Lacheev

Main Thesis & Background

The purpose of this article is to evaluate the VanEck Vectors Gaming ETF (NASDAQ:BJK) as an investment option at its current market price. This is a broad casino/gaming fund, with an objective to track an index consisting of companies involved in casinos and casino hotels, sports betting, lottery services, gaming services, gaming technology and gaming equipment.

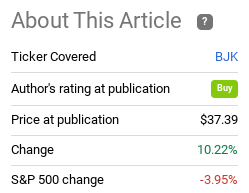

I turned bullish on this sector, and BJK by extension, in the middle of the year. Despite some choppy trading over the past 7 months since that review, the fact is BJK has done quite well. This fund has beaten the S&P 500 handily over that time period:

Fund Performance (Seeking Alpha)

With the new year around the corner, I thought it was time to take another look at BJK. On first glance I assumed it would be time to downgrade my outlook given how wide the spread has been between the fund and the rest of the market. I usually see such “alpha” as a time to take some chips off the table and look for a better entry point later. In fairness, I wouldn’t fault anyone for doing that as market volatility picks up. But my personal view is BJK could have more room to run. The underlying sector has a lot of momentum and there are some definite positives supporting that push. I will discuss each in-depth in the following paragraphs.

Sports Betting Expansion In USA

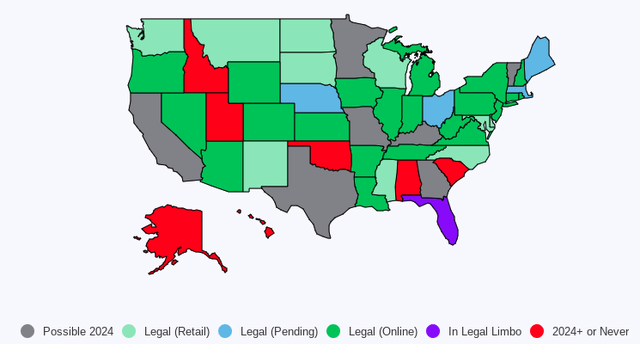

The first topic I will touch on is the rapid expansion of online sports betting (and casino wagering) domestically. While this trend was slow to catch on at first, there have been two developments that I see really benefiting the sector and share prices in the near term. The first is that more states have been jumping on the bandwagon and offering mobile/online wagering. While traditional “casino” bets are only legal in a handful of states, sports betting has been a growing trend from both state governments and U.S. residents. What started with just a handful of states has grown, with more likely to come aboard in 2023 and 2024:

Sports Betting Legality (USA) (PwC)

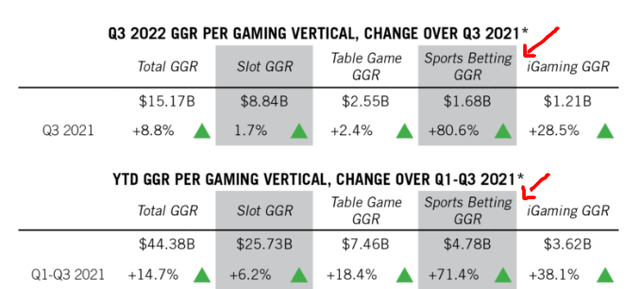

While online sports betting will not be a universal right across the U.S. for a long time (if ever), the expansion into more states throughout every region of the country has its benefits. Not surprisingly, this has led to a sharp uptick on wagering. While 2021 saw a large amount of bets placed across the sports universe, 2022 has seen the sector grow by leaps and bounds:

Sports Betting Growth (YOY) (American Gaming Association)

The positive takeaways here is there have been high sportsbook win percentages (for bookmakers) and also strong growth in existing markets. This has resulted in sports betting setting new records with revenue through September reaching an all-time annual high of $4.78 billion, beating 2021’s full-year record of $4.34 billion. Clearly, this is what investors want to see.

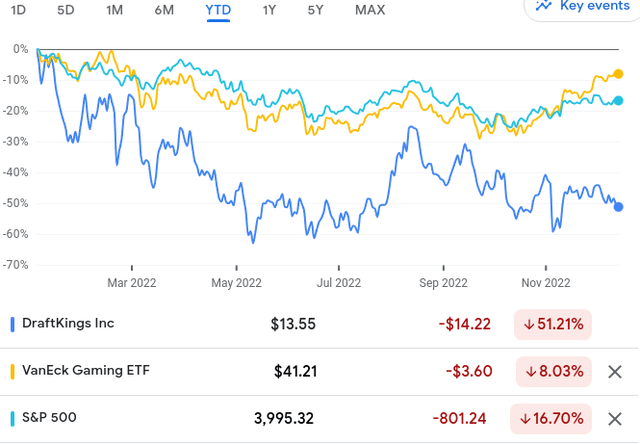

Now it is important to remember this has not come without cost. Revenue is not profit, and these books have been generating a tremendous amount of revenue through bonuses and other promotions to lure in new customers. The end result has been a rocky start for the industry. Last year saw top books lose quite a bit of money due to lucrative promotions and a race to the bottom. Big offenders such as DraftKings (DKNG) are not yet profitable and investors have soured on the prospects as 2022 has gone on (despite the overall sector being up since May as I stated at the beginning of the article):

YTD Performance (Google Finance)

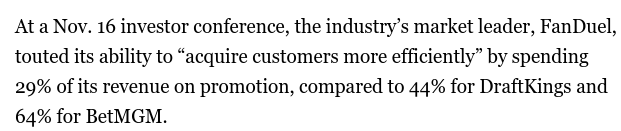

While DKNG is the poster child for excess promotions and heavy stock losses, they are by no means the only ones. BJK is still down for the year and some of the biggest names have spent the last few years spending quite a bit of revenue on customer acquisitions via promotions:

Revenue Spend (FanDuel Investor Conference)

Readers may be asking themselves – how is this good news? On the surface it definitely is not and is a key point to why these names have struggled over the past 12 – 24 months. The silver lining for investors, however, is that the bookmakers have caught on and are lowering their promotion spend. This is point number two to why I like this sector – revenue is growing at a time when customer acquisition spend is also going down. This means profits are finally starting to materialize and are at least trending in the right direction. For this reason I see the expansion of online sports wagering across the country as a bullish signal now, when before it meant amplified losses. This bodes well for BJK going forward.

Optimism On Macao Via China Re-Openings

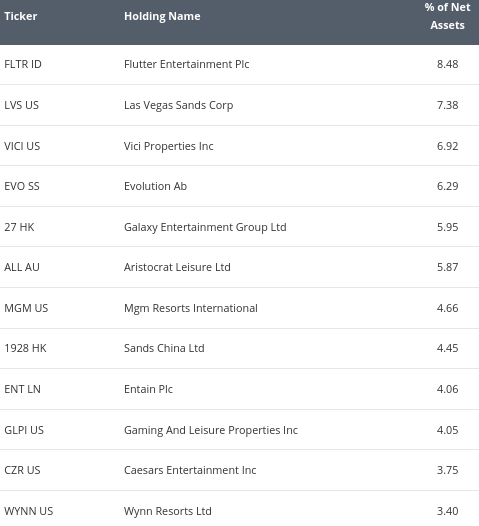

Digging deeper into BJK, readers should remember this is more than just an online wagering play. While this is a growing trend in the U.S. and Canada and also an established theme in Europe, BJK is exposed to traditional brick and mortar casinos as well. Some, such as MGM (MGM) and Wynn (WYNN), among others, have exposure to both online and traditional wagering. So this ETF is a diverse play on the sector – which I prefer:

BJK’s Top Holdings (VanEck)

While I personally see this as a less risky option than a pure e-betting play, such as through Roundhill Sports Betting & iGaming ETF (BETZ), that does not mean this is risk-free. In 2022 the traditional casinos have gotten a boost from an increase in leisure travel in the U.S. into Las Vegas. But the reverse is that these names have suffered in Macao since the region has seen strict pandemic-era measures both there and in mainland China (which it relies heavily on for tourism).

The point is that this investment can work both ways. When times are good and spending are travelling and spending on gambling, then traditional brick and mortar casinos will do well. But when lockdowns persist or a recession hits – watch out. This headwind has been a serious one throughout 2022, especially in Asia. This underscores that while BJK has beaten the S&P 500 this calendar year it is still down since January 1st.

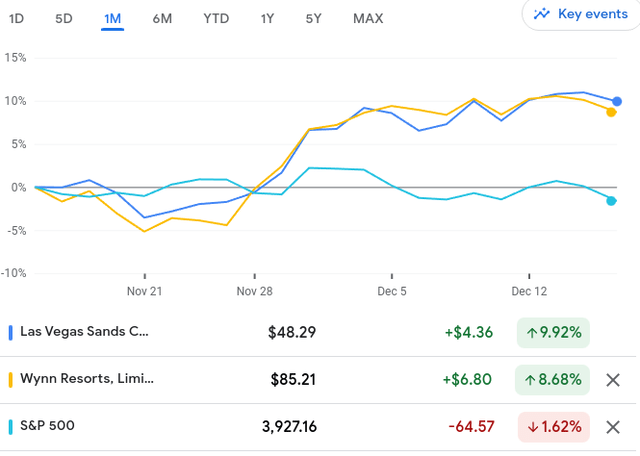

This begs the question: where is the opportunity? This rests almost entirely on Macao and China’s re-opening, which are finally starting to turn the page. I will manage expectations by saying a lot of this is starting to get baked into share prices. Names like Wynn and Las Vegas Sands (LVS) that have a lot of exposure to Macao have been soaring of late:

1-Month Return (Google Finance)

My point here is that while I remain bullish on the sector, I wouldn’t get carried away with new positions. If one is new to this idea, I would ladder in, because we will probably see a fair amount of volatility as the Chinese government’s re-opening plans get hashed out. But I still see a general trend upward, and that is the broader point.

Chief among the tailwinds to emphasize was China’s announcement of easing travel restrictions. While this has implications across the country, for this review I would focus on the impact to Macao, since that is most relevant for BJK. Specific items include:

- Allow tour groups into Macao, the world’s largest gambling jurisdiction

- The removal of ongoing testing requirements for mainlanders after they enter Macao

- Removal of a requirement to scan into venues before entering

The conclusion I draw is that Macao is set to see a surge in visitation after China has been disproportionately locked down for a long time. This is a welcome sign for casino operators on the island and will directly impact BJK in a positive way in the months to come.

Consumer Sentiment / Inflation Are Risks

So far, I have taken a fairly bullish tone on gaming and BJK and I stand by that outlook. But I am not going to suggest this is a risk-free idea. This is a risk-on investment theme even in the best of times, and that is certainly the case now with so much uncertainty in the world going into 2023. With inflation continuing to crimp discretionary spend, consumers worried about the job market in the new year, and the potential for stricter Covid policies in China at a moment’s notice – this ETF is fraught with risk. This risk has been worth the reward since May, but let us not be blind to the challenges facing the sector.

The challenges are multi-fold. When recessions hit, visits to discretionary and expensive destinations like Las Vegas (and other casino hotspots) can take a hit. I presume that Macao helps to deflect some of this domestic risk, but a challenging domestic gaming environment is not ideal for BJK regardless. Further, while spend is down across e-betting platforms, costs for customer acquisition costs are still quite high. This poses challenges for companies trying to grow their consumer base. And a recession in the U.S. won’t help matters in this regard either. Finally, European markets remain under pressure due to the Russia-Ukraine military conflict, higher interest rates there, and a worrying energy crunch this winter. This could pressure sports betting and gaming in that mature market and also be a drag on BJK.

What I am trying to get across is that investors need to recognize the risks and not blindly enter this space. BJK has been a winner in the second half of the year and that momentum could easily push into early 2023. But there are headwinds that could derail this optimistic outlook quite easily. Keep this in mind, pace yourself with entry points, and don’t forget that betting on the house is not always a sure thing!

Bottom-line

BJK has had a good run and I see signs it could keep going. With interest rates still going up and inflation uncomfortably high, readers should approach all equity plays with some level of caution. But BJK’s out-performance since the middle of the year sets it up nicely to keep pushing higher in Q1 next year. China is the big catalyst, so I will be monitoring any backsliding with respect to lockdowns very closely. But as long as the re-opening theme dominates the headlines, it provides a nice hedge against slowing growth in the U.S. and Europe. Therefore, I will reiterate my “buy” call on BJK, and suggest readers give this idea some consideration at this time.

Be the first to comment