ipopba

A Quick Take On BigBear.ai Holdings

BigBear.ai (NYSE:BBAI) reported its Q2 2022 financial results on August 9, 2022, missing expected revenue and EPS estimates.

The company provides organizations and U.S. government agencies with cybersecurity and analytics software with machine learning capabilities.

While the firm may see some potential for its healthcare-related efforts, the inherent lumpy nature of government contracting will likely weigh on the stock in the period ahead.

Until we begin to see improved financial results, I’m on Hold for BBAI.

BigBear.ai Overview

Columbia, Maryland-based BigBear.ai was founded to provide decision support software enhanced by machine learning technologies for use in cybersecurity and analytics applications.

The firm is headed by Chief Executive Officer Amanda Long, who started with the company on October 12, 2022 and was previously an executive at IBM involved with the Watson artificial intelligence project there, among others.

The company’s primary offerings include:

-

Data analytics

-

Modeling solutions

-

Enterprise planning & logistics

-

Professional services

The firm acquires customers through its direct sales efforts as well as through government contract and subcontract bidding processes.

BBAI focuses its efforts on government, manufacturing, and healthcare organizations.

Market & Competition

According to a 2021 market research report by 360 Market Updates, the global market for digital transformation strategy consulting was an estimated $58.2 billion in 2019 and is forecast to reach $143 billion by 2025.

This represents a forecast CAGR of 16.2% from 2020 to 2025.

The main drivers for this expected growth are a large transition from on-premises, legacy systems to cloud-based environments with complex architectures.

Also, the COVID-19 pandemic has likely pulled forward significant demand to modernize enterprise systems, resulting in increased growth prospects for technology-centric consultancies.

Major competitive or other industry participants include:

-

Globant

-

EPAM

-

Slalom

-

Accenture

-

Deloitte Digital

-

McKinsey

-

BCG

-

Ideo

-

Cognizant Technology Solutions

-

Capgemini

-

Company in-house development efforts

Recent Financial Performance

-

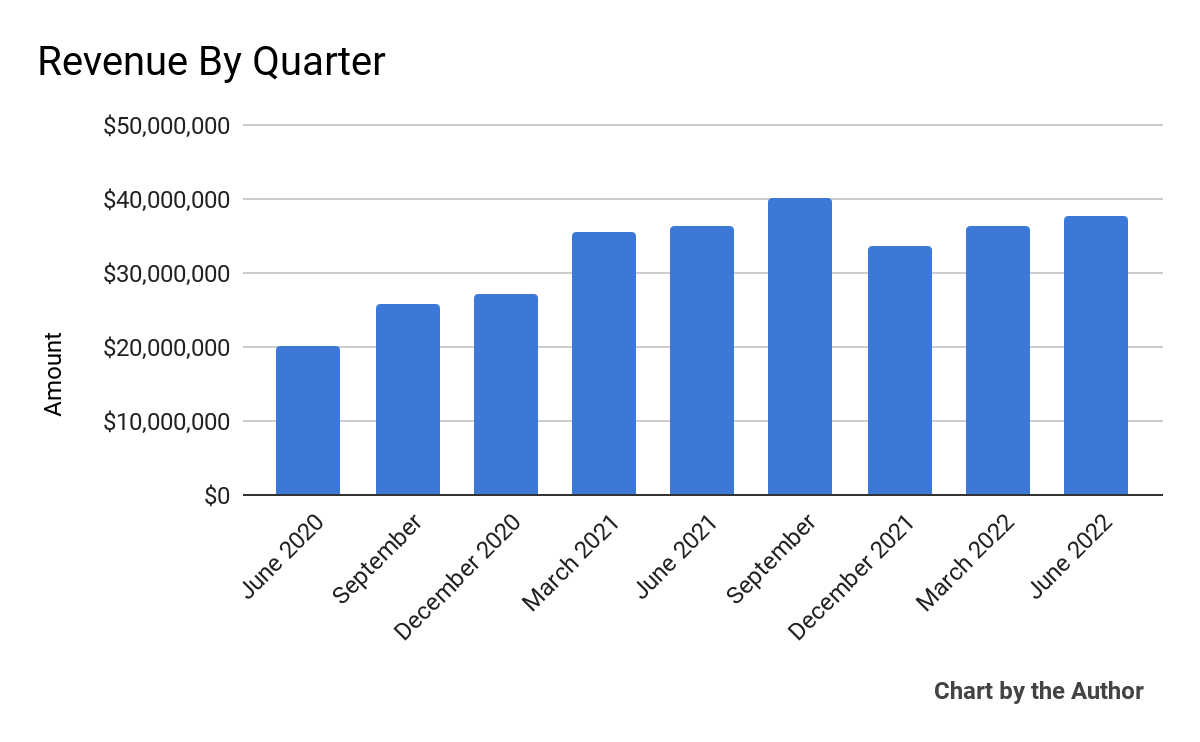

Total revenue by quarter has generated the following growth trajectory:

9 Quarter Total Revenue (Seeking Alpha)

-

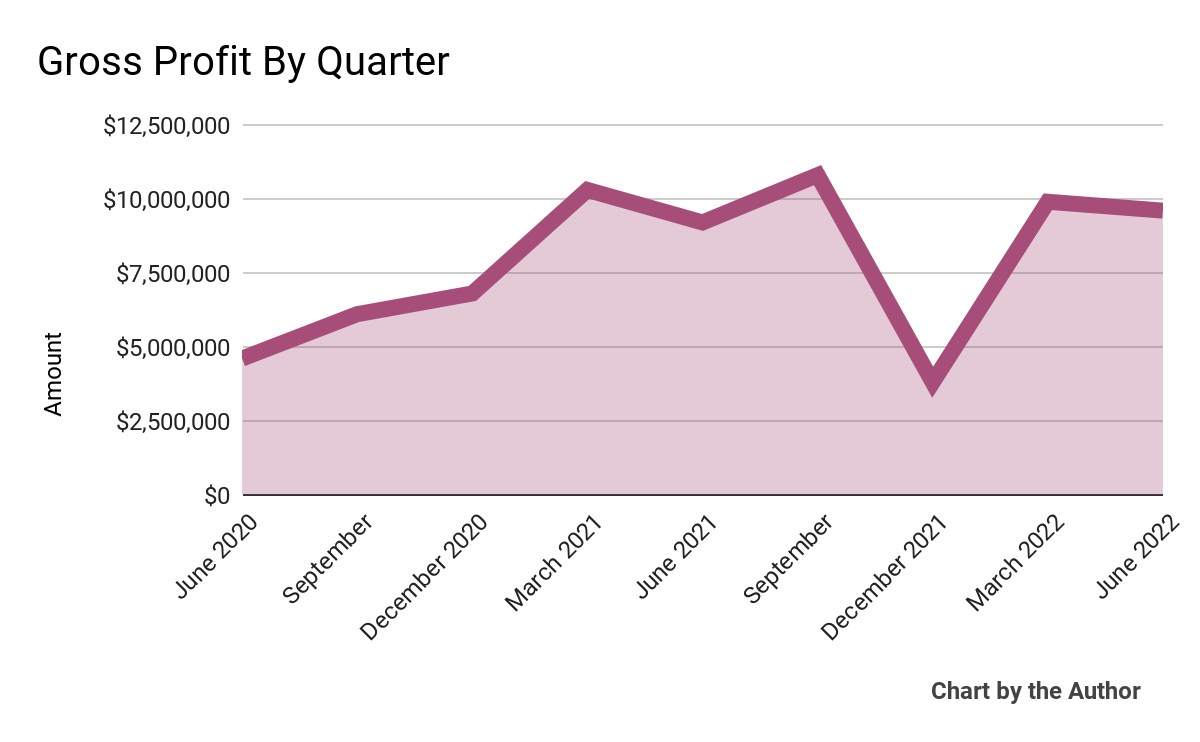

Gross profit by quarter has proceeded accordingly:

9 Quarter Gross Profit (Seeking Alpha)

-

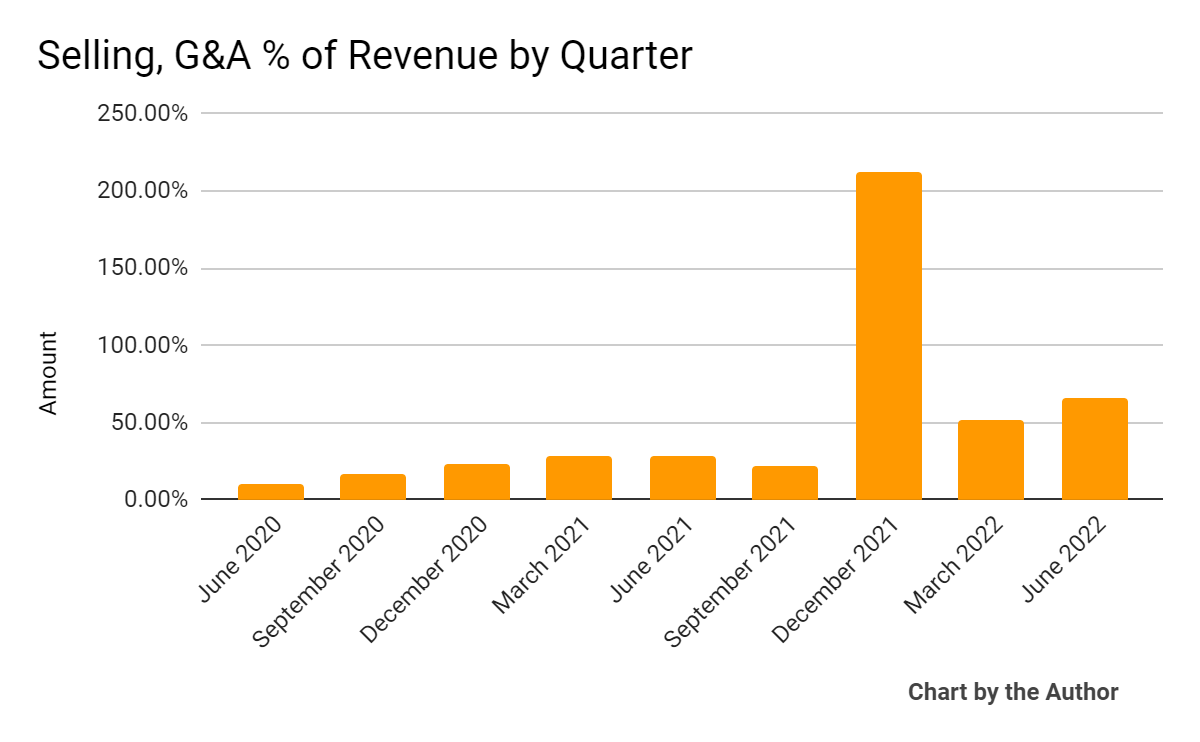

Selling, G&A expenses as a percentage of total revenue by quarter have risen over time:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

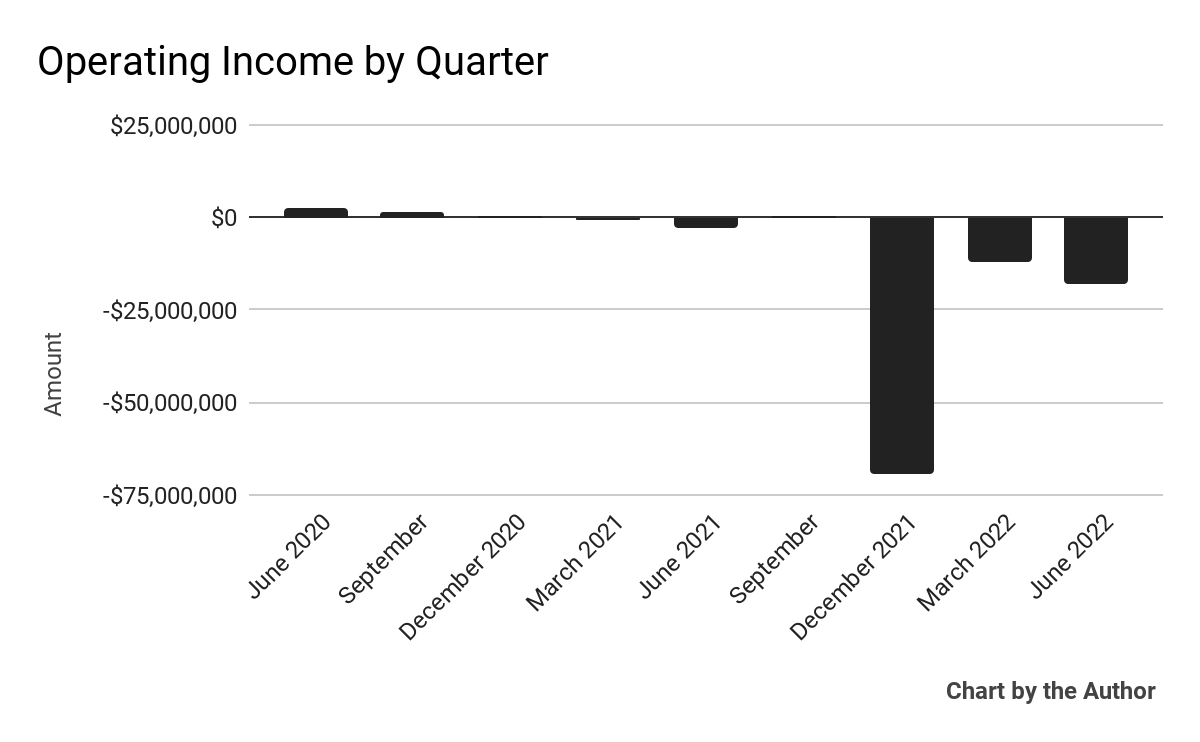

Operating income by quarter has been uneven and frequently negative:

9 Quarter Operating Income (Seeking Alpha)

-

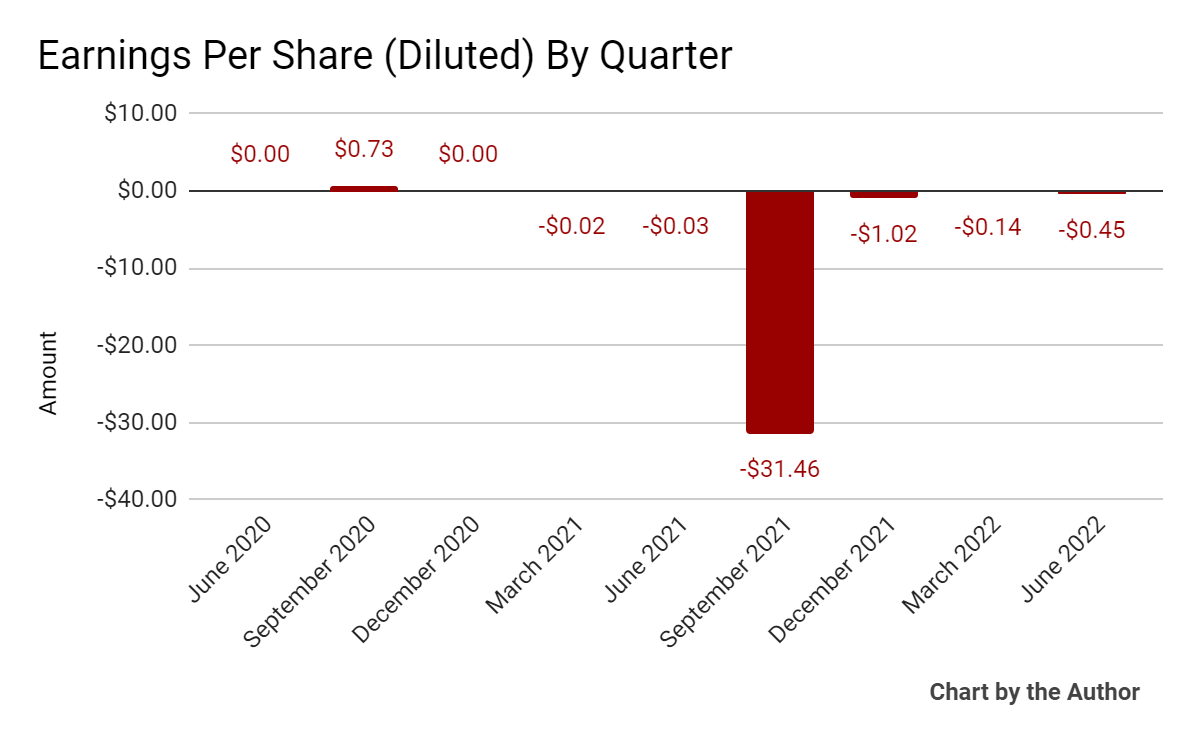

Earnings per share (Diluted) have also been mostly negative in recent quarters:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

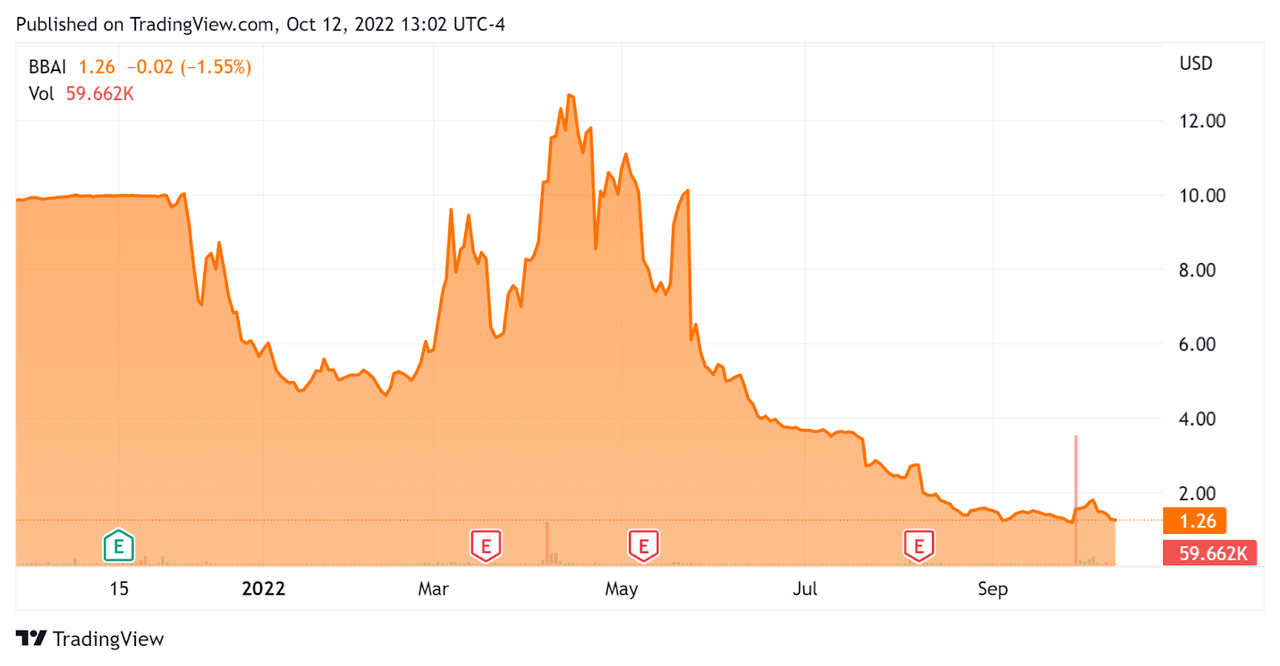

In the past 12 months, BBAI’s stock price has fallen 87.2% vs. the U.S. S&P 500 index’s drop of around 17.3%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

2.30 |

|

Revenue Growth Rate |

18.5% |

|

Net Income Margin |

-131.1% |

|

GAAP EBITDA % |

-59.8% |

|

Market Capitalization |

$176,770,000 |

|

Enterprise Value |

$340,210,000 |

|

Operating Cash Flow |

-$52,110,000 |

|

Earnings Per Share (Fully Diluted) |

-$33.07 |

(Source – Seeking Alpha)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

BBAI’s most recent GAAP Rule of 40 calculation was negative (41.3%) as of Q2 2022, so the firm has performed poorly in this regard, per the table below:

|

Rule of 40 – GAAP |

Calculation |

|

Recent Rev. Growth % |

18.5% |

|

GAAP EBITDA % |

-59.8% |

|

Total |

-41.3% |

(Source – Seeking Alpha)

Commentary On BigBear.ai

In its last earnings call (Source – Seeking Alpha), covering Q2 2022’s results, management noted the challenges to its second quarter results, with the Ukraine war and a slowing U.S. economy contributing to delays in expected revenue receipts.

The firm has seen delays in government contract flows, negatively impacting ‘anticipated contract awards in our near-term pipeline.’

On a positive note, the company received a first place award by the US Cyber Command in a recent prototyping event for AI/ML full spectrum cyber technologies.

As to its financial results, revenue rose 3.6% year-over-year, while SG&A expenses as a percentage of revenue rose and operating losses worsened.

Management did not disclose any company retention rate metrics, which provide visibility into its product/market fit and sales & marketing efficiency.

BBAI’s Rule of 40 results have been negative, so the firm is in need of significant improvement for this common performance metric.

Adjusted gross margin for its analytics segment dropped from 46% to 39% year-over-year, due to the company’s participation in prototype projects which typically require lengthy demonstration periods by the government before awarding the contract.

Also, the company booked a hefty goodwill charge of $35.3 million related to contracting delays.

For the balance sheet, the firm finished the quarter with cash and equivalents of approximately $30 million

Over the trailing twelve months, free cash used was $53 million, with only $0.9 million being from capital expenditures and the rest from operating losses.

Looking ahead, management reduced its revenue guidance for full year 2022 to $160 million at the midpoint of the range and adjusted EBITDA to be negative.

Regarding valuation, the market is valuing BBAI at an EV/Revenue multiple of 2.3x.

The primary risk to the company’s outlook is its substantial reliance on services contracts, which are more easily subject to spending priority changes versus software contracts.

2023 may see the potential for some upside catalyst for the stock if the firm can move some of its prototype contracts into production, but given the ongoing war in Ukraine and the unpredictable effects on government spending, I’m not optimistic.

While the firm may see some potential for its healthcare-related efforts, the inherent lumpy nature of government contracting will likely weigh on the stock in the period ahead.

I wish the new CEO well, but until we see improved financial results, I’m on Hold for BBAI.

Be the first to comment