Astrid Stawiarz

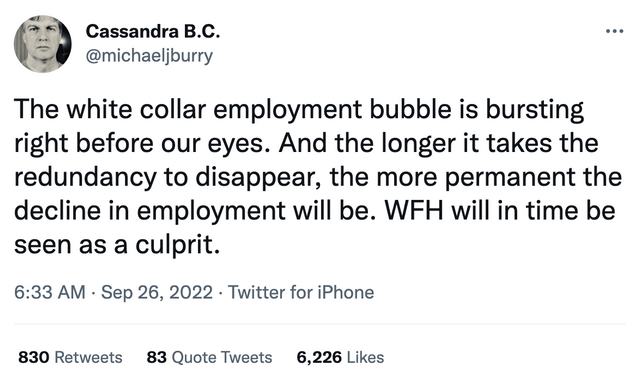

Renowned investor and hedge fund manager Michael Burry of “Big Short” fame recently declared that he believes white collar jobs are going to decline meaningfully in the coming months and years. He also implied that he believes this decline in white collar jobs will likely be long-lasting, if not permanent:

Michael Burry (Twitter)

In this article, we will share our take on what this means for the S&P 500 (SPY).

What Is The White Collar Employment Bubble?

In short, the so-called white collar employment bubble essentially refers to the fact that at the moment, unskilled and semi-skilled workers are in short supply, but there are plenty of white-collar workers. On top of that, unskilled and semi-skilled workers often work in essential jobs that are considered to be less likely to be lost in the current economic downturn than those doing redundant white collar jobs. As Business Insider recently posited:

A growing number of economists expect at least a mild recession to materialize in 2023, and signs point to it resembling the downturn of the early 1990s. That slump saw white-collar — or high-income office workers — face a heightened risk of job loss while those in blue-collar sectors like mining and manufacturing generally fared much better than in previous recessions.

This is simply due to the fact that right now there is a massive shortage of blue collar jobs like truck drivers, hospitality and restaurant employees, and other employees necessary for actually creating and delivering the goods and services that consumers want and need on a daily basis.

In contrast, office employees are becoming increasingly redundant due to two major trends:

(1) Work from home. The work from home trend is threatening office jobs because it reduces the need for many traditional office roles like secretaries and receptionists. On top of that, it is also making it less appetizing for companies to hire white collar employees given that such employees are increasingly demanding the ability to work from home, which is beginning to show evidence of reducing overall productivity.

(2) Increasing automation. While increasing automation is also expected to deal a blow to blue collar jobs eventually, many of these technologies are not here yet. For example, autonomous trucks are expected to deal a death blow to the truck driving profession, but this technology is unlikely to be broadly implemented until at least the middle to late years of this decade. Furthermore, while restaurant, retail, and even factory workers are all expected to be ultimately replaced by robots that tech companies like Tesla (TSLA) are producing, this technology is even further away from being widely deployed, with some predicting these machines to not be meaningfully impactful until the end of this decade.

In contrast, the increasingly widespread adoption of enterprise software, data analytics, and machine learnings are increasingly rendering office jobs moot as much of the traditional number crunching, document processing, and repetitive analysis performed by office professionals is now being performed by software.

As a third strike against the safety of white collar jobs at the moment, most companies have already more than fully recovered their number of white collar jobs from before the COVID-19 outbreak. In contrast, blue collar hiring continues to lag pre COVID-19 levels. As a result, there is much less margin of safety and demand for white collar workers relative to blue collar ones.

As a result of these trends, the value of many white collar employees is now declining. With companies increasingly striving to cut costs and offset inflationary headwinds, slashing white collar payroll will likely increasingly be seen as a great way to improve profitability.

Why Might The White Collar Employment Bubble Be Bursting?

On the surface, it appears that all continues to be strong in the U.S. labor market. In fact, recent unemployment data from the Labor Department implies that job demand is still strong, and the unemployment rate is low. In fact, the U.S. economy added 350,000 jobs in August, so where is the concern?

Well, as already stated, in a recession companies generally either have to or at least choose to cut costs aggressively in order to preserve profitability, or even stay afloat. Given that white collar jobs are losing value and the demand for them is largely being met while blue collar workers remain in short supply, once we enter the stage of the current downturn where companies pursue cost cuts, white collar workers are likely to be hurt more.

While there remains some debate as to whether or not we are currently in a recession, the fact is that we are not growing much, if at all on a GDP basis. Furthermore, with inflation sky-high and economic conditions widely expected to worsen before they improve, companies are likely already planning layoffs in order to better position themselves for the coming economic challenges. In fact, there are already signs that big tech companies are already cutting jobs, meaning that they are mostly white-collar jobs too.

Last, but not least, the Federal Reserve – with its balance sheet unwinding and interest rate increase programs – is effectively waging war on the jobs market in order to fight inflation. This is because as interest rates rise, the economy will inevitably slow down. Consumers will reduce spending since it is more costly to borrow and saving money is more rewarding, businesses will also invest less since capital is now more expensive and shrinking consumer demand will also result in less incentive to invest to meet that demand. As a result, jobs will then be cut as reduced demand and fewer investments in longer term projects means that less manpower is needed, and costs will need to be cut.

What Are The Implications For The S&P 500?

Well, the implications are not pretty. With unemployment at just 3.7% in August, there is significant room for job losses from here. This, in turn means that the Federal Reserve likely feels like it has plenty of wiggle room as it tries to balance fulfilling its dual mandate of full employment and price stability. As Federal Reserve Chairman Jerome Powell said during the recent Jackson Hole Economic Symposium:

[Our policies will bring] some pain to households and businesses. These are the unfortunate costs of reducing inflation. But a failure to restore price stability would mean far greater pain.

As a result, we can expect the Federal Reserve to hike interest rates meaningfully moving forward. This means that not only will stock prices continue to face pressure due to increased discount rates being applied to stock valuations, but it also means that a severe economic slowdown is likely in order. This, in turn, will lead to an accelerated popping of the white collar employment bubble, which in turn will lead to declining revenues and profits for corporations, ultimately leading to a vicious cycle commonly referred to as an economic contraction. As a result, earnings estimates will likely be reduced even further, further reducing the valuations applied to equities.

Making matters even worse is the simple fact that the SPY does not look particularly cheap at the moment despite having a miserable year-to-date. According to currentmarketvaluation.com, the SPY is overvalued according to the Yield Curve, Buffett Indicator, and P/E Ratio models. While the Interest Rates, Margin Debt, and S&P 500 Mean Reversion models imply it is fairly valued, it is unlikely that these models fully factor in the immense distortion and misallocation of capital that has taken place due to the Federal Reserve being too dovish in the immediate aftermath of COVID-19.

Regardless, while markets are not as frothy as they were earlier this year, given the foreboding economic outlook, the SPY does not look particularly exciting as an investment choice at the moment either.

Investor Takeaway

White collar workers have had it pretty good in the wake of the COVID-19 pandemic while blue collar jobs have not come back as strong. Now, with many blue collar roles desperately searching for employees to fill them, there is a built-in margin of safety for blue collar workers in the face of a severe recession. Unfortunately for white collar workers, no such margin of safety exists, save for the most in-demand specialized roles.

Given the Fed’s increasing hawkishness, fueled in large part by the stubbornly low unemployment rate, it seems like a near certainty that the white collar employment bubble will burst in a meaningful manner in the coming quarters. As a result, we will also very likely experience a noticeable recession that will take a bite out of corporate earnings. The likely outcome of this combination of rising interest rates and reduced corporate earnings is that the SPY – which is actually still overvalued based on several highly respected market valuation models – will struggle to recover from the losses suffered year-to-date and could even head further lower.

As a result, at High Yield Investor we are steering clear of the large index funds like SPY and are instead carefully picking areas of the markets that are meaningfully undervalued and are best positioned to weather a recession.

Be the first to comment