peshkov

Despite declining energy prices and some analysis pointing to further declines ahead, there are some big-name contrarians taking the opposite side of that bet. In this article, we discuss the opposing arguments, why we side with the contrarians, and some of our top picks.

The Energy Bear Case

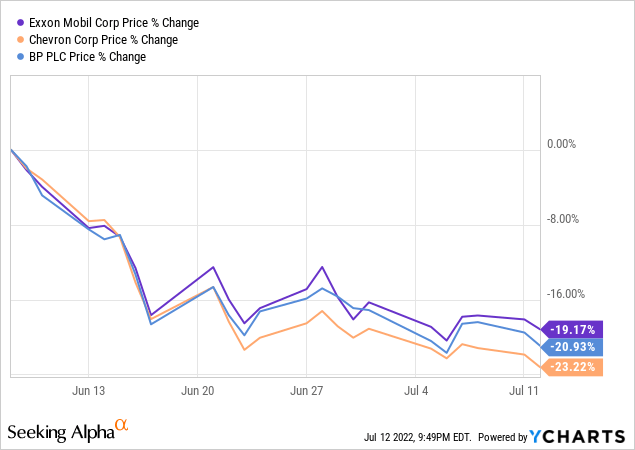

Energy prices are dropping right now on fears that a recession will destroy demand. Since June 8th, major oil producers like Exxon Mobil (XOM), Chevron (CVX), and BP (BP) are down by around 20% each:

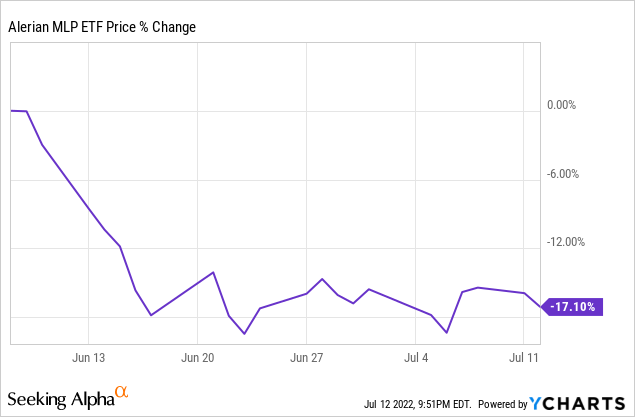

Even the midstream sector (AMLP) has taken a beating despite its resistance to commodity price swings. Since June 8th, it has declined almost as much as the major oil producers:

Experts like Norbert Rücker – Head Economics and Next Generation Research, Julius Baer – are predicting that energy prices could fall much further in the coming months, stating:

The sentiment cycle has likely turned earlier than expected and could continue to pressure prices going forward. We see fundamentals unchanged. With Russian oil still flowing, the shale business expanding and demand stagnant, oil prices should eventually drop into the single digits…Should the economic cycle unexpectedly soften more meaningfully, the fundamentals would change more markedly, putting even greater pressure on oil prices.

The Contrarian Thesis

However, there are several highly respected investors who are buying what the market is selling.

Warren Buffett’s Berkshire Hathaway (BRK.A)(BRK.B) is buying Occidental Petroleum (OXY) hand-over-fist, purchasing billions of dollars’ worth of shares recently, bringing his stake to 18.6% of the company.

On top of that, Brookfield Asset Management (BAM) – the world’s second largest alternative asset manager with about three quarters of a trillion dollars in assets under management – recently published a white paper which explained why there are reasons for investor optimism on energy (particularly the midstream sector) in the face of a likely recession. In it, BAM stated:

Fears of a global recession are picking up among investors and macro economists alike. We are not recession prognosticators-they are incredibly difficult to predict and even the experts rarely agree on timing. Yet with recession concerns growing, we believe a look back at how energy has performed during past downturns can help investors prepare for the scenario of an imminent economic slowdown. In this paper, we explore what recessions have historically meant for energy fundamentals and energy equities-and why we see reasons for energy investor optimism during the next down cycle.

The bullish thesis for energy in the current environment works as follows:

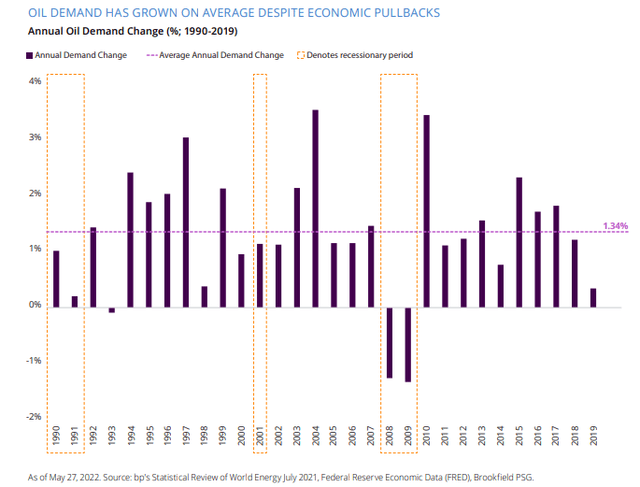

1. Remarkably Resilient Oil Demand

There have only been three years between 1990 and 2019 when crude oil demand declined, and it was not severe in any of those cases. In 1993, oil demand very slightly declined but then saw robust growth in the four years following. During the Great Recession of 2008-2009, crude oil demand only declined by 1.3% each year and represented the largest decline in oil demand since the early 1980s. Meanwhile, demand quickly bounced back in 2010, with demand setting a new global record that year and increased every year until the COVID lockdowns forced a demand decline in 2020.

Oil Demand Growth (BAM)

It is also worth noting that energy costs make up only 2.7% of Americans’ total personal consumption expenditures today, below the historical average of 2.9% and well below the 3.4% average during the Great Financial Crisis.

It is also worth noting that during the last three recessionary periods, oil demand only declined during one of them and continued growing at a solid clip during the other two.

2. Current Supply Constraints

On top of the remarkably stable picture for oil demand throughout the past several decades, there are some unique supply constraints in the current environment that could also serve to prop up oil prices even if we enter an economic recession. These include:

- Significant lack of upstream investment in recent years

- OPEC+ capacity sits near historical lows at ~2 million bpd.

- If just 25% of Russian pre-war exports are rejected by global markets, it would fully offset the amount of oil demand lost during the Great Recession

3. Strong Demand For North American Energy Exports

With the current energy crisis in Europe and sustained economic growth momentum in Latin America and Asia, there is ever-growing demand for U.S. and Canadian energy. This bodes well for North American energy companies, particularly the midstream infrastructure businesses that are mission critical components of exporting these commodities to international markets.

4. Midstream Is Recession Resistant

On top of these encouraging demand and price fundamentals, the midstream sector has also proven itself to be remarkably recession resistant. This is because the vast majority of its cash flows tend to come from fee-based contracts and a diverse array of sources, including different types of hydrocarbons and finished products.

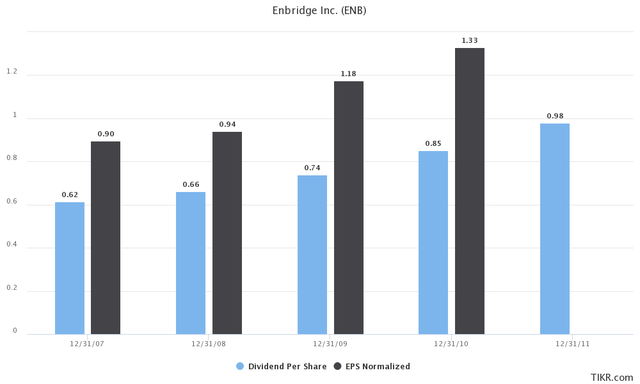

For example, Enbridge (ENB) saw its normalized earnings per share and dividends per share increase each year during the Great Financial Crisis:

Meanwhile, Enterprise Products Partners (EPD) saw its EBITDA decline by a mere 0.8% in 2020.

5. Attractive Business Fundamentals

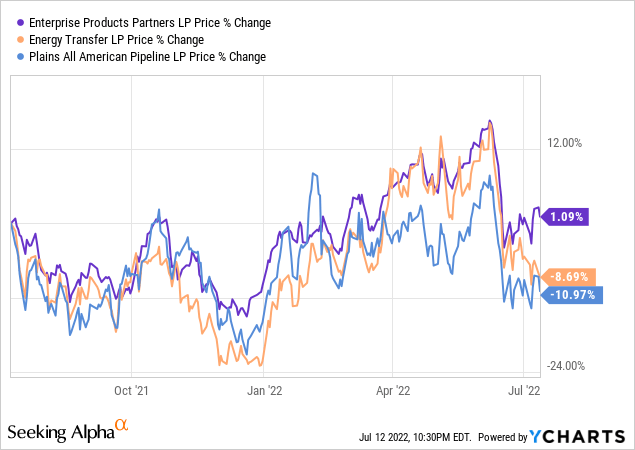

Last, but not least, energy valuations remain compelling despite the strong energy prices. For example, over the past year, the leverage ratios, distribution payouts, EBITDA and distributable cash flow generation, and overall portfolio strength of three midstream businesses in Plains All American (PAA), Energy Transfer (ET), and EPD have all dramatically improved. However, PAA’s and ET’s unit prices have actually fallen considerably over the past year while EPD’s has been essentially flat:

With these businesses gushing free cash flow and boasting the best fundamentals ever in their histories, it makes little sense for them to be trading so cheaply right now, especially when you consider how commodity price and recession resistant they are.

Investor Takeaway

While some are bearish on energy, we see it as highly unlikely that energy experiences another precipitous drop in the near future given the supply constraints, remarkably resilient demand, and growing dependence on U.S. energy exports in global markets. Furthermore, we are giving ourselves an additional ring of safety around our energy cash flows by investing in the midstream sector, which has shown the ability to essentially weather some of the worst industry crises in decades unscathed.

As a result, we feel really good about investing aggressively in investment grade midstream businesses like EPD, ET, and PAA at valuations that are at clear discounts to historical averages, yields that are 400-500 basis points superior to what is being offered in fellow income sectors like REITs (VNQ) and utilities (XLU), and boast balance sheets and distributable cash flow coverage ratios that are at historically strong levels. We discuss our rationale further for midstream and EPD and ET as top picks in particular in our recent interview on Wall Street Breakfast’s Weekend Bite.

Be the first to comment