kertlis/E+ via Getty Images

While the broader REIT market has struggled in 2022 with the Vanguard Real Estate Index/ETF (VNQ) delivering a total return of -13% year-to-date, Blackstone’s (NYSE:BX) non-traded REIT, BREIT, has shown a +9.3% year-to-date return. However, while BREIT had generated large inflows through the first 9 months of the year, recently, it has been hit with a number of redemption requests. Redemption requests now exceed the quarterly limit (5%) which has lead Blackstone to suspend redemptions (until next month/quarter).

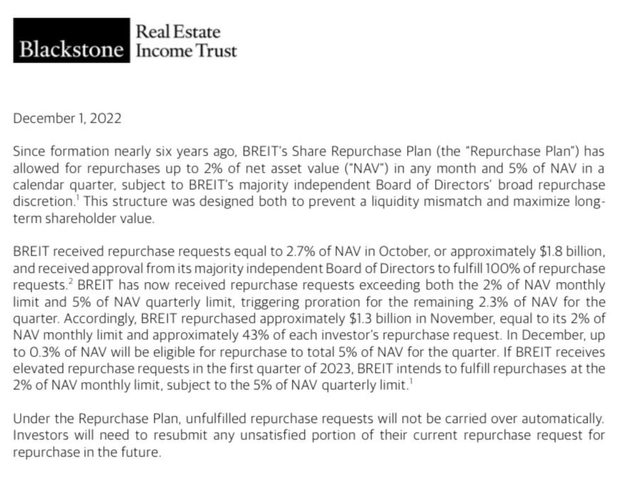

Notice of redemption halt (BREIT)

Given that Blackstone is investing into long duration core real estate assets, it only makes sense that there should be limits on redemptions. Were there no redemption limits, Blackstone would be forced to fire sale assets which would hurt all BREIT investors. As such I think it is prudent to have such protections in place.

With a dimmer view of the prospects for BREIT and the associated Fee Related Earnings (FRE), I am steering clear of Blackstone shares.

Overview of BREIT

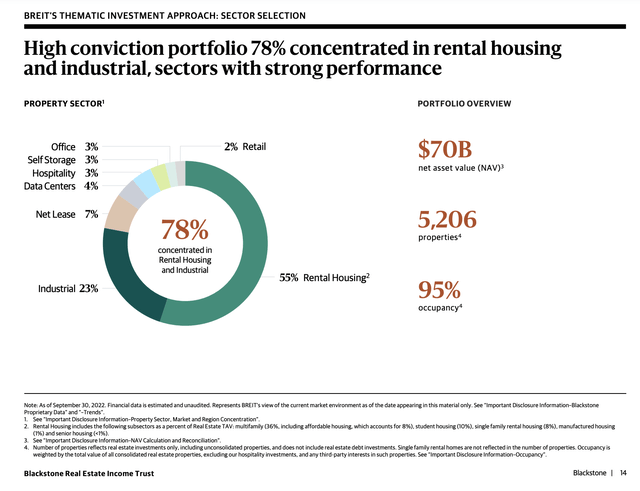

BREIT overview (BREIT Investor Presentation)

BREIT has been a juggernaut for Blackstone – since its formation in 2016, it has attracted $70 billion in equity (with total assets of over $120 billion after taking into account leverage). In 2021 alone BREIT attracted over $20 billion in net inflows and had brought in another ~$17 billion through the first 9 months of 2022. BREIT has been an important growth engine for Blackstone, generating an annual management fee of 1.25% plus a performance fee of 12.5% of returns in excess of 5%. Interestingly, the more volatile performance fee is included in Blackstone’s ‘Fee Related Earnings’.

However, this well publicized halting of redemptions could cause some investors to re-think their allocation to BREIT and lead to continued redemptions as we head into 2023 and reduced inflows in the future.

Transaction slowdown & Limited Price discovery

The rapid interest rate hikes in 2022 have led to a dramatic slowdown in the private real estate transactions market. This does beg the question of how a vehicle like BREIT can accurately estimate its NAV at a time when nearly all market participants have discussed the lack of price discovery occurring in real estate markets. This was a recurring theme in many public REIT on 3Q22 conference calls – here are some 3Q22 transcript excerpts from sunbelt multifamily REITs (BREIT has significant sunbelt multifamily exposure) Camden Property Trust (CPT) and Mid-America (MAA):

Camden CEO Ric Campo on Transaction market (Camden 3Q22 transcript (Seeking Alpha)) Mid-America CIO Brad Hill on transaction market (3Q22 MAA conference call Seeking Alpha)

The rapid slowdown in transactions and limited visibility into property values puts BREIT in a tough position. If BREIT sets its NAV estimate is too low, new investors are advantaged versus existing investors as they buy in below true value of properties. However, if BREIT sets NAV too high, astute investors will recognize that they can exit above fair value and will redeem (disadvantageous to those who remain in BREIT). The outsized redemption requests received in 4Q22 could indicate that investors believe BREIT’s NAV estimate is too high.

Conclusion

With limited price discovery in private markets and rising investor redemption requests, I expect BREIT may see more outflows as we move in 2023. Further, I suspect this could lead to lower NAV estimates for BREIT which could negatively impact Blackstone’s ‘Fee Related Performance Revenue’ in 4Q22 and beyond. As such, I am avoiding Blackstone shares.

Be the first to comment