Sean Anthony Eddy/E+ via Getty Images BioCryst

When you sell in desperation, you always sell cheap. – Warren Buffett.

Author’s Note: This is an abbreviated version of an article originally published in advance inside Integrated BioSci Investing for our members.

In biotech investing, you should always pay attention to “pipeline shuffling.” For instance, a drug development termination usually means a value depreciation of your investment. Nevertheless, there are situations in which it’s prudent for the management to cut further advancement of a molecule. Here, they can conserve cash to advance another more promising replacement drug.

That being said, BioCryst Pharmaceuticals, Inc. (NASDAQ:BCRX) recently canceled all developments centering on its lead developmental franchise (BCX9930). On the surface, that might sound terrible to investors. Nevertheless, I believe this is an excellent corporate development for the company. In this research, I’ll feature a fundamental analysis of BioCryst while focusing on the latest pipeline development.

Figure 1: BioCryst stock chart.

About The Company

As usual, I’ll deliver a brief corporate overview for new investors. If you are familiar with the firm, I suggest that you skip to the subsequent section. I noted in the prior article:

Operating out of the Research Triangle Park, North Carolina, BioCryst dedicates its laser beam focus on the innovation and commercialization of novel medicines to serve the unmet needs in orphan (i.e., rare) diseases. As the crown jewel of this pipeline, berotralstat (Orladeyo) is approved for the treatment of a rare condition coined hereditary angioedema (i.e., HAE) in the US, EU, Japan, Canada, and recently Switzerland. Notably, Orladeyo is now available for both adults and kids 12 years and older. [There are also other molecules to power long-term upsides).

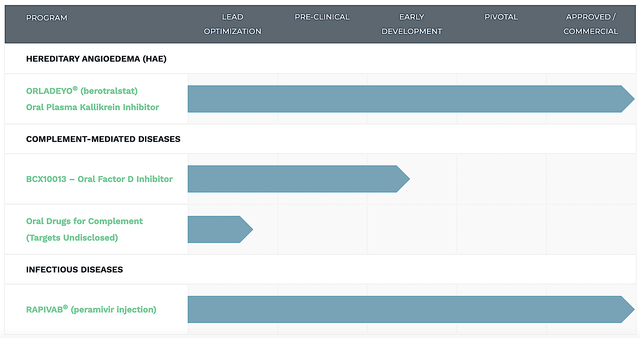

Figure 2: Therapeutic pipeline (Source: BioCryst).

Silver Bullet For Hereditary Angioedema

To better appreciate Orladeyo’s prospects, you should go over the underlying science of hereditary angioedema. As a chronic condition, HAE is caused by either a low-level or malfunctioning of the protein (C1 inhibitor) of the complement cascade. The aforesaid deficiency causes periodic attacks that result in rapid swelling of the hands, feet, limbs face, windpipe, voicebox, etc.

During the episode, the patient is treated with IV fluids and pain medicine. In severe cases, epinephrine is used to prevent further fluid losses. As for preventative (i.e, prophylaxis) measures, androgen like danazol are previously used to boost the production of C1 inhibitors. Nowadays, you can use medicines such as Cinryze, Berinert, Ruconest, Kalbitor, and Firazyr.

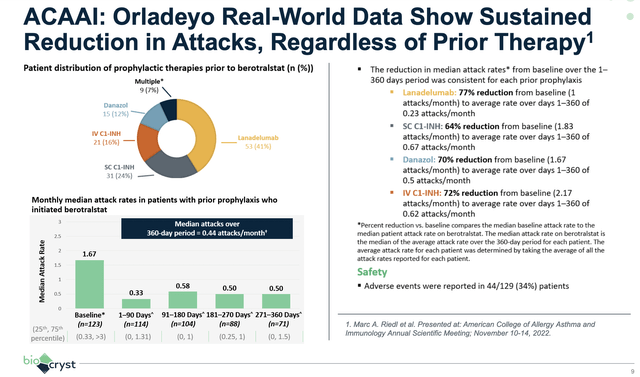

As shown below, no matter which prior therapy the patients received, treatment with Orladeyo results in an extremely robust reduction in attacks. Precisely speaking, patients on Ordelayo enjoyed 64% to 77% attack reductions. With such a strong efficacy profile, you can bet that Orladeyo would trump other prophylactic drugs.

Figure 3: Orladeyo’s therapeutic prowess

Orladeyo Commercialization Progress

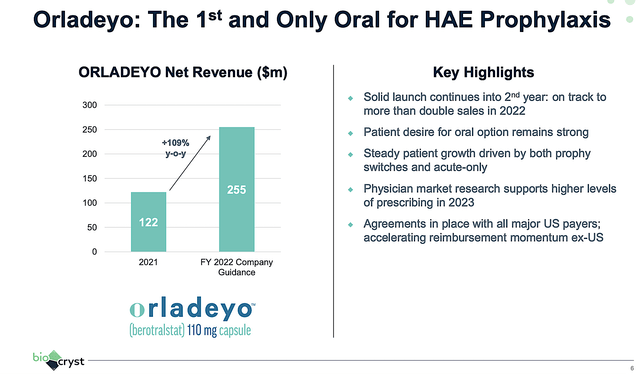

Riding therapeutic prowess, Orladeyo is delivering robust sales figures. For Fiscal 2022, Orladeyo is expected to generate $255M. Therefore, that would represent a 109% year-over-year (YOY) increase from the $122M for Fiscal 2021. On that trajectory, Orladeyo is already 1/4 of a blockbuster in just two years into launch.

Figure 4: Orladeyo’s great prospects.

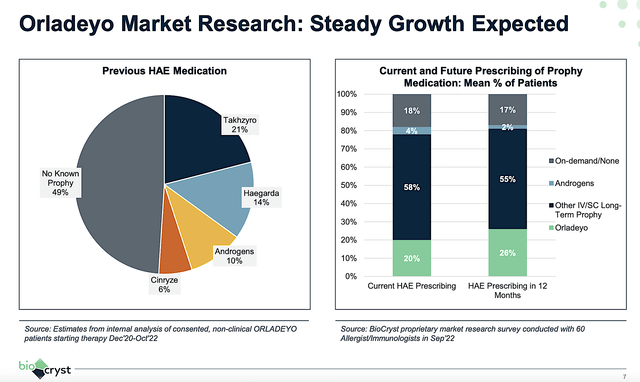

Having high expectations for Orladeyo, the question is when it would become a blockbuster (i.e., a drug that garners at least $1B in annual sales). Viewing the figure below, Orladeyo is currently capturing 20% of the HAE total prescription. Nevertheless, it’s expected to gain at least 6% of the market shares from competitors in the next 12 months. If this trend continues, you can expect Orladeyo to take a lion’s share of this market.

Figure 5: Orladeyo’s steady market expansion.

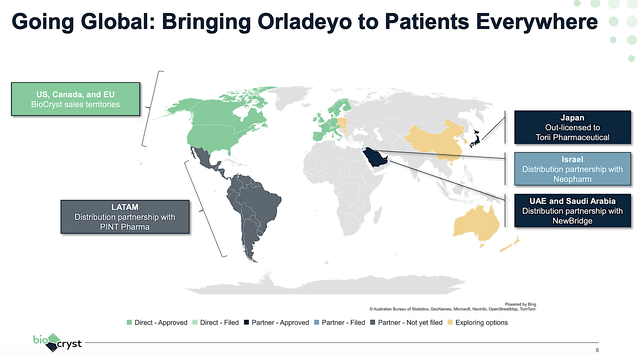

To boost sales growth, BioCryst is aggressively pushing Orladeyo’s entry into the broader markets. As you can see, the company already launched Orladeyo in-house in North America and the EU. However, it’s much more strategic to partner with various distributors elsewhere in the world.

With the recent approval in Israel, BioCryst is leveraging Neopharm. That way, the drug can be sent to as many patients as possible. Taking all that together, I believe that Orladeyo could become a blockbuster three to five years from now.

Figure 6: Orladeyo’s global launch.

BCX9930 Termination To Focus On BCX10013

As you know, BioCryst recently announced that the company had decided to terminate BCX9930’s development. Specifically, the management doesn’t believe that BCX9930 is competitive based on its recent data. While this decision seems bad on the surface, you can bet that it’s an excellent corporate decision.

By dropping what would become unfruitful developments, the company can conserve its precious cash for lucrative molecules. In drug development, the chances of innovation failure are quite high. Hence, it’s not a shame for the management to stop development if the data isn’t supportive. Let the data guide your development. After all, data is pure yet human emotion like ego is not. In illuminating his wisdom to the shareholders, the President and CEO (Jon Stonehouse) enthused:

With the new competitor efficacy data presented at ASH, and the limitations preventing us from optimizing the dosing of BCX9930 for increased efficacy, it is unlikely that BCX9930 could meet the new standard of care. We have made this decision prior to fully investing in the pivotal development program and commercialization activities, and will focus on our potential best-in-class asset, BCX10013, and our other programs.

Financial Assessment

Just as you would get an annual physical for your well-being, it’s important to check the financial health of your stock. For instance, your health is affected by “blood flow” as your stock’s viability is dependent on the “cash flow.” With that in mind, I’ll assess the 3Q2022 earnings report for the period that ended on September 30.

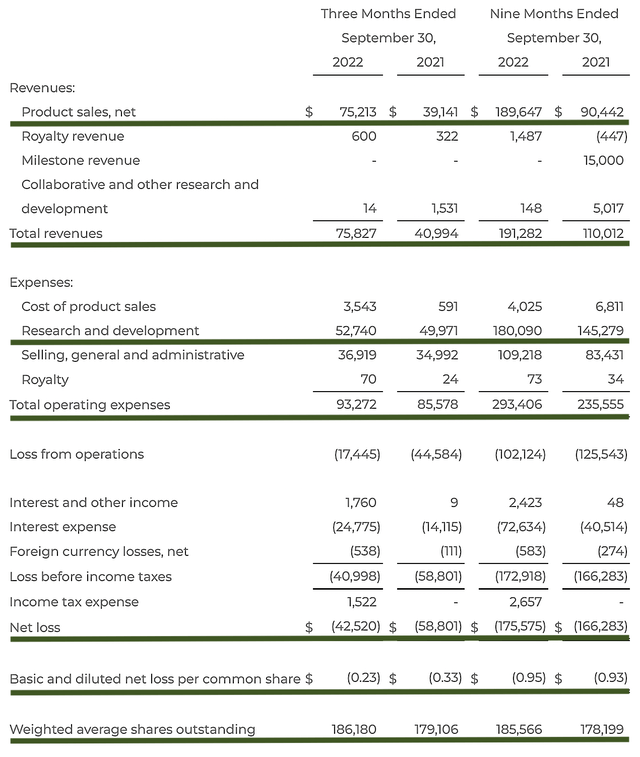

As you know, BioCryst procured $75.2M in revenues, i.e., a 92.3% YOY increase from $39.1M last year. That aside, the research and development (R&D) for the respective periods registered at $57.2M and $49.9M. I viewed the 14.6% R&D increase positively because the money invested today can turn into blockbuster profits tomorrow. After all, you have to plant a tree to enjoy its fruits.

Additionally, there were $42.5M ($0.23 per share) net losses compared to $58.8 ($0.33 per share) net declines for the same comparison. On a per-share basis, the bottom line improved by 30.3%. Hence, that is supporting the notion that the management is conscientious about operational expenses.

Figure 7: Key financial metrics.

About the balance sheet, there were $462.6M in cash, equivalents, and investments. Against the $93.2M quarterly OpEx and on top of the $75.2M in sales, there should not be any concern about the cash position within the next few years. Simply put, the cash position is extremely robust relative to revenue and the burn rate.

While on the balance sheet, you should check to see if BioCryst is a “serial diluter.” After all, a company that is serially diluted will render your investment essentially worthless. Given that the shares outstanding increased from 179.1M to 186.1M, my math reveals a 3.9% annual dilution. At this rate, BioCryst easily cleared my 30% cut-off for a profitable investment.

Potential Risks

Since investment research is an imperfect science, there are always risks associated with your stock, regardless of its fundamental strengths. More importantly, the risks are “growth-cycle dependent.” At this point in its life cycle, the main concern for BioCryst is whether the company can continue to ramp up sales for Orladeyo.

Moreover, the other risk is that BCX10013 might not generate robust results. Given that BCX9930 is now gone, BCX10013 or another molecule has to generate positive results to give the pipeline more depth. Else, a single molecule pipeline is likely a recipe for disasters.

Conclusion

In all, I raised my recommendation on BioCryst from a buy to a strong buy with the upgraded 5/5 stars rating. BioCryst is a highly promising growth biotech. Subsequent to Orladeyo two years ago, the product launch has been a huge success. Even when the company is commercializing the drug with an in-house team, the projected revenue for Fiscal 2022 estimate is already 1/4 of a blockbuster. Due to various global expansions (and more importantly the stellar therapeutic profile of the drug), you can bet that Orladeyo would become a blockbuster in the next three to five years. Overall, BioCryst is a great stock for the long-term biotech investor’s portfolio.

Be the first to comment