease but with all the lags they will do very well.

Conclusion

BXSL should profit in a difficult environment. It could provide a high certainty that other stocks lack and returns of 10 to 12 percent with a very low risk. For these reasons, BXLS is a strong buy for those who want a guaranteed cash flow with little risk to the principal. For these people, Blackstone Secured Lending Fund it is a strong buy.

Be the first to comment