OlgaMiltsova

Everyone thinks of changing the world, but no one thinks of changing himself.” – Leo Tolstoy

Today, we put Biora Therapeutics (NASDAQ:BIOR) in the spotlight for the first time this year. When we last looked at this entity in the fourth quarter of last year, it was still transitioning from being an entity called Progenity (PROG). The company was in the middle of transforming from its focus as a genetic testing company to being a company focused on developing its drug candidates. Second quarter results just hit the wires this week. Therefore, it seems an opportune time to peak back in on this small cap concern and check in on how its transformation is proceeding. An analysis follows below.

Company Overview:

August Company Presentation

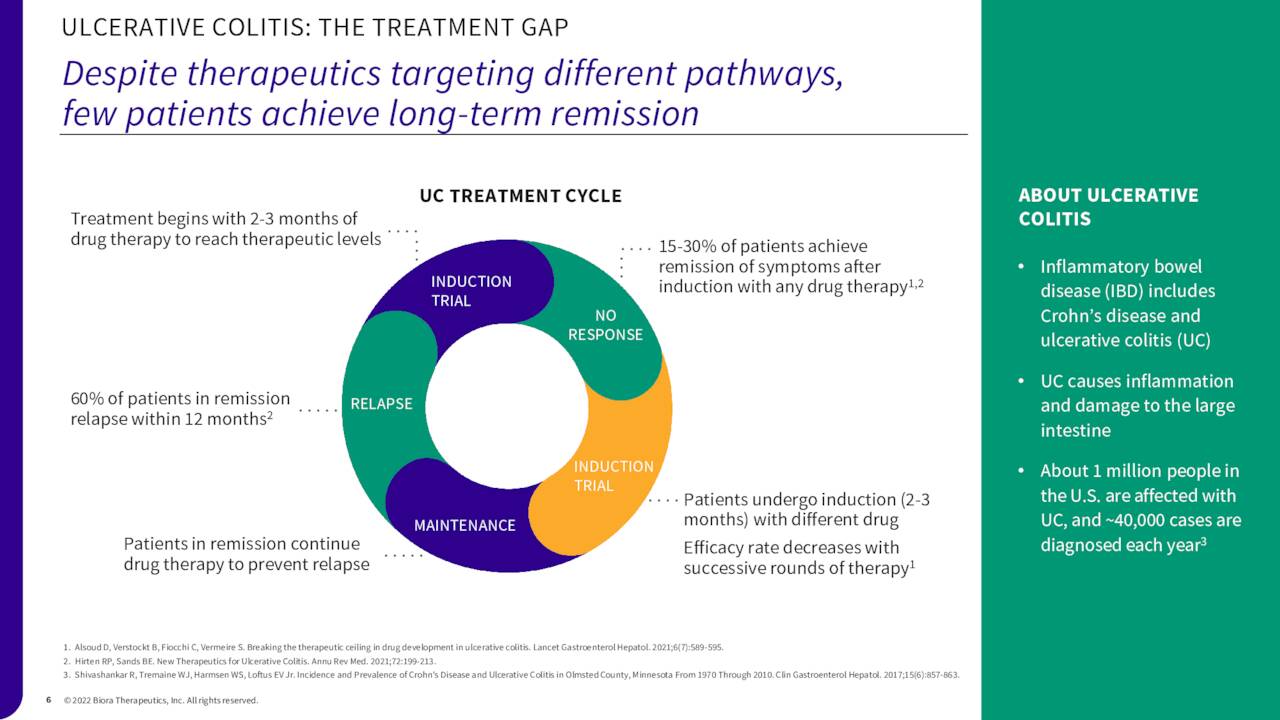

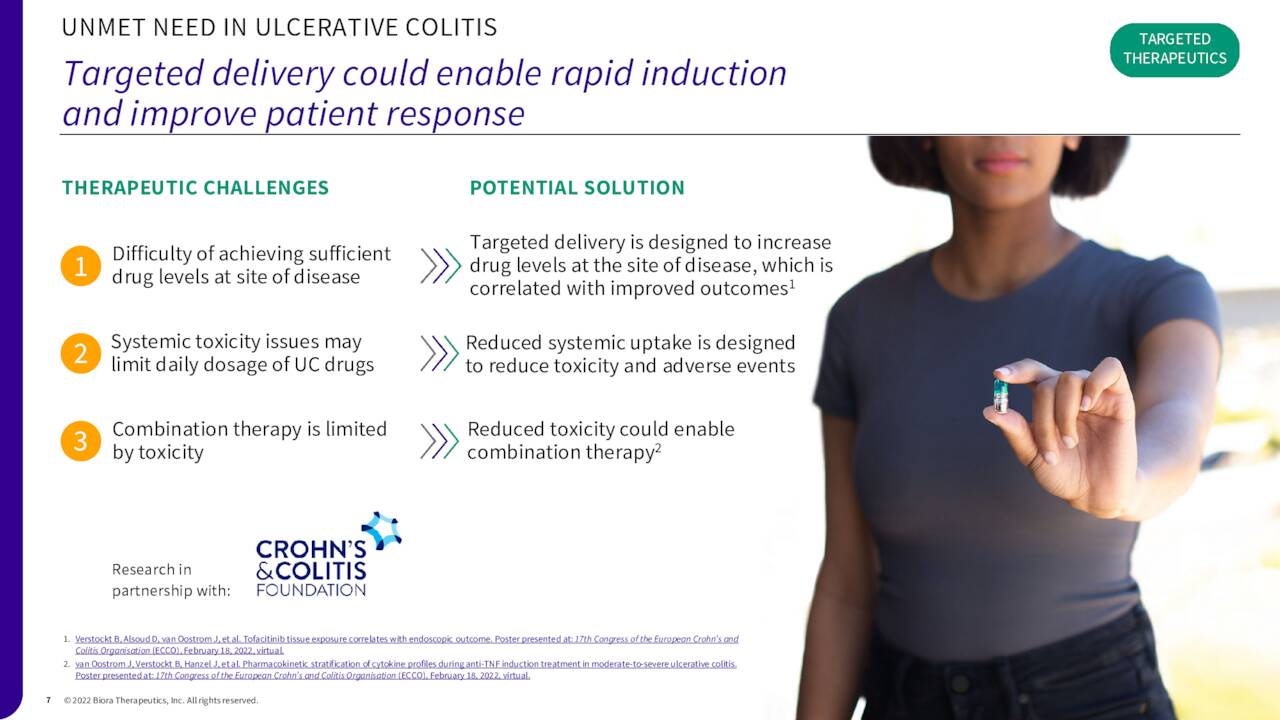

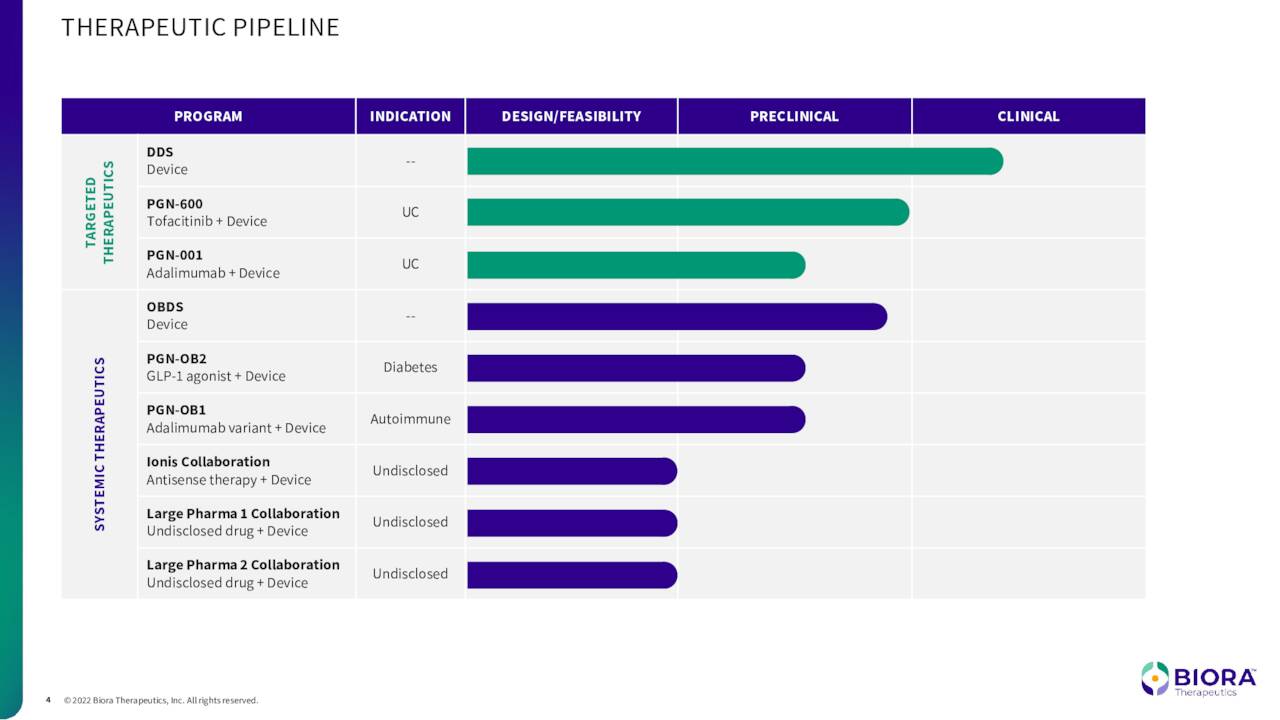

The refocused Biora Therapeutics is still based in San Diego. The company’s targeted therapeutics program uses an ingestible smart capsule for targeted delivery of therapeutics in the GI tract to enhance the treatment of inflammatory bowel diseases. Leadership believe this approach has plenty of potential targets, including holding great promise to more effectively treat Ulcerative Colitis, a large indication. It also is targeting IBD. According to management on its last earnings conference call.

Annual global sales for UC drugs are estimated to be approximately $7 billion and the inflammatory bowel disease or IBD space overall is about $19 billion globally. “

August Company Presentation August Company Presentation

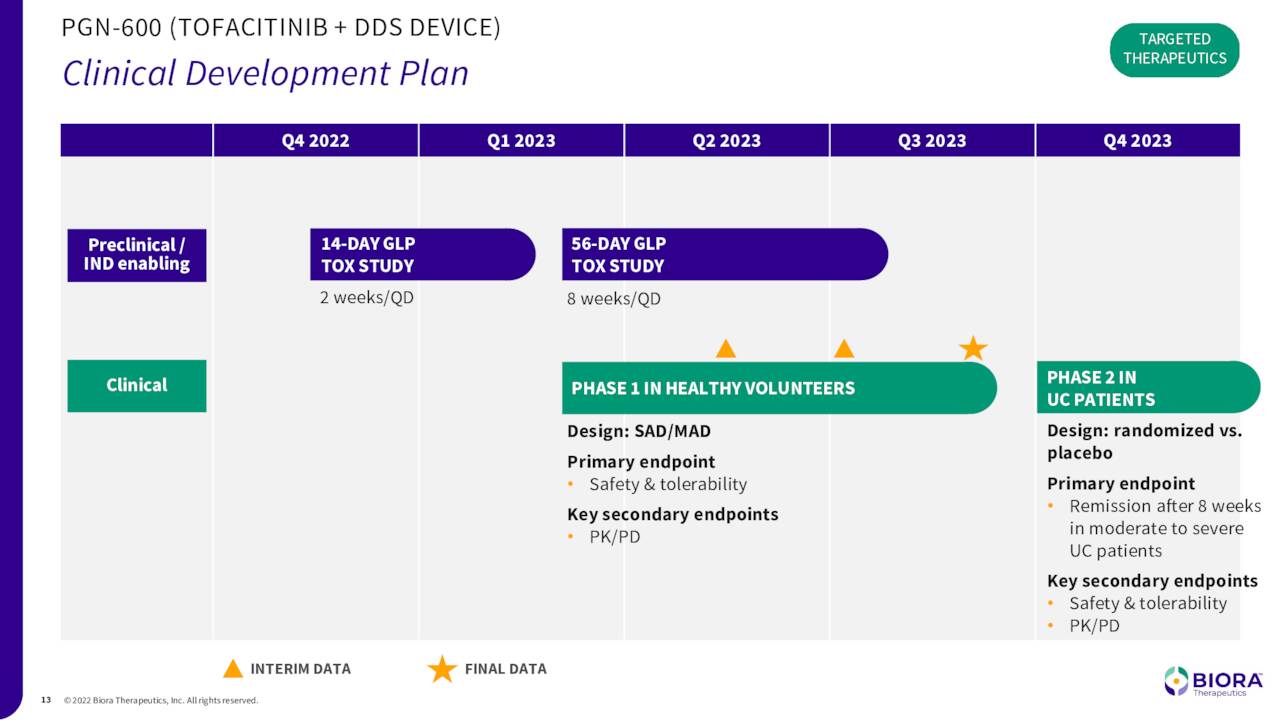

Here is the current development plan for the most advanced candidate in this developmental area, PGN – 600, which is combination of Biora’s device and their proprietary formulation of tofacitinib.

August Company Presentation

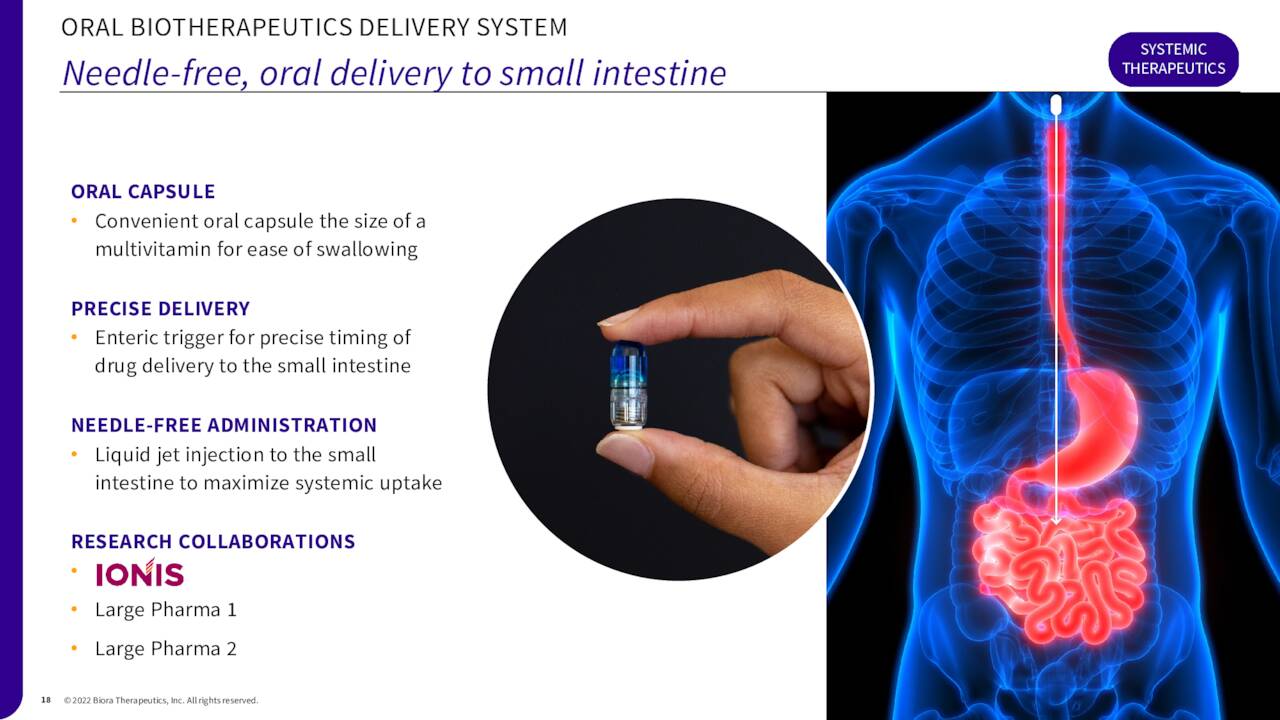

The company is also focused on an oral delivery approach via ingestible capsules as an alternative to intramuscular injectable vaccines. This method could eventually see use for proteins as well as monoclonal antibodies.

August Company Presentation

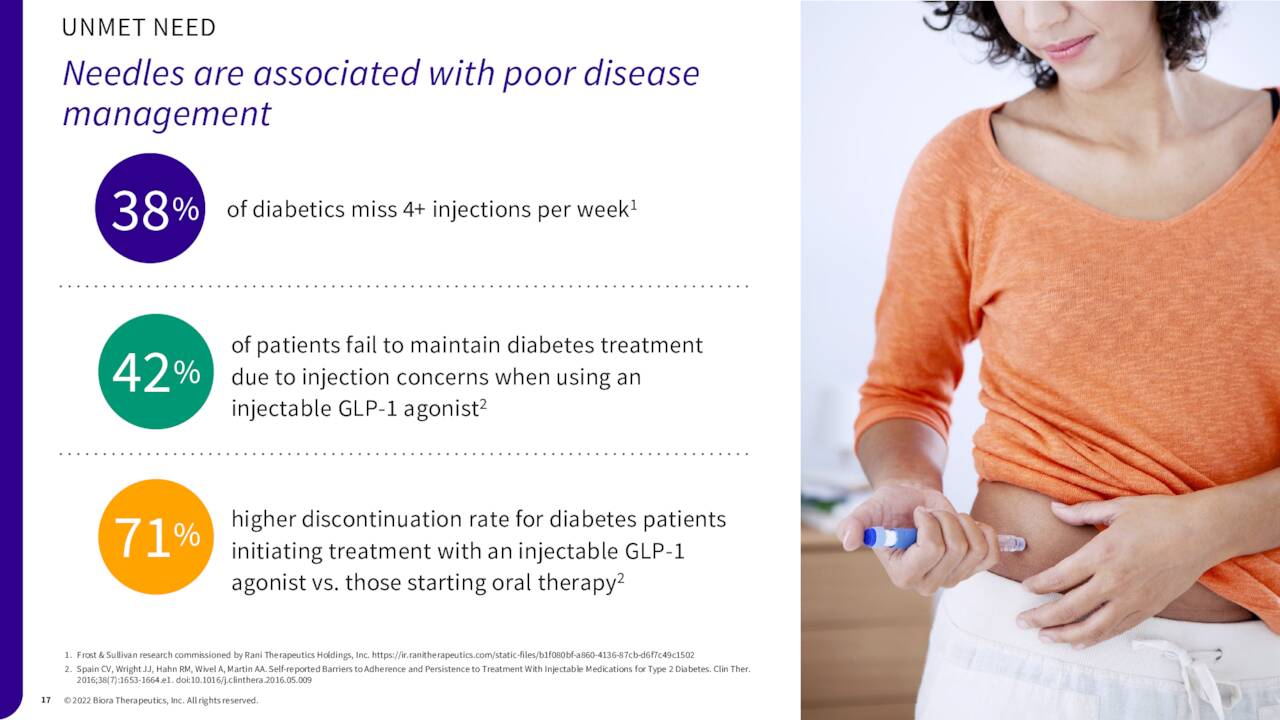

The replacement of needle injection via an easy to take oral capsule could yield more effective results in a variety of disease areas. The company has a research collaboration with Ionis Pharmaceuticals (IONS) in these initial efforts. Preclinical activities should run into the third quarter of 2023, and are scheduled to start early stage clinical activities by the end of that year. The company estimates the area of the diabetes market it is targeting to be well over $20 billion by 2025.

August Company Presentation

Management believes the management of diabetes could be vastly improved to name one large target area.

August Company Presentation

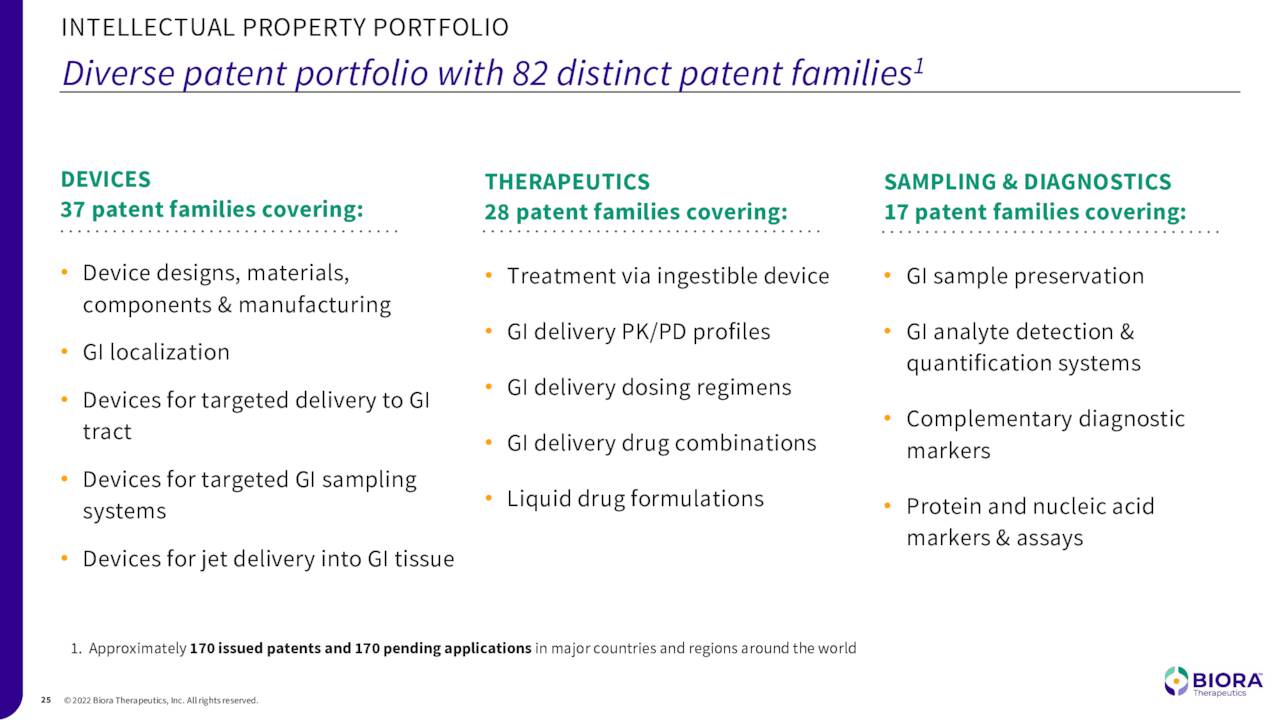

With two core developmental focus areas, the company has numerous candidates in the pipeline. The company’s portfolio has numerous patents around the company’s intellectual property. That said, its candidates all in the very early stages of the long developmental lifecycle as can be seen above.

August Company Presentation

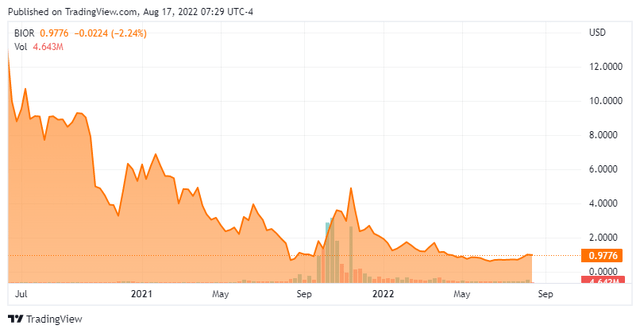

The company has a few product candidates in the pipeline. The stock currently trades right near a buck a share and sports an approximate market capitalization of $180 million.

Analyst Commentary & Balance Sheet:

On May 3rd, BTIG initiated the shares with a Buy rating and $4 price target. Here is the commentary at the time from their analyst.

Biora has pivoted from primarily being a diagnostic and tools company to building out a “potentially powerful drug R&D engine,”. The analyst sees the stock “trading at a large discount with substantial room for long-term upside” as Biora’s platform potential becomes better understood by investors.”

H.C. Wainwright also reissued its Buy rating and $6 price right after second quarter results posted. Those are the only analyst ratings I can find over the past six months.

Just over one out of every ten shares is currently held short. There was one small under $5,000 sale of stock earlier this month by a company director. That is the only insider activity in the shares so far in 2022. The company posted a net loss of $5.5 million in the second quarter despite operating and other costs running just north of $20 million for the quarter. Operating costs did fall considerably in the quarter from the first quarter. Leadership believes it can get monthly operating costs down to $4 million by the end of the year. Biora ended the second quarter with just over $48 million in cash and marketable securities on the balance sheet. Management believes it has cash on hand to ‘get well into 2023‘.

Verdict:

Biora has some potential intriguing technology that could hold considerable long term promise given the large indications it is targeting. The issue around owning the stock is everything in the company’s pipeline is in extremely early stage development. Any potential product is many, many years from any potential commercialization. Outside a significant new collaboration partner for development or significant payouts from existing ones, Biora is likely have several additional capital raises before any potential product hits the market. Meaning any shareholder is risking seeing substantial capital dilution before the company’s gets anything over the ‘finish line‘ with the FDA. Therefore, the stock only merits a small ‘watch item‘ position by long term investors comfortable with that sort of risk/reward profile.

The snake which cannot cast its skin has to die. As well the minds which are prevented from changing their opinions; they cease to be mind.” – Friedrich Nietzsche

Be the first to comment