ipopba

A person is, among all else, a material thing, easily torn and not easily mended. ― Ian McEwan

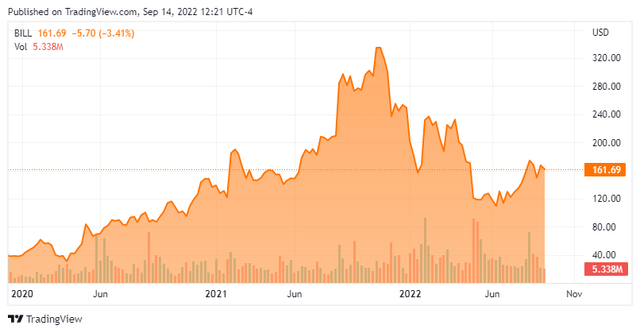

Today, we profile Bill.com Holdings (NYSE:BILL) for the first time. The company is showing impressive revenue growth. However, the shares looks very vulnerable at current trading levels. Valuations are stretched by many metrics, insiders seem to be doing a substantial amount of profit taking in 2022, and the company’s customer base could be significantly impacted in a recession scenario, which seems more and more likely. An analysis follows in the paragraphs below.

Company Overview

May Company Presentation

Bill.com Holdings is based in San Jose, CA. The company provides cloud-based software that simplifies, digitizes, and automates back-office financial operations for small and midsize businesses. These capabilities enable users to automate accounts payable and accounts receivable transactions, as well as enable users to connect with their suppliers and/or customers to do business, eliminate expense reports, manage cash flows, and improve office efficiency. The company had over 400,000 business customers in over 150 countries use it services in FY2022. It managed $225 billion in payments and had 4.7 million members that originated or received an electronic payment through their platform. The stock trades just over $160.00 a share and sports an approximate market capitalization of $18 billion.

May Company Presentation

Fourth Quarter Results

On August 18th, the company reported fourth quarter numbers to close out FY2022. Bill.com had a non-GAAP loss of three cents a share as revenues surged over 220% on a year-over-year basis to a tad over $200 million. Both top and bottom numbers easily beat the consensus. In May of last year, Bill.com acquired SMB spend management company Divvy for $625 million in cash and $1.875 billion in stock which accounted for the majority of the year-over-year growth. It also did a smaller purchase of Invoice2go. That said organic transaction fees rose an impressive 90% from the same period a year ago while organic revenue increased 71%.

Management also upped forward guidance significantly as they see revenues for the just started FY2023 about 10% above the consensus that existed at the time.

Analyst Commentary & Balance Sheet

Since the company posted second quarter results, 15 analyst firms including Wells Fargo and Bank of America have reissued Buy or Outperform ratings on the stock. Price targets range from $180 to $300 a share. Berenberg Bank ($143 price target) and Evercore ISI ($165 price target) have maintained Hold ratings on the stock since earnings came out.

Approximately one out of every dozen shares of outstanding float are currently held short. Insiders seem much less sanguine than analyst firms and have been non-stop sellers of shares in the stock, initiating hundreds of sell transactions in 2022 that look like they total at least $100 million in aggregate. They have disposed of nearly $3 million worth of shares so far in September. The company ended FY2022 with approximately $2.7 billion worth of cash and marketable securities against $1.7 billion of long term debt.

Verdict

The current analyst consensus has Bill.com making 33 cents a share as revenues rise 50% to nearly $970 million in FY2023. This will be the first full year profit for the company and a nice milestone. Revenues are projected to slow to just under 35% in FY2024 as earnings per share grow to 61 cents a share.

May Company Presentation

The company has a solid business model, provides significant capabilities and has executed well. One of my vendors uses Bill.com to send me my monthly invoice and the service works quite seamlessly. However, as an investor there are several red flags here starting with valuation. Even with an approximate 30% decline in the stock in 2022 to date, the stock still trades north of 250 times projected FY2024’s profits and 18 times this fiscal year’s anticipated sales.

Higher interest rates also tend to hurt growth stocks as they raise the discount rate and the company’s core customers are likely to be impacted by what looks like an impending recession. The company’s CEO noted on company’s fourth quarter earnings call that they were ‘starting to see signals of the macro environment impacting spend patterns, especially in discretionary categories like advertising‘.

Growth as it is, is already projected to slow in FY2023 from FY2022 significantly as comps get harder and will like slow again in FY2024. Add it all up, it is easy to see why insiders look like they are in profit taking mode at current trading levels.

Real dishes break. That’s how you know they’re real. ― Marty Rubin

Be the first to comment