SvetaZi/iStock via Getty Images

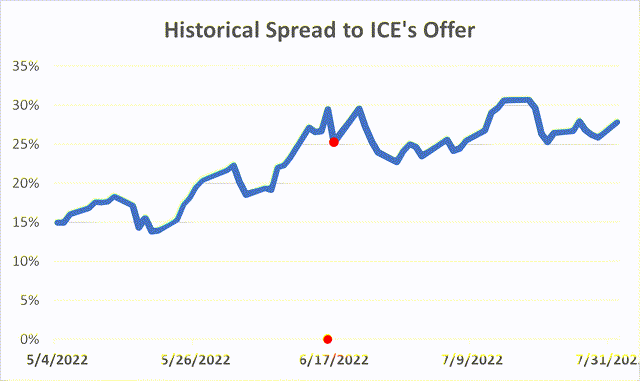

This is a large merger between two leading mortgage software providers. The spread used to fluctuate in the 15%-20% range but widened to 30% during the general market sell-off. At the current spread of 28%, this appears to be an asymmetric risk/return opportunity. If the market continues its bounce back from June lows, I expect the spread to narrow to previous levels.

Yahoo Finance. Note: Red dots represent June 17 – FTC’s second request date

Mortgage tech provider Black Knight (NYSE:BKI) is getting acquired by financial exchange and clearing house giant, Intercontinental Exchange (ICE). The consideration is ~80% cash ($68/share) and ~20% stock (0.144 ICE shares for each one of BKI) – at current prices this equates to $82/share.

The merger has attracted antitrust regulators’ attention – in June, the FTC issued a second request for the companies. Regulator’s inquiry followed a public letter sent by the Community Home Lenders Association (CHLA) who argued that the merger could lead to higher service prices for mid- and small-sized mortgage providers, including independent mortgage banks (IMBs) who are generally unable to build their own in-house software. FTC’s investigation is ongoing and the agency will have 30 days to decide once the companies submit required information. Merger is expected to close in H1’23.

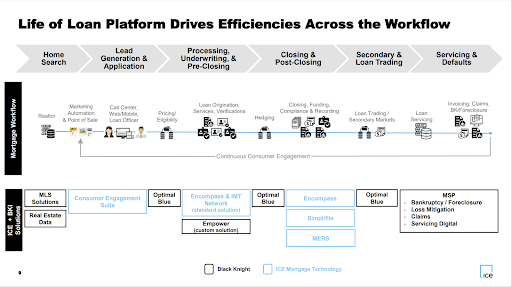

Overall, the transaction seems highly synergistic as mortgage software services provided by both companies align nicely. BKI’s primary focus is on mortgage servicing software while ICE operates mortgage origination software (origination includes lead generation, application and loan underwriting processes). The combined company will be able to more efficiently onboard loans from origination to servicing systems – a benefit for both the software provider and its customers, i.e. lenders. Moreover, both ICE and BKI own other businesses involved in other steps of a mortgage process – for instance, ICE runs electronic signing software Simplifile. Given this, the combined company will be able to integrate numerous platforms that will cover the entire mortgage process (which includes mortgage origination, servicing, settlement and default). Another benefit for the buyer – the merger is expected to raise the recurring revenue share of ICE’s mortgage technology segment from ~50% to ~70%.

ICE and Black Knight Investor Presentation, May 5, 2022

The transaction will require shareholder approval. This seems likely given the offer premium to current share price and the low-cost basis of several major institutional shareholders (a combined 35% stake) who by my estimation are already sitting on 50%+ returns. Shareholders have not voiced any opposition so far. Meeting date has not been set yet.

From an antitrust perspective, horizontal overlap across the two segments (loan origination and servicing) between the companies is rather limited:

-

In the mortgage origination software market, BKI is the third largest player in the segment with a 10% market share but is significantly behind ICE who controls ~50% of the market.

-

In the mortgage servicing segment, BKI had a 56% market share as of 2021 while ICE does not offer any competing platform.

For these reasons, the main risk here is how antitrust regulators will evaluate the degree of vertical integration and its impact on small- and mid-sized lenders. In my view, there are some arguments which suggest the currently priced-in regulatory risk is too high:

-

BKI serves mostly large mortgage providers – reportedly, the company services loans for 23 out of 25 largest industry players. As of 2020, 25 largest lenders have originated ~40% of total home loans (in units). Taking into account BKI’s mortgage servicing software market share (56%) and the fact that the company’s large client base extends beyond the 25 largest companies, exposure to smaller IMBs does not appear to be significant. This suggests that acquiring BKI will not provide ICE a significant market power in the small/mid-mortgage servicing segment – one of the main concerns of CHLA.

-

Likewise, BKI’s presence in the origination software market, despite the seemingly significant market share (10%), suggests the acquisition could have little impact on independent mortgage banks. Apparently, BKI’s origination service client base is limited to less than 2% of ~6500 lenders in the US. The reason for this is that the company’s offerings are very distinct from ICE’s – BKI’s software is customized for each client while ICE focuses on standardized products.

-

Analysis of merger cases reviewed by the FTC since Jan’21 suggest that mergers were mostly blocked due to significant horizontal overlap. Only two transactions involving vertical integration were blocked – Lockheed Martin-Aerojet Rocketdyne and Illumina-Grail. However, both cases involved companies operating in monopolistic markets – this is hardly the case with BKI who has competitors in the mortgage servicing software space. Here it is important to note that the FTC recently withdrew previous vertical merger guidelines. New guidelines are in the making and are expected to be published before the end of 2022 which implies some uncertainty.

-

Fundamentally, the merger will eliminate the so-called double marginalization, i.e. markups that separate entities would impose in the different stages of a mortgage process. Moreover, the transaction is focused on digitalization and process automation which could reduce software product prices. Cost synergies are estimated at $200m over 5 years compared to ~$2.6bn in 2021 pro-forma combined revenue from the mortgage technology segment.

-

CHLA has also argued that the deal will hinder innovation, however, ICE actually operates open networks and gives access to its APIs. Moreover, the buyer has said that it is willing to expand this approach to Black Knight’s products. Given that ICE already runs non-exclusive marketing/distribution partnerships with numerous start-ups, I believe the merger could actually spur innovation in the mortgage tech space.

Both companies have seemed confident in securing the approval. Apparently, before signing the agreement, companies hired third-party experts to evaluate the deal. Due diligence results that followed were very encouraging. From ICE’s CEO remarks (emphasis is author’s):

But what we did is we said to ourselves, before we do a major transaction, we better be pretty sure. So, we told the Black Knight team, we weren’t prepared to go ahead with the deal unless we would – had absolute confidence that you know, this was lawful and legal and in the best interests of the industry. So, we got them to agree to create a clean room. They hired a third party. We hired a third party. We put all of the information – competitive information we could think of into that clean room, asked them for their competitive information. And they had their party, we had our party go through everything independently and give us a view on what – where they thought overlaps might be and how the market would view this, how regulators would view it, what’s lawful. And both parties came back and then told us that they thought this was imminently doable, that there was very little of any overlap, that it was perfectly lawful and it was good for the consumer and good for the industry. And so, it gave us a lot of confidence. So we’ve done a lot of that work already ourselves before we even announced the deal.

Protected Downside

Regulatory pushback on vertical integration remains a risk and merger approval is by no means guaranteed. However, I believe there is sufficient margin of safety here even if the deal breaks:

-

According to the proxy, BKI attracted buyout interests from other buyers. In Jul’21, the company received two merger proposals from an undisclosed technology company and a consortium of three private equity buyers. In Aug’21, the PE consortium submitted a proposal valuing the company at $87.50/share. The deal was rejected by BKI’s Board, however, talks with the consortium re-started earlier this year and in April the buyer group submitted an acquisition offer valuing the company between $73 and $75 per share. Other PE firms were also mentioned among those interested. Overall, this suggests that even if the current deal breaks, BKI could remain a buyout target which suggests that the downside here might be protected.

-

BKI’s stock sell-off amid increasing interest rates and recession fears earlier this year does not seem fully justified. The company has quite a low exposure to housing market cyclicality – BKI signs long-term (4-5 year) recurring revenues contracts which contain a fixed subscription fee (with set annual increases) and activity-based fees (which have a floor). Switching costs seem to be high with a lengthy 12-18 month process. As a result, the company’s revenues have grown steadily at a 7% CAGR since 2015 when BKI was spun-off from Fidelity National Financial. Moreover, increasing foreclosures would be an additional revenue stream. In other words, BKI seems to be well positioned for a potential economic recession which could limit the downside here. ICE’s CEO confirmed this point, adding that the offer is basically intended to snatch BKI on the cheap (emphasis is author’s):

Well, first of all, the best time to buy a business is when others don’t see the vision and so part of it was just an opportunistic moment in time. Black Knight is a company that we followed and it traded at a multiple higher than our company and deservedly so. And for some reason, the market really pushed down their share price in the beginning of this year, even though we had conviction that they were going to be doing well in this environment. And so others that knew the company I think saw the opportunity and suddenly, there were a lot of inbounds to their management team on offers to do other things.

-

BKI’s share price has moved up only 1% since the day before the merger announcement. There are no direct peers, however, most competitors have traded up at least 4%. Share prices of the two seemingly closest peers – JKHY and FISV (who serve the same end markets as BKI and have largely recurring revenues) – have increased 8% and 7%. This could indicate that the downside is already baked into the BKI share price. However, given that this is a hedged trade, it has to be noted that the share price of the buyer, ICE, fell by 12% over the same time – the worst performance among its peers.

|

MLNK |

G |

BKI |

JKHY |

ANSS |

MSCI |

EXPN |

FISV |

|

|

Market Capitalization ($bn) |

1.4 |

8.9 |

10.2 |

15.1 |

24.3 |

38.4 |

26.2 |

67.9 |

|

Enterprise Value ($bn) |

1.7 |

9.7 |

12.9 |

15.3 |

24.4 |

42.2 |

29.2 |

88.5 |

|

Price Change Since May 3 |

5% |

20% |

1% |

8% |

0% |

10% |

4% |

7% |

Source: Company filings.

Price changes of the buyer and its peers:

|

ICE |

LSE |

NDAQ |

CME |

CBOE |

|

|

Price Change Since May 3 |

-12% |

2% |

13% |

-11% |

4% |

Conclusion

In my view, BKI offers an asymmetric risk/reward opportunity. I believe the current spread does not justify the antitrust risk. Meanwhile, BKI’s fundamentals and reported interest from other buyers seem to protect the downside. If the broader market continues to rebound after the sell-off, I think the spread should come back to its initial post-deal announcement levels. For these reasons, I will open a long position in BKI.

Great News

Our new premium marketplace service is on its way to launch on September 15! The marketplace will feature only our highest-conviction special situation investment ideas backed by high-quality/original research. More details are coming shortly so stay tuned!

Be the first to comment