Michael Vi

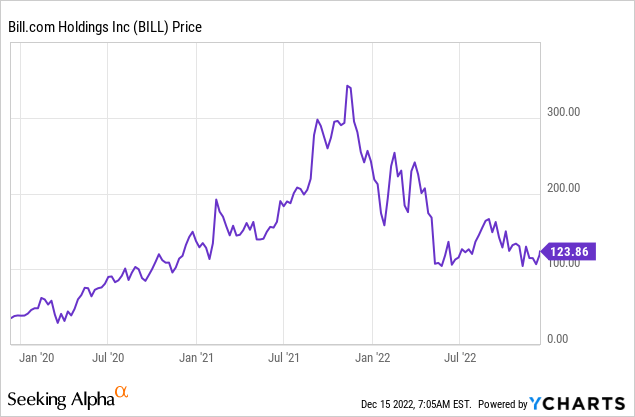

Bill.com Holdings, Inc. (NYSE:BILL) is an online bill payment platform that automates the process for small-medium-sized businesses [SMBs]. There are approximately 30 million small businesses in the U.S. alone, and thus Bill.com has huge total addressable market (“TAM”). The company is currently spearheading this opportunity and growing its revenue at a rapid rate of over 90% per year. In this post, I’m going to break down its business model, financials and valuation. Let’s dive in.

Business Model

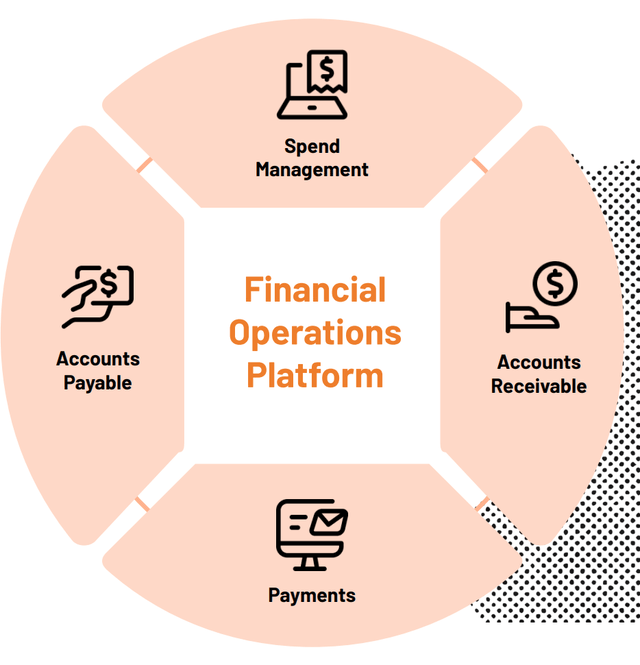

Bill.com has developed an all-in-one financial operations platform that covers four key areas; Spend Management, Accounts Receivable, Payments, and Accounts Payable. Its core customer base is small-medium-sized businesses that have previously used a complex selection of excel spreadsheets to manage their financial back office. Bill.com offer a simple value proposition that automates these financial activities, so business owners can spend more time on their business.

Business Model (Q1 FY23 report)

The company sells its product through a combination of “self-service” direct options for its customers – in addition to strategic partnerships with accounting firms and financial institutions.

Super Financials

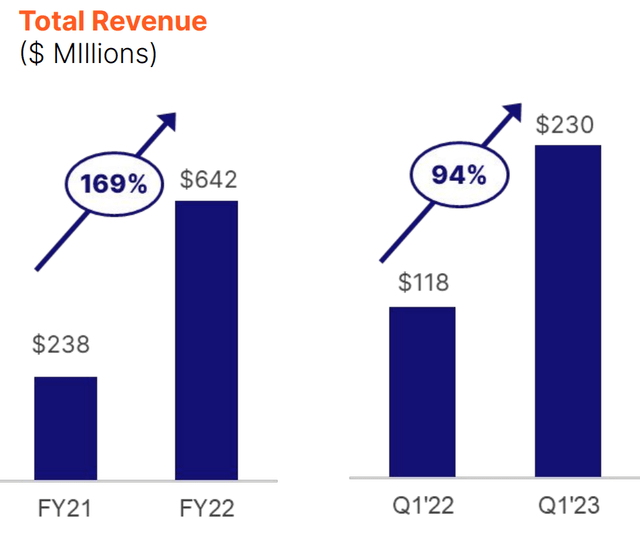

Bill.com reported strong financial results for the first quarter of fiscal year 2023. Revenue was $229.92 million, which increased by a blistering 94% year-over-year and beat analyst estimates by $19.03 million.

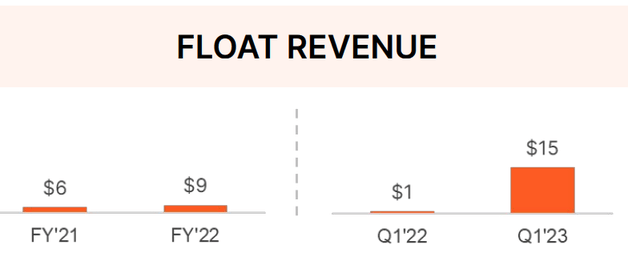

The company’s “core revenue” consists of subscription and transaction fees was $215 million, which increased by a rapid 83% year-over-year. Bill.com also benefits from the rising interest rate environment, as it earns interest on customer funds, while transactions are being processed. Therefore, the company’s “Float Revenue” was $15 million in Q1 FY23, which increased by $14 million year-over-year.

float revenue (Q1 FY23 report)

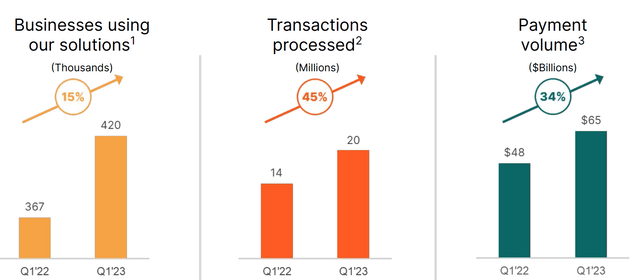

Bill.com also reported a record number of net new customers, as businesses using its solution rose by 15% to 420,000. The number of Transactions processed increased by a solid 45% to 20 million and Payment volume reached $65 billion, up 34% year-over-year. These are strong results, especially given the tepid macroeconomic environment.

Notable customer wins in the quarter included “Repurpose Inc,” a compostable home goods company. Bill.com has helped to save their finance team 2 days out of every week. BergenKDV is another customer of Bill.com, which has used the solution to drive its accounting advisory practice.

Bill.com is has grown its business through a combination of organic, acquisitions, and partners. In 2021, the company acquired Divvy, a leader in Spend Management solutions for small-medium sized businesses. This acquisition has proven to be popular with the customers of Bill.com, as many have adopted both solutions. More recently, the business has also signed a “definite agreement” to acquire Finmark, a financial planning tool for startups and SMBs. This acquisition has strong synergies with Bill’s SMB customers and gives accountants the ability to offer forward-looking planning as an extra service, which is key for fast-growing startups.

Bill.com has continued to build out its vast partner ecosystem, which now includes over 6,000 accounting companies from KPMG to PwC. The company is deeply embedded into the accountant’s ecosystem and even has a partnership with CPA.com, the largest accounting professional website in the U.S.A.

In addition, Bill.com has partnerships with 6 of the top 10 financial institutions in the U.S., which includes big names such as Wells Fargo (WFC) and American Express (AXP) (which I have written about here). The company reported the signing of two new bank partners in the quarter.

Accounting partners (Q1 FY23 report)

Bill.com continues to improve its international offering and has recently made it easier for Canadian and U.K suppliers to receive payment in their preferred currency.

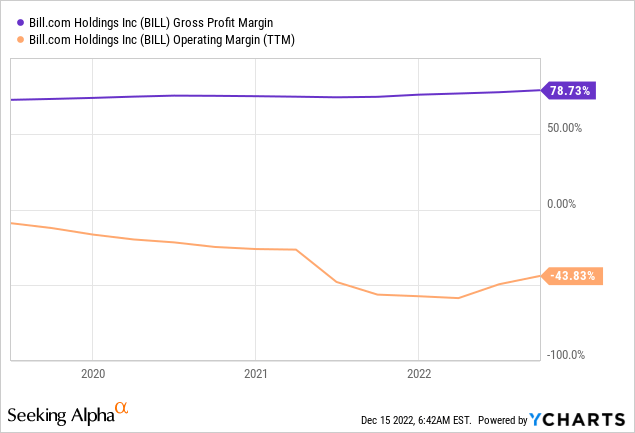

Profitability and Expenses

As a software company, Bill.com has a super high gross margin [Non-GAAP] of 85.8% which has increased by 2% year-over-year. This was driven by improved operating leverage and the aforementioned increase in float revenue.

The company also reported Non-GAAP operating income of $9.1 billion at a 4% margin, which increased by a fantastic 12% year-over-year.

This resulted in Non-GAAP earnings per share [EPS] of $0.14, which beat analyst estimates by $0.08. These results were despite a $16 million increase in operating expenses since the last quarter. This was driven by continued R&D investments into new products and growth in Sales and Marketing expenses, related to the recently acquired Divvy platform. However, it should be noted the company is operating at a loss on a GAAP basis.

Bill.com has a solid balance sheet with cash, cash equivalents, and short-term investments of $2.6 billion. The company does have fairly high debt of $1.7 billion, but just $75 million of this is current debt, due within the next two years.

Advanced Valuation

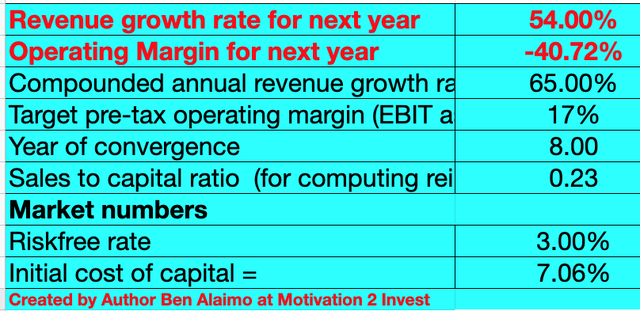

In order to value Bill.com, I have plugged the latest financials into my discounted cash flow model. I have forecasted 54% revenue growth for next year, which is based on an extrapolation of management’s guidance for the next quarter. This is slower than the most recent growth rate of 94%, which would be expected given the macroeconomic environment. However, for years 2 to 5, I have forecasted growth rates to improve to 65% per year.

Bil.com stock valuation 1 (created by author Ben at Motivation 2 invest)

To increase the accuracy of the valuation, I have also capitalized the company’s R&D expenses, which has lifted net income slightly. However, the company still has a long way to go to reach my 17% forecasted operating margin in year 8. This is achievable as the business scales with its acquisition and continues to hold on to its customer through high retention.

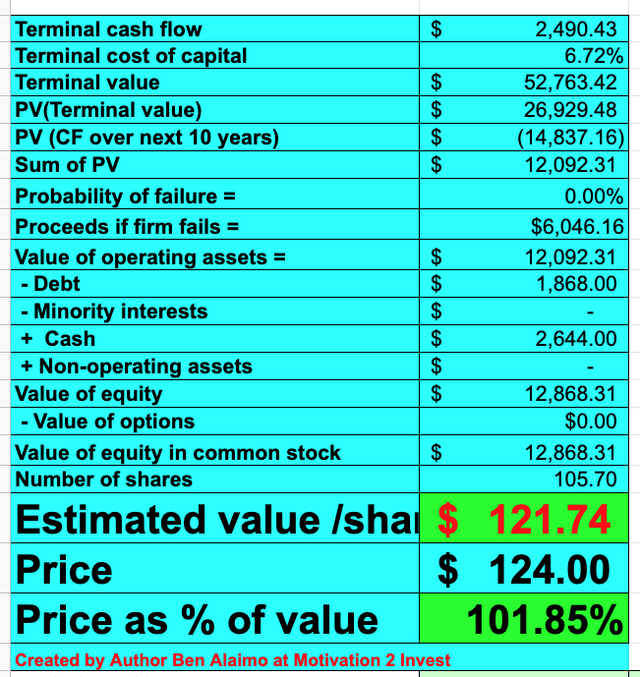

Bill.com stock valuation 2 (created by author Ben at Motivation 2 Invest)

Given these factors, I get a fair value of $122 per share. The stock is trading at ~$124 per share at the time of writing, and thus I will deem the company to be “fairly valued.”

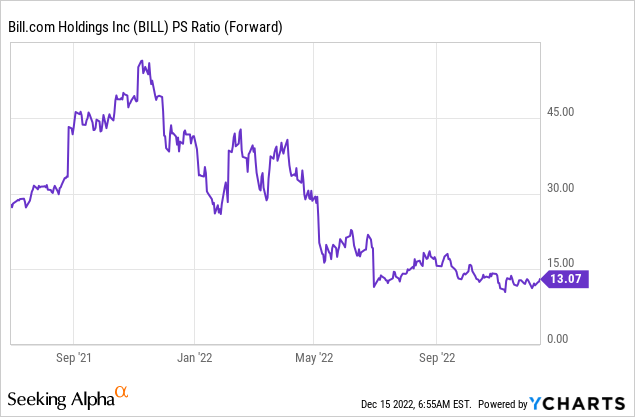

As an extra data point, Bill.com trades at a Price to sales ratio = 17, which is 59% cheaper than its 5-year average.

Risks

Longer Sales Cycle/Recession

The high inflation and rising interest rate environment has caused many analysts to forecast a recession. Therefore, it would not be a surprise if we saw longer sales cycles and delayed business spending which will result in lower transaction volume. A positive is Bill.com has a strong retention rate, which means its customers will likely stick with the platform even in tough economic times.

Final Thoughts

Bill.com Holdings, Inc. is a tremendous company that is growing at an outstanding rate. The business has made a series of acquisitions that look to have strong synergies and management has the large SMB market in its sights. Bill.com Holdings stock is fairly valued intrinsically and undervalued relative to historic multiples, thus BILL could be a great long-term investment opportunity.

Be the first to comment