FG Trade

Blackstone Secured Lending (NYSE:BXSL) is a BDC managed by Blackstone (BX) which came public in October of 2021 at $26.15 per share (equal to its NAV at the time). After factoring in dividends (and special dividends) received, the total return has been -4% which compares favorably to the broader equity market (SPY total return -14% since BXSL IPO).

With a low leverage profile and positive exposure to rising interest rates, I think BXSL has a positive risk reward for income oriented investors. Further, as I outline below, I think the company is well positioned to weather an economic storm.

Positives

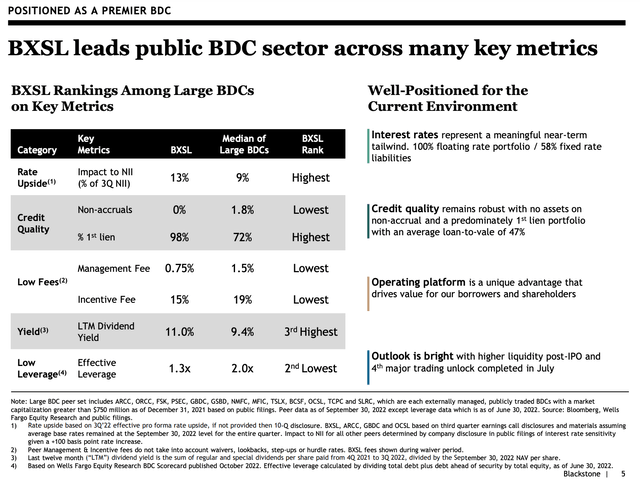

Blackstone Secured vs. BDC peers (Investor Presentation)

There are many things to like about BXSL, including:

- BXSL is managed by Blackstone the world’s largest private equity firm and has unparalleled access to deal flow which is an ongoing source of opportunity for BXSL.

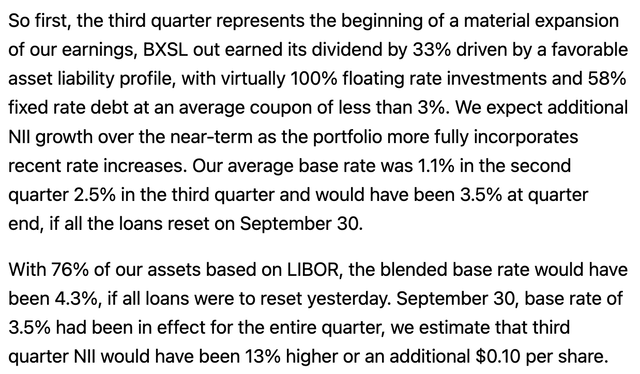

- 100% of the loans made by BXSL are floating rate – this means that BXSL benefits from the rise in interest rates. There is a slight lag between rate increases and an increase in BXSL’s earnings – for instance third quarter results do not yet reflect the full benefit from rising interest rates. While BXSL earned $0.80 in the third quarter, on the company’s third quarter conference call, management noted that earnings would have been $0.90 (+12.5%) at the (then) prevailing interest rate:

Management Commentary on the impact of interest rates (3Q22 Earnings Transcript from Seeking Alpha)

Note that Libor has since increased another 100 bps suggesting quarterly earnings could be in excess of $1.

- Strong probability of dividend increase and special dividends. As mentioned above, I expect BXSL could earn $1 per quarter in the current interest rate environment. BXSL is structured as a BDC which means that it is required to pay out 90% of net income. This would allow the company to return $3.60 per share to shareholders (versus $2.40 annual regular dividend).

- BXSL has relatively low leverage at just 130% of equity (versus 200% median for large cap BDCs as shown above). Should BXSL incur losses in its loan book, it won’t have an outsized impact on NAV. Further, 58% of BXSL’s debt outstanding have fixed rates (fixed rate debt has an average cost below 3.0%) so while BXSL’s assets are benefitting from higher rates, its cost of funds is less impacted, increasing its spread and earnings.

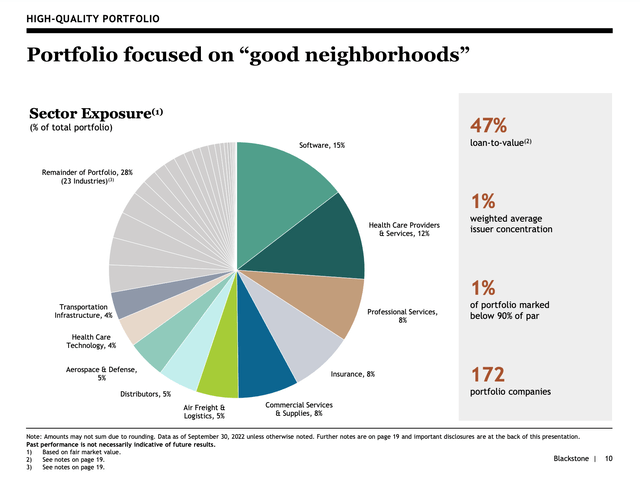

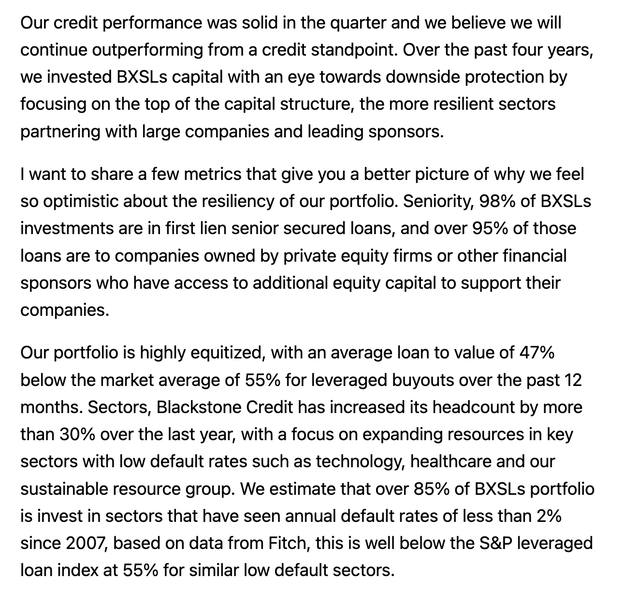

- While BXSL lends to leveraged firms, the loan to value (‘LTV’) is just 47% which means that there is a large cushion (values have to decline more than 50%) before BXSL shareholders incur a loss.

- As shown below, BXSL lends primarily to companies with high levels of recurring income and which should fare well in an economic downturn.

Portfolio by Industry (Investor Presentation)

Risks/Downside analysis

As is always the case in lending, the risk is not getting paid back. As we sit today, the loan book is performing quite well:

Management Commentary on Asset Quality (3Q22 Earnings call transcript from Seeking Alpha)

As the economy seems poised for a recession, it is a matter of when, not if, BXSL starts to experience lending losses. Fortunately, the company is well positioned to weather any losses given that

- pre-provision income is elevated due to higher interest rates

- active plan whereby BX works with borrower to improve operations – further Blackstone’s relationships should help mitigate loan losses

- as previously mentioned, BXSL has low leverage so loan losses shouldn’t have an outsize impact on NAV.

In thinking through what loan losses might be in a tough economy, I’d note that peak annual leveraged loan loss rates during the 2008-2009 financial crisis were 5-6%. One way to think about a 6% loss rate assumption is 10% defaults across the portfolio and 40% recoveries. In a severe recession, BXSL may cut its dividend (depending on whether losses are recognized in a couple of quarters or spread out over a few years). A less draconian recession scenario would be defaults of 5% and ~50% recoveries leading to a 2.5% annual loss rate. Deducing 2.5% loss rates ($1.50/sh) from $1 of quarterly earnings power ($4/annual run rate) would allow the company to continue to pay its dividend through a regular recession.

Valuation/Expected Return

I see no reason why BXSL should trade below its $25.75 per share NAV. This implies 14% upside. In addition, in the absence of a severe recession, shareholders will collect dividends of $2.40 (and as mentioned above, this is likely to be higher without a recession/ loan loss provisions). So in addition to the 14% upside to NAV, I expect to collect a nearly 11% annual dividend yield. Assuming it takes two years for BXSL to trade up to NAV, this would be an annualized total return of 17-18%.

Conclusion

With a low leverage profile and positive exposure to rising interest rates, I think BXSL has a positive risk/reward for income-oriented investors.

Be the first to comment