When you sell in desperation, you always sell cheap. – Warren Buffett.

When you invest in biotech, it’s important that you know the investment thesis (i.e., the story of why you invest in the stock). That way, you can best follow the story over time to see if you should continue to hold, reduce, or add more shares to your positions. As you can appreciate, adjusting your positions based on the fundamentals are imperative to long-term investing success. After all, there can be many changes to a biotech’s investing story amid the clinical data release, FDA approval, marketing partnership, etc.

That being said, I’d like to revisit an orphan disease innovator known as BioCryst (BCRX). As a promising growth company, BioCryst enjoyed its taste of regulatory and some market success. Nevertheless, there are recent changes that can affect the investment thesis. In this research, I’ll feature a fundamental analysis of BioCryst and share with you my expectations of this intriguing growth equity.

StockCharts

Figure 1: BioCryst stock chart

About The Company

As usual, I’ll deliver a brief corporate overview for new investors. If you are familiar with the firm, I suggest that you skip to the subsequent section. Operating out of the Research Triangle Park, North Carolina, BioCryst dedicates its laser beam focus on the innovation and commercialization of novel medicines to serve the unmet needs in orphan (i.e., rare) diseases.

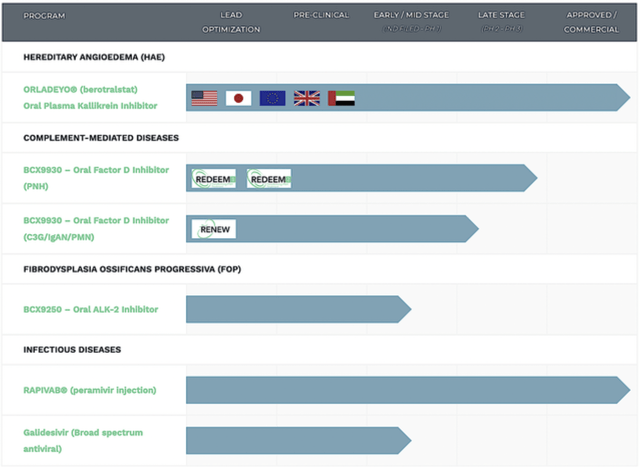

As the crown jewel of this pipeline, berotralstat (Orladeyo) is approved for the treatment of a rare condition coined hereditary angioedema (i.e., HAE) in the U.S., EU, Japan, Canada, and recently Switzerland. Notably, Orladeyo is now available for both adults and kids 12 years and older.

BioCryst

Figure 2: Therapeutic pipeline

Orladeyo for Hereditary Angioedema

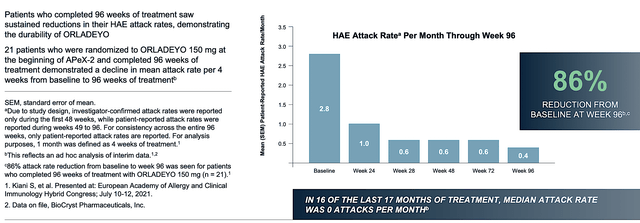

As Orladeyo is crucial to BioCryst’s growth, you should first analyze its latest development. Underlying Orladeyo’s robust growth is the excellent efficacy and safety data. As you can see below, Orladeyo posted an 86% reduction in HAE attacks. The drug is also well tolerated with minimal adverse effects.

BioCryst

Figure 3: Orladeyo efficacy (Source: BioCryst)

Over a year into the launch, Orladeyo already generated $49.7M in sales growth for 1Q2022 compared to $10.9M for the same period a year prior. The 161.3% year-over-year (YOY) growth rate is quite substantial. As a general-rule-of-thumb, I believe that a drug with great efficacy/safety would continue to garner steady growth even when it doesn’t have a large sales/marketing partner.

While discussing sales growth, it is interesting to note that Orladeyo’s growth is split 50/50 between new and recurring prescribers. That data point tells you two things. One, the drug has a loyal following with happy patients and physicians. Two, the company’s sales/marketing team is able to continue pushing Orladeyo to new offices.

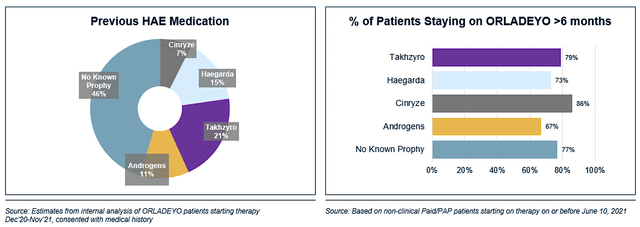

That aside, 50% of patients on Orladeyo have switched from another therapy, of which half are switched from lanadelumab (Takhzyro). Specifically, most patients who switched to Orladeyo remained on the drug for over six months. In my opinion, the switch/stay is proof in the pudding that patients prefer Orladeyo over conventional drugs.

BioCryst

Figure 4: Orladeyo switch statistics (Source: BioCryst)

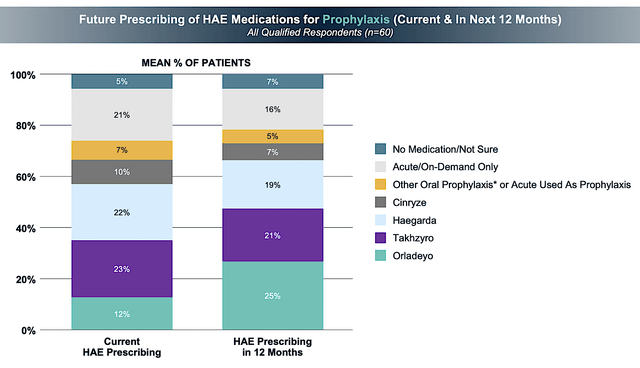

And, if the aforesaid trend continues into the next few years, you can expect that Orladeyo would have the most dominant market shares of HAE. For Fiscal 2022, BioCryst projected that Orladeyo sales would reach over $250M. You can bet that Orladeyo would reach that mark because the company recently conducted a survey on allergists/immunologists that revealed highly favorable results.

BioCryst

Figure 5: Prescribing survey (Source: BioCryst)

In the aforesaid survey, there was a consensus among the docs (who treat on average seven HAE patients) that Orladeyo prescription would double over the next 12-months. The fact that Orladeyo is also recently approved in Switzerland supports the robust sales increase going forward. Commenting on the recent approval, the CEO of BioCryst Pharma Deutschland GmbH (Waldemar Heiduk) noted:

We have made significant progress in making Orladeyo available to many patients in Europe since we received European Commission approval of our oral, once-daily prophylactic therapy last year. With today’s announcement, we look forward to launching Orladeyo in Switzerland soon, pending finalization of our reimbursement plans.

What’s better than the Switzerland approval is the fact that BioCryst also secured a sales/marketing partner with Pint Pharma for Orladeyo in the pan-Latin America region. I’m highly in favor of a small company to leverage on the large/robust sales/marketing partner. After all, there is already an established network of sales/marketing forces to quickly deliver the drugs to countless physicians and patients.

BCX9930 Status

As you already know, Orladeyo’s development is on track. And, the story on that front is going even better than I expected. Now, the challenging part to this growth story is BCX9930. As such, it’s important that you dig through the bottom line of the BCX9930 developments. That way, you can determine where this growth story is unfolding.

Accordingly, BioCryst surprised investors on April 08 by noting that the company had paused the REDEEM trials. Moreover, the FDA subsequently placed a “partial clinical hold” on those studies. As you can see, this is related to the elevation of creatinine in patients taking the high dosage (i.e., 500mg BID or twice a day).

Of the three patients in the said studies, all of their creatinine already normalized. Now, two patients discontinued treatment while the other one who had just a slight creatinine elevation is still using the drug. Notably, BioCryst estimated that a third of all patients in REDEEM experienced a rising creatinine level. Similarly, BioCryst observed this trend for patients on the high dosage (i.e., 500mg BID) in a long-term extension trial.

Keep in mind that the rising creatinine did not occur for lower dosage. While this seems frightening, it’s not as bad as you believe. Creatinine is a protein that is released by your kidneys. And, creatinine elevation can occur due to various factors such as a prolonged run, taking Tylenol or doing anything that exerts stress on the kidneys. Another approved medicine for diabetes (i.e., metformin) can cause rising creatinine with prolonged use. Your physicians simply have to follow the creatinine level and adjust the metformin dosage accordingly.

What is significant here is that only the higher dosage causes rising creatinine. On the other hand, if the low dose also causes creatinine elevation then the drug is no good. As the company goes back to the FDA to amend the study protocols to use only the low to mid dosages, I believe that this problem should be ameliorated. Commenting on this situation, the President and CEO (Jon Stonehouse) remarked,

We also have made substantial progress in our investigation with BCX9930. Based on our initial findings, we believe that both dose and dosing regimen could be contributing factors to the safety signal we have observed. By the end of the third quarter, we plan to discuss our proposed approach to resume the REDEEM trials, under a revised dosing protocol, with regulators.

Competitor Landscape

Regarding competition, Orladeyo competes with many conventional drugs for HAE. They include Takhzyro, Haegarda, cinryze, androgens, etc. Nevertheless, most patients on these molecules are now switching Orladeyo. As you recall, the prescribers survey also forecasted that Orladeyo would trump competitors to double in prescription in the next 12-months.

Financial Assessment

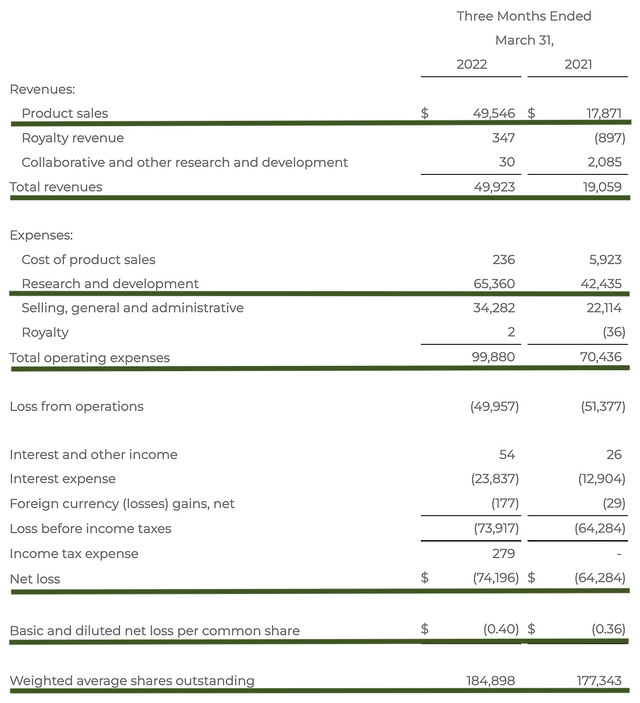

Just as you would get an annual physical for your well-being, it’s important to check the financial health of your stock. For instance, your health is affected by “blood flow” as your stock’s viability is dependent on the “cash flow.” With that in mind, I’ll assess the 1Q2021 earnings report for the period that ended on March 31.

As follows, BioCryst procured $49.9M in revenues compared to $19.05M for the same period a year prior. As you know, Orladeyo sales consisted of the bulk revenues (i.e., $49.5M). The 161.3% YOY sales growth is a testament to the therapeutic prowess of this drug.

That aside, the research and development (R&D) for the respective periods tallied at $65.3M and $42.4M respectively. I view the 54.0% R&D increase positively because the capital invested today can turn into blockbuster profits tomorrow. After all, you have to plant a tree to enjoy its fruits.

Additionally, there were $74.1M ($0.40 per share) net losses compared to $64.2M ($0.36 per share) net declines for the same comparison. As the company increased its R&D investment, it made sense for the bottom line depreciation to widen. Over the years (as BioCryst continues to grow), you can expect a positive net earnings due to the economy of scale.

BioCryst

Figure 6: Key financial metrics (Source: BioCryst)

About the balance sheet, there were $446.8M in cash, equivalents, and investments. On the projected $250M annual revenue (i.e., $49.5M quarterly revenue) and the estimated $480M annual OpEx (i.e., $99.8M quarterly OpEx), there should be adequate capital to fund operations into 3Q2024. Simply put, the cash position is strong relative to the burn rate.

While on the balance sheet, you should check to see if BioCryst is a “serial diluter.” After all, a company that is serially diluted will render your investment essentially worthless. Given that the shares outstanding increased from $177.3M to $184.8M, my math reveals a 4.2% annually dilution. At this rate, BioCryst easily cleared my 30% cut-off for a profitable investment.

Valuation Analysis

It’s important that you appraise BioCryst to determine how much your shares are truly worth. Before running our figure, I’d like to share with you the following:

Wall Street analysts typically employ a valuation method coined Discount Cash Flows (i.e., DCF). This valuation model follows a simple plug-and-chug approach. That aside, there are other valuation techniques such as price/sales and price/earnings. Now, there is no such thing as a right or wrong approach. The most important thing is to make sure you use the right technique for the appropriate type of stocks.

Given that developmental-stage biotech has yet to generate any revenues, I steer away from using DCF because it is most applicable for blue-chip equities. For developmental biotech, I leverage the combinations of both qualitative and quantitative variables. That is to say, I take into account the quality of the drug, comparative market analysis, chances of clinical trial success, and potential market penetration. For a medical diagnostic device, I focus on market penetration and sales. Qualitatively, I rely heavily on my intuition and forecasting experience over the decades.

Be the first to comment