Chayanan/iStock via Getty Images

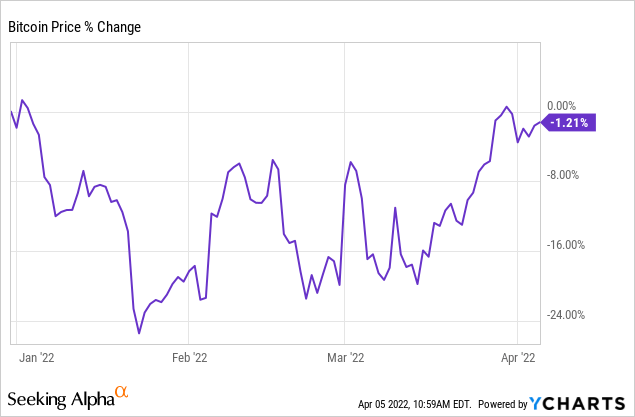

Bitcoin (BTC-USD) has regained prominence after a tough start to the year, but it remains to be seen whether its price surge is sustainable or if it was an overhyped “buy the dip” moment after the financial markets sold off due to a variety of systemic shocks. We’ve been able to identify a few key influencing factors and thought it would be helpful to provide the public with our findings. We think the largest cryptocurrency in the world could sustain its recent performance in the medium term; here’s why.

Key Drivers

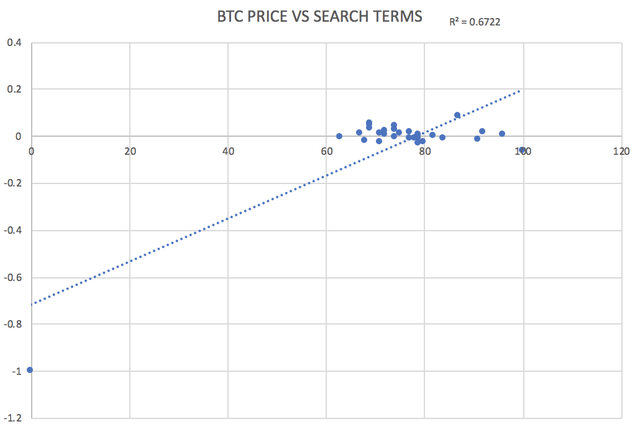

It should come as no surprise that a community-driven asset has coincidentally surged along with an increase in its online searches. I modeled the past 30 days’ Bitcoin returns and calculated its explained variance with a linear regression in Excel.

The regression shows that there’s a 67.22% certainty that search terms can explain Bitcoin’s price movement during the past month.

Author’s Calculations with data from Yahoo

The comparison between search terms and Bitcoin’s price is certainly valid; however, it remains coincidental, and it’s really about what led to the abundance of google-searched during the past month.

The most helpful analysis would be to observe the yield curve’s relation to the war in Ukraine and the broad-based market sell-off earlier this year.

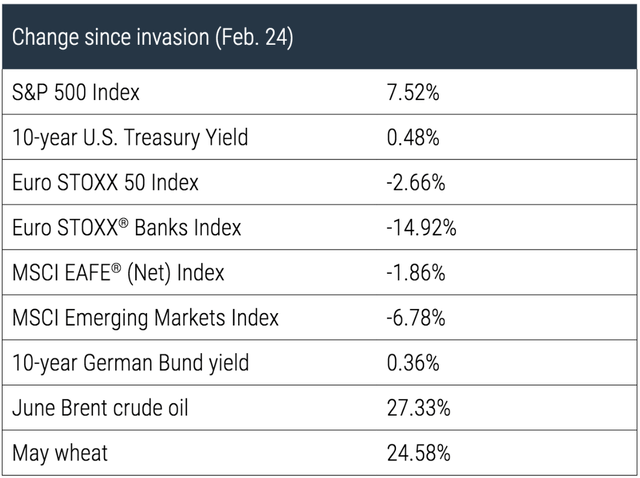

According to Carillon Tower Advisers, equities and other risky assets such as Bitcoin suffered from a market reaction to a “worst-case scenario” during February and early on in March.

Since the 24th of February, the yield curve has stabilized and now holds a flat to moderately upward sloping curve, indicating stable overall economic conditions.

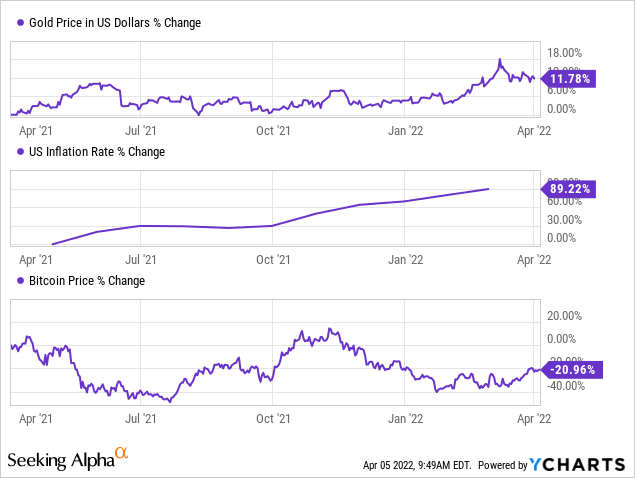

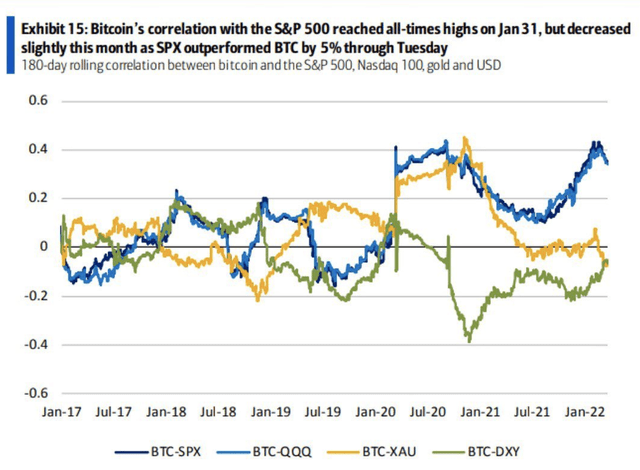

We’ve recently seen an increasing correlation between Bitcoin and the Nasdaq, suggesting that Bitcoin as a previous inflation hedge may now be considered a “tech stock esque” investment for market participants. This may sound odd to many. However, the influencing variables of assets change with time.

It’s also clear that a negative correlation between Gold and Bitcoin has developed recently. In turn, Gold has returned as the cornerstone inflation hedge during the past year, while Bitcoin has voided its role as an inflation hedge and has started trading like a high-risk tech stock instead.

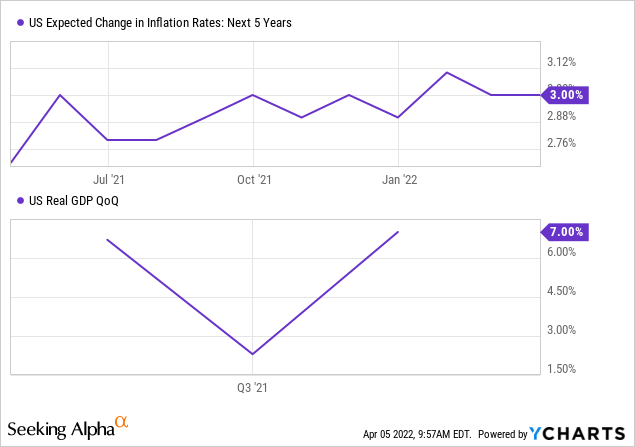

Although supply-chain bottlenecks have been exacerbated with sanctions on Russian energy resources, the market seems to believe that matters have again been thought of as a “worst-case scenario”. Inflation will likely remain high but not as high as most believe.

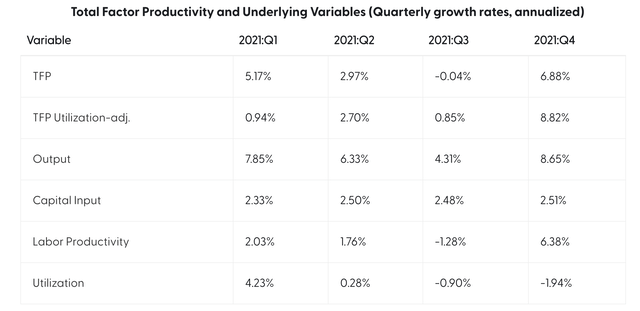

We see inflation as a temporary threat because real GDP in the U.S. is surging with 7% year-over-year growth, and this could sustain itself for quite some time, especially considering the robust technological improvements that society yielded during the earlier stages of the pandemic.

A growing real GDP doesn’t necessarily lead to further growth in broad-based inflation, as much of the recent inflation has been down to push inflation. If economies continue to re-open and upstream operations experience better capacity utilization, we could see an economy with lower inflation growth but higher real GDP growth.

The market is probably overestimating inflation, which could aid technology stocks when everyone comes to their senses. A second matter that could boost technology bets is the total factor productivity, which explains the proportion of the GDP attributable to technological advances. This datapoint ultimately provides a tailwind to tech stocks. If Bitcoin sustains its correlation to the Nasdaq, we could see it surge in conjunction with technology stocks, considering the TFP has found prominence again after flatlining for a while (note that Q-1 2022 data isn’t yet available).

Momentum

Momentum is one of the most overlooked factors in the market. Mark Carhart developed the 4-factor pricing model in 2014, which trumped all the previous asset pricing models due to the simple fact that it considered momentum.

Furthermore, Professor Elroy Dimson of Cambridge University accredited momentum-based investing by stating that: “stocks that beat the S&P 500 in the preceding 12-months are likely to gain 17.5% on average in the following year.”

Many may question whether Professor Dimson’s findings are applicable to Bitcoin. Well, I’ll justify it by reverting to Bitcoin’s growing correlation with stock indices that I mentioned earlier in the article.

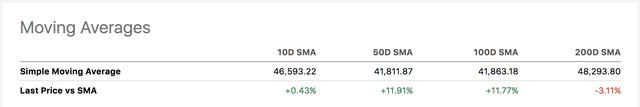

To finish this segment, Bitcoin’s trading above its 10-, 50-, and 100-day moving averages suggests that a momentum pattern has formed. The pattern is likely sustainable if our economic analysis holds true barring any additional geopolitical friction.

Risks

The most significant risk that we’ve come across with Bitcoin is the inconsistency of its influencing variables. The asset has experienced various price surges but for different reasons. The common denominator seems to be political influences and abrupt changes in economic policies.

However, it’s clear that Bitcoin’s key drivers are inconsistent, making any analysis of the asset a lot more subjective than an analysis of stocks or bonds.

Finally, although we believe that Bitcoin has gotten too large to regulate with hard lines, it’s evident that much of the cryptocurrency space is still being increasingly regulated. The asset class correlation could have a systemic effect on Bitcoin, thus making it a less lucrative investment.

The Bottom Line

Bitcoin has become increasingly correlated to high beta technology stocks as shown by its correlation to the Nasdaq. Simultaneously the asset has disconnected itself as an inflation hedge while gold has regained its status as the ultimate inflation safety net. We believe that Bitcoin can sustain its recent momentum based on the macroeconomic outlook and the likelihood of a sustained momentum pattern.

Be the first to comment